COMEX Can’t Find Any 400 Oz Bars For Its New Gold Futures Contract

Submitted by Ronan Manly, BullionStar.com”>BullionStar.com

With continuing problems besieging the tag team COMEX – LBMA paper gold markets where the front month gold futures contract (now June) continues to trade above the London spot price of price, the contango that emerged a week ago between the New York – London ‘gold price discovery’ duopoly shows no sign of abating.

NYLON (New York and London)

While the pricing suggests that the core ailment relates to bullion bank liquidity problems faced by market makers in the London ‘gold’ market, this didn’t stop the London Bullion Market Association (LBMA) rushing out a statement last Tuesday, March 24, in an attempt to shift focus to CME’s COMEX, saying that:

“The London gold market continues to be open for business. There has, however, been some impact on liquidity arising from price volatility in Comex 100oz futures contracts. LBMA has offered its support to CME Group to facilitate physical delivery in New York and is working closely with COMEX and other key stakeholders to ensure the efficient running of the global gold market.”

Notwithstanding that on Tuesday 23 March, the London market had seen gold bid-ask spot spreads blowing out to US$ 100 and LBMA market makers breaching their responsibility to actively provide two-way price quotations, the LBMA forged ahead with pinning the blame on COMEX, and bizarrely offered to support COMEX to ‘facilitate physical delivery in New York’.

What this meant, said LBMA-embedded news wire Reuters, was that:

“the LBMA and executives at major gold-trading banks asked CME to allow 400-ounce bars to be used to settle Comex contracts”

Next day, Wednesday March 25, the CME played out its part of the script, announcing the launch of a “new gold futures contract with expanded delivery options that include 100-troy ounce, 400-troy ounce and 1-kilo gold bars” but a contract which still has a unit size of 100 ounces, identical to the COMEX flagship GC 100 contract.

Enhanced Delivery – When Black is White

Who launches a new exchange traded product in the middle of the biggest financial crisis for generations? Only a set of panicking bankers it would seem. And who has a fully developed new gold futures contract waiting in the wings to roll out the day after the gold market blows up? The same panicking bankers.

Unbelievably, the CME has christened this new contract as the ‘Gold (Enhanced Delivery) futures contract” (code 4GC) which will, according to the CME script “enable delivery in New York City of Kilo, 100 oz and 400 oz bar sizes for maximum flexibility.”

With COMEX gold futures de facto physically deliverable in name only and loco London gold never delivered on to the COMEX despite the disinformation campaign from the LBMA, the last thing on the minds of the CME-LBMA axis is ‘delivery in New York City’.

What is on the minds of the LBMA bullion banks though is that, unable to control the COMEX gold price contango, they are now rushing to put in place a tighter leash for the existing GC 100 ounce contract, which they will now have with inter-commodity spreads between 4GC and GC, all under the control of unallocated gold in London.

COMEX ACEs vs Penn and Teller

While the mechanics of the new 4GC contract are left for future analysis, some people may be asking how can a 400 oz gold bar, the kind that are held by central banks, be used to physically settle a gold futures contract with a unit size of 100 ozs. For that the CME has rolled out one of its more sleight of hand tricks, introducing the CME’s Accumulated Certificates of Exchange (“ACE”) mechanism, an illusion which Penn and Teller would be proud of.

“A 400 oz bar”, says the CME “cannot be used to facilitate delivery of a single contract with a unit size of 100 oz due to its larger size.”

Therefore:

“The ACE mechanism facilitates the conversion of 400 oz bars in fractional units which can be used for delivery. Once a 400 oz bar is warranted, it can be assigned to the Clearing House, and in return the Clearing House will issue four ACEs.

Each ACE will represent an equal share of ownership of the larger bar. That means that each 400 oz bar will result in the issuance of 4 ACEs. ACEs can only be issued against the 400 oz bars, not the smaller 100 oz or kilo bars.”

And just like that, when you thought bullion bankers and their frontmen, the CME and LBMA, could not create even more paper gold, they just went ahead and did. And it gets better, since according to the CME:

“Once issued, ACEs can be held as long as necessary. A client can use ACEs to comply with short delivery requirements (1 ACEs reflecting one futures contract of 100 oz) or it can be swapped back against a 400 oz bar by exchanging 4 ACEs. A customer can comply with delivery requirements with ACEs or regular bars, or a combination of both.”

A totally new meaning to holding all the ACEs.

