Dismal 3Y Auction Prices At Lowest Yield Since 2013 As Bid-To-Cover, Directs Plunge

After the precipitous decline in bond yields over the past few days, traders were keenly looking to today’s 3Y coupon auction to gauge primary market demand for US paper following the record repricing. And with good reason.

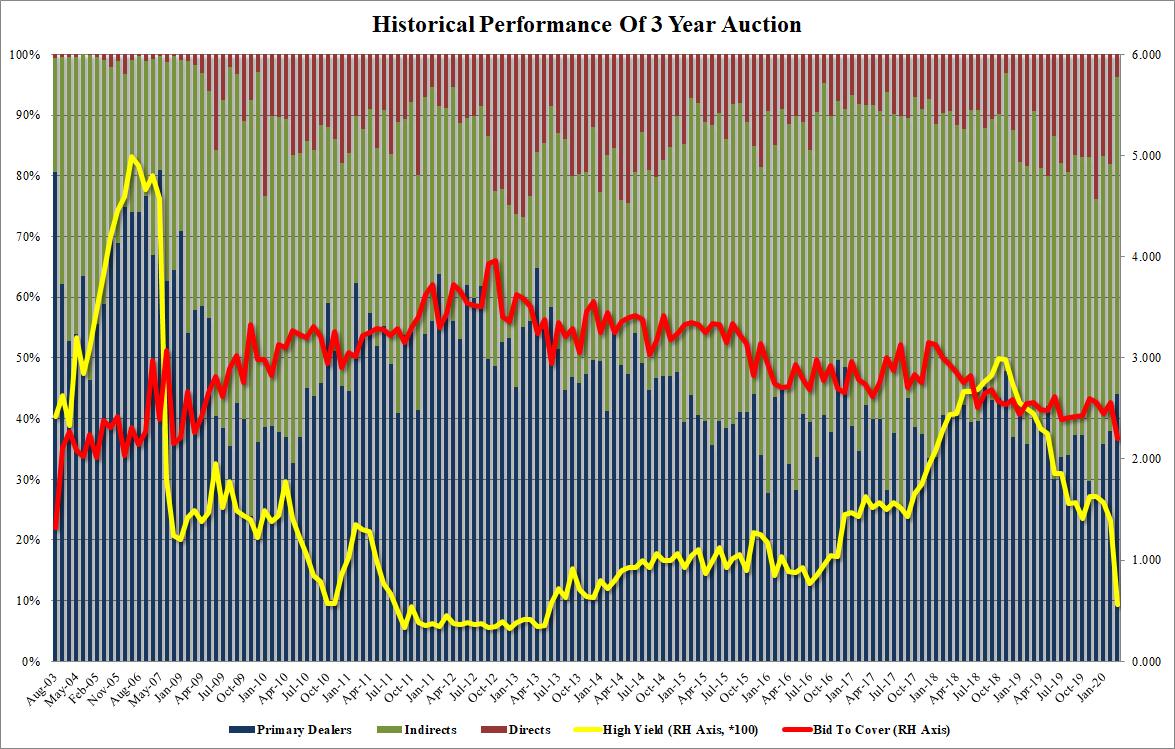

Moments ago, the Treasury sold $38 billion in 3Y paper, which priced at a high yield of 0.5630%, the lowest since May 2013 and a whopping 2.7bps tail to the 0.536% When Issued – this was the third consecutive tail and the biggest in at least five years of auctions.

The gaping tail was not the only indication of waning auction demand for US paper: the bid to cover plunged from 2.56 to 2.20, far below the six auction average, and the lowest BtC since December 2008!

The internals were ugly as well: while Indirect appetite was there, taking down 52.3% of the auction, it was the plunge in Directs that was shocking, with just 3.7% alloted to Dealers and far below the six auction average of 18.2 This left Dealers holding 44.0% of the auction up sharply from 38.0% in February and the highest since November 2018.

What today’s auction reveals is that a new problem may be emerging: whereas until now there were no concerns about auction demand, yields are now so low (and even lower when FX hedged), that should the yield drop persist we may soon have an auction where mandatory Dealers, and a handful of Indirects, are the only buyers to emerge. Which of course is yet another reason why the Fed will soon have no choice but to launch Quarantative Easing and restart buying coupon treasuries outright.

Tyler Durden

Tue, 03/10/2020 – 13:13

via ZeroHedge News https://ift.tt/38yi6R2 Tyler Durden