Black Thursday: “One Giant Margin Call” Drags Dow Down 10%

Rosenberg Research‘s David Rosenberg provides our intro today:

“The fact that Treasuries, munis, and gold are getting hit tells me that everything is for sale right now. One giant margin call where even the safe-havens aren’t safe anymore. Except for cash.”

The Fed unveiled an unprecedented liquidity facility to rescue malfunction Treasury markets from themselves.. but it failed terribly.

For a few brief moments, as Dow futs exploded 1500 points higher, it looked like it might just work… but no…

Stocks puked into the close! Look at Small Caps!!! The Dow was down 10%! This was utter carnage today…

This was the biggest daily drop since 1987

As one veteran trader said:

“this is the market telling The Fed it has to buy stocks.”

This is what it looks like when what shred of Fed liquidity that was left finally evaporates…

Investors are at the most-extreme fear level on record…

And as far as The Fed ‘solving’ the liquidity or dollar shortage issues… it utterly failed!

Source: Bloomberg

Trannies and Small Caps are now underwater since Trump was elected…

Source: Bloomberg

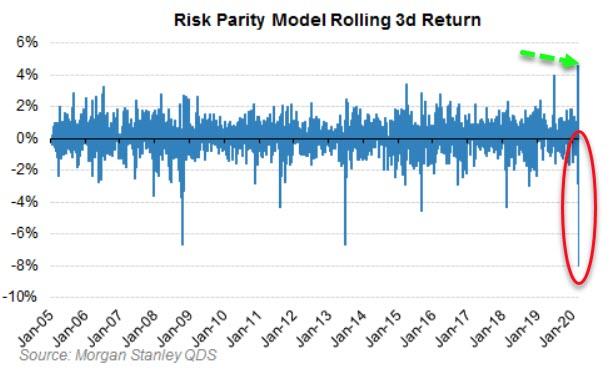

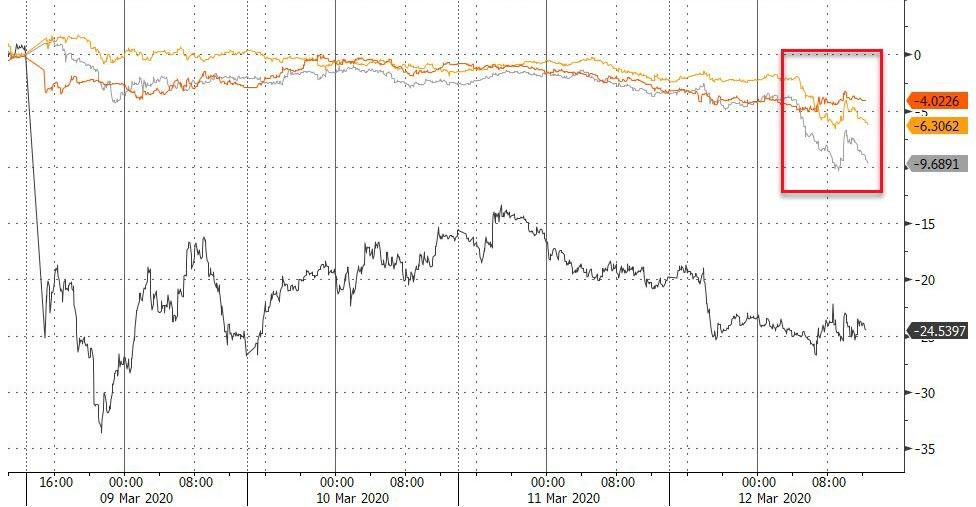

The ongoing liquidation of one or many risk-parity funds, as we noted earlier…

…appears to be continuing with bonds and stocks both getting dumped as the funds are delevered.

