“We’re About Halfway There” – Historic Carnage Everywhere Sparked By Dollar Margin Call Panic

It’s definitely a ‘deer’ day…

Stocks down, Bonds down, credit down, gold down, oil down, copper down, crypto down, global systemically important banks down, and liquidity down…

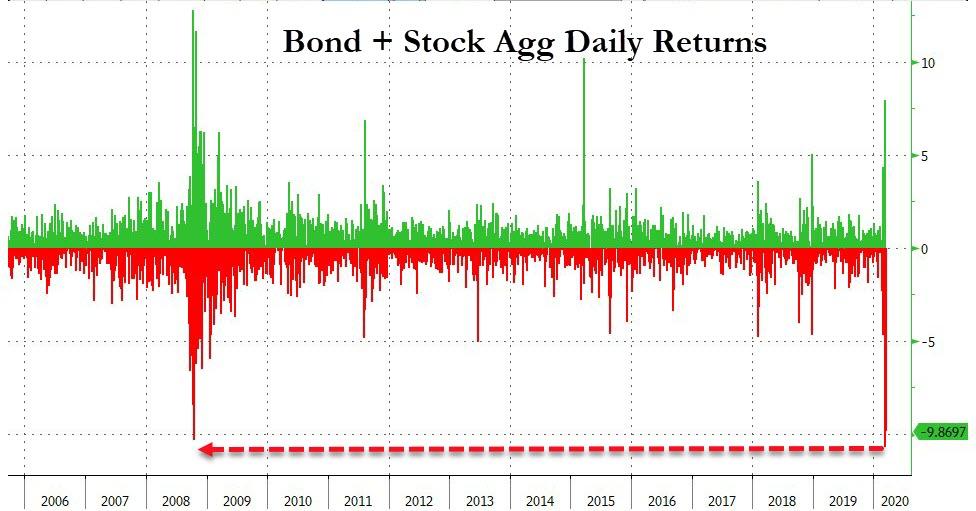

Today was the worst day for a combined equity/bond portfolio… ever…

Source: Bloomberg

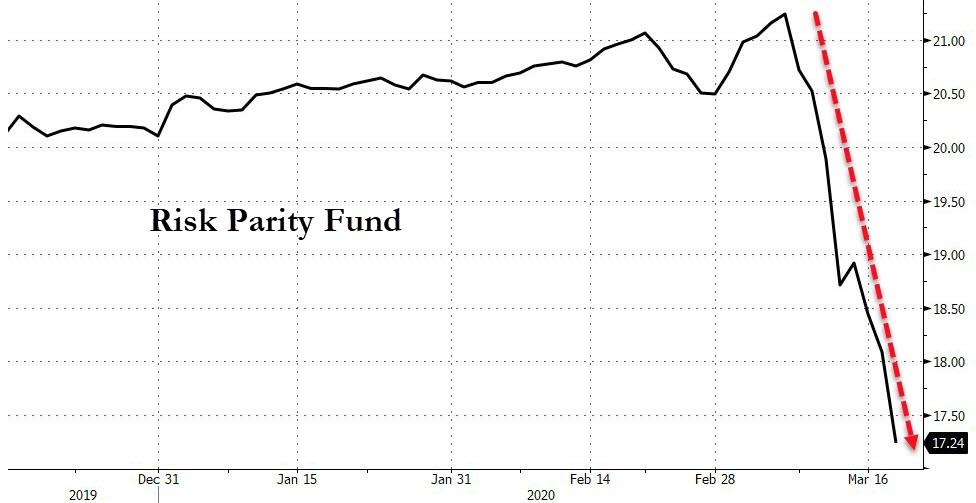

Crushing risk-parity funds as bond-stock correlation soars unnaturally…

Source: Bloomberg

Jeff Gundlach predicted during his DoubleLine call yesterday that “the U.S. national debt likely to grow to $30 trillion in two or three years as spending explodes in response to the crisis”, which means about $3-4 trillion in net issuance per year, and that upcoming supply tsunami is certainly sending bond prices lower, potentially dealing a deathly blow to the risk-parity/balanced “60/40” portfolio model.

…and only two things up – Dollar and VIX hit record highs.

VIX surged over 85 intraday and closed at a new record high…

Source: Bloomberg

And Treasury VIX also hit a record high…

Source: Bloomberg

The dollar exploded to a new record high today…

Source: Bloomberg

..as the global dollar short margin call came due…

Source: Bloomberg

Beyond the traditional “safe haven” role of US Treasuries, Goldman notes that the Dollar has a number of features which help explain its behavior during economic downturns and periods of extreme market volatility:

1. Denominator of US capital markets. The Dollar denominates US equity and bond markets, the world’s largest important capital markets. Because of the large size of US markets, international investors tend to hold many more US assets than domestic investors hold of international assets. This imbalance can have implications for currency markets. For instance, many non-US investors own US equities on an FX-hedged basis. When equity market cap declines they are left with over-sized hedges, and bringing the notional value of hedges down therefore generates USD buying. Because the US market is so large, these flows tend to dominate any USD-selling flows by US investors. Research from the BIS suggests this was one factor behind the Dollar’s appreciation during the Global Financial Crisis. Some of the issues playing out in money markets— especially wide cross-currency basis—reflect similar underlying imbalances.

