“Essentially Nothing Left To Sell In Stocks” – Nomura Thinks The Risk-Parity Deleveraging Rout Is Over

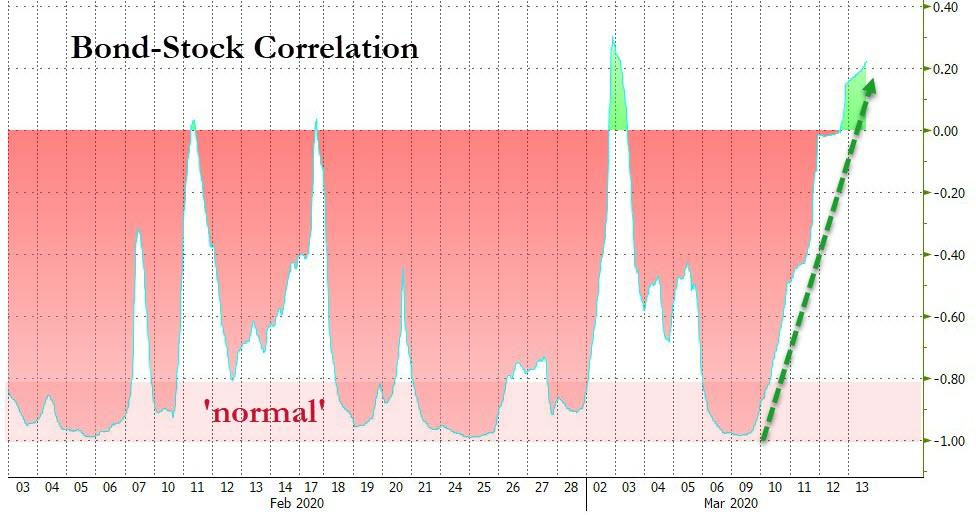

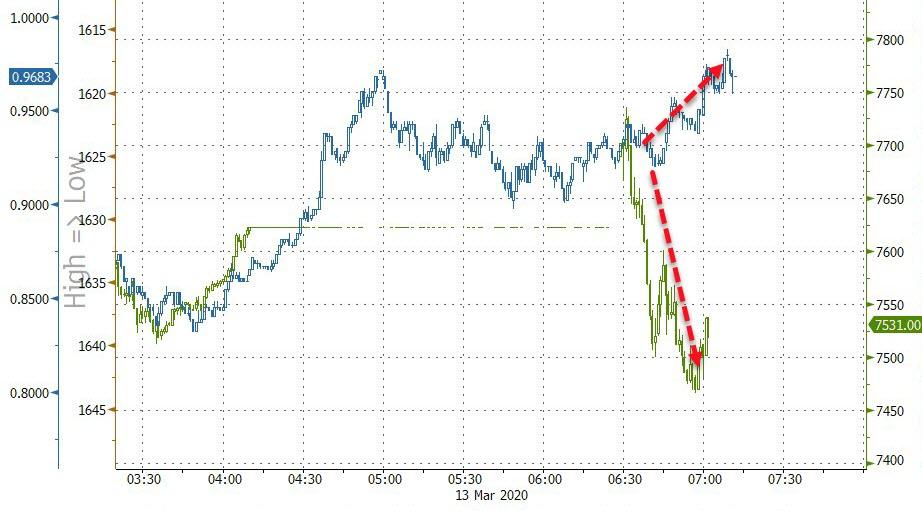

As we have been detailing all week, this has been the worst period for Risk-Parity (or vol-targeting) funds in history, with a massive breakdown in the stock-bond correlation from historical ‘norms’…

Causing Risk Parity funds in particular are to suffer the worst 4 day period on record.

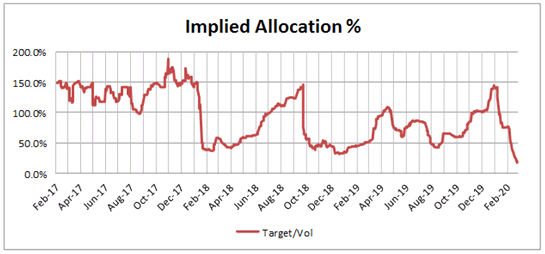

However, as Nomura’s Charlie McElligott believes, vol-targeting funds have essentially nothing left to sell in the Equities-space, “only” -$7.4B sold yday in US Eq, as the aggregate Equities $exposure is currently “0 %ile” since 2000

