Futures Slide As European Economy Craters, Dollar Surges: All Eyes On Payrolls

S&P futures have erased much of yesterday’s late day ramp alongside European stocks with investors awaiting data on non-farm payrolls and business activity to assess the extent of the economic hit from the coronavirus pandemic which has now infected more than a million people around the world. Bond yields dropped and the dollar surged as attempts to ease liquidity strains appear to be failing again as traders hunkered down ahead of March payrolls data that are expected to decline for the first time since 2010. And while the NFP will be bad, it is already old news in light of the last two initial jobless claims which showed 10 million layoffs in just the past two weeks.

The drop erased some of Wall Street’s Thursday 2% rally when oil soared on hints of a Saudi-Russia deal, but doubts returned on whether the rebound would last as demand tapers off due to the health crisis. Walt Disney said on Thursday it would furlough some U.S. employees this month, while sources said luxury retailer Neiman Marcus was stepping up preparations to seek bankruptcy protection.

Putting the past month in context, one month ago, on March 3, there were 92,000 coronavirus cases primarily in China. Today there are over one million cases worldwide, with the US and EU account for the biggest portions. In the US, over 75% of individuals and 90% of GDP is under a stay at home order, including 38 state-wide orders.

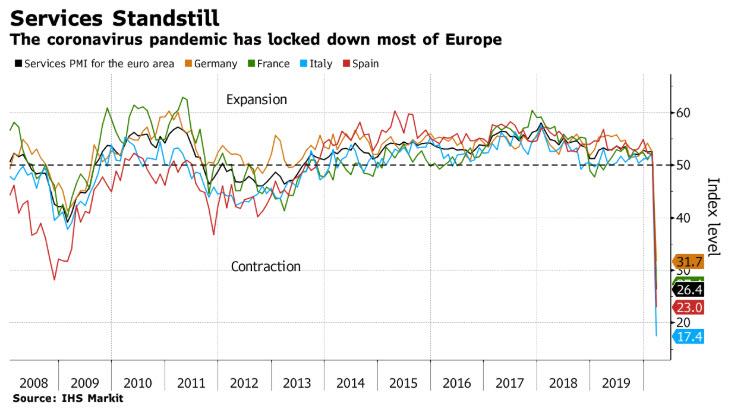

The Stoxx 600 index slumped following service PMI reports showing an unprecedented slump in the euro-area economy last month with insurers and energy shares pacing declines. Markit said its monthly measures of services and manufacturing points to an annualized economic contraction of about 10%. With new business, confidence and employment all down, there is “worse inevitably to come in the near future,” it said.

Markit’s composite Purchasing Managers Index fell to 29.7 in March, it said Friday, even lower than initially estimated. That’s down from 51.6 in February and far below the 50 line that divides growth from contraction. Almost every country in the survey had a record-low reading.

“No countries are escaping the severe downturn,” said Chris Williamson, chief business economist at IHS Markit. “But the especially steep decline in Italy’s service sector PMI to just 17.4 likely gives a taste of things to come for other countries as closures and lockdowns become more prevalent and more strictly enforced in coming months.”

The reports capped a gloomy week for Europe’s economy, where figures showed manufacturing in a deep recession, huge jumps in jobless claims, and thousands of companies in Germany cutting hours for workers.

The measure for services, which includes hotels and restaurants, was at 26.4, with Italy dropping to just 17.4.

Earlier in the session, Asian stocks fell, led by consumer discretionary and finance, after falling in the last session. Markets in the region were mixed, with Singapore’s Straits Times Index and Australia’s S&P/ASX 200 falling, and Jakarta Composite and Thailand’s SET rising. The Topix declined 0.4%, with Insource and Helios Techno falling the most. The Shanghai Composite Index retreated 0.6%, with Qibu and Chimin Health Management posting the biggest slides.

