“Fool Me Once…” – No, This Drop & Pop Is Not A Q4 2018 Replay

Authored by Sven Henrich via NorthmanTrader.com,

I sense there is a tendency right now to say that this correction is just similar to the Q4 2018 correction. And it’s true on the surface you can make that argument. 20% decline on $SPX, oversold readings similar on several indicators and all that could make the case for business as usual.

After all the Fed has cut and will cut some more and stimulus bazookas will get launched all over the place. I get it.

But I want to add some nuance to all this and that is to state clearly: This is not anything like the Q4 2018 correction. It’s worse, much worse and it’s left utter destruction in its wake and I want to highlight some of this so everyone can get get an appreciation for what just happened and why we may not expect a magic recovery similar following December 2018.

For one, back then we went from a tightening environment (brief as it was) to an easing one. The jawboning force was strong. The liquidity multiple expansion was as awe-inspiring as it was fool hearty.

But it has turned into an utter disaster for investors. Index chart after index chart containing stocks of the broader market highlight that the entire 2019 rally was in essence the biggest bull trap in many years.

Here, stand in awe at the utter capital destruction that has just taken place.

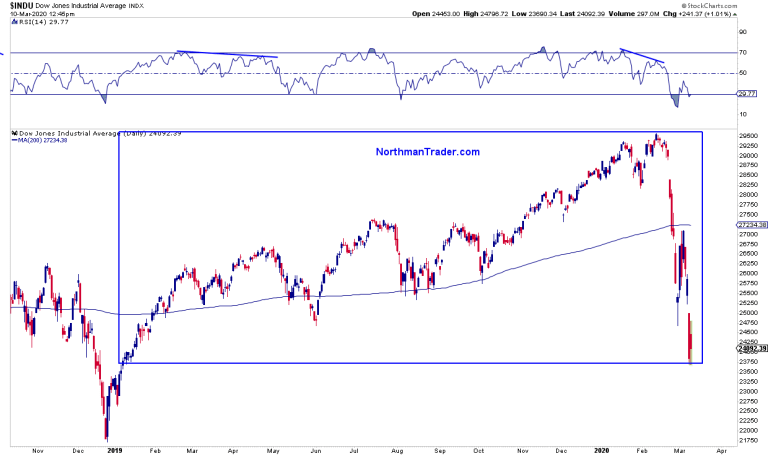

$DJIA back to January 2019 levels:

What a chart like this basically says is that every buyer in the past 13 months (who didn’t sell) is under water. That’s a lot of buying.

Anybody that has bought stocks in the past year has been taken to the cleaners. ETFs, pension funds, institutions, hedge funds, buybacks, retail, you name it.

This is mass destruction. And ALL are praying right now for a big rally to break even or recover some of these losses. Heck any buyers over the past 2 weeks just got hammered.

And the destruction is even worse in many other indices.

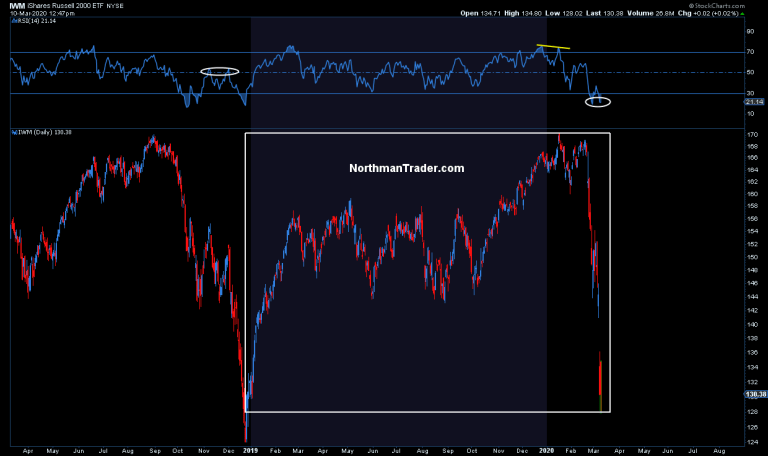

Small caps:

