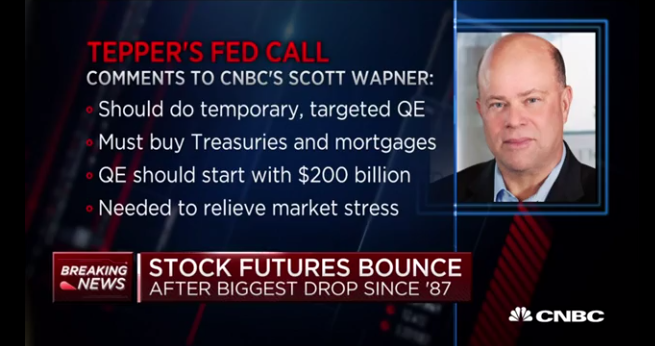

Appaloosa’s David Tepper Says Fed Needs To Conduct Targeted QE

Appaloosa’s David Tepper was heard on CNBC earlier this year, making bullish bets on the stock market. He emailed CNBC’s Joe Kernen in January, saying, “I love riding a horse that’s running.” He added, “We have been long and continue that way.” Tepper also said, “At some point, the market will get to a level that I will slow down that horse and eventually get off.”

So, several months later, the equal-weight S&P has crashed 18% in the last week, one of the most aggressive down moves since the financial crisis, and it appears Tepper is calling for the Federal Reserve to conduct targeted QE in the amount of $200 billion to start. In an interview on CNBC on Friday morning, Tepper said the Fed should purchase Treasuries and mortgages, a move that could relieve market stress, he noted.

Tepper’s call for QE is likely because he’s been turned into a bag holder, derailed by bat soup, after making risky bullish bets earlier this year. His solution to bail out his losing positions: Ask the Fed to print more money.

Tyler Durden

Fri, 03/13/2020 – 12:20

via ZeroHedge News https://ift.tt/2IGlq1U Tyler Durden