Bank Of Japan Buys Record Amount Of ETFs, Admits ‘Paper Losses’, Plans Program Expansion

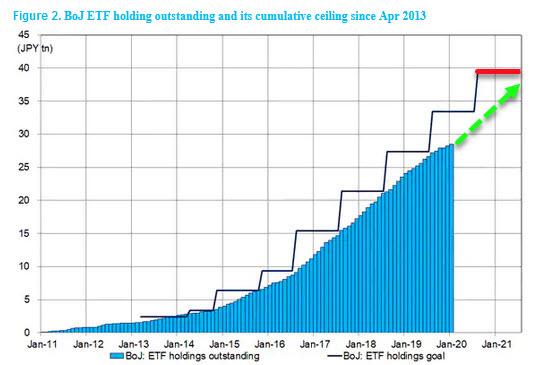

Having blown over two trillion yen since October in purchasing stocks (ETFs) in the open market to “support Japan’s economy,” markets are rife with speculation the Band of Japan (BoJ) could pledge next week to buy ETFs at a faster pace than the current commitment to do so by roughly 6 trillion yen ($58.12 billion) per year.

Following pressure from Japanese Prime Minister Shinzo Abe,

“Markets are making nervous movements amid uncertainty over the global economic outlook. Based on agreements made among G7 and G20 nations, the government will work closely with the BOJ and authorities of other countries to respond appropriately,” Abe said in a meeting with ruling party executives on Tuesday.

Reuters reports that such a step is among options the central bank may consider if it approaches the ceiling as a result of aggressive purchases, according to sources familiar with the BOJ’s thinking.

In a somewhat surprising moment of transparency for the Japanese central bank, BOJ Governor Haruhiko Kuroda told parliament the BoJ had bought a cumulative 2.04 trillion yen worth of ETFs since October last year.

Kuroda also revealed the BoJ’s own estimate showed its holdings of ETFs may incur paper losses once Tokyo’s Nikkei stock average falls below 19,000 – 19,500. The Nikkei stood around 19,665 on Tuesday after briefly slipping below 19,000 in morning trade.

In accordance with Abe’s wishes, since BoJ issued an emergency statement on March 2 pledging to offer ample liquidity via market operations and asset buying, Kuroda has been accelerating the pace of ETF buying.

The BoJ bought 100.2 billion yen ($979 million) on Monday, matching a record pace of purchases made twice last week.

Eiji Maeda, the BOJ’s executive director, said the central bank was scrutinising daily price moves and taking appropriate action to stabilise markets.

“We of course won’t hesitate to take additional measures if needed, depending on future market developments,” he said.

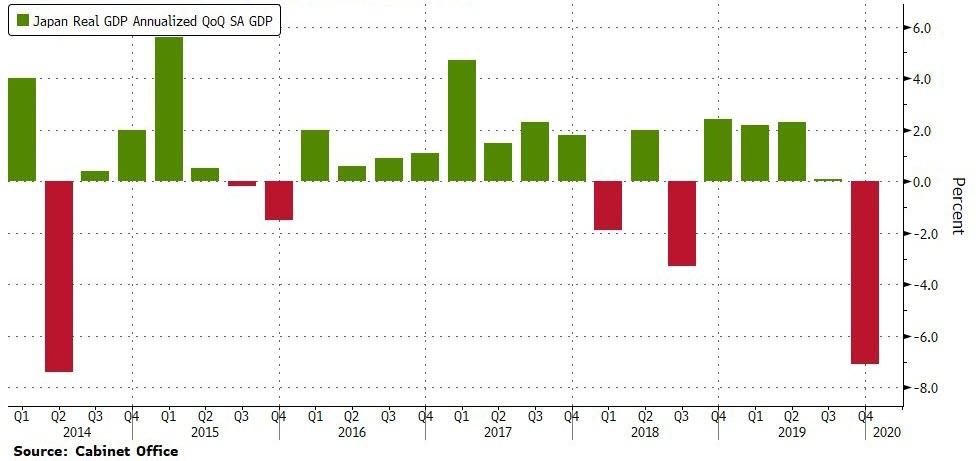

So this clearly failed plan – of buying stocks directly in the market – has done nothing for the economy or the people’s wealth and is now actually destroying central bank capital…

But they believe they should just do more of it… and this is the same shit that is now being casually discussed in US banking circles.

Einstein would be proud.

Tyler Durden

Tue, 03/10/2020 – 19:25

via ZeroHedge News https://ift.tt/2VYEb8J Tyler Durden