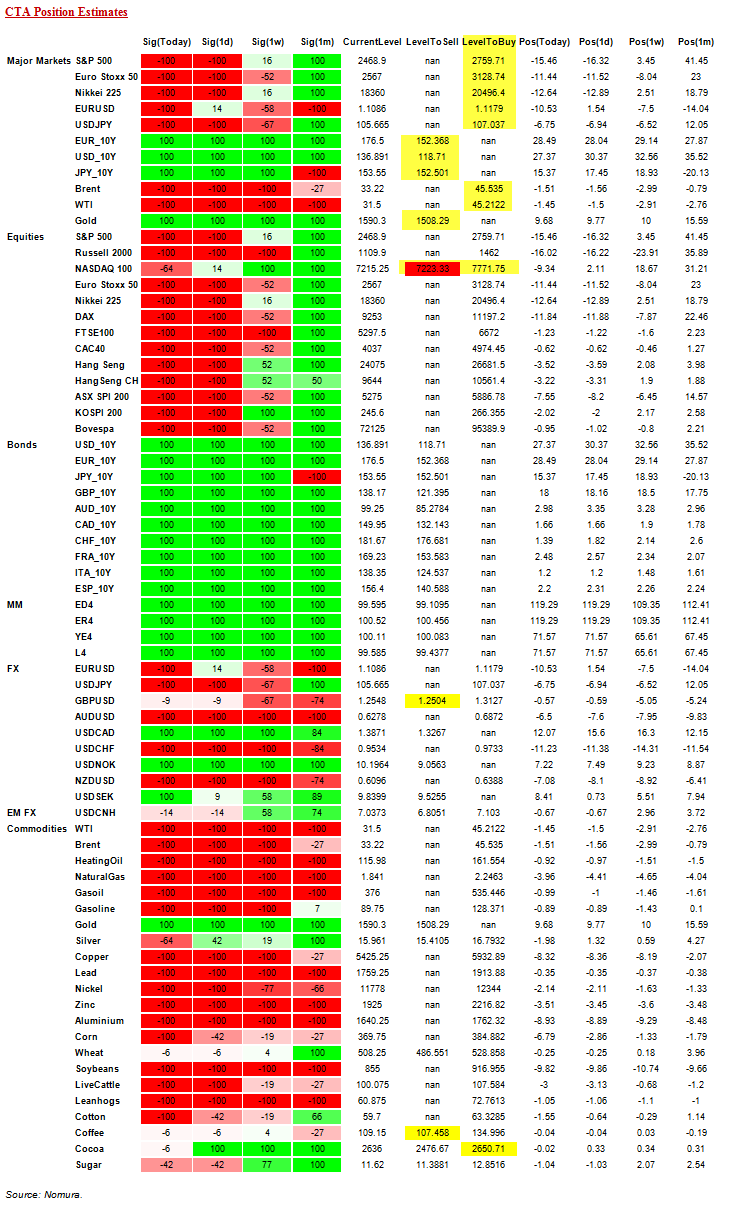

CTAs are almost entirely -100% Short across the Global Equities futures strip with the exception of Nasdaq (“just” -64% Short), and have added leverage into the move lower in recent days.

However it is actually possible that further extension of today’s violent rally is at risk of triggering “mechanical” covering, with levels to buy “feasibly” within range over coming days, and in light of this “realized vol” environment making such moves possible

-

NASDAQ 100, currently -63.6% short, [7215.25 close], more selling under 7223.33 (+0.11%) to get to -82% , max short under 7222.61 (+0.10%), buying over 7771.75 (+7.71%) to get to -25% , more buying over 8275.57 (+14.70%) to get to 56% , flip to long over 7772.48 (+7.72%), max long over 8276.29 (+14.71%)

-

HangSeng CH, currently -100.0% short, [9644.0], buying over 10561.43 (+9.51%) to get to -56% , more buying over 10649.88 (+10.43%) to get to 25% , flip to long over 10649.88 (+10.43%), max long over 11103.68 (+15.14%)

-

Nikkei 225, currently -100.0% short, [18360.0], buying over 20496.43 (+11.64%) to get to -82% , more buying over 21271.86 (+15.86%) to get to -25% , flip to long over 21273.7 (+15.87%), max long over 22649.68 (+23.36%)

-

S&P 500, currently -100.0% short, [2468.9], buying over 2759.71 (+11.78%) to get to -82% , more buying over 2918.04 (+18.19%) to get to -25% , flip to long over 2918.28 (+18.20%), max long over 3048.26 (+23.47%)

-

Euro Stoxx 50, currently -100.0% short, [2567.0], buying over 3128.74 (+21.88%) to get to -82% , more buying over 3337.62 (+30.02%) to get to -25% , flip to long over 3337.87 (+30.03%), max long over 3463.44 (+34.92%)

-

Russell 2000, currently -100.0% short, [1109.9], buying over 1462.0 (+31.72%) to get to -82% , more buying over 1484.17 (+33.72%) to get to -25% , flip to long over 1484.28 (+33.73%), max long over 1529.24 (+37.78%)

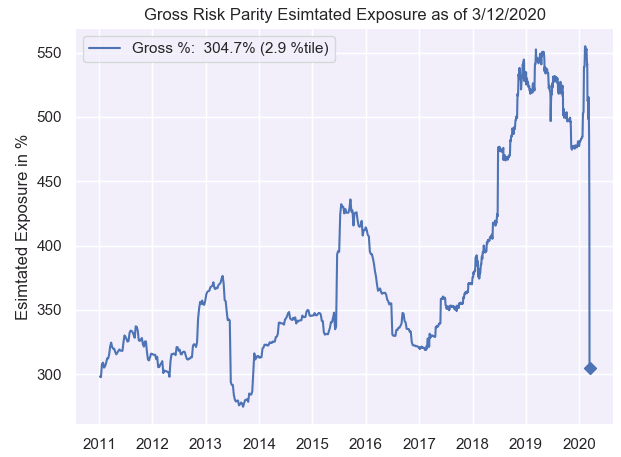

Risk Parity however was the story yesterday however, “by far” the largest culprit in the cross-asset deleveraging purge, with our model estimates showing aggregated gross-exposure slashed from 450% (61st %ile since ’11) down to 305% (2.9%ile) on the session—see below for a scale of the deleveraging on the asset-level:

So, is the worst over? Or is that just the end of the mechanical, forced-deleveraging selling and now comes the real action?

We do note that this morning’s open has seen more bond-AND-stock selling…

Tyler Durden

Fri, 03/13/2020 – 10:13

via ZeroHedge News https://ift.tt/2IJ84Sv Tyler Durden