Source: Bloomberg

And the bond-stock correlation has collapsed…

Source: Bloomberg

The S&P remains above the Dec 2018 lows for now, buit blew through the 200-week average that been notable support…

Source: Bloomberg

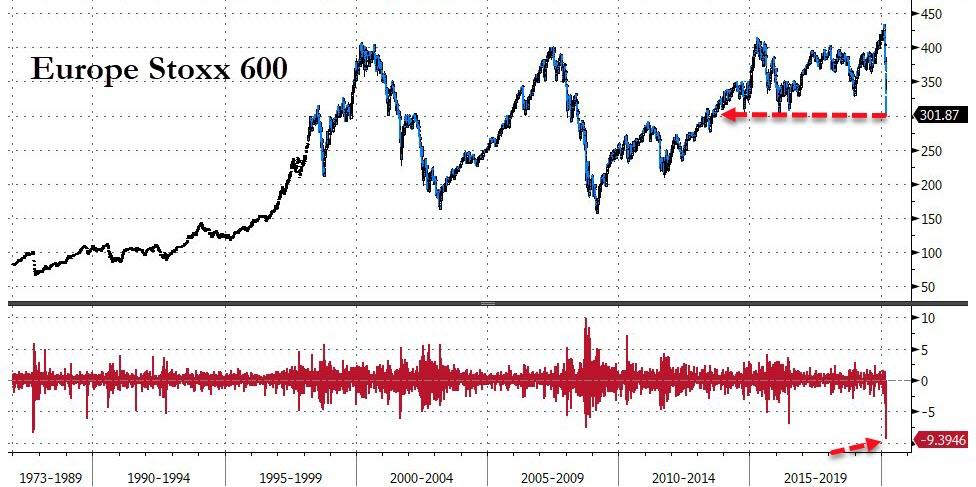

Europe was a bloodbath:

-

STOXX EUROPE 600 EXTENDS DROP, WORST DAILY LOSS EVER

-

STOXX 600 BANKS INDEX AT RECORD LOW

-

FTSE 100 INDEX DROPS AS MUCH AS 11%, MOST SINCE 1987 CRASH

-

FTSE 100 HITS 12-YEAR LOWS

Source: Bloomberg

Virus-related stocks crashed… again…

Source: Bloomberg

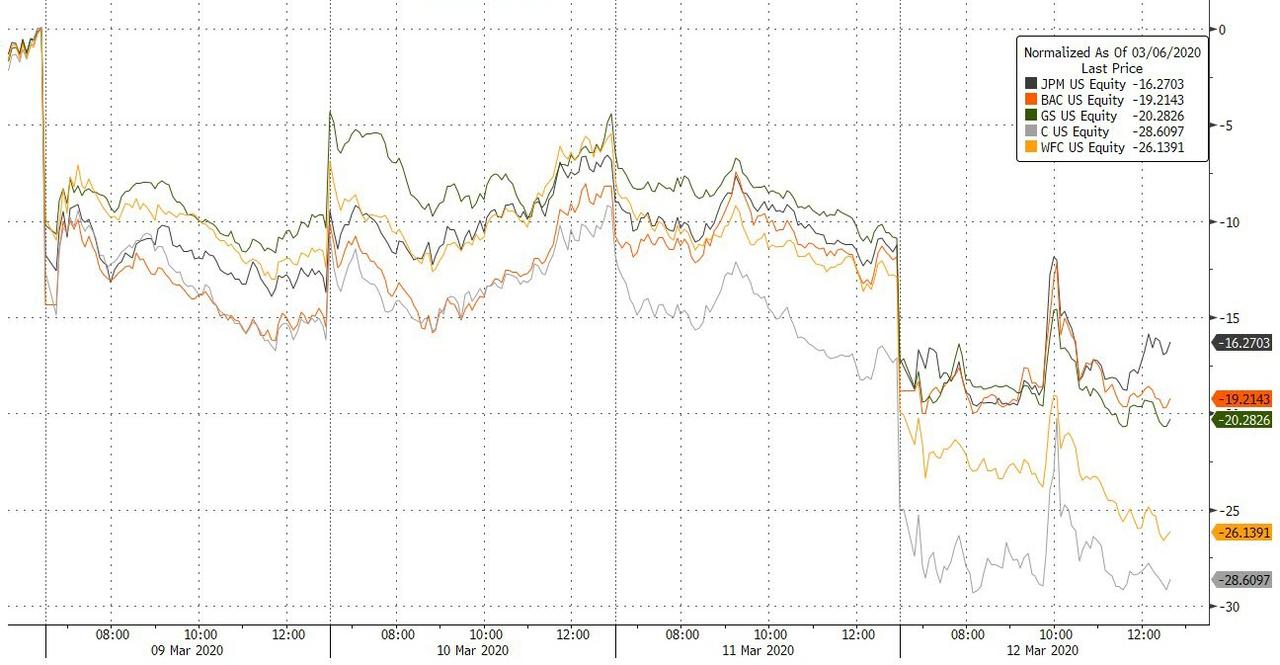

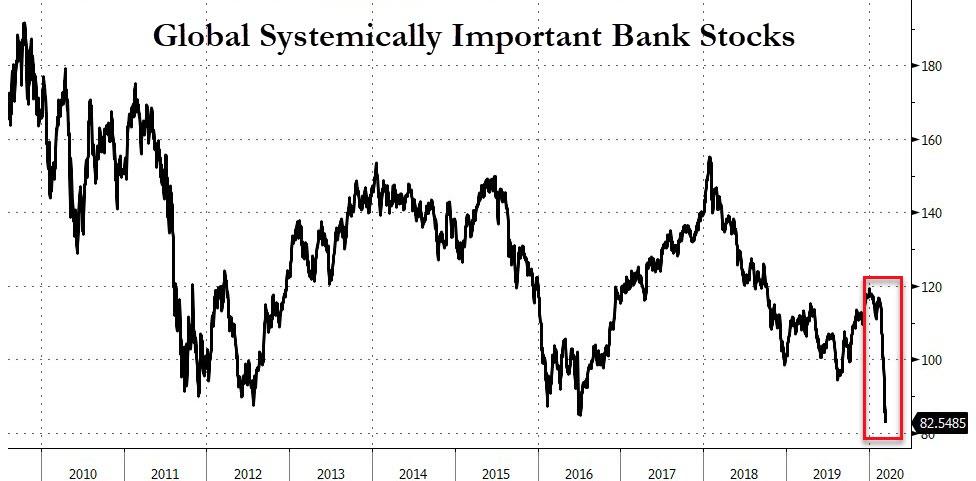

Banks were blitzed…

Source: Bloomberg

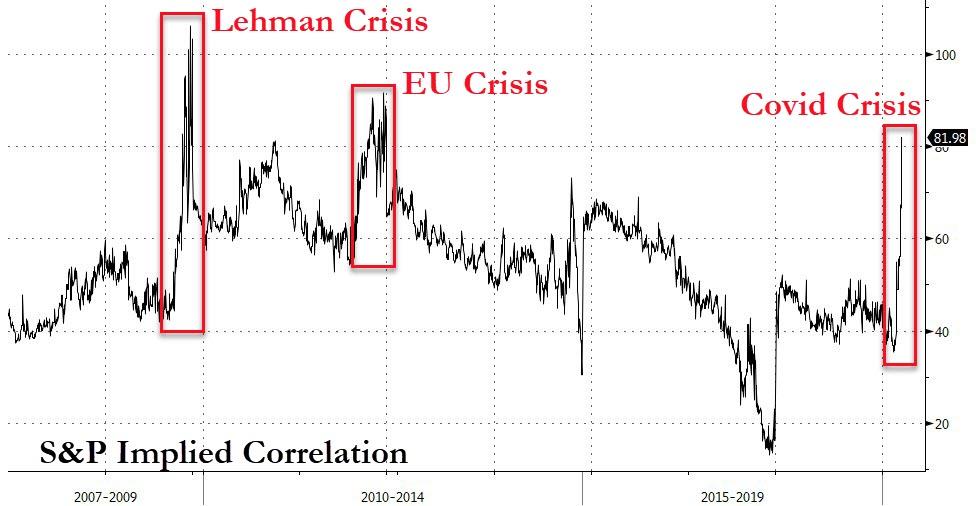

VIX exploded higher – to its highest close since Oct 22, 2008…but this time the velocity is far faster

