“Brace For Impact” – The Real Economy Is Degrading Very Quickly

What a week we just had in the precious metals market.

From a huge drop last Friday – which in the past would have presaged further declines the following week – to a significant rebound in the gold price, coupled this time with a major drop in the US dollar – which I will argue may be the signal for a switch to inflationary conditions.

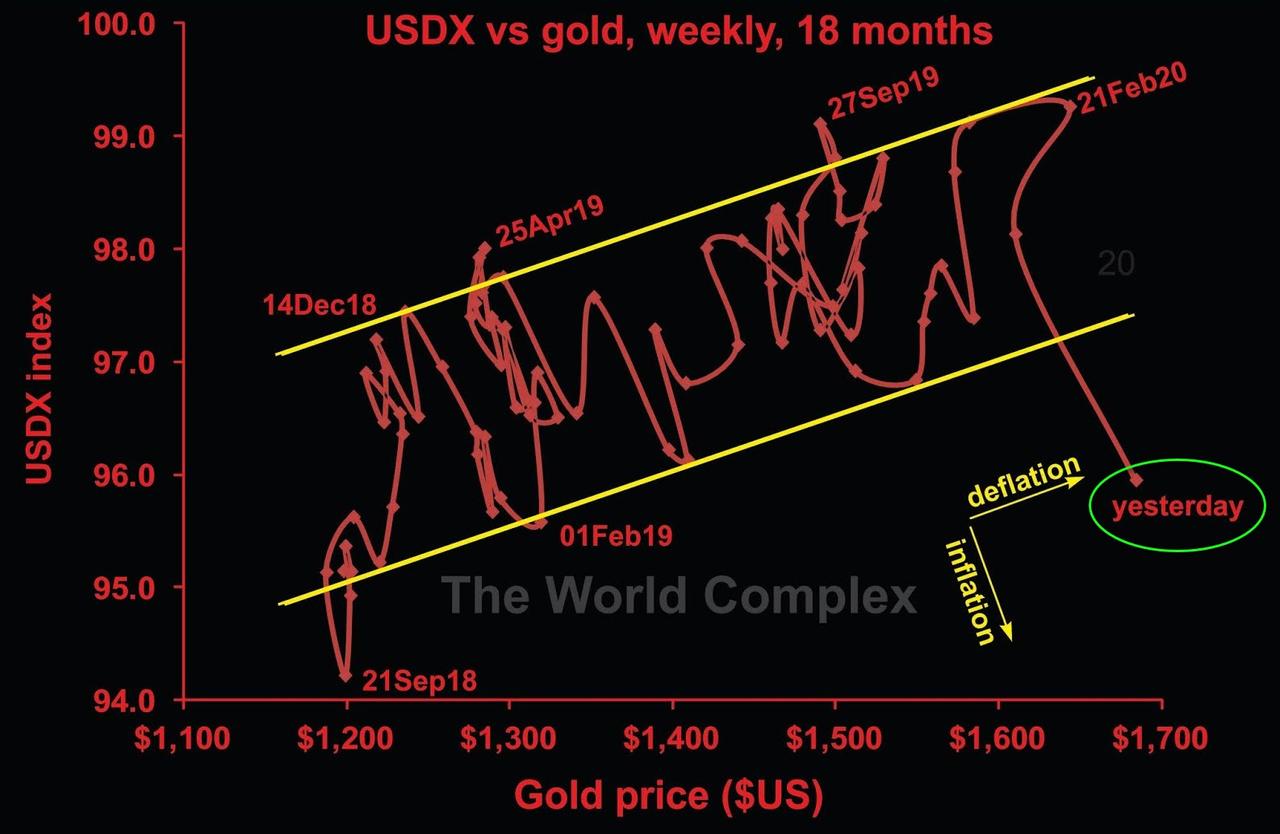

First the chart

We see the nice deflationary trend of the past 18 months looks to have been decisively broken by last week’s action.

Although it will be a few weeks before we can be absolutely sure, last week suggests that we are about to embark on another bout of inflation, no doubt as carefully calibrated by the Masters of the Universe as they can fill a shot-glass of whiskey from a pool of liquidity the size of a football field. Either, like a small child pouring very carefully, they have poured only too much, or they have sloshed out enough whiskey to fill a large swimming pool, and we are about to see what happens when it all lands in a shot glass.

Now, why the need for some liquidity?

