US Equity Market Crashes Below 2007 Highs Despite Massive Surge On Trump Stimulus Plan

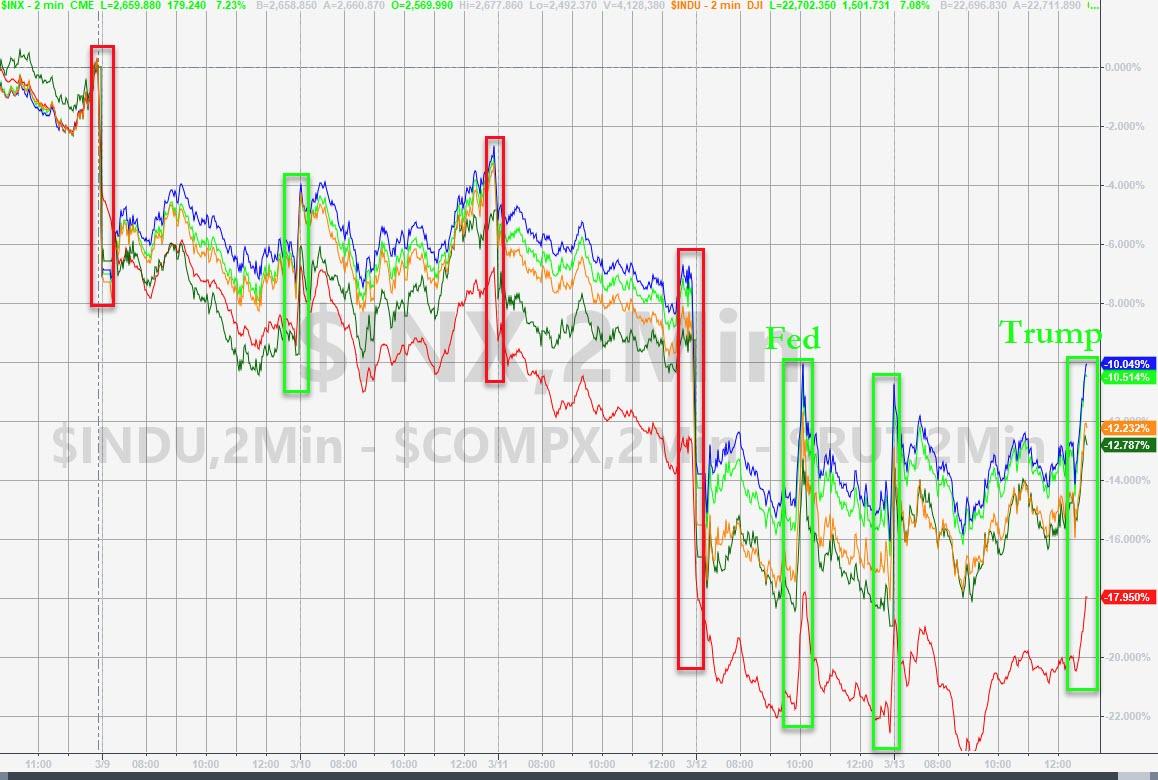

Today saw the biggest spike in US equities since October 2008 after an avalanche of intervention in the last 24 hours across the world and extended by 1600 Dow points as Trump unveiled his stimulus/testing plan…

