30Y Sale Saved By The Fed’s Bazooka As Record Tail Hints At Near Auction Failure

Maybe there is a reason why the Fed announced its massive, $1 trillion repo expansion and QE 5 moments before today’s 30Y auction: perhaps the NY Fed was worried that without it, the auction would not have failed due to the total collapse in bond market liquidity (as discussed earlier).

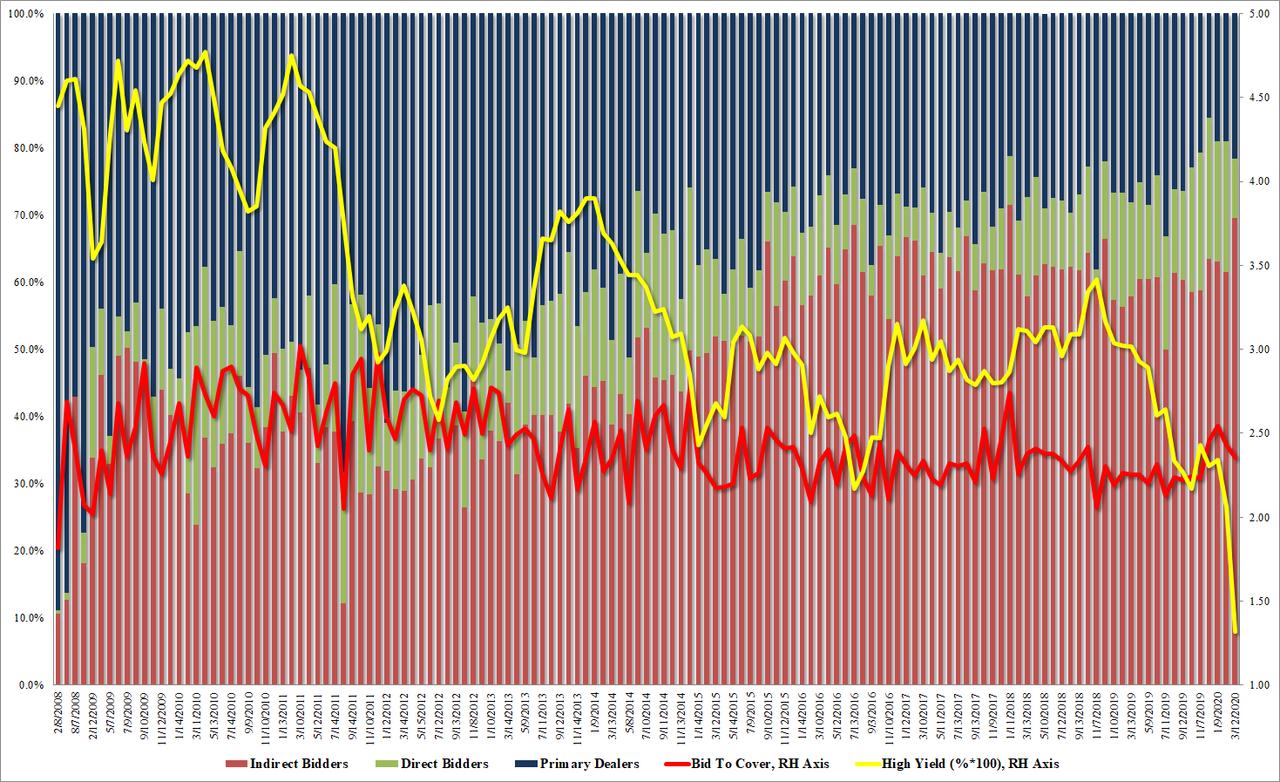

In any case, with the Fed firing its bazooka, at 1pm the US Treasury announced the result of today’s $16BN 30Y auction, which despite coming in at the lowest yield ever of 1.320%, down from 2.061% just one month ago, was a whopping 4bps tail to the When Issued 1.28%, which according to our files, may have been the biggest tail on record, and confirmation that absent the Fed’s Bazooka the auction may indeed have failed, starting the collapse of the US as we know it.

That said, the internals were surprisingly strong, with the Bid to Cover sliding from 2.428% to 2.358%, if on top of the 6 auction average, while Indirect buyers took down 69.5%, the second highest after Jan 2018, even as Directs tumbled from 19.4% to 8.9% leaving Dealers holding 21.6%, up from 19.1%.

Overall, a passable 30Y auction, if one whose whopping tail confirmed that it may have been this close from failing had the Fed not stepped in moments earlier with QE5.

Tyler Durden

Thu, 03/12/2020 – 13:22

via ZeroHedge News https://ift.tt/38MhKq7 Tyler Durden