Goldman: “The World Is In A Recession”

And there it is: a little over a year since Goldman boldly predicted 4 rate hikes in 2019 on expectations of a global, coordinated, reflating recovery, the Fed cut its fed funds rate to zero and unleashed a historic QE/repo bazooka meant to unclog frozen funding, Treasury and credit markets, moments ago Goldman’s chief economist capitulated declaring in a note that the world is in a recession.

While it’s hardly news for anyone who has followed the actual newsflow, and not just from the coronavirus but events leading into the current crisis, Goldman still has a certain cache on Wall Street, and now that the most reputable bank has broken the seal, watch for every other sellside researcher to follow suit.

Here are some of the highlights from his post:

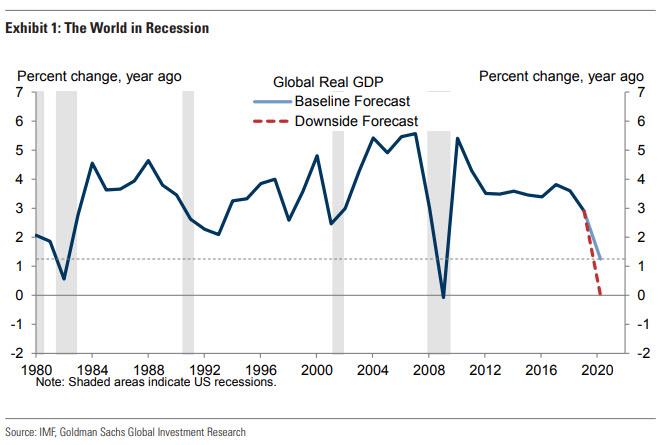

Over the past few days, the escalation of the coronavirus crisis in Europe and the US, as well as the exceptionally poor January/February data out of China, have led us to downgrade our growth forecasts sharply across most of the world’s major economies. Consequently, our global GDP growth forecast for 2020 has fallen to just 1¼%. This would be less bad than the deep recessions of 1981-82 and 2008-09 but worse than the mild recessions of 1991 and 2001.

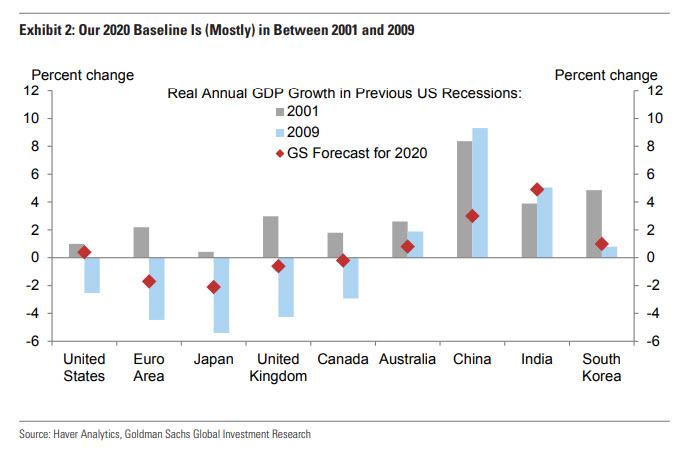

Consistent with this, our 2020 GDP forecasts across most of the major countries are in between the numbers seen in the mild recession of 2001 and the deep recession of 2008-2009. However, China now looks significantly weaker than in either of these episodes, when it sharply outperformed most other countries.

Exhibit 1 shows that we now expect the global economy—more precisely, the 40 economies under our coverage aggregated using purchasing power parity-adjusted GDP—to grow just 1¼% in 2020. Although there is no universally agreed-upon definition of a global recession, the chart shows that a 1¼% number should easily qualify. In fact, 1¼% would be the third-weakest year of the past four decades—not as bad as the deep recessions ending in 1982 and 2009 but worse than the mild recessions of 1991 and 2001.

Looking across the major economies, we now see several economies—most clearly the Euro area and Japan—with outright annual GDP contractions. More broadly, Exhibit 2 shows that our GDP forecasts across most of the major advanced economies are in between the numbers seen in the mild recession of 2001 and the deep recession of 2008-2009. The exception is Australia, which held up exceptionally well in the GFC. The emerging world is more of a mixed bag, with China looking much weaker but India somewhat firmer than in 2008-2009, according to our current forecasts

Although we expect the recession to be front-loaded, with a recovery in H2, the risks remain on the downside.

- First, we have not yet built a full lockdown scenario into our forecasts for the United States and other advanced countries outside Europe, but several US states and cities now seem to be heading in that direction.

- Second, we assume that new infections slow sharply after April. While this is consistent with the experience of China, Japan, and Korea, it is unclear whether the mitigation and testing actions taken by Western authorities are sufficient to produce a similarly rapid turn.

Tyler Durden

Tue, 03/17/2020 – 08:47

via ZeroHedge News https://ift.tt/2QnqUmG Tyler Durden