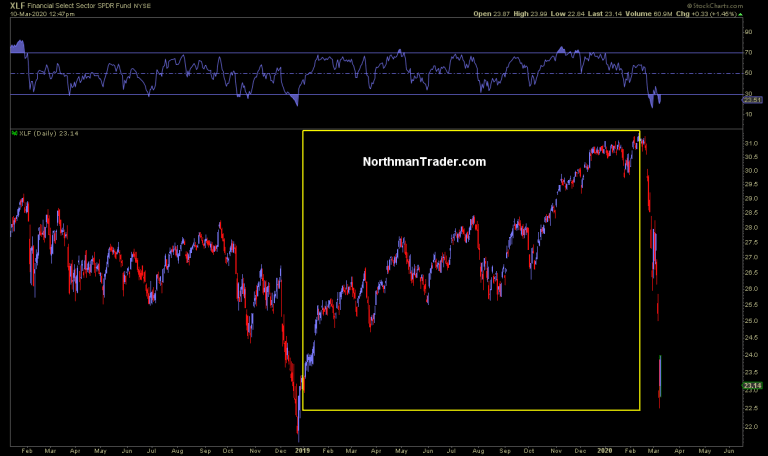

Financials:

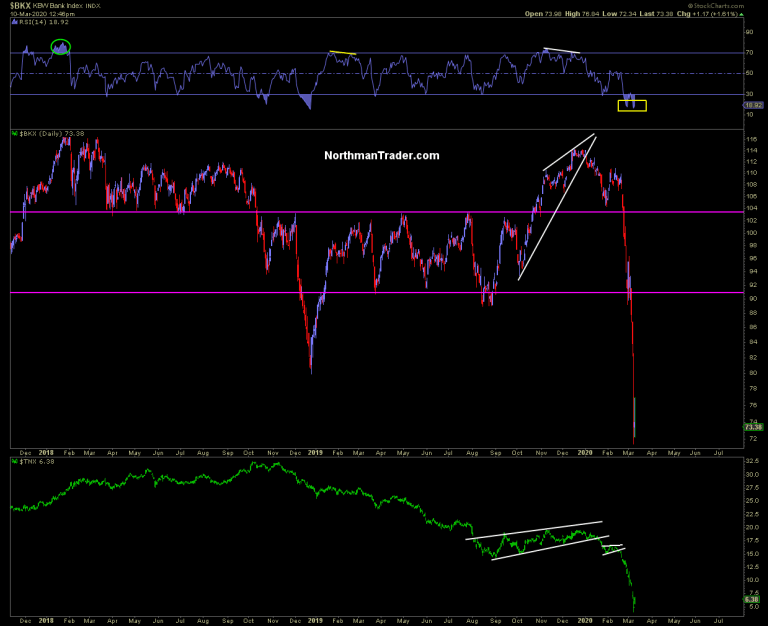

The banking index:

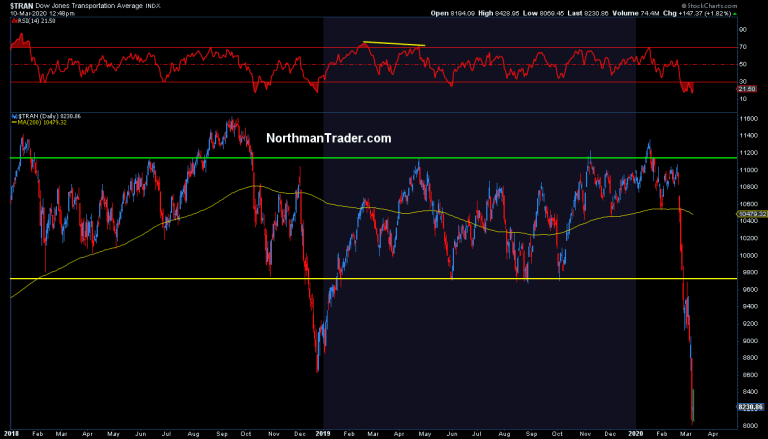

Transports:

It’s a complete horror show.

Now, this is not anything like Q4 2018. This is deeper, steeper, and it happened so fast most didn’t get out. They’re trapped and hence any rallies in the future are subject to major resistance.

