Fed Fires Bazooka Just As Implied Correlation Hits Systemic Crisis Levels

With so many talking heads claiming the 20%-plus drop in stocks and VIX’s jump back above 60 as a sure-fire indication that the market is in chaos and needs much more Fed help stat, we remind readers that VIX reflects a contemporaneous premium for up/down movements in the future offering little insight into downside risk per se and more reflective of a regime shift in market volatility – i.e. a rising VIX means market participants expect the markets to move around more (up and/or down).

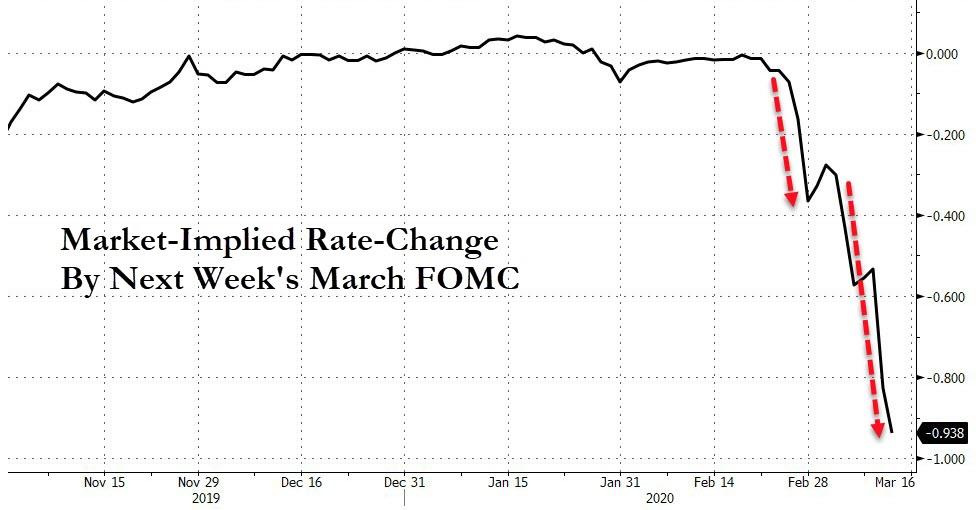

The market is actually demanding over 90bps of rate-cuts now!

However, there is a cleaner (and smoother – less spike-and-decay-like) way of judging the level of concern in trader’s heads.

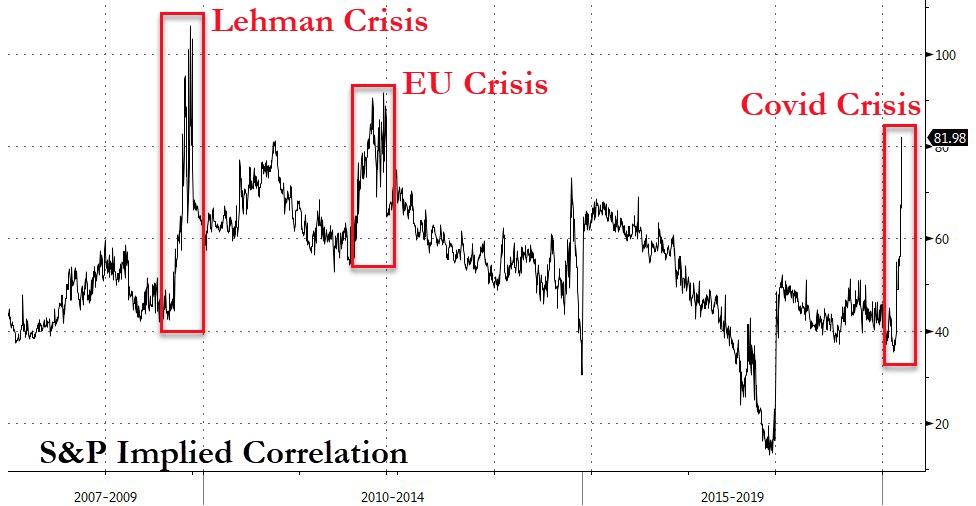

The implied correlation, a topic we have discussed in the past at length, quantifies the difference between the index’s volatility and the summation of the underlying volatility of the names in an index. In a nutshell, the implied correlation measures the relative demand for instant liquid index macro protection relative to its underlying names (a slower less liquid way to protect yourself). The higher the correlation, the greater the risk of a very significant systemic downside move (since correlations tend to approach 1 when systemically bad events occur).

By implicitly measuring the market’s demand for this relative protection – and its implicit downside risk sentiment – implied correlation is much more applicable as a measure of investor sentiment.

Currently, implied correlation is rising rapidly – exploding back above 80 – signaling that this is the first systemic event since the European crisis, and is actually accelerating faster (worsening more aggressively) than during the Lehman crisis.

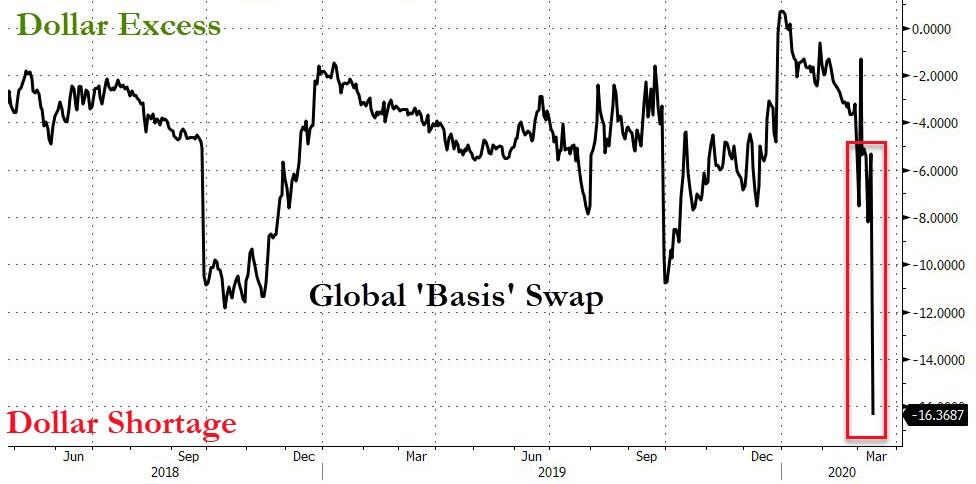

At each of those previous crises, The Fed stepped in by unleashing unlimited (and highly opaque) FX swap lines with the world’s central banks to flood the world with dollars.

We suspected, given the current dollar liquidity crisis, that we would see The Fed announce these swap lines imminently. But the moment we finished preparing this post, The Fed unleashed its biggest bailout yet with $4 trillion of cumulative repo liquidity.

Tyler Durden

Thu, 03/12/2020 – 13:46

via ZeroHedge News https://ift.tt/2TJ4OwM Tyler Durden