UMich Sentiment Slumps To 5-Month Lows As Stock Market Confidence Crashes

Having rebounded dramatically for the last six months, University of Michigan’s consumer sentiment index was expected to tumble notably in preliminary March data.

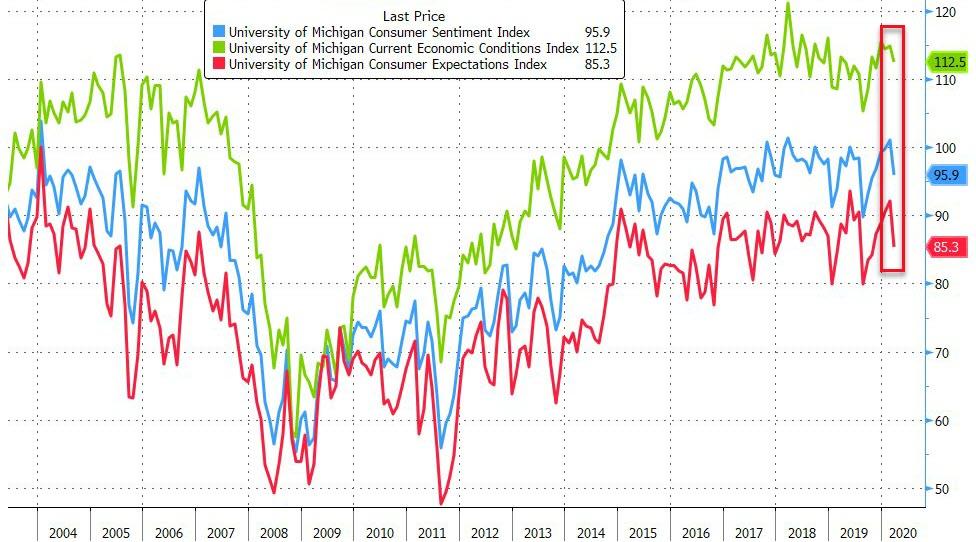

The headline UMich sentiment index was near its highest since 2000 in February, and has tumbled to 95.9 in flash March data (slightly better than the 95.0 exp) – the lowest since October, but ‘hope’ plunged:

-

Current economic conditions index fell to 112.5 vs. 114.8 last month

-

Expectations index fell to 85.3 vs. 92.1 last month

Source: Bloomberg

Buying Conditions, interestingly, improved across all areas…

Source: Bloomberg

65% of respondents believed the stock market will be higher in 12 months in February – near record highs – but that confidence crashed in March, tumbling 6.9 points to 58.7 – the biggest sentiment slump since August 2011 whenb S&P downgraded USA’s credit…

Source: Bloomberg

The survey conducted from Feb. 26 through late Wednesday evening captures a period that started with the virus beginning to spread across the country and culminated with the Dow Jones Industrial Average plunging into a bear market, the World Health Organization declaring a pandemic and President Donald Trump restricting travel from Europe.

“The initial response to the pandemic has not generated the type of economic panic among consumers that was present in the runup to the Great Recession,” , Richard Curtin, director of the University of Michigan consumer surveysaid in a statement.

“Nonetheless, the data suggest that additional declines in confidence are still likely to occur as the spread of the virus continues to accelerate.”

Curtin added that the figures suggest Americans’ early reaction to the public health crisis reflected a perception of the pandemic “as a temporary event.”

And as Rosenberg Research’s David Rosenberg warns, sentiment is about to get a lot worse:

“The big death rate headlines will likely hit consumer confidence very hard indeed and deepen an already likely deep recession and equity market collapse, potentially causing a significant backlash against the current U.S. administration.”

Tyler Durden

Fri, 03/13/2020 – 10:09

via ZeroHedge News https://ift.tt/3aRzYI1 Tyler Durden