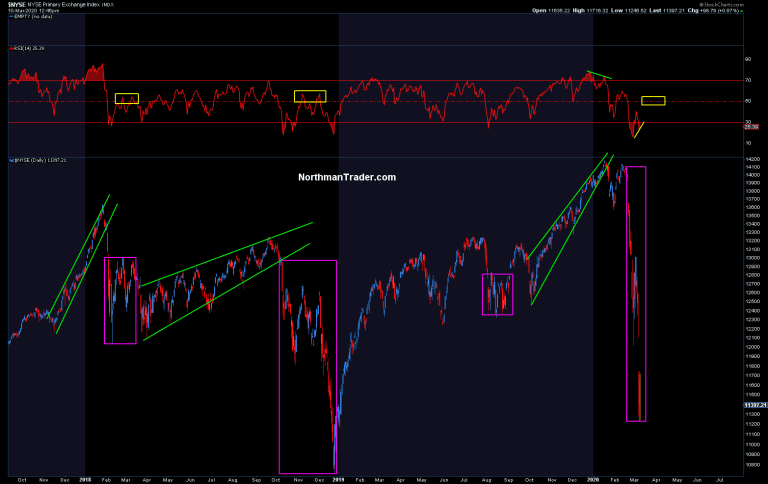

Perhaps the broader picture can be best highlighted with a chart of the broader $NYSE index:

Just 3 weeks ago people were celebrating the greatest bull market ever. This here is a shock, full blown shock to the entire asset spectrum.

A shock like this does not magically “V” shape itself out of trouble.

Sure, the charts are massively oversold and the printing bazookas will come. The problem is of course, they’ve already done all that:

Fed policy failure in one chart.

And now they will be forced to launch the final bazookas to try to save it all.

The hubris of it all.$SPX. pic.twitter.com/anE5RfJfsn— Sven Henrich (@NorthmanTrader) March 10, 2020

All for naught and now their stimulus efficacy is greatly diminished. I was highly critical of last year’s Fed induced liquidity driven multiple expansion rally.

Frankly I thought it was stupid, but participants embraced it and now people paid the price and are hoping for the Fed to bail them out again.

The entire spectacle is quite unseemly to me. Again they’re talking tax cuts and bailouts and I’ve made my views clear on this.

They just had the biggest tax cut handout ever.

If they can’t manage through a crisis because they didn’t plan and just squandered cash on buybacks I say let them fail.

It’s called capitalism. Right?

Let’s stop with this constant subsidy bailout nonsense. pic.twitter.com/YHfH7qXoPi— Sven Henrich (@NorthmanTrader) March 10, 2020

So let’s be clear: This was not a garden variety 20% market correction. This was a crash in multiple and widely held asset classes.

And as Dan Nathan mentioned today, these type of events come with a very specific risk:

This is pretty much what a financial market crash looks like…at this point the worry is that recession fears cause a protracted bear market, a series of lower highs & lower lows that only heals with time (see 2000-2003 & 2007- 2009) or you know BTFD because don’t fight the Fed pic.twitter.com/Xwb2EyKQQY

— Dan Nathan (@RiskReversal) March 10, 2020

So indeed it’ll all come down to efficacy. Can they bail the construct one more time or is this all destined for failure, a global recession unavoidable now this long in the tooth and highly indebted business cycle?

It’s the biggest question with far reaching consequences. The up trend is busted. Big time. Price needs to get back above the megaphone trend line or the technical picture suggests a much more dire conclusion if a global recession unfolds:

If they cannot avert a global recession here’s a technical scenario for you.

Have a nice day.$SPX pic.twitter.com/Fc0vFeD6pB— Sven Henrich (@NorthmanTrader) March 10, 2020

We have ECB, FED and BOJ meetings coming up. None can afford to disappoint markets. Their job is now to restore confidence into badly damaged markets and hurt investors. If rally attempts fail then what we’ve seen here in Q1 2020 is not the end. It’s the beginning.

I repeat: This is not like Q4 2018. The damage is much more pervasive. Last year’s central bank interventions trapped investors in some of the highest market valuations in history, but produced little growth. In fact they’ve produced no growth. None. And now growth is slowing anyways implying this was a policy disaster that has hurt people as it encouraged investors to chase stocks.

What’s the old saw? Fool me once shame on you, fool me twice shame on me.

Or the George Bush version if you prefer 😉

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Wed, 03/11/2020 – 08:29

via ZeroHedge News https://ift.tt/2TGHdwL Tyler Durden