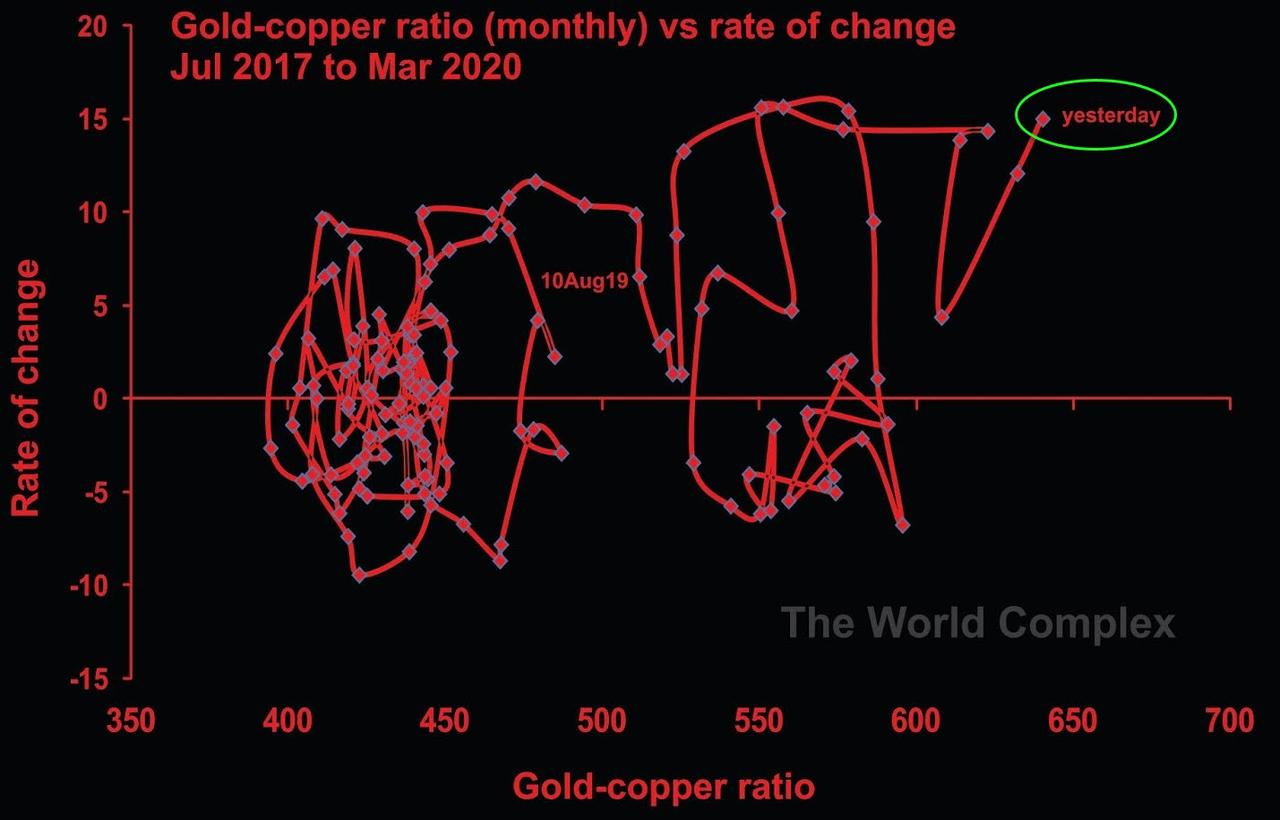

Another chart:

This graph plots the gold-copper ratio against its rate of change. I typically interpret this ratio as an indicator of the real world preference between bricks and mortar and financials. When the ratio is low, it’s a sign that people would rather make refrigerators than chase derivatives.

Rate of change is the vertical axis. Near the top of the chart means that the plot is shifting towards the right at high speed. Currently, the system is moving toward the right (ratio is increasing) at the fastest rate in the last couple of years.

To me, this means the real economy is degrading very quickly.

Thus the Fed may feel pressured to pump out some liquidity.

If we are moving into an inflationary cycle, then one consequence, according to this recent post, is a decrease in the gold-silver ratio. Given that moves tend to get larger as liquidity sloshes around the system, the gold-silver ratio could hit a significant low, implying a new all-time high for the silver price (in fiat terms).

Normally I would wait a few weeks to have greater certainty, but if there is a swimming pool full of whiskey heading for a shot glass I want to get as close to ground zero as possible with a bucket.

Tyler Durden

Tue, 03/10/2020 – 17:00

via ZeroHedge News https://ift.tt/2xv5AoJ Tyler Durden