Bridgewater’s Macro Fund Crashes 20% Amid Historic Turmoil

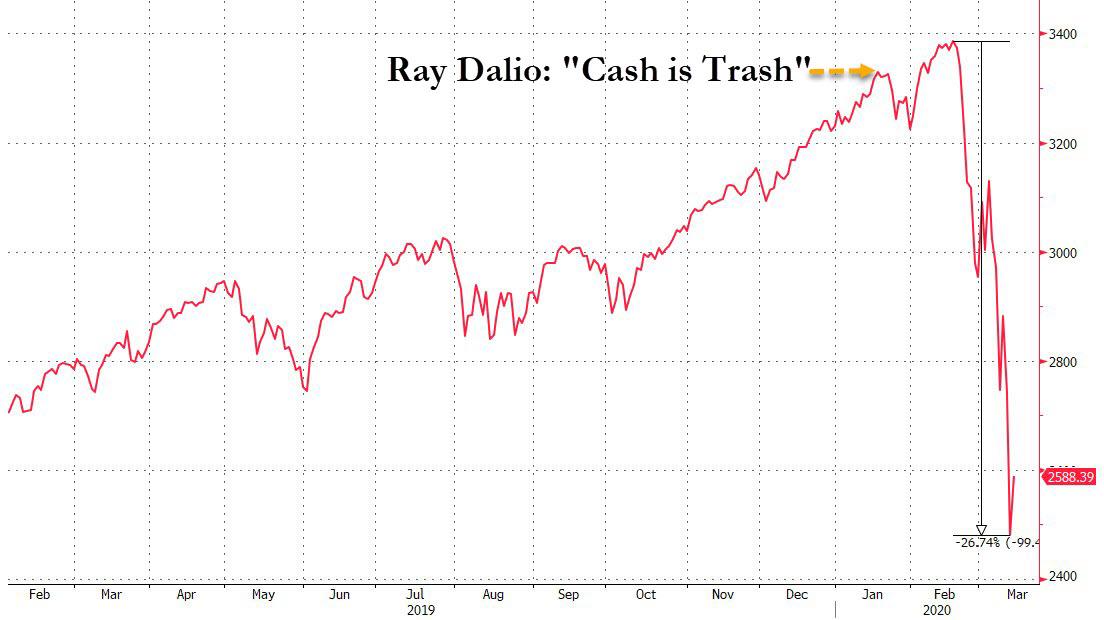

On Friday we were amused to report that just six weeks after billionaire Sinophile investor, Burning Man connoisseur, and author of “principles”, Ray Dalio announced during this year’s Davos boondoggle that “cash is trash“…

… not only did the market suffer its biggest crash since the financial crisis, but as investors pulled money out of all risk assets at a record pace, the inflows to cash – at $137 billion – were the biggest ever.

And as it turned out that cash was the exact opposite of trash, we mused that “it is hot takes like these that make us wonder if all those apocryphal rumors about how Bridgewater became the world’s biggest hedge fund are actually true.”

One day later it is almost as if Bloomberg read our mind (and blog) because picking up on this wonder, Bloomberg reported that Dalio’s macro fund – not his risk-parity All Weather fund – plunged 20% this year as the billionaire fund manager found himself on the wrong side of a market rout caused by the escalating coronavirus pandemic. Citing sources, Bloomberg reports that Bridgewater’s Pure Alpha Fund II which manages roughly $80 billion, tumbled roughly 13% this month through Thursday, following an 8% drop in the first two months of the year.

The good news: Dalio’s catastrophic Davos take was basically talking his book, and not the other side of it as so many banks do these days; indeed the Bridgewater founder offered a fairly rosy outlook for markets as recently as last month, when he said in mid-February that investor concerns over the virus “probably had a bit of an exaggerated effect on the pricing of assets because of the temporary nature of that, so I would expect more of a rebound.”

Then just last week, Dalio tripled down, when the famous creator of workplace “principles” tweeted words of encouragement as markets crashed, saying “look for the opportunities” but only after protecting against “the risk of ruin”, and yet protecting the risk of ruin usually involves holding on to substantial amounts of cash, so… which is it?”

Periods of turbulence provide both large risks and large opportunities, so after you make sure that you and your people are safe from the risk of ruin, look for the opportunities. It is because at such times most people pay the most attention to the risks than the opportunities. pic.twitter.com/gvkv4LLNJc

— Ray Dalio (@RayDalio) March 9, 2020

Bridgewater’s February performance is poised to be the worst month on record for the Pure Alpha II strategy, whose worst month until now was a 10.5% drop in April 2008 around the time of the Bear Stearns collapse. Ironically, it was just in November when Dalio made a big stink at the WSJ for daring to suggest that he was betting on a market crash:

The Wall Street Journal wrote an article that said “Bridgewater Bets Big on Market Drop.” It’s wrong. I want to make clear that we don’t have any such net bet that the stock market will fall.

In retrospect, after such a catastrophic performance to start 2020, he should have as the fund’s LPs will soon make abundantly clear as they pull their money out of the fund.

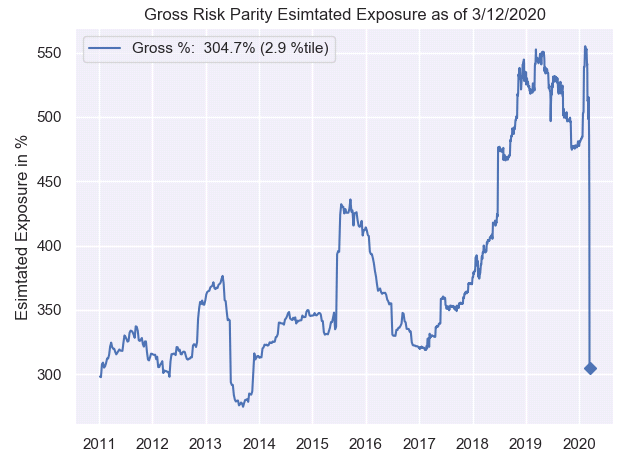

That said, Pure Alpha’s implosion is only half the story: following last week’s historic VaR shock which saw the biggest Risk Parity unwind of all time…

… what we would like to know is whether Bridgewater’s All Weather risk parity fund was also behind the cataclysmic gyrations in the market that culminated in a broad-based liquidation of pretty much everything. We hope to find out soon enough.

Tyler Durden

Sat, 03/14/2020 – 11:43

via ZeroHedge News https://ift.tt/2vY5cPb Tyler Durden