Of note, China announced more stimulus when the PBOC unveiled another targeted (and expected) cut in the reserve requirement ratio (RRR) of 100bp for small-to-medium banks, unleashing RMB 400bn liquidity in total. It will also lower the interest paid on excess reserves to 0.35% from 0.72%, the first cut since November 2008. The announcement today followed Premier Li’s comments at the State Council meeting on March 31, in line with expectations

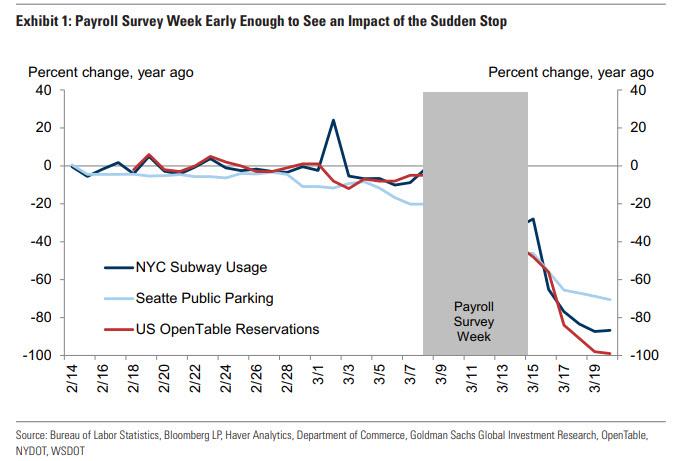

While economic data is now of secondary importance as the US descends into a (hopefully brief) depression, traders will be eyeing today’s jobs report which will end a historic 113 straight months of employment growth as stringent measures to control the coronavirus pandemic shuttered businesses and factories, confirming a recession is underway. However, as previewed earlier, today’s Payrolls report will not fully reflect the full extent of the layoffs as it covers data until March 12.

With lockdowns for many economies around the world expected to go on for longer, data are showing the severity of the impact. Nearly 10 million people in the U.S. have lost their jobs in the past two weeks, while the virus continues to pressure corporate balance sheets. American Airlines will slash international flying as far out as the end of August as the pandemic batters travel demand through the normally busy summer season.

After that, at 10 a.m. ET we will get the ISM’s non-manufacturing activity index which likely dropped to 44 in March from 57.3 in February. A reading below 50 indicates contraction in the services sector, which accounts for more than two-thirds of U.S. economic activity.

“We are not going to have the real recovery in the market until what we think is the peak in the amount of infections and deaths,” Stephen Dover, head of equities at Franklin Templeton, said on Bloomberg TV. “We are going to continue to have very wide volatility until we can get over this uncertainty.”

In rates, ten-year Treasury yields are steady around 0.6%, while German equivalents are little changed at minus 0.44%

In FX, the dollar surged against all Group-of-10 peers, heading for a weekly advance, on rising demand for the world’s reserve currency after global coronavirus cases surged past 1 million. The Bloomberg Dollar Spot Index rose 0.5% for the day, bringing its weekly advance to 2.2%. Antipodean currencies led losses in the basket, while the pound slid the most in two weeks. The yen weakened alongside the euro, pound and Swiss franc.

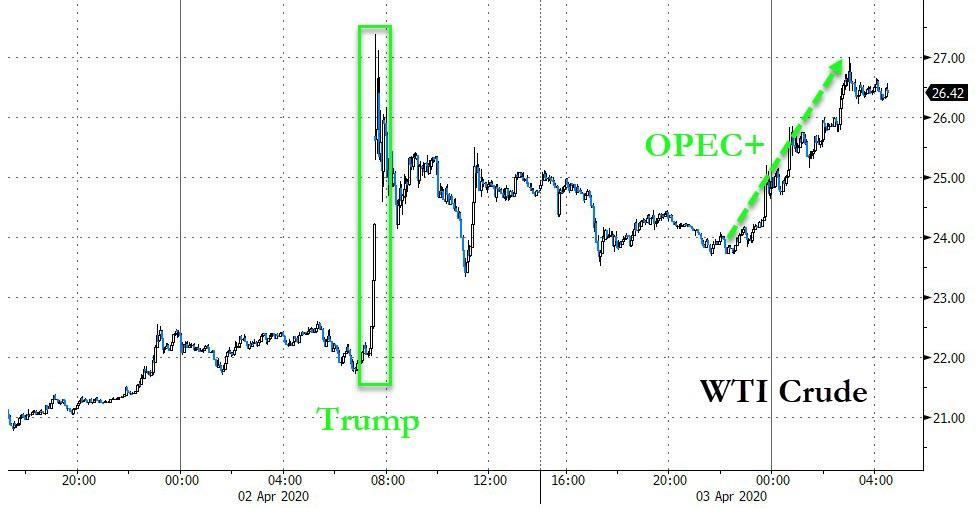

In commodities, crude oil fluctuated following the biggest jump on record a day earlier, but jumped over 10% on news the OPEC+ coalition will hold a virtual meeting on Monday.