2. Intervention currency. When central banks intervene to defend against excessive depreciation, they most often sell US Dollars to buy their domestic currency. All else equal this slows the Dollar appreciation against that cross. But for the broad Dollar often more important is what comes next: selling USD changes the currency composition of reserve assets, so reserve managers may take rebalancing operations, buying USD vs other reserve currencies like EUR or GBP to replenish supply of the preferred intervention currency. As a result, FX intervention may paradoxically boost the Dollar vs certain G10 crosses.

3. Global invoice and lending currency. The Dollar denominates most global commodity trade, most cross-border lending to emerging markets, and an outsized share of global trade volumes (see here for more background). In an economic downturn: (i) commodity prices fall, resulting in lower USD revenues for producers; (ii) trade volumes fall, resulting in lower USD revenues for other exporters, and (iii) cross-border lending dries up, resulting in lower USD assets for borrowers. Exactly how these factors effect FX spot markets is a source of debate. But, in our view, they may create Dollar scarcity in some parts of the global economy, resulting in selling of non-USD assets to accumulate USD balances.

Said simply: the USD is the world’s reserve currency, which while a huge benefit to the US when times are good, is an unbearable burden during crashes such as this one. While there is no simple solution, the legendary inventor of the MOVE index did propose a brilliant solution back in 2016: the Fed can always crush the dollar by buying gold in the open market, effecting another FDR-like devaluation of the dollar. Because as J.P.Morgan famously said in 1912, “Money is gold, nothing else.” One year later the Fed was born.

But for now, gold is being puked (to raise dollars) along with every other asset…

Source: Bloomberg

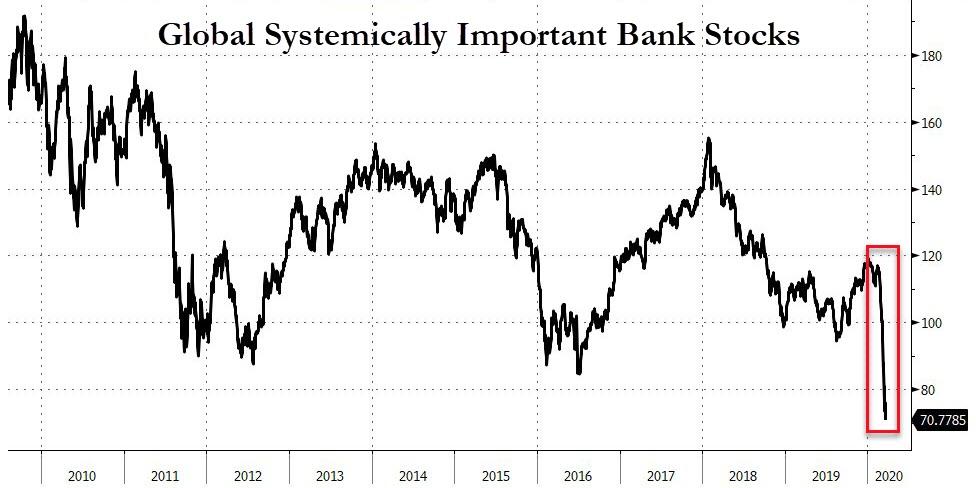

In other ominously concerning news, global systemically important banks have collapsed…

Source: Bloomberg

As Deutsche Bank counterparty risk is exploding to record highs…

Source: Bloomberg

Globally, stocks were notably lower today but China continues to magically outperform Europe and US massively…

Source: Bloomberg

US futures were limit-down overnight, ETFs signaled more selling pressure but ramped at the open as the algos kicked in… but that didn’t last… markets rallied in the last few minutes as Senate passed the first bailout bill (but that did not last)…

Small Caps were the worst on the day, Nasdaq best, but everything was crushed…

Source: Bloomberg

Intraday, Dow futures were lifted to VWAP 3 times after the cash open… and sold twice…

Source: Bloomberg

The Dow crashed back into the red since Trump’s inauguration today…

Source: Bloomberg

Directly virus-affected sectors continued to collapse…

Source: Bloomberg

US bank stocks are now unchanged since 1996…

Source: Bloomberg

Source: Bloomberg

Credit markets continue to collapse with IG worst…

Source: Bloomberg

But HY is a bloodbath too (HY CDX +130bps to its highest since 2011)…

Source: Bloomberg

Treasury yields were higher on the day, but came well off the highest yields into the close as 30Y was bid…

Source: Bloomberg

The daily ranges in bond yields is just stunning – 30Y yields traded in a 35bps range today (for a 1.8% yield – not an 18% yield!!)

