2008 Playbook: Unknown Unknowns

Submitted by Nick Colas of DataTrek Research

While Donald Rumsfeld may not be one’s go-to guy for decision making paradigms, his 2002 mention of “unknown unknowns” is worth considering just now as an investment framework. The idea here is that we all make judgments based on a tripartite spectrum of available information. Specifically:

Known knowns (entirely baked into asset prices):

-

COVID-19 both spreads easily and is sufficiently harmful to require countries to limit economic activity dramatically in order to contain the virus before it overwhelms their health care systems.

-

Policymakers have responded by providing large scale fiscal and monetary stimulus in the hopes of tiding over economies during the worst of the outbreak.

-

Medical researchers are working on improved therapeutic treatments as well as vaccines. Testing is becoming faster and more widespread.

Known unknowns (partially baked into asset prices):

-

The exact duration of national lockdowns around the world and their impact on labor markets.

-

The pace of economic recovery once the immediate danger has passed/possibility of reinfection during a restart.

-

The size and timing of further fiscal/monetary stimulus (NY Governor Cuomo highlighted this in his press briefing today with respect to state budgets, an important source of US fiscal spending).

Unknown unknowns (not in asset prices and near-impossible to assess today):

-

Inflation rates over the next 1-3 years, a push-pull of fiscal/monetary stimulus and uncertain consumer/business confidence.

-

Any change of personal/corporate tax rates to stabilize government deficits (both at national and state levels).

-

The political implications of COVID-19 on the November US general election. Worth noting: President Trump’s latest Gallup approval rating out on March 24th were the highest of his presidency and may have helped boost stock prices last week.

-

The effect of exploding deficit spending around the world on the cost of capital.

-

How emerging market economies with large dollar-denominated debts will handle a slow global economic recovery or how the European banking system will deal with a sharp recession in its most vulnerable countries.

-

Just as the Great Recession did lasting damage to younger job seekers, will the current global downturn affect those finishing/just out of college right now?

You probably have many other “unknown unknowns” you could add to this list, but that’s exactly the point when considering how well US equities have held up; the S&P 500 at 2541 implies:

-

No structural damage to US large cap earnings power. We’re trading at 20x the trailing 10-year average S&P earnings of $122/share, not the 10x we saw in 2009.

-

Confidence that visibility into that $122/share earnings run rate will be there in November 2020 (near term equity prices tend to lever off 6-month forward economic/profit conditions).

-

That the CBOE VIX Index over 60, even on large up days, is only a sign of near-term potential volatility rather than a sign equity prices are fundamentally wrong.

-

That markets will continue to ignore bad economic news or disappointing corporate profit reports because either they are temporary or they will spur further monetary/fiscal stimulus.

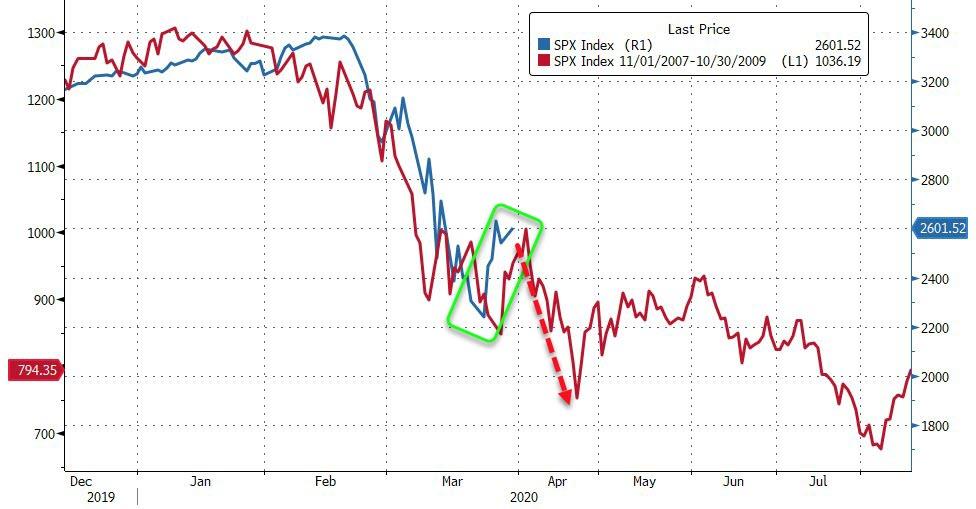

As for how this is playing out in our 2008 Playbook construct, once again using September 29th 2008 and March 9th 2020 as starting points (the first +5% “crash day” move in each sequence):

#1: Because policymakers now both “own” the COVID-19 Crisis (unlike Q4 2008 when there was a US election pending) and learned from 2008 to go big/early (both in fiscal and monetary policy), the damage to the S&P 500 has not been as bad in 2020 as it was in 2008:

-

The index is down 7.5% from September 29th, 2020.

-

In 2008, the S&P was 15.0% lower on October 17th from September 29th, the same number of trading days as we’re including in the prior point.

#2: From this point in 2008, for the next 19 trading sessions the S&P 500 was in a very broad band but went essentially nowhere.

-

The index closed at 940 on Friday, October 17th 2008.

-

19 trading days later, the S&P closed at 911, down 3.1% from that 940 level. In between October 17th and November 13th the index had an +11% day (October 28th) and four +5% decline days (October 22, post-election November 5/6, and November 12).

#3: The real crack for US stocks in 2008 came right after this waiting period, happened very suddenly, but bounced back relatively quickly:

-

After holding the 900 level, the S&P went to 752 in just 5 trading sessions (November 14th to November 20th), a 17.5% decline. The headlines at the time centered on which financial institutions/auto makers would receive TARP funding, and how much.

-

The S&P then came roaring back over the last 27 trading days of 2008 and closed at 903 with just one +5% crash day (-8.9% on December 1st).

This experience is emblematic of how markets behave when “unknown unknowns” shove their way into asset prices, and it continues to serve as our template for what to expect now. Specifically:

-

Markets think they have a solid handle on the known knowns and the known unknowns. That should make for a period of notionally stability, even if the day-to-day price action feels otherwise.

-

When economic events outrun policymaker’s responses, however, there is a sharp (18% in 2008) decline that doesn’t last long but creates an investable crisis low.

-

Yes, the S&P did not really bottom until March 9th 2009 but you would not have wanted to sell at that 752 low on November 20th given the sharp bounce back through year end.

Bottom line: the 2008 playbook says we should see volatile but generally sideways US equity price action this week and next. Should there be a sudden shock from an unknown unknown that creates a +15% decline (2100 on the S&P, in round numbers), that would also fit with the 2008 playbook. Buying that new low would feel awful, but it would also be a signal to policymakers that they will need to take further steps. In the end, that’s why we lean on the 2008 playbook so much: in periods of crisis capital markets drive policy response.

Tyler Durden

Mon, 03/30/2020 – 13:20

via ZeroHedge News https://ift.tt/2WSpLYc Tyler Durden