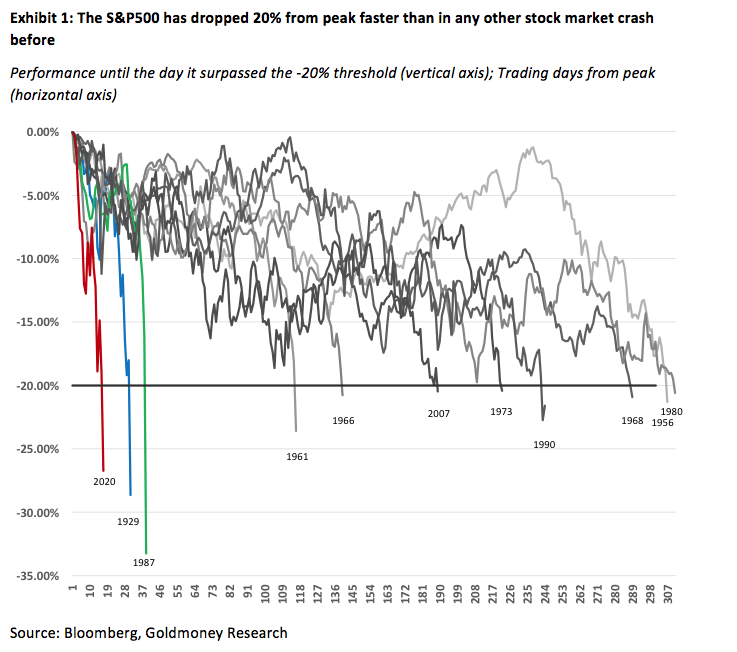

But, overall, the market just suffered its fastest, most aggressive collapse into a bear market… ever…

But even more ominously, the broadest measure of the US equity market – The NYSE Composite Index – has collapsed below the 2007 highs (despite trillions in added liquidity)…

Ray Dalio nailed the top…

We’re sorry but no clip better serves as an analogy for this Minsky Moment than this one…

US equity markets ended the week on a stronger note, big gains overnight (limit up in futures), a plunge at the cash open, only to rebound when rumors hit that the President would declare a National Emergency (implicitly some fiscal largesse) and when he announced his plans, the market went vertical… this was the best day for stocks since 10/28/08…

This was the market’s worst week since Oct 2008, but Small Caps’ 20% crash this week is the worst since 1987 (Small Caps’ 3-week plunge of 30% is the worst ever)

European stocks were hit hard this week too (Italy down over 23% on the week – worst week in history)…

Source: Bloomberg

And even Chinese stocks sold off with ChiNext hit hardest…

Source: Bloomberg

Direct-Virus-impacted sectors were monkeyhammered this week…

Source: Bloomberg

Banks were battered (but bounced today)…

Source: Bloomberg

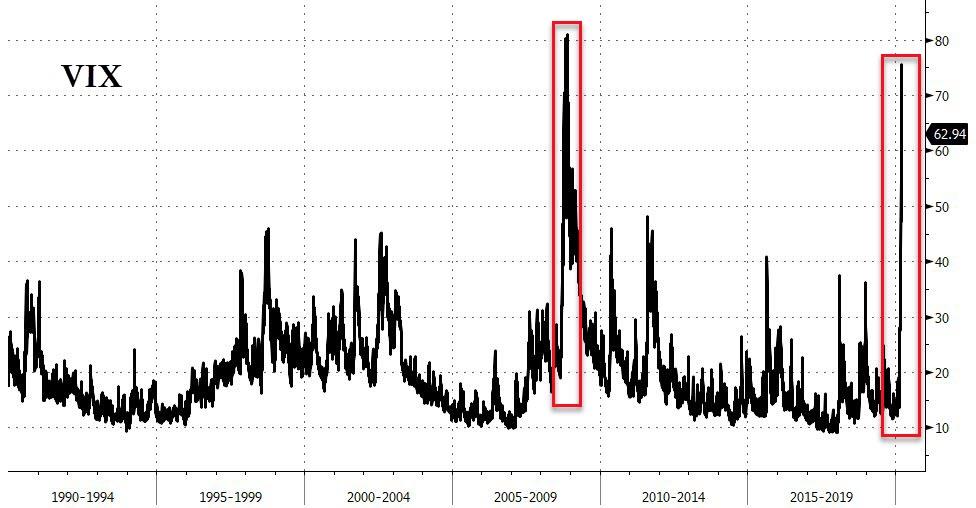

VIX surged higher this week at an unprecedented pace, closing near record highs…

The VIX term structure collapsed to its most inverted since Lehman this week…

Source: Bloomberg

Investment Grade credit crashed this week – by our record this is the biggest weekly spread decompression in history…