‘COMEX – We have a Problem’

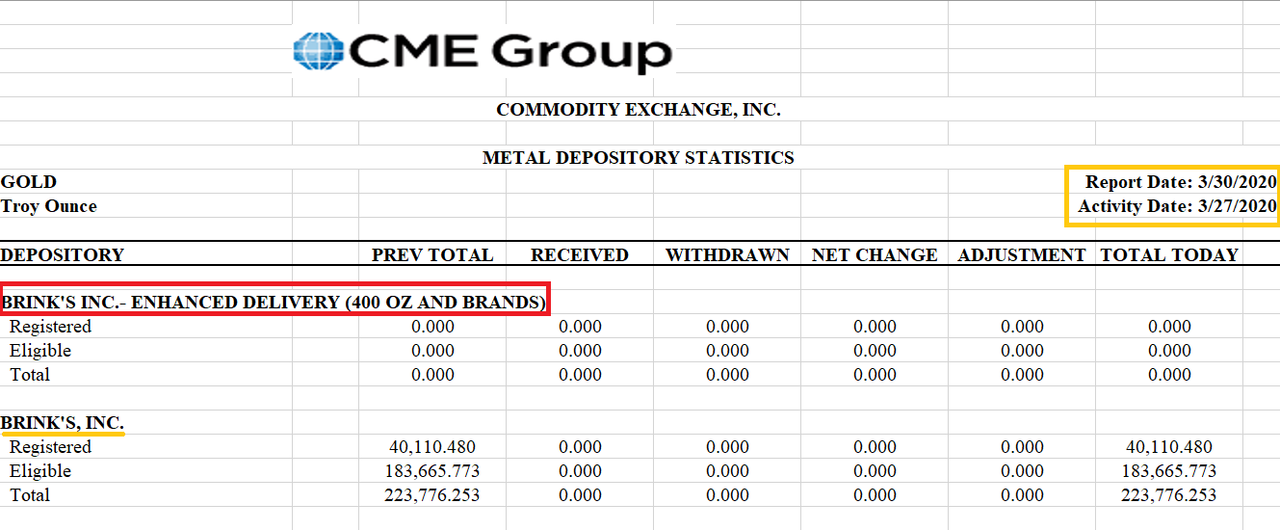

Fast forward March 30, and with the new ‘Gold Enhanced Delivery futures’ contract ready to start trading, the COMEX daily gold vault inventory report (which lists nine approved vaults in New York City and surrounding areas) has just been published showing a new set of lines items for 400 oz bars, but, and here is the punchline, there are absolutely no 400 oz gold bars listed on the entire report. Not one.

This means there are ZERO ounces of gold in the COMEX vaults in the form of 400 oz gold bars. For example, while the JP Morgan vault (JP MORGAN CHASE BANK NA) shows positive quantities for gold ounces in the form of 100 oz bars or 1 kilo bars classified as ‘Registered’ or ‘Eligible’, the separate 400 oz line items under the heading ‘JP MORGAN CHASE BANK NA – ENHANCED DELIVERY (400 OZ AND BRANDS)’ shows just repeated 0.000s.

In COMEX parlance, registered gold means gold currently in the approved vaults that COMEX approved vault operators previously attached warrants to as part of the COMEX futures delivery process. On the other hand, eligible gold is unrelated to COMEX gold futures trading, and could be owned by anyone, for example mints, refineries, jewellery companies, investment funds, banks or individuals.

In addition to JP Morgan, the new line items for 400 oz gold bar vault holdings is repeated across six other vaults, namely the vaults of the three security transport carriers Brinks, Loomis and Malca-Amit, the two Delaware approved vaults of Delaware Depository and IDS of Delaware, and Manhattan based Manfra, Tordella, and Brookes (MTB).

But very suspiciously, and this is the other key point, the two other big vault operators that along with JP Morgan dominate COMEX vaulting in New York, namely HSBC and Bank of Nova Scotia, do not have new line items on the report for the new 400 oz gold bar category. HSBC and Scotia are mysteriously absent. Does this mean these vaults are holding back on reporting 400 oz bars are have asked for an exclusion? Because any 400 oz bars would have to be reported under the Eligible gold category.

Conclusion

So what does all of this mean? Is there not even one vaulted 400 oz gold bar in the whole of New York? Why is COMEX rushing in a new contract deliverable in 400 oz gold bars when it is reporting that there are zero 400 oz gold bars in its approved vaults. Is this all just a smoke and mirrors exercise with the bullion bankers in London and New York laughing over champagne as mainstream new reports claim the very same bankers are scrambling to charter private jets laden with gold bars from London to New York?

And finally, are JP Morgan vault staff currently scrambling to rush 400 oz gold bars across the tunnel between the NY Fed gold vault and Chase Manhattan gold vault under Liberty Street in southern Manhattan? Inquiring minds would like to know.

This article was originally published on the Bullionstar.com website under a similar title ‘COMEX can’t find a 400 oz bar for its new 400 oz gold futures contract‘.

Tyler Durden

Tue, 03/31/2020 – 13:35

via ZeroHedge News https://ift.tt/2vZmjjk Tyler Durden