Bazooka Fired: Fed Unleashes $1.5 Trillion Repo Bailout, Expands “Not QE” To QE5

After increases in its repo facility twice already this week, from $100billion to $150billion to $175billion per day, and adding added a new 1-month term repo facility, the New York Fed just stunned the market and fired its biggest bazooka since Lehman (not coincidentally, just moments before today’s 30Y Treasury auction, as a failed auction would mean, well, game over), by announcing a total of $1 trillion in 3-month repos over two days ($500BN today, $500BN tomorrow), as well as an additional $500BN in one-month repos offered weekly, which means up to $3 trillion in cumulative repos (if fully allotted) may be online by the end of the month.

But wait, there’s more, because the fed also finally threw in the towel on the semantics bullshit it was pulling since Sept 2019 by pretending that “QE” is “NOT QE”, when it officially expanded not-QE/QE4 to Q5, when it announced it would start purchasing coupon Treasuries as part of its POMO operations, which as a reminder, was the official trigger transforming Not QE into QE .

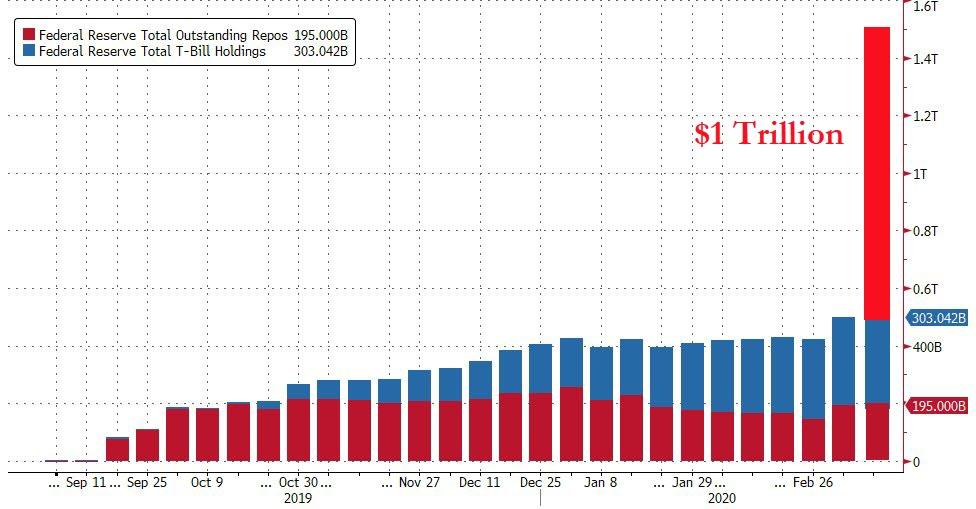

For some context of how that compares to what they have been doing, assuming full allotment on the 2 $500BN repos…

Full Statement by NYFed:

The Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York has released a new monthly schedule of Treasury securities operations and has updated the current monthly schedule of repurchase agreement (repo) operations. Pursuant to instruction from the Chair in consultation with the FOMC, adjustments have been made to these schedules to address temporary disruptions in Treasury financing markets. The Treasury securities operation schedule includes a change in the maturity composition of purchases to support functioning in the market for U.S. Treasury securities. Term repo operations in large size have been added to enhance functioning of secured U.S. dollar funding markets.