Source: Bloomberg

The dollar exploded today – its 7th straight day of gains and biggest jump since June 2016’s Brexit vote flight to safety… (NOTE the dominant dollar buying trend appears to come from the European session)…

Source: Bloomberg

As the dollar exploded higher so its fiat peers collapsed (except the Shekel which was bid?)…

Source: Bloomberg

With cable crashing to its lowest since 1985!!

Source: Bloomberg

Crypto was modestly lower on the day…

Source: Bloomberg

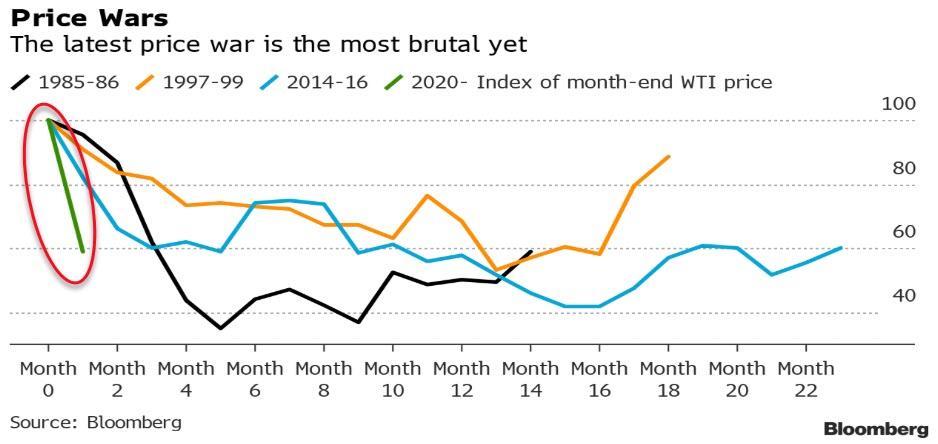

Total and utter carnage in commodity-land today with WTI crashing 25% at one point…

Source: Bloomberg

Gold outperformed its peers on the day but was still lower…

Silver was slammed, sending the Gold/Silver ration to yet another record high…

Source: Bloomberg

WTI Crude was devastated, crashing to just above $20 ($20.06 intraday lows) – NOTE, WTI traded as high as $65.65 in January after the Soleimani assassination and Iran missile strike…

WTI is at its lowest since 2002…

Source: Bloomberg

This is by far the worst price action of any oil price war…

Finally, as one trader told us, “we’re only about halfway there” in stocks as the central-bank-sponsored delusion of the last few years is wiped away…

Source: Bloomberg

US equity markets have merely fallen to the same level of valuation at the peak in 2007…

Source: Bloomberg

So, you can’t print your way to prosperity after all? As Bill Ackman so ominously warned:

“You cant borrow your way out of the problem, you can’t lend your way out of the crisis.. you have to kill the virus.”

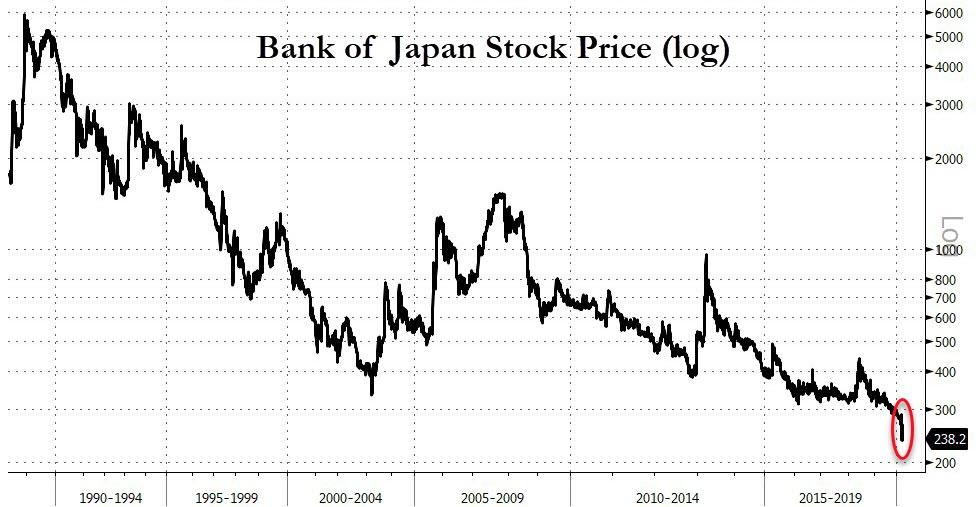

And if you’re being told “buy the dip”, “buy and hold”, “long-term value”… ask the Japanese how that worked out for them when The BoJ finally lost control…

Source: Bloomberg

Is the world losing faith in global central banks?

They failed…

Source: Bloomberg

Bank of Japan stock (yes it trades publicly) crashed to a record low…

Source: Bloomberg

And Japanese sovereign risk is soaring…

Source: Bloomberg

As is USA sovereign risk as MMT reality starts to dawn on markets…

Source: Bloomberg

Tyler Durden

Wed, 03/18/2020 – 16:01

via ZeroHedge News https://ift.tt/2QrlcQB Tyler Durden