Expected data include non-farm payrolls, unemployment, and PMIs. Constellation Brands is reporting earnings

Market Snapshot

- S&P 500 futures down 1.3% to 2,484.50

- STOXX Europe 600 down 0.6% to 310.07

- MXAP down 0.5% to 132.75

- MXAPJ down 0.5% to 429.35

- Nikkei up 0.01% to 17,820.19

- Topix down 0.4% to 1,325.13

- Hang Seng Index down 0.2% to 23,236.11

- Shanghai Composite down 0.6% to 2,763.99

- Sensex down 1.8% to 27,753.84

- Australia S&P/ASX 200 down 1.7% to 5,067.48

- Kospi up 0.03% to 1,725.44

- German 10Y yield fell 0.7 bps to -0.44%

- Euro down 0.5% to $1.0805

- Italian 10Y yield fell 4.2 bps to 1.296%

- Spanish 10Y yield unchanged at 0.709%

- Brent futures up 5.9% to $31.71/bbl

- Gold spot down 0.2% to $1,611.34

- U.S. Dollar Index up 0.5% to 100.68

Top Overnight News

- The euro-area economy is in a slump of unprecedented scale, which may worsen further as lockdowns to contain the coronavirus are extended. IHS Markit said its monthly measure of services and manufacturing points to an annualized economic contraction of about 10%

- Oil advanced above $32 a barrel in London as OPEC+ scheduled an urgent meeting next week to try and stem the crude market’s rout, with an output cut of 10% of global production being discussed

- U.K. services industries shrank at the fastest pace in at least two decades as the destruction of the coronavirus took hold. IHS Markit’s Purchasing Managers Index for the sector fell to 34.5 last month, the steepest downturn since the survey began in 1996

- The European Central Bank’s 750 billion euro ($811 billion) emergency bond-buying program is the “central pillar” of its response to the coronavirus crisis, but Europe also needs continent-wide fiscal action, Finnish governor Olli Rehn said on Friday

- The People’s Bank of China needs to make a more complete evaluation before taking a decision to change the rate paid on bank deposits, a senior official said in Beijing Friday

- The cost of the coronavirus pandemic could be as high as $4.1 trillion, or almost 5% of global gross domestic product, depending on the disease’s spread through Europe, the U.S. and other major economies, the Asian Development Bank said

Asian equity markets were mostly lower as the region failed to sustain the energy-led euphoria from Wall St where risk appetite was driven by the record surge in oil prices after comments from President Trump spurred hopes of a potential Saudi Arabia and Russia oil price truce, in which he noted that he spoke to the Saudi Crown Prince who spoke with Russian President Putin and expects them to announce an oil production cut of 10mln-15mln BPD. Nonetheless, the momentum lost steam overnight given Russia’s denial of any talks occurring between President Putin and the Saudi Crown Prince, with key data releases including Chinese Caixin PMIs and looming US NFPs adding to the cautiousness. ASX 200 (-1.7%) gave up early gains as the initial surge in the energy sector reversed course and amid continued weakness in financials, while Nikkei 225 (U/C) also deteriorated after failing to hold above the 18000 level. Hang Seng (-0.2%) and Shanghai Comp. (-0.6%) conformed to the overnight indecision as participants digested the latest PMI releases from China in which Caixin Services PMI topped estimates and Composite PMI improved, although both remained in contraction territory with the former at its 2nd weakest reading on record. Finally, 10yr JGBs were pressured as Japanese stocks initially traded positive and following the BoJ’s Rinban announcement in which it lowered purchases in the short-end, although this wasn’t much of a surprise given the increased frequency of purchases for this month and JGBs later rebounded off lows as the risk appetite waned.