The VIX term structure is almost as inverted as it was at the peak of the Lehman crisis…

HY Credit was hammered…

Source: Bloomberg

HY Energy credit markets are getting destroyed…

Source: Bloomberg

Investment grade credit is also really ugly – not just the level but the velocity is unprecedented…

Source: Bloomberg

The chaos in Treasury markets – which The Fed hoped to fix with its $4 trillion bazooka – remain as liquidity evaporated again and yields soared into the close, despite equity ugliness…

Source: Bloomberg

A mixed picture across the term structure today with the short-end bid and the long-end dumped (3Y -6bps, 30Y +8bbps)…

And once again, yields were puked higher after the 1430 margin call…

Source: Bloomberg

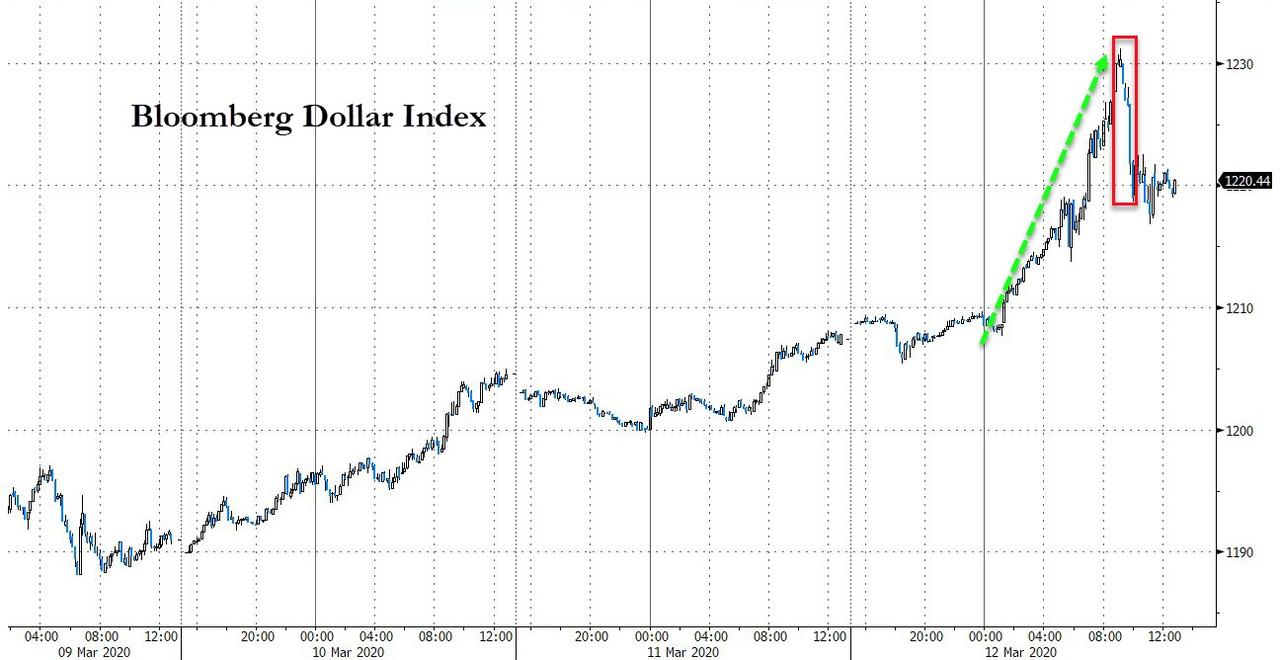

The dollar accelerated higher again today as everything else was sold to grab cash (but did drop on The Fed’s actions)…

