“This Is Bearish” Goldman Warns, Saying Not To Expect More China Stimulus

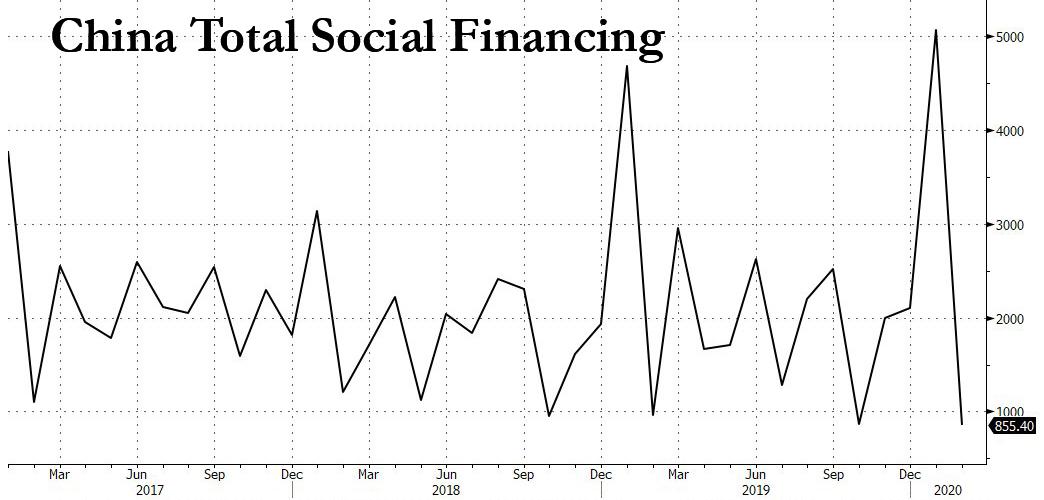

With the US scrambling to come up with a fiscal stimulus response or any credible response to the coronavirus pandemic for that matter, investors have been looking to China with growing desperation to bail them out – just as it did in 2008. Only it’s not looking too good, because one day after China – whose debt/GDP is now about 350% compared to just over 100% during the financial crisis – reported a huge drop in its monthly credit injection as measured by its February’s Total Social Financing series, which crashed to a record low after January’s record high…

… earlier this morning Goldman’s commodity sales desk blasted out a short and sweet email, which may have crushed any hopes that China will bailout the market.

Citing a quote by China’s premier Li, published overnight in an official Chinese government website:

只要今年就业稳住了,经济增速高一点低一点都没什么了不起的

… which Goldman’s desk translates as the following:

“As long as we stablize the economy this year, and as long as employment is stable this year, it will not be a big deal if the economic growth rate is higher or lower.”

Goldman’s Adam Gillard writes that this is confirmation that Premier Li is now guiding down stimulus, and warns that “Chinese investors have fully priced stimulus, which is why Oct rebar is unchanged vs pre-virus levels, despite record inventories.“

His conclusion, which one can confirm by taking a quick look at any market today, was simple: “This is bearish.“

Tyler Durden

Thu, 03/12/2020 – 11:40

via ZeroHedge News https://ift.tt/2W3neKp Tyler Durden