Source: Bloomberg

HY credit risk also exploded this week – again the biggest weekly decompression in our datasets…

Source: Bloomberg

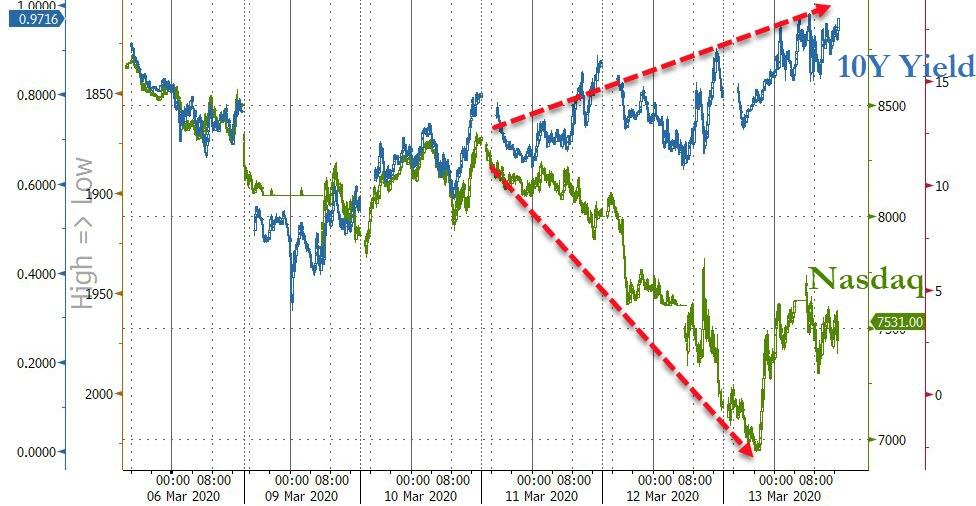

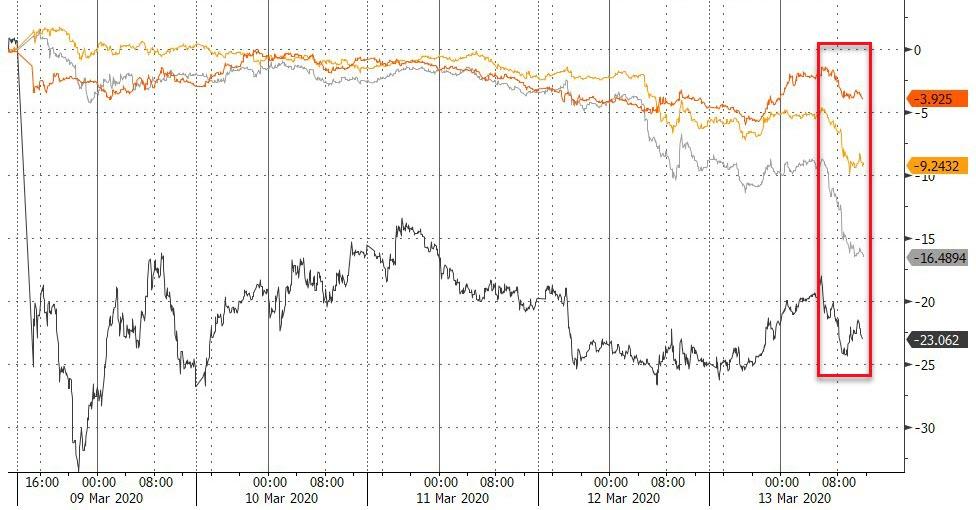

Stocks and bonds were dumped unceremoniously this week…

Source: Bloomberg

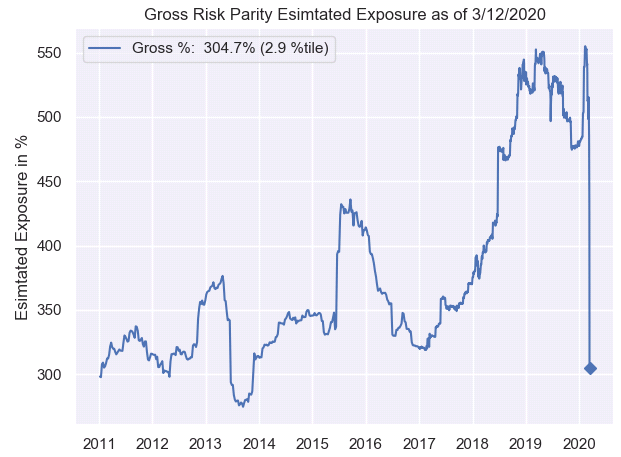

As Risk-Parity Funds saw the biggest deleveraging losses in history…