Top Asian News

- Indonesia Is Ready to Add to $25 Billion Stimulus, Minister Says

- Singapore to Close Schools, Most Workplaces Amid Virus

- Japan’s Airlines Seen Joining Global Carriers With Huge Losses

A relatively tame session thus far in the European equity space, albeit major cash bourses reside in negative territory (Euro Stoxx 50 -0.8%), after the optimism seen on Wall Street yesterday faded during the overnight session – in which APAC bourses lost steam and closed largely in the red. European sectors mostly with energy faring the worst amid yesterday’s pullback in energy prices, although financials stand as the marked laggard, whilst healthcare names outperform – potentially on the back of heavyweight Novartis (+1.6%) after the Co. announced it plans to initiate Phase III clinical trials to evaluate the use of Jakavi for treating a severe immune overreaction in coronavirus patient. In terms of individual movers, Tullow Oil (+25%) sees significant upside after noting it remains on production target, whilst shares also see tailwinds from the rising energy prices. H&M (+3.7%) rises after Q1 products were considerable above forecasts, whilst revenue, group sales and online sales saw YY increases – albeit the Co. warned that losses will be seen in Q2 amid material negative virus impacts. Adidas (-3.8%) falls amid reports the Co. is seeking EUR 1-2bln in government aid due to the fallout from COVID-19. Remy Cointreau (-2.6%) is similar subdued as the virus is to cause steeper Q1 2020 losses than the -26% YY figure seen in Q4 2019. State-side, Tesla shares rose some 18% after-market after Q1 deliveries topped estimates and its Shanghai factory achieved record production.

Top European News

- ECB’s Rehn Calls for Europe-Wide Systemic Solution to Crisis

- U.K. Services Shrink Most on Record After Virus Lockdowns

- AB InBev and Heineken Decline on Mexico Alcohol Ban Concerns

- HNA’s Swissport Is Said to Hire Houlihan to Advise on Debt

In FX, the Dollar is back in the ascendancy after Thursday’s oil-induced stumble and regaining momentum as most other currencies flounder amidst the ongoing spread of COVID-19 and economic fallout evident in services PMIs. The DXY has extended above 100.000 and currently probing a relatively key upside chart level at 100.631 (50% retracement from 102.999 ytd peak to recent 98.270 trough) in the run up to NFP, the final US Markit PMI and non-manufacturing ISM.

- GBP/AUD/NZD – The biggest G10 losers, with Sterling succumbing to all round selling pressure in wake of the weaker than prelim UK services PMI that nudged the composite reading further below 50.0 and pushing Cable back under 1.2400 then 1.2300 to circa 1.2263, while Eur/Gbp has rebounded to 0.8800 from around 0.8740 even though the Eurozone surveys were even bleaker, Spain and Italy in particular. Meanwhile, the Aussie and Kiwi have handed back all their recovery gains from 0.6075 and 0.5900+ to sub-0.6000 and almost 0.5850 despite slightly firmer than forecast Australian retail sales overnight and another PBoC RRR cut that has not helped the Yuan either (Usd/Cnh just under 7.1200 vs 7.1115 Usd/Cnh fix – highest midpoint since March 2008).

- CHF/CAD/EUR/JPY – Also losing more ground vs the Greenback, as the Franc slips towards 0.9800 where a 1.1 bn option expiry resided and Loonie hands back gains forged from yesterday’s crude price spike within a 1.4208-1.4116 range. Meanwhile, the aforementioned dire Eurozone services PMIs and composite prints have precipitated a further pull-back in Eur/Usd to sub-1.0800 and the Yen has reversed from 108.00+ all the way back above the 200 DMA (108.33).

- NOK/SEK – In contrast to their major counterparts, more upside for the Scandinavian Kronas as oil returns to the boil ahead of Monday’s hastily convened OPEC+ meeting to discuss an output cut and the Riksbank continues to rule out a repo reduction in favour of any other monetary stimulus that may be deemed necessary. On that note, more should be forthcoming after Sweden’s services sector slumped into contractionary territory alongside manufacturing in March, while Norway’s jobless rate jumped nigh on 5-fold to 10.7%, though not quite as high as anticipated (consensus 13.5%). However, Eur/Nok is hovering shy of 11.2500 and Eur/Sek near 10.9600.

