Even The Most Powerful Central Banks Cannot Save Us

Authored by Ye Xie, macro commentator at Bloomberg

Even the Most-Powerful Central Banks Cannot Save Us

First, the European Central Bank tried and failed to calm the market. Then, the Fed brought out the bazooka and it turned out to be a dud.

What the world’s two most-powerful central banks showed Thursday was that they are powerless in dealing with a bug. That’s bad news for global markets, and China is no exception.

Literally, there was no place to hide. Gold sold off, along with stocks, credit and oil, for a second day.

European stocks tumbled the most on record and U.S. investment-grade bond funds suffered unprecedented outflows.

It happened even as the ECB boosted its QE and liquidity tools, while the Fed resumed its own asset purchase programs.

What’s more worrying is that the stress is emerging in dollar funding markets as banks and investors scramble for the U.S. currency to hunker down. You can see the dollar hoarding in the widening cross-currency basis swap, and falling CNH forwards.

As a result, the dollar rallied and the offshore yuan tumbled the most since December.

The Fed stepped in quickly Thursday with massive repo operations to alleviate the funding stress. Keep an eye on that to see if it succeeds in calming markets down. If not, the yuan could weaken along with others.

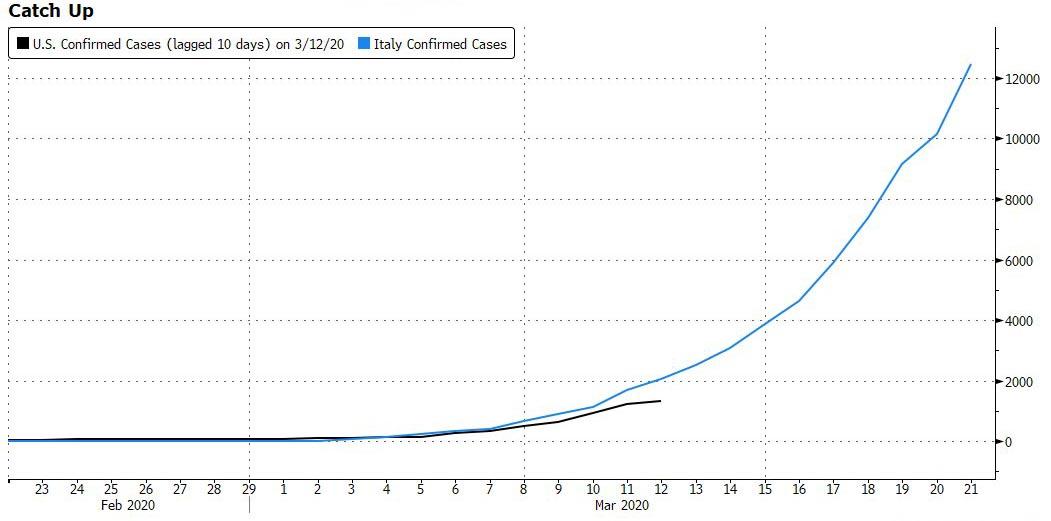

China clearly is not in the eye of the storm. Yet its currency and equity markets are now down for the year. The problem is that the contagion of the virus is still growing exponentially globally. The following chart shows how the number of confirmed coronavirus cases in the U.S. is following the same path as Italy.

Until other governments start to panic, the worst is yet to come.

Tyler Durden

Thu, 03/12/2020 – 22:45

via ZeroHedge News https://ift.tt/2IIZzak Tyler Durden