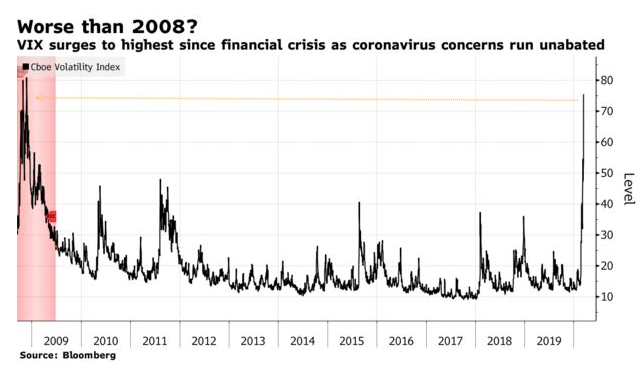

“More Violent, More Persistent”: Market Fear Worse Now Than In 2008, Man Who Inspired VIX Says

The academic best known for coming up with the idea of the VIX – also know as Wall Street’s fear gauge – says that the fear looming over the markets now is far greater than the fear we faced in 2008.

Dan Galai, a professor at the Hebrew University of Jerusalem told Bloomberg:

“The level of uncertainty is even beyond what we saw in 2008 immediately after Lehman Brothers collapsed.”

Galai continued:

“If you look at 2008, it spiked and then within a day or two, it was going down very fast. Here, it’s been steadily going up instead of going down. It’s more violent, and it’s more persistent.”

The VIX is an indicator of expected near-term swings in the S&P 500 and has closed above 45 for four days in a row, which is the longest streak of this kind since 2009. It closed on Friday at 63, despite stocks spiking during the last half hour of trading. The VIX spiked up to 76 on Thursday, as stocks experienced the largest one day drop since October 1987.

Galai notes that monetary response likely won’t do much to stave off the problem.

“I don’t think interest rates have any effect right now. Monetary steps, in my view, are completely redundant,” he said.

Galai had proposed using gauges to measure volatility in 1989 and his proposal led to the CBOE VIX. Galai likens strategies that short volatility – including one that buried a Credit Suisse short-volatility note in 2018, as a “substitute for Las Vegas”.

Now you tell us…

Tyler Durden

Sat, 03/14/2020 – 19:45

via ZeroHedge News https://ift.tt/2U1v0Sk Tyler Durden