Goodbye Buybacks: Gap, MGM Halt Stock Repurchases Due To “Unprecedented Volatility In Financial Markets”

It’s funny how life works: when stocks were surging, nobody had a problem with stock buybacks. Sure, the occasional politicians or strategist cautioned that share repurchases, especially those funded with debt, are a growing danger to financial stability, but as long as these same buybacks helped push stocks – especially those of tech names – and the overall market higher, most kept their mouth shut, even though using company cash to buy your own stock (and boost management’s stock-linked comp) at all time highs is idiotic and best, and criminal at worst.

And then everything changed, and in the span of less than 3 weeks stocks crashed from all time highs into a bear market, in a move that has now surpassed the Global Financial Crisis in velocity, if not extent (yet). Ironically, instead of urging companies to use their cash to take advantage of the sharp drop in value and buyback stock now (as opposed to at all time highs), politicians are advising companies to cut back on all buybacks.

Case in point, earlier today Sherrod Brown, the top Democrat on the Senate Banking Committee, urged banks to stop buying back shares amid the spread of the coronavirus and use the saved proceeds to “invest in American families, communities and small businesses.”

Quoted by Bloomberg, Brown said on the Senate floor that “Banks need to be investing in their communities right now, not investing in their CEOs’ stock portfolios.”

In his remarks, Brown said JPMorgan Chase is in the midst of repurchasing $30 billion of shares and Wells Fargo is buying back $23 billion, only the truth is that they aren’t, or rather won’t be for long, because as we showed just yesterday, stock buybacks are now crashing just when they should be soaring and when the market needs them the most.

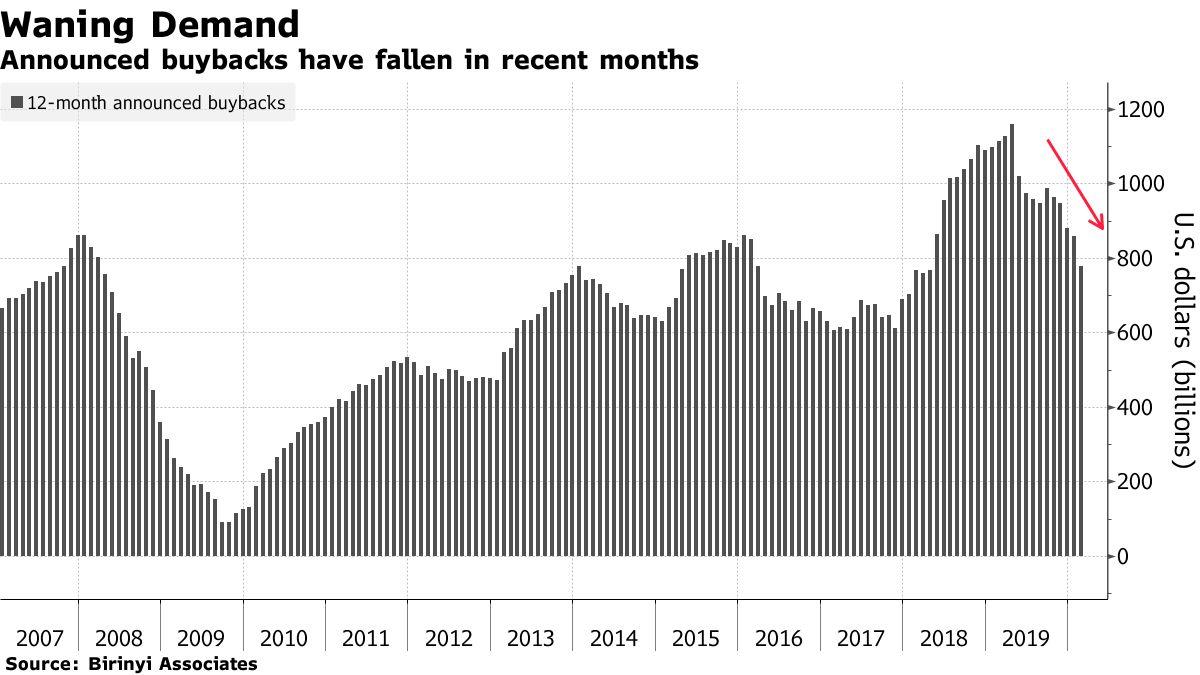

In fact, according to Bloomberg calculations, companies have announced $122 billion of share repurchases in January and February, the lowest in years and down 46% from a year ago – the biggest drop to start a year since 2009.