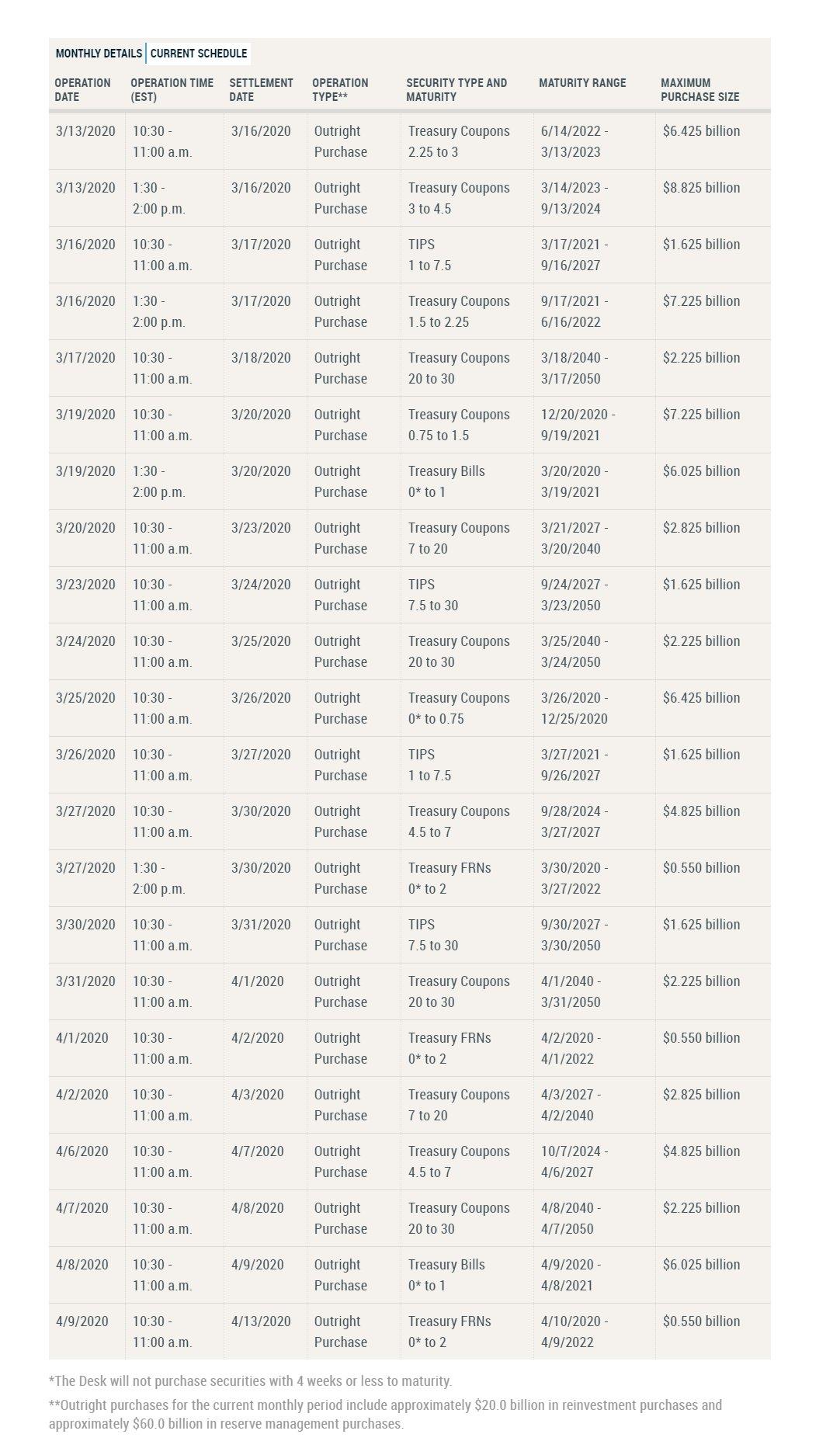

As a part of its $60 billion reserve management purchases for the monthly period beginning March 13, 2020 and continuing through April 13, 2020, the Desk will conduct purchases across a range of maturities to roughly match the maturity composition of Treasury securities outstanding. Specifically, the Desk plans to distribute reserve management purchases across eleven sectors, including nominal coupons, bills, Treasury Inflation-Protected Securities, and Floating Rate Notes. The distribution of purchases across sectors will be the same distribution as the Desk uses to reinvest principal payments from the Federal Reserve’s holdings of agency debt and agency MBS in Treasury securities. The first such purchases will begin tomorrow, March 13, 2020.

Today, March 12, 2020, the Desk will offer $500 billion in a three-month repo operation at 1:30 pm ET that will settle on March 13, 2020.

Tomorrow, the Desk will further offer $500 billion in a three-month repo operation and $500 billion in a one-month repo operation for same day settlement.

Three-month and one-month repo operations for $500 billion will be offered on a weekly basis for the remainder of the monthly schedule.

The Desk will continue to offer at least $175 billion in daily overnight repo operations and at least $45 billion in two-week term repo operations twice per week over this period.

These changes are being made to address highly unusual disruptions in Treasury financing markets associated with the coronavirus outbreak. Reserve management purchases into the second quarter will continue to be conducted with this maturity allocation. The terms of operations will be adjusted as needed to foster smooth Treasury market functioning and efficient and effective policy implementation.

Finally, for those looking forward to the official return of QE, i.e., the monetization of coupons in addition to Bills, here is the Fed’s full monetization schedule.

Some parting thoughts following this historic announcement: this was by far the biggest bazooka the Fed has fired since the financial crisis, and… it may not be enough. In fact, stocks are still deep in the red, which means one of two things:

- i) The Fed’s credibility is now shattered

- The market expects a fiscal bailout, or some MMT-esque combination of both.

Until and unless the markets gets what it needs, the Fed is now a sideshow and in fact, if this bazooka fails, Powell may consider submitting his resignation this week.

Tyler Durden

Thu, 03/12/2020 – 13:55

via ZeroHedge News https://ift.tt/3cRpYQU Tyler Durden