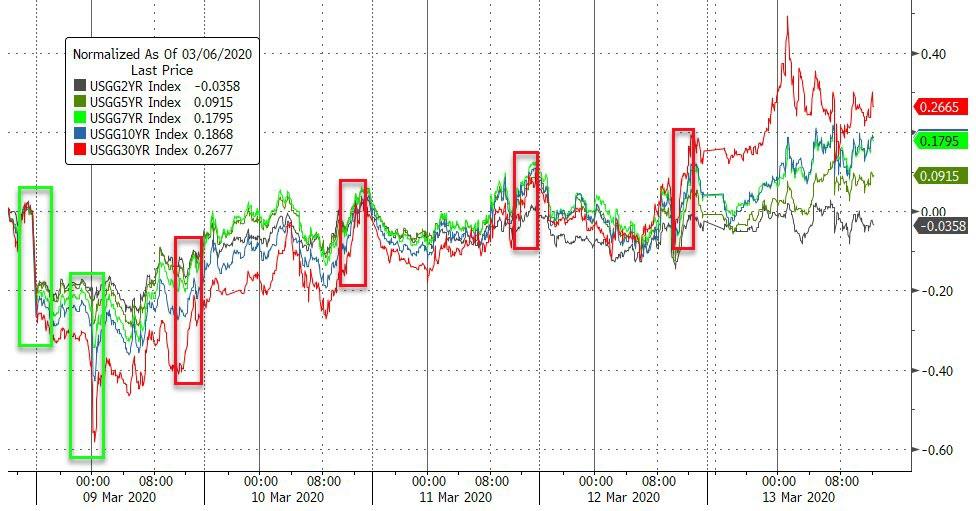

Bonds suffered a total bloodbath this week – despite the collapse in stocks, with the end of day seeing a melt-up in rates…

Source: Bloomberg

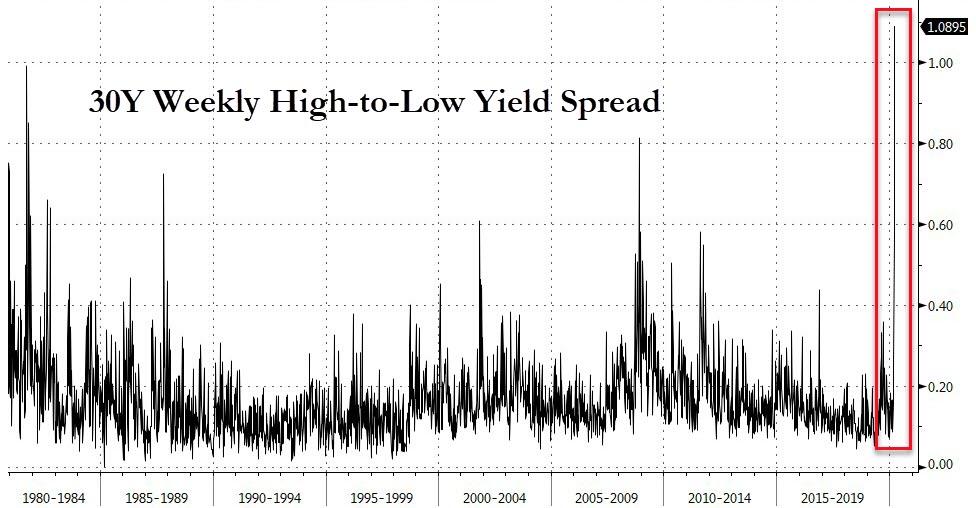

30Y yields exploded higher this week after Sunday night’s crash to record lows. Today saw 30Y spike to 1.79% intraday before tumbling back to 1.39% on the Fed’s emergency QE today…