Source: Bloomberg

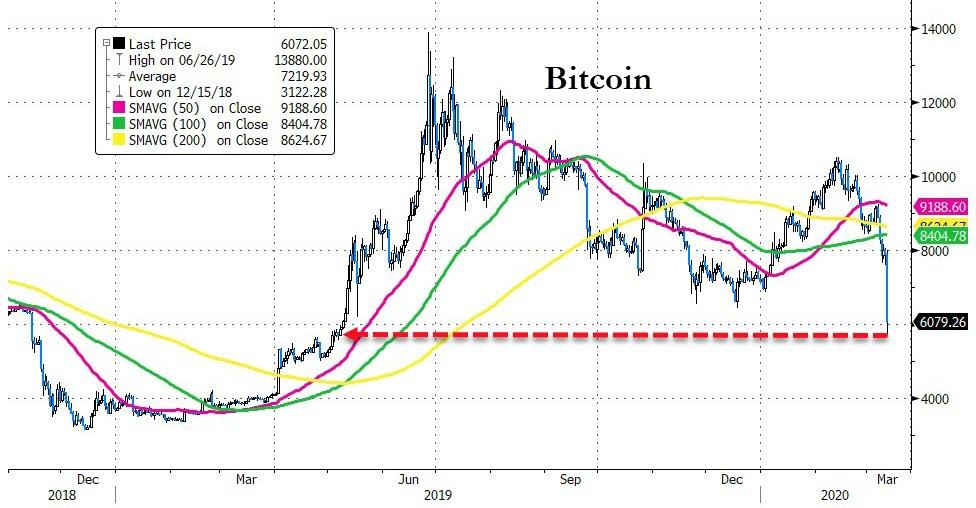

Crypto was clubbed like a baby seal across the board…

Source: Bloomberg

Bitcoin puked to below $6000 intraday, blowing through all it skey technicals…

Source: Bloomberg

Commodities were all smashed today…

Source: Bloomberg

WTI was hit hard today, plunging over 5% and trading as low as $30.02 intraday…

Gold was smashed lower today on massive volume as it seems the “liquidate eveything” plan is in play…

Finally, it is notable that this is the first systemic crisis since the European collapse…

Source: Bloomberg

And in case you thought the ‘fortress balance sheet’ banks were going to save the world… the world’s most systemically important banks crashed to record lows today…

Source: Bloomberg

The market is demanding almost 100bps of rate-cuts by The Fed by next week…

Source: Bloomberg

The deer are back!

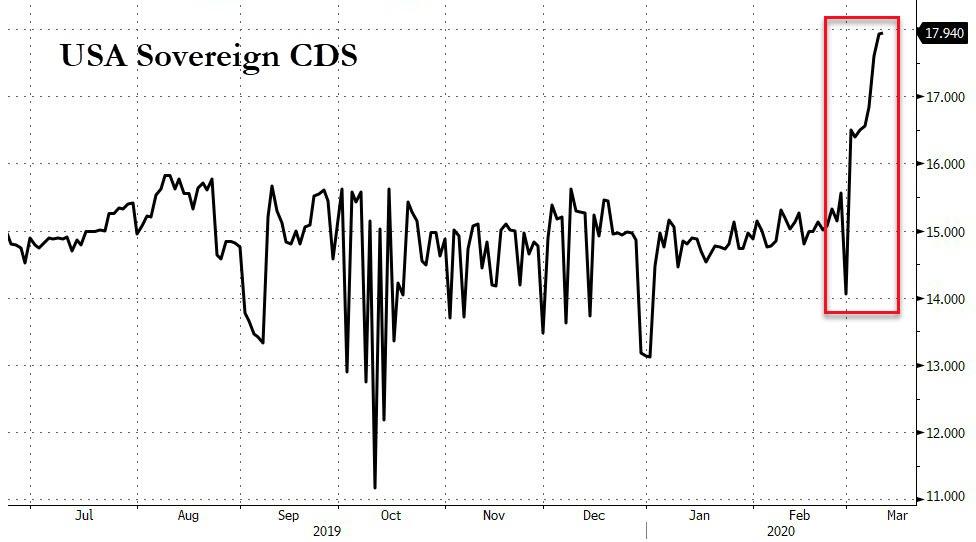

And if none of that worries you – this might. USA’s sovereign credit risk is rising notably…

Makes you wonder…

Tyler Durden

Thu, 03/12/2020 – 16:01

via ZeroHedge News https://ift.tt/2IEQ0sM Tyler Durden