Black Swan Fund That Crushed It In 2008 Has Best Month Since The Financial Crisis

It’s official: the black bat that sparked the coronavirus (it didn’t, the coronavirus was actually created in the Wuhan Institute of Virology as a gain-of-function experiment that was leaked into the broader population, but let’s play with the narrative for now), is now a black swan.

Shortly after we were discussing the market’s black swan-dive, Bloomberg appropriately writes that a black swan fund that hit it out of the ballpark during the global financial crisis (which also “nobody could possibly predict” also) just notched its best month since then.

36 South Capital Advisors skyrocketed to fame after posting huge returns in 2008. Now it’s gained big from the February mayhem, after spending years patiently waiting for the next cataclysm, Bloomberg notes adding that according to preliminary Eurekahedge data, tail funds gained a modest average of around 5%. Richard “Jerry” Haworth of 36 South says his return “was more than five times that.” And with markets still turmoiling on Friday, there could be more gains in store for these types of options-based strategies that benefit from volatility breakouts.

“February was our best month since 2008 and we believe the strongest performance is likely ahead of us,” London-based Haworth told Bloomberg, without giving a specific figure.

With a majority of hedge funds once again massively underperforming, and the HFR equity long/short index cratering, and back to year ago levels…

… early data suggests tail-risk managers had their best month overall since August 2015, according to Eurekahedge data, which was enough to push them toward the top of the fund-performance tables “in what is so far turning out to be a mixed, albeit relatively palatable, month for hedge funds,” said Mohammad Hassan, analyst at the research and indexing firm.

Other winning strategies include precious metals-focused funds, short-term systematic CTAs and short-biased managers, according to Hassan. In the latter category, the world’s biggest bears – such as Russell Clark and Crispin Odey – gained big, although it remains to be seen if the month’s stellar returns will be enough to offset years of underperformance.

The tally is even more questionable on a full-year basis, which shows tail funds are up so far in 2020 only after 8 straight years of losses.

Indeed, as Bloomberg notes, “the jury’s out on whether these players are a good overall value for what they deliver. Tail funds, which manage $4.6 billion according to Eurekahedge, can charge stiff fees and deliver years of lackluster returns as investors await the big one. Whether there are cheaper or more effective ways to hedge – like bonds or gold – is up for debate.”

To be sure, a far simpler strategy of merely buying long-term Treasuries in the form of the TLT 20+ Year Treasury Bond ETF, delivered a 6.6% total return last month. Better yet, one can buy the TLT without spending 2 and 20 (or more) for management fees (of course, being long Treasurys goes against the Wall Street canon of “buy stocks” but then again Wall Street hasn’t been right about anything for a long, long time).

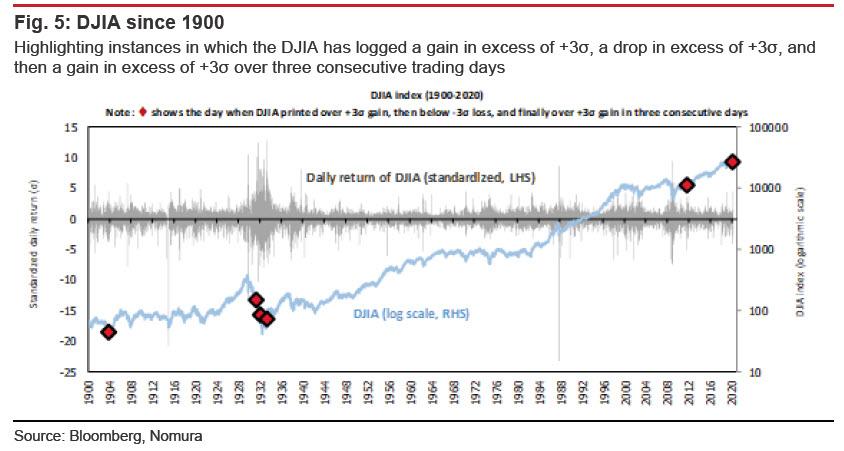

On the other hand, “fat tail”-focused funds and other long-volatility strategies use techniques for reducing the eye-watering costs of holding hedges over extended periods, such as relative-value derivatives trades. One reason for the relatively modest performance reflected in the Eurekahedge data may be that under a common definition – an event more than three standard deviations from the norm – last week’s market moves didn’t necessarily qualify as a tail, according to Bloomberg, although as Nomura showed overnight, the three consecutive 3-sigma moves we saw in equity stocks have happened just six time since 1900.

Therefore, anyone who successfully caught the move and traded it, has certainly made a killing.

“Tails tend to be more extreme in the distribution,” said Wayne Himelsein, president of hedge fund Logica Capital in Los Angeles. “Black Friday of ’87. The global financial crisis in ’08. Most tail risk managers will start kicking in at down 15%, 20%, 25%.”

The jury is still out on when the current multiple-sigme market move will end, and just how the Fed – which even Bullard now admit is losing credibility – will step in to restore calm to a market which for the past decade has grown habituated to central bank intervention during any time of market turmoil. Until we wait, those fat-tail funds suddenly look quite attractive.

Tyler Durden

Fri, 03/06/2020 – 15:30

via ZeroHedge News https://ift.tt/2PQz7PF Tyler Durden