Source: Bloomberg

After collapsing to 69bps on Sunday night/Monday morning, this week’s blowout on yields is the biggest ever…

Source: Bloomberg

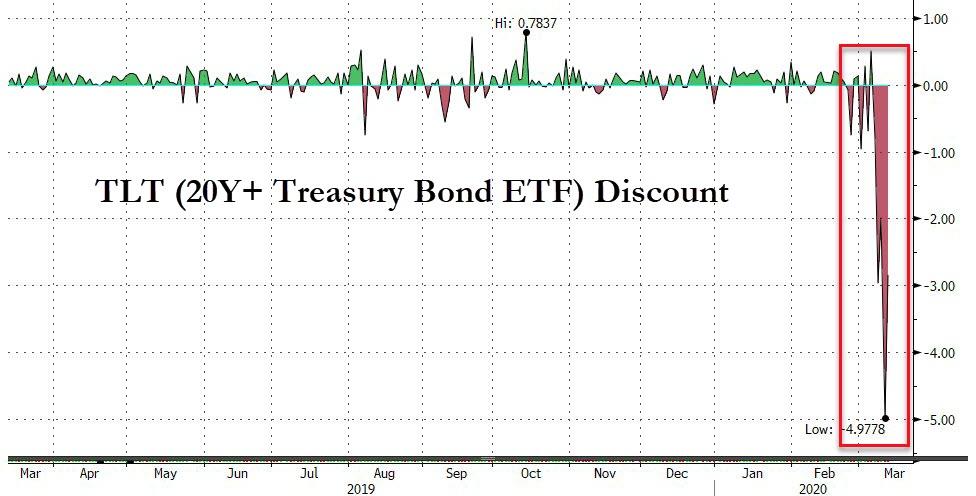

But most worryingly, the Bond ETF world really started to break as massive, unprecedented discounts occurred in Treasury, Muni, and HY Credit ETFs exposing the illiquidity of the underlying assets…

Source: Bloomberg

In Munis, the SEC restricted short-sales in the ETF to try and maintain some order – it failed.

Source: Bloomberg

Before we leave bond land, we note that CMBX crashed back towards its lows as virus anxiety impacting malls and the credit collapse combine to benefit Carl Icahn’s short…

Source: Bloomberg

And the market is now demanding practically 1 full percentage point cut in rates next week by The Fed…

