Bank Of England Follows Fed With 50bp “Emergency” Rate Cut As Chancellor Unveils “Corona Budget”

Six months ago, it seemed almost unimaginable that anything would replace Brexit as the biggest ambient risk for the UK economy. But after six deaths and hundreds of confirmed infections, the coronavirus has accomplished this seemingly impossible task. And after publishing a litany of screeds warnings about the impending Brexit fallout, the BoE decided to serve up a 50bp emergency rate cut to save the British economy from the looming viral threat.

Two days after UK stocks faced their worst shellacking since the financial crisis, the BoE slashed rates in what appears to be the first part of a one-two punch that will also include Boris Johnson’s first budget. Chancellor Rishi Sunak, who took over from his predecessor Sajid Javid just three weeks ago, has been thrust into the spotlight Wednesday morning as he prepares to unveil what’s become known as the “coronavirus budget”, according to the BBC.

During a post rate-cut press conference, BoE Governor Mark Carney said the coronavirus will cause “an economic shock that could prove large and sharp, but should be temporary.”

Carney also said the BoE is “coordinating actions with those to be outlined in the Chancellor’s budget later today.”

BOE Governor Mark Carney says coronavirus will cause “an economic shock that could prove large and sharp, but should be temporary”

More on U.K. emergency rate cut: https://t.co/xclCCZpQtu pic.twitter.com/qywT8ZGfzq

— Bloomberg Brexit (@Brexit) March 11, 2020

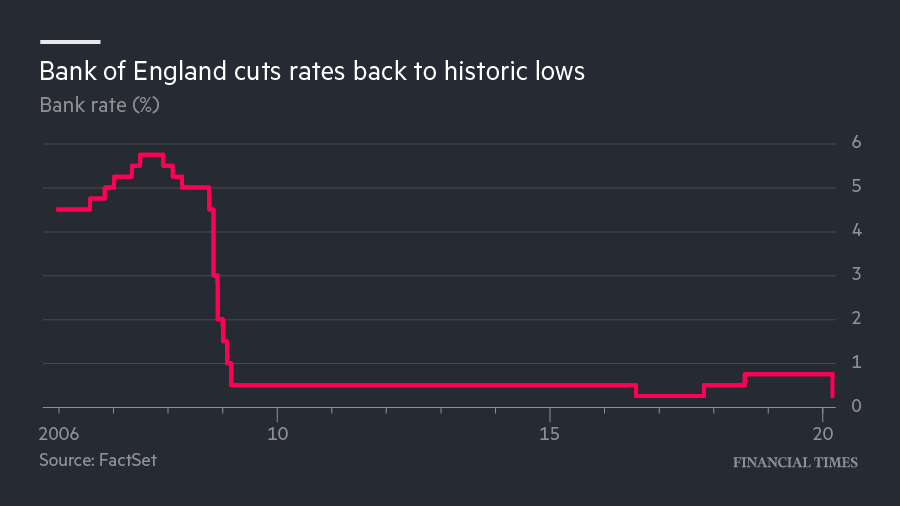

The cut – the largest since March 2009, when the British economy was still reeling from the financial crisis – reduced Britain’s benchmark overnight rate to just 25 basis points.

The BoE wasn’t alone on Wednesday: The Central Bank of Iceland lowered its benchmark interest rate by 50bps on Wednesday, bringing the bank’s 7-day term deposit rate to new all-time low of 2.25%.

Many who aren’t closely familiar with the BoE’s practices and traditions might find this strange, but outgoing Gov Carney on Wednesday also formally handed the reins to his successor, Andrew Baily. During Baily’s remarks, the new BoE governor said the central bank had used ‘roughly half’ of its policy ammunition on Wednesday, but caveated that this could change depending on how effective forward guidance is.

As FX analyst Viraj Patel pointed out, if Rishi’s coronavirus budget includes significant short-term support for workers and businesses, the UK will become the first developed country (ignoring China) to deliver a comprehensive economic response to the viral crisis (compare this to what’s going on in the US). He added that unlike the Fed, market’s are pricing in a “one and done” approach from the BoE

Markets pricing in very little additional stimulus from BoE now. Bank have been clear on ZLB being just above zero (anti-negative rates) which gives them little scope to cut further without changing their ZLB stance. With this floor – $GBP should stay supported as other CBs ease pic.twitter.com/8HKws6CENM

— Viraj Patel (@VPatelFX) March 11, 2020

The pound dipped on the news, but has since rebounded.

Tyler Durden

Wed, 03/11/2020 – 06:44

via ZeroHedge News https://ift.tt/2VZX1fH Tyler Durden