In commodities, the Dollar is back in the ascendancy after Thursday’s oil-induced stumble and regaining momentum as most other currencies flounder amidst the ongoing spread of COVID-19 and economic fallout evident in services PMIs. The DXY has extended above 100.000 and currently probing a relatively key upside chart level at 100.631 (50% retracement from 102.999 ytd peak to recent 98.270 trough) in the run up to NFP, the final US Markit PMI and non-manufacturing ISM.

- GBP/AUD/NZD – The biggest G10 losers, with Sterling succumbing to all round selling pressure in wake of the weaker than prelim UK services PMI that nudged the composite reading further below 50.0 and pushing Cable back under 1.2400 then 1.2300 to circa 1.2263, while Eur/Gbp has rebounded to 0.8800 from around 0.8740 even though the Eurozone surveys were even bleaker, Spain and Italy in particular. Meanwhile, the Aussie and Kiwi have handed back all their recovery gains from 0.6075 and 0.5900+ to sub-0.6000 and almost 0.5850 despite slightly firmer than forecast Australian retail sales overnight and another PBoC RRR cut that has not helped the Yuan either (Usd/Cnh just under 7.1200 vs 7.1115 Usd/Cnh fix – highest midpoint since March 2008).

- CHF/CAD/EUR/JPY – Also losing more ground vs the Greenback, as the Franc slips towards 0.9800 where a 1.1 bn option expiry resided and Loonie hands back gains forged from yesterday’s crude price spike within a 1.4208-1.4116 range. Meanwhile, the aforementioned dire Eurozone services PMIs and composite prints have precipitated a further pull-back in Eur/Usd to sub-1.0800 and the Yen has reversed from 108.00+ all the way back above the 200 DMA (108.33).

- NOK/SEK – In contrast to their major counterparts, more upside for the Scandinavian Kronas as oil returns to the boil ahead of Monday’s hastily convened OPEC+ meeting to discuss an output cut and the Riksbank continues to rule out a repo reduction in favour of any other monetary stimulus that may be deemed necessary. On that note, more should be forthcoming after Sweden’s services sector slumped into contractionary territory alongside manufacturing in March, while Norway’s jobless rate jumped nigh on 5-fold to 10.7%, though not quite as high as anticipated (consensus 13.5%). However, Eur/Nok is hovering shy of 11.2500 and Eur/Sek near 10.9600.

US Event Calendar

- 8:30am: Change in Nonfarm Payrolls, est. -100,000, prior 273,000

- Change in Private Payrolls, est. -131,500, prior 228,000

- Change in Manufact. Payrolls, est. -10,000, prior 15,000

- Average Hourly Earnings YoY, est. 3.0%, prior 3.0%

- Average Weekly Hours All Employees, est. 34.1, prior 34.4

- Average Hourly Earnings MoM, est. 0.2%, prior 0.3%

- Unemployment Rate, est. 3.8%, prior 3.5%

- Labor Force Participation Rate, est. 63.3%, prior 63.4%

- Underemployment Rate, prior 7.0%

- 9:45am: Markit US Services PMI, est. 38.5, prior 39.1

- 9:45am: Markit US Composite PMI, prior 40.5

- 10am: ISM Non-Manufacturing Index, est. 43, prior 57.3

DB’s Jim Reid concludes the overnight wrap

I came down from my upstairs home office for lunch yesterday and I’ve never seen my wife so stressed. After two weeks of looking after the kids without anywhere to take them she is at the end of her tether. The twins (2) are hitting, biting and kicking each other and crying all the time and Maisie (4) wants to be entertained 24/7 and can’t work out why she isn’t doing all her daily activities. The new trampoline gives them 30mins each day where they can all release energy but it’s very hard work to police. When I showed her our “The Exit Strategy” note link here where it suggested that it could be around mid-May before restrictions were lifted based on our Hubei-model she nearly walked out. Where she would be allowed to go in these times was a question I didn’t ask. However when I came down for dinner everyone was in a good mood as they have found this new augmented reality feature on google where it puts a wild animal in your house that you can then capture on photo or video with you (or your kids) in the frame. It is very funny. If your kids need 30mins of entertainment in these dull times and want to be in a shot with a live animal just type lion, panda, penguin or snake (there are other animals) into google on your phone and click on “see in 3D”.