Source: Bloomberg

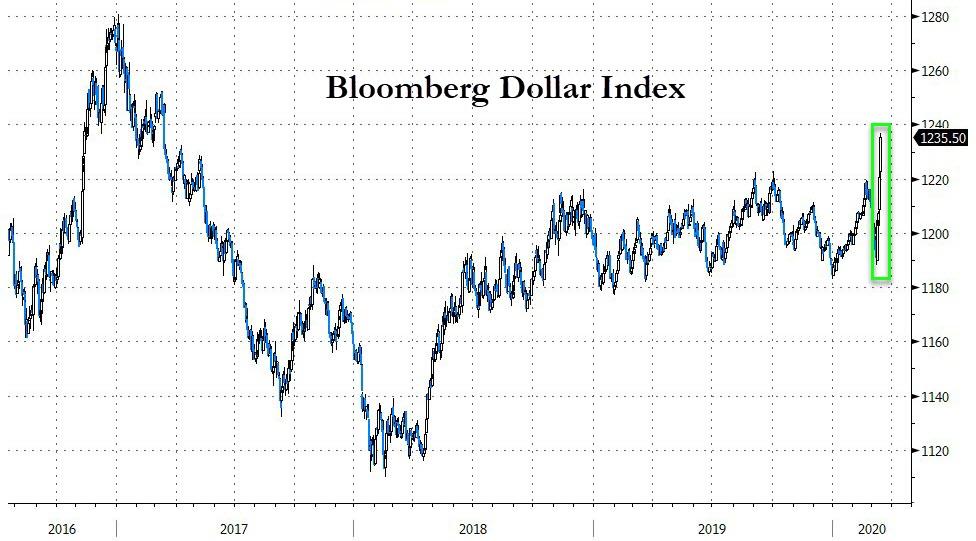

The Dollar was massively bid this week as it appears key safe-haven flows – and liquidity demands – sparked a ‘sell-everything-else’ trade worldwide… (3 days this week were the biggest daily gains in the dollar since Nov 2016)

Source: Bloomberg

This was the biggest weekly gain for the dollar since Oct 2008 (Lehman)…

Source: Bloomberg

Japanese Yen had its worst week since Nov 2016…

Source: Bloomberg

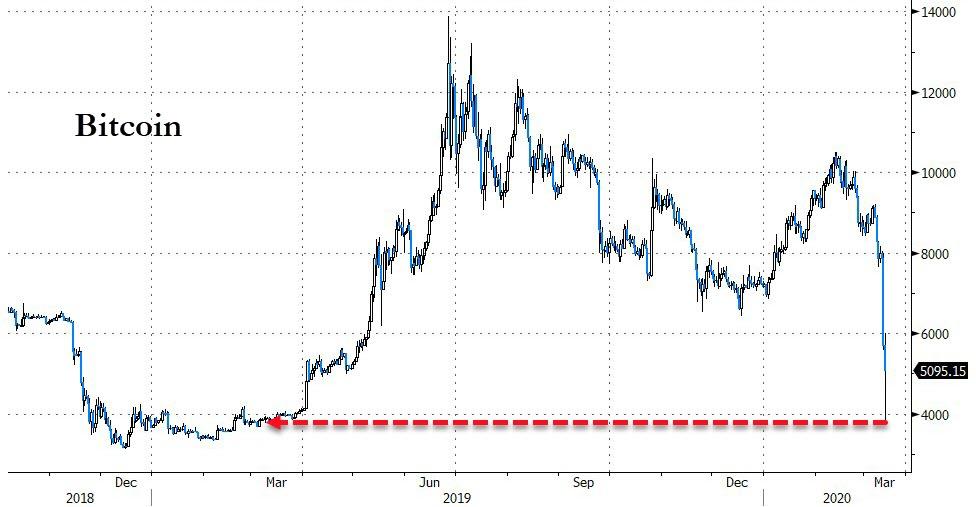

This was the worst week for cryptos since April 2013 – a total bloodbath (yes, Bitcoin Cash is down over 50% this week)…

