Oil Jumps, Stocks Dump As ‘Helicopter Money’ Sends USA Risk Soaring

The story of the week is fourfold:

-

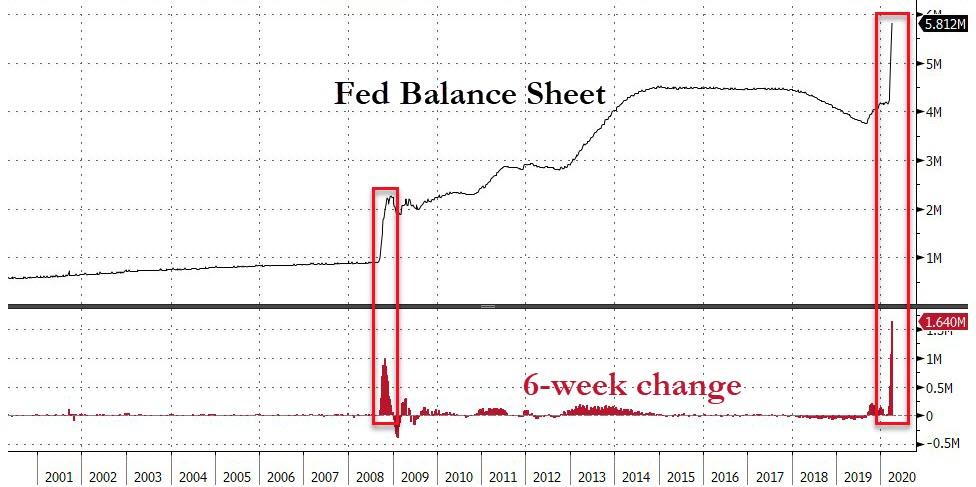

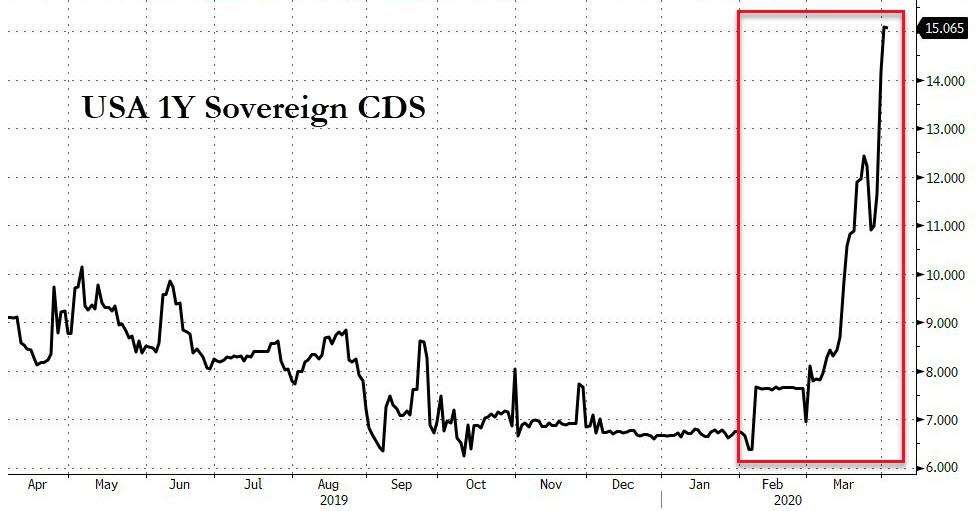

Helicopter money begins… and the sovereign risk of the USA soars

-

Oil has best week ever on hopes of supply cut.

-

Stocks sink as any rebalance flow support evaporated.

-

Lockdown effects are starting to be seen in labor and survey data

‘Helicopter Ben’ unleashed hell…

Source: Bloomberg

As the trillions in bailout booty starts to get handed out to the public, markets did not “love the smell of helicopter money in the morning”…