Looking at the new virus cases and fatalities we may be looking at alternative ways to distract ourselves for sometime yet in certain countries even if light at the end of the tunnel continues to appear in those earliest infected in Europe. With global cases rising over 1 million and fatalities above 50,000, the US, UK, and Turkey (recent addition to the top 10 and now included in our tables) are the only countries in the top 10 of total cases that still have double digit daily growth in new cases. Italy and Spain continue to offer hope though, with still slowing new case and death rates. For the full tables as well as case growth and fatality charts see our new Corona Crisis Daily.

Straight to China now where this morning we’ve had the March Caixin services PMI which printed at a better than expected 43.0 (vs. 39.0 expected and 26.5 in the previous month). This backs up the jump observed in the state PMIs but still remains in contractionary territory unlike the state one. In the details, the employment index fell to 48.0 from 48.5 in February, the lowest on record since the series began. So while there are signs that China is stabilizing it still continues to reel under the after effects of the virus induced lockdown. The composite reading came in at 46.7 (vs. 27.5 last month). Elsewhere, Japan’s final services PMI was confirmed at 33.8 versus the 32.7 flash while Australia’s services PMI printed at 38.5 and readings in Hong Kong (34.9) and Singapore (33.3) were both sub-35.

In other overnight news, the PBoC Deputy Governor Liu Guoqiang has said that the PBoC needs to make a more complete evaluation before taking a decision to change the rate paid on bank deposits. These comments counter the market expectations that the PBoC would act soon to alleviate the pressure on bank profit margins, amid reductions on lending rates in recent weeks. He added, that above all, a deposit rate cut needs to consider the public’s feeling. Meanwhile, Zhu Jun, head of PBOC’s International Department has said in an interview that countries need to take more powerful measures to prevent and control the coronavirus epidemic, and more proactive fiscal policies to stabilize market confidence. Elsewhere, Washington Governor Inslee has extended the states “Stay Home, Stay Healthy” order to May 4.

Asian markets are closing out the week on a slight down note with the Nikkei (-0.14%), Hang Seng (-0.58%), Shanghai Comp (-0.33%) and Kospi (-0.13%) all down. Meanwhile, futures on the S&P 500 are down -0.97% and yields on 10y USTs are down -1.1bps with the US dollar index trading largely flat. The price of Brent crude has fallen -3.77% this morning and thus paring some of yesterdays big gain (more below).

Indeed the main news item from markets yesterday was the massive move in oil prices, which surged after President Trump tweeted that he expected and hoped that Saudi Arabia and Russia would be cutting back oil production by “approximately 10 Million Barrels, and maybe substantially more”. He then said it “Could be as high as 15 Million Barrels.” In response, Brent crude was up by +21.02% in its largest move higher in data that goes back all the way back to 1988, and exceeding the +14.61% increase back in September after the strike on Saudi oil facilities. Meanwhile WTI was also up by +24.67%, even more than the +23.81% increase we saw on March 19th, and is now the largest one day in either direction on record since 1983 when the data starts. The +24.67% rally is slightly more than the largest one day decline of -24.59% on March 9th, showing just how extreme oil moves have been over the last month. It would have been nice to hear the response from the Saudis to verify, but for the day Mr Trump had a profound impact. Meanwhile, US Treasury Secretary Steven Mnuchin has said overnight that energy companies impacted by the oil-price war can turn to the Federal Reserve’s lending facilities for aid but won’t get direct loans from his department. He said, “Our expectation is the energy companies, like all our other companies, will be able to participate in broad-based facilities, whether it’s the corporate facility or whether it’s the main street facility, but not direct lending out of the Treasury.”

Even before the President’s tweet, oil was earlier around +10% higher thanks to reports that China was planning to buy oil for its emergency reserves, with Bloomberg saying that Beijing had set an initial target of holding government stockpiles equivalent to 90 days of net imports. The moves helped support the currencies of oil-producing nations, with the Norwegian Krone the top-performing G10 currency yesterday, up+0.63% against the dollar and the Canadian dollar close behind, up +0.37% against USD.

With the massive moves in oil prices, it was energy stocks that led equity markets higher yesterday, with the S&P 500 energy index up +9.08%, and the STOXX 600 Oil & Gas index up +5.22%. In terms of the broader market, the S&P 500 ended the session up +2.28% (after a strong last 90 mins), while the STOXX 600 rose +0.42%. For the S&P, this meant it was the 23rd out of the last 24 sessions in which the index has moved by at least 1% in either direction. By comparison, back round the turn of the year when things were rather calmer, we went all the way from mid-October until late January where the S&P didn’t move more than 1% at all.

With risk assets rallying, sovereign bonds were relatively quiet with the main action being tighter peripheral spreads as hope is returning over a pan EU aid scheme for the likes of Italy and Spain. 10yr Bund yields rose +2.5bps to -0.43% while Italian, Portuguese and Spanish bonds tightened to bunds by -6.8bps, -4.8bps and -2.0bps. Meanwhile, credit lagged the rally slightly yesterday. In the US, HY cash was +6bps wider, with IG spreads+1bp wider. In Europe HY spreads were 4bps tighter and IG was unchanged.

Speaking of credit, as we have noted in the past several weeks, there have been some heavy outflows from corporate bond funds since the crisis broke out. To add some positive news, this morning we have published the report Corporate Bond Funds Finally See Some Inflows. This has been a welcome reprieve, partly due to the announced central bank support. You can download the full report here.

Before the bulk of the oil moves that seemed to kick start a risk rally, investor sentiment was hampered by some truly unprecedented jobless numbers yesterday, with figures from a range of countries giving an alarming indication of the scale of the coming employment crisis. The US was the most notable, where the weekly initial jobless claims rose to 6.648m in the week to March 28th, which is more than double the previous week’s record 3.307m reading. That’s 10m in two weeks. To put this into perspective, the total number of employees on nonfarm payrolls totaled 152.5m in February, so this is consistent with some serious rises in unemployment. No one was expecting such a huge number, and it exceeded even the highest estimate on Bloomberg’s survey of economists. As mentioned previously, the worst week in the financial crisis was “only” 665k in March 2009 and the worst week in 53 years of data was 695k in October 1982, which gives a sense of how massive these numbers are.

It wasn’t just the US facing this problem though. In Spain, the number of people filing for jobless claims rose by 302,265 in March (a big miss considering the consensus was at 30,000), the biggest increase on record, and that doesn’t include those who’ve only been laid off temporarily. In Ireland, the Live Register, which measures demand for jobless benefits, rose to a seasonally adjusted 207.2k in March, while a further 283k claimed the pandemic unemployment payment and 25.1k claimed the new coronavirus wage subsidy. And in France, Labour minister Muriel Penicaud said that 400,000 businesses had applied for temporary unemployment for 4 million workers. To put that in context, the INSEE’s data for the total employment number in France stood at 28.5m in Q4.

Looking ahead to today, many will be paying attention to the US jobs report for March to give further colour on the situation. However, given how fast-paced things are moving it’s worth noting that the March survey actually cut off before the recent spike in jobless claims. So take the reading with a pinch of salt, as it won’t fully reflect the deterioration we saw towards the end of the month. The other release to watch out for will be the services and composite PMIs from around the world for March, which follow the manufacturing releases on Wednesday. The flash numbers saw numbers in the 29 to 40 range so worse than manufacturing.

Turning elsewhere now, and the coronavirus is continuing to wreak havoc on the plans of central banks, with the ECB announcing yesterday that they were extending the timeline for their monetary policy strategy review. Having previously said that it would conclude by the end of the year, they’ve now extended this until mid-2021. Unsurprisingly, they also announced that the annual ECB Forum on Central Banking in Sintra is being postponed until November. In terms of other delays thanks to the virus, reports came through from the US that the DNC were going to postpone the Democratic convention from July until August 17.

To the day ahead now, and the data highlights out today will be the release of the services and composite PMIs for March from around the world, along with the US jobs reports for March this afternoon. Elsewhere we’ll also get the ISM non-manufacturing index for March from the US, as well as Euro Area retail sales for February.

Tyler Durden

Fri, 04/03/2020 – 08:13

via ZeroHedge News https://ift.tt/2wXE82I Tyler Durden