Source: Bloomberg

With Bitcoin crashing below $4,000 intraday

Source: Bloomberg

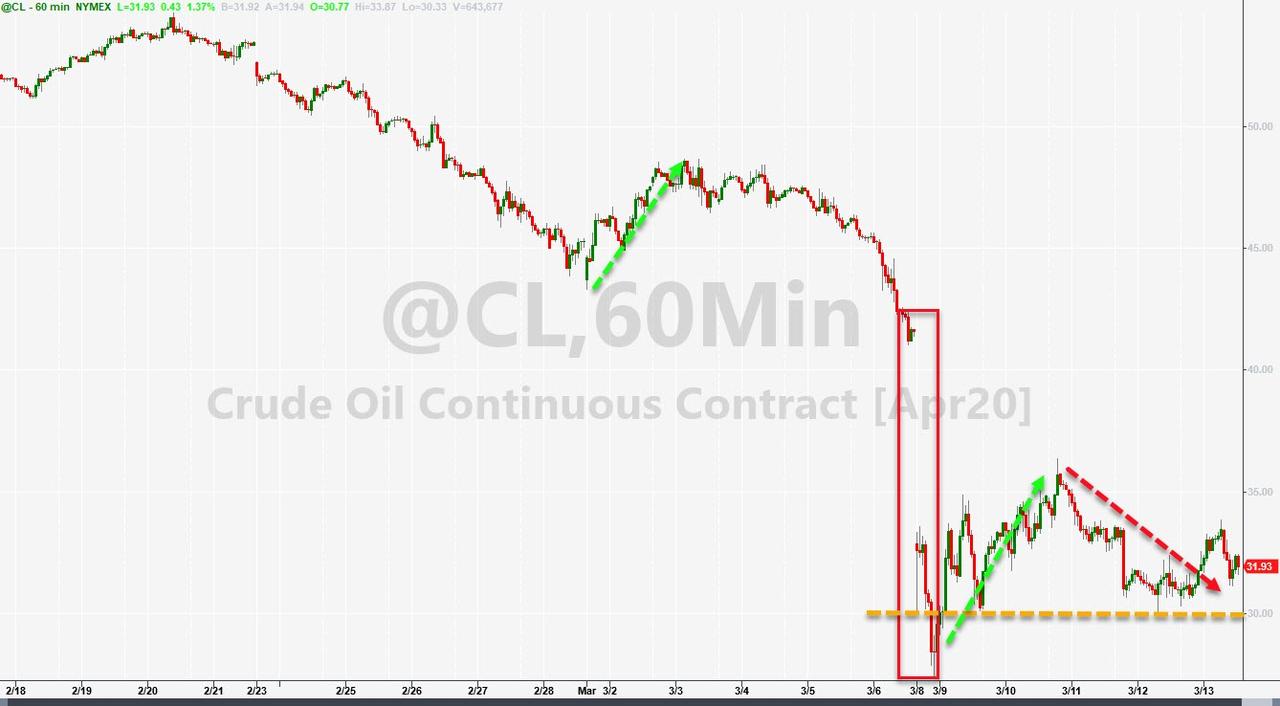

The surge in the dollar this week did not help but commodities were clubbed like baby seals as it seemed someone was mass liquidating everything in a scramble for cash…

Source: Bloomberg

This was WTI’s worst week since Dec 2008 (and biggest 3-week drop ever)…

Gold suffered its worst week since Sept 2011, smashed back below $1600…

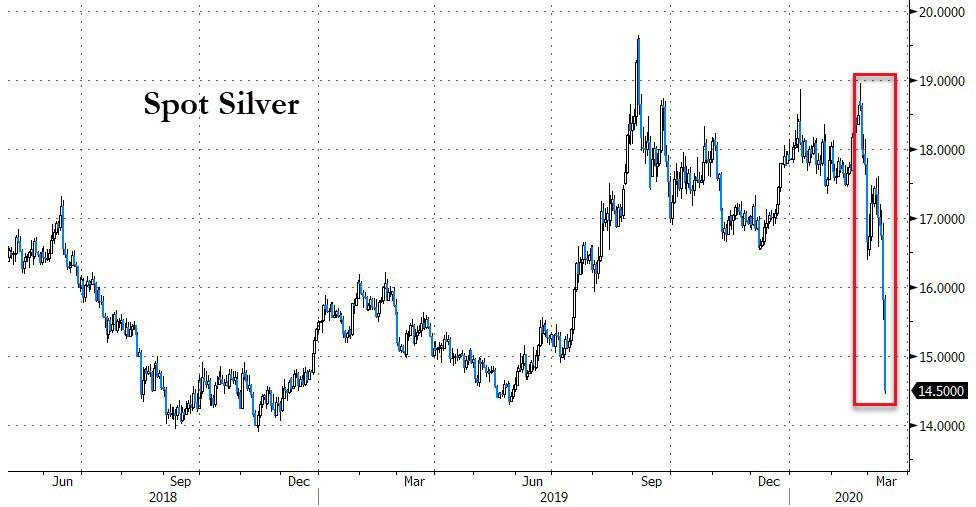

Silver also saw its worst week since Sept 2011…

And perhaps the most stunning moves were in precious metals among all this chaos as gold slumped into the red for the year and high-flying palladium was destroyed…