And just to confirm that Brown has little to worry about, and that buybacks are effectively over for the foreseeable future – once again, just as they should be ramping up to serve as a buffer to the market crash – after the close two major companies announced they are halting stock repurchases either due to the uncertainty associated with the coronavirus, or due to the surge in market volatility.

The Gap was first, when as part of its Q4 and full year results, the clothing retailer announced that “in light of the current economic uncertainty stemming from a number of factors, including the coronavirus outbreak, it currently intends to suspend share repurchases in fiscal year 2020.“

Then just minutes later, hospitality and casino giant MGM Resorts doubled down when it reported that it had terminated its offer to purchase up to $1.25 billion of shares of common stock, and that even though the tender offer is due to expire at midnight tonight, “no shares will be purchased in the tender offer and all tendered shares will be returned to holders.”

“As a result of the unforeseen and unprecedented volatility in the financial markets due to coronavirus, and the resulting impact on our ability to determine and maintain an offering price range, we have decided to terminate the tender offer,” said Jim Murren, Chairman and CEO of MGM Resorts. “The health and safety of our guests and employees is our highest priority, and we continue to take all steps necessary to combat the impact of the coronavirus. As leaders in the communities where we operate, we are constantly coordinating with health and public officials to ensure that MGM provides the latest information and guidance to our employees and guests.”

“To date, efforts to contain the virus have resulted in cancellations or postponements of major conferences, festivals, and sporting events as well as a reduction in broader travel demand in Las Vegas and across the globe. As a result, our domestic resorts have been impacted in the near term primarily driven by increased cancellations in our hotel and convention bookings in Las Vegas particularly during the months of March and April. In light of these trends, we are actively managing our costs to help protect our margins. Further, MGM China continues to be impacted by low visitation following the 15-day closure of our Macau properties.”

“Our recently closed real estate transactions, as well as the contemplated $1.4 billion redemption of operating partnership units, will provide us with approximately $8.2 billion of net cash proceeds, allowing us to achieve our strongest balance sheet in the last decade and one of the strongest in our industry. The execution of our asset light strategy has uniquely positioned us with the flexibility to continue to make purchases under our recently announced $3 billion share repurchase program, while maintaining our strong liquidity position in this environment.”

Concluded Mr. Murren, “At this time, we believe the Company has ample liquidity to weather the current uncertainties in the marketplace. More importantly, we do not expect the coronavirus to have a material impact on our business long term.”

Translation: instead of buying back $1.25BN in stock, we have decided to preserve that liquidity as things are about to get even worse (ignoring the risk that the company’s bank may soon pull their revolver).

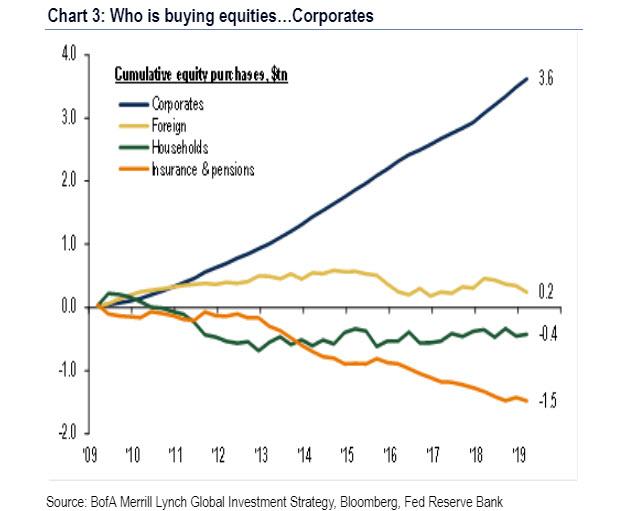

What this means in a bigger picture, is that while stock buybacks sent stocks to all time highs over the past decade, as corporations were the single biggest buyer of stocks…

… these same buyers will no longer be present even though the shares are now at least 20% cheaper, for one simple reason: liquidity suddenly matters a lot, and just like during the financial crisis, nobody knows when all of this liquidity will be pulled. It also means that a market that was reliant on stock buybacks to levitate, may be in far bigger trouble than the modest 20-some percent drop it has suffered so far…

Tyler Durden

Thu, 03/12/2020 – 18:05

via ZeroHedge News https://ift.tt/2W7Utw3 Tyler Durden