As USA Sovereign risk accelerated further…

Source: Bloomberg

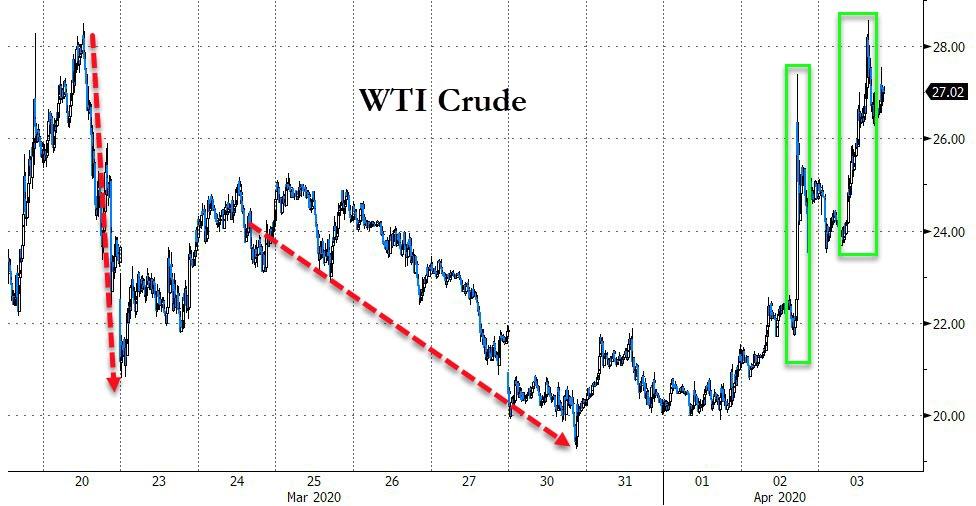

Hopes of a supply-cut sparked the single-biggest daily gain ever and the biggest weekly gain ever in crude oil…

Source: Bloomberg

But in context, there’s a long way to go…

Source: Bloomberg

And despite energy’s gains, US equity markets were carved up this week, with Small Caps clubbed like a baby seal (5th weekly loss of last 6), as any month-/quarter-end rebalance flow support evaporated entirely… (NOTE broiadly speaking US markets rallied into the EU close then sold off every day this week),,,

Over the past two weeks however, The Dow is still up around 9% and Small Caps just over 2%…

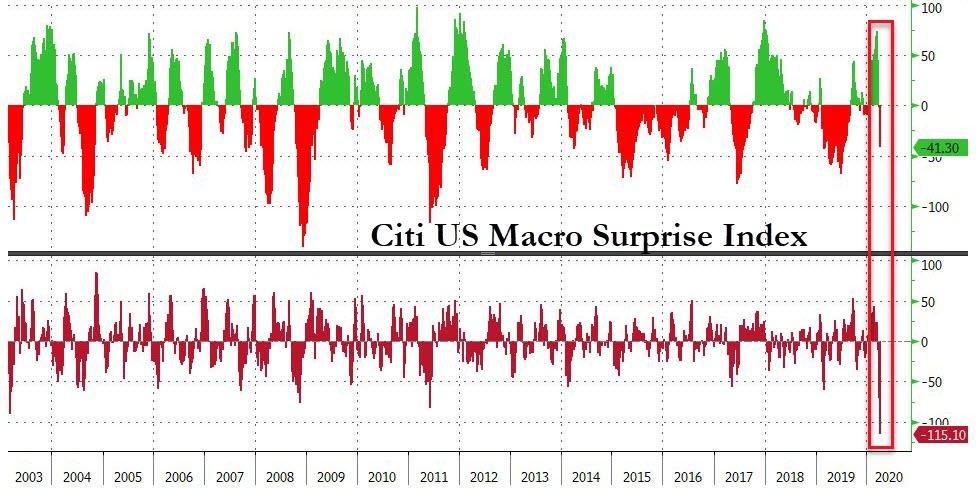

And finally, the impact of the lockdowns is starting to hit as US Macro Surprise Index crashes by the most ever

Source: Bloomberg

* * *

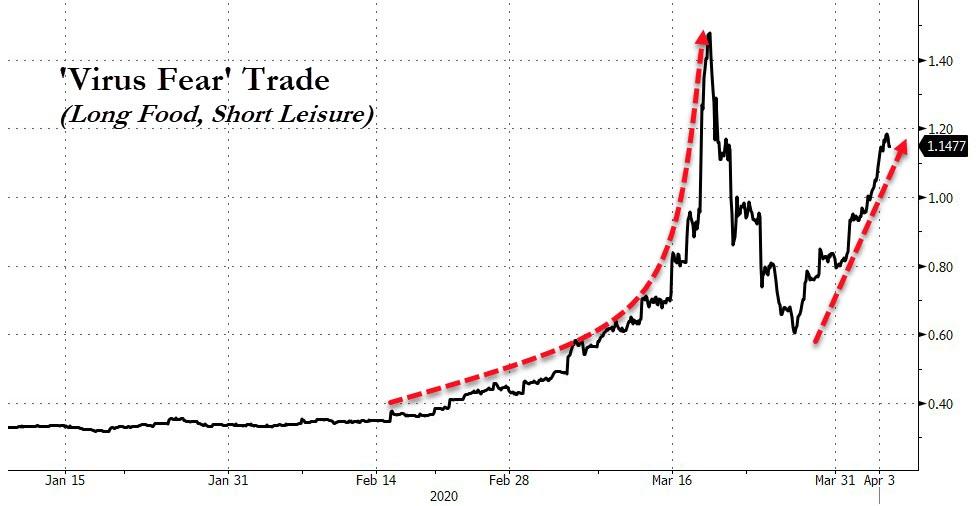

The ‘Virus-Fear’ Trade is back in a big way…

Source: Bloomberg

After last week’s hope-filled bounce, big banks bloodbath’d this week…

Source: Bloomberg

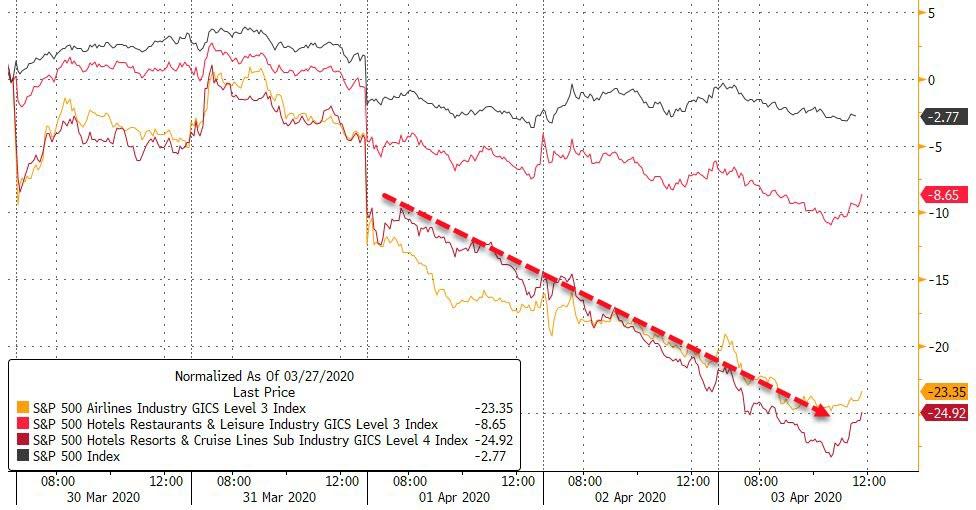

And virus-impacted sectors were also slammed…

Source: Bloomberg

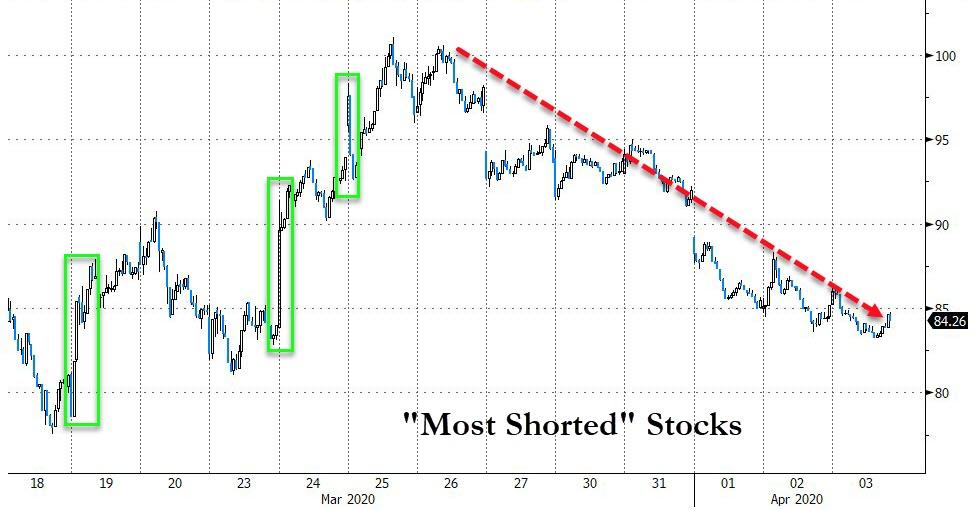

“Most Shorted” stocks are down 6 days in a row

Source: Bloomberg

VIX and the market decoupled this week (VIX notably lower as stocks sank)…

Source: Bloomberg

Credit markets were sold all week, despite The Fed’s support…

Source: Bloomberg

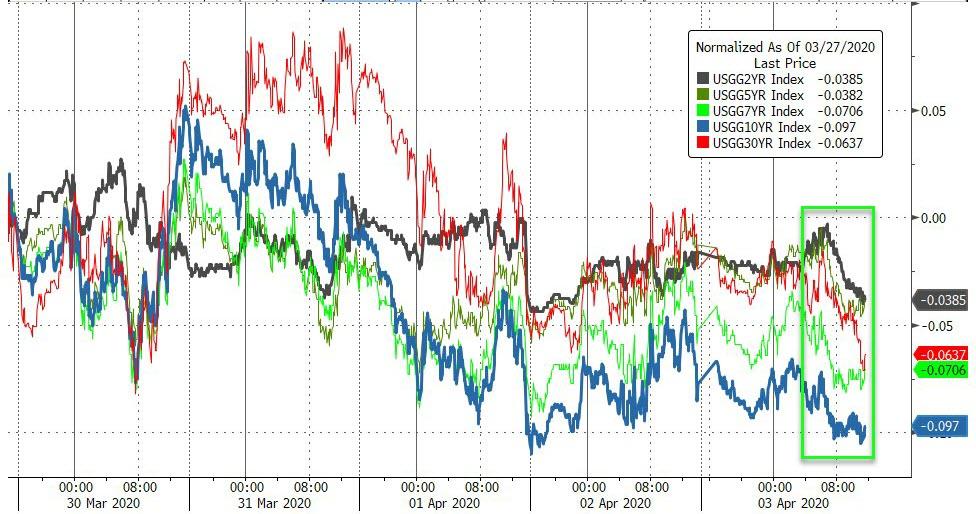

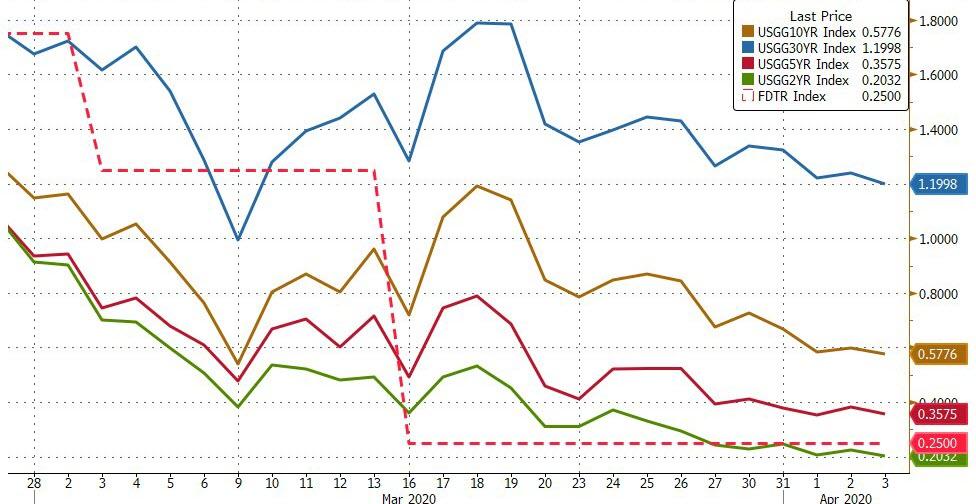

Treasuries were bid this week with 10Y outperforming, 2Y underperforming…

Source: Bloomberg

10Y Yields fell back below 60bps…

Source: Bloomberg

Note – yields did spike at the end of the day after The Fed announced another taper…

Source: Bloomberg

The week’s yield drop pushed everything across the curve back near cycle yield closing lows…

Source: Bloomberg

The Dollar was up 4 of the 5 days this week (and 3rd week of last 4)

Source: Bloomberg

A late-week bid pushed most of the cryptospace into the green with Bitcoin Cash leading the week…

Source: Bloomberg

Commodities were practically unchanged on the week despite the dollar gains, but obviously oil was the outlier with its best week ever…

Source: Bloomberg

Interestingly, oil’s surge coincides with its price relative to silver dropping below 2x (2 ounces of silver / barrel of oil) once again…

Source: Bloomberg