Source: Bloomberg

Finally, this was the worst weekly loss for a ‘diversified’ book of bonds and stocks since Lehman…

Source: Bloomberg

And, if you’re wondering where this ends, it’s simple – below 2,000 for the S&P 500… as the last five years of equity market gains have been total delusion…

Source: Bloomberg

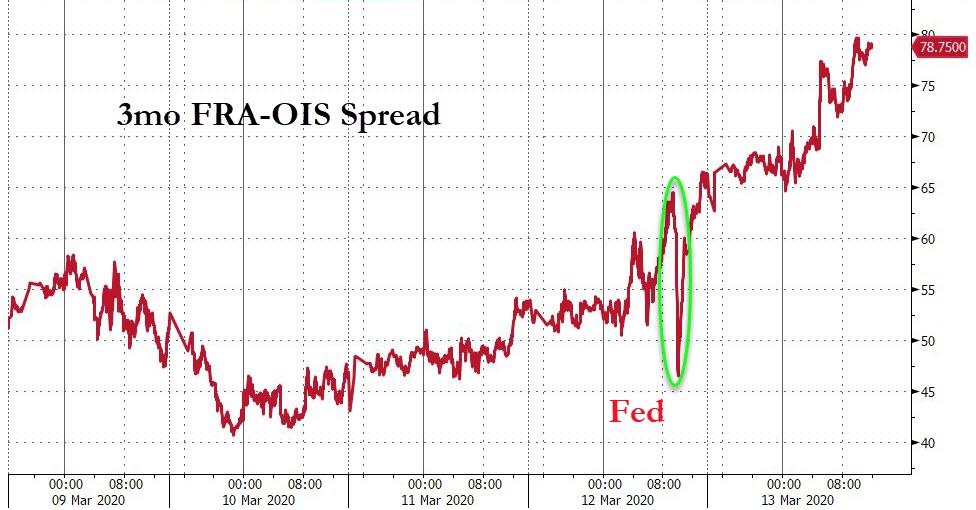

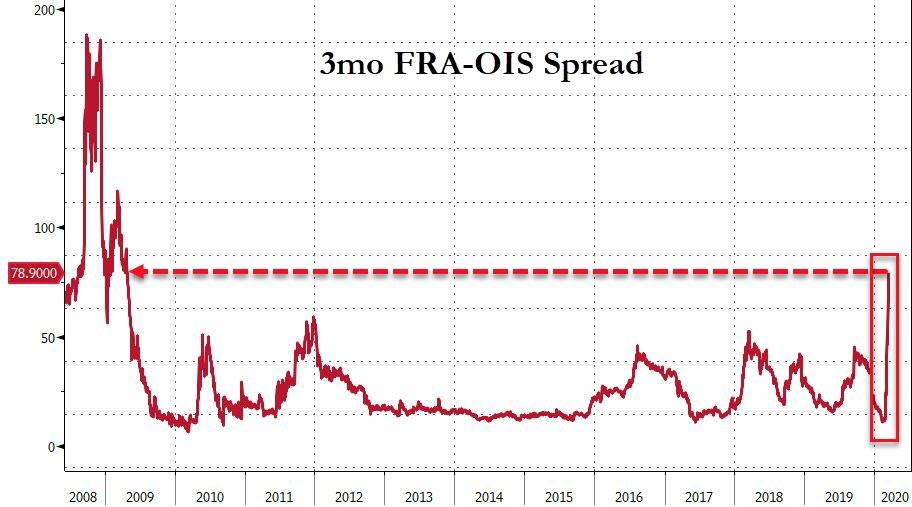

And if you thought The Fed’s Trillion-dollar-plus care-package helped… it didn’t! FRA-OIS spreads continued to blow out, strongly suggesting massive dollar shortages and/or fear of systemic bank credit risks…

Source: Bloomberg

Tyler Durden

Fri, 03/13/2020 – 16:02

via ZeroHedge News https://ift.tt/2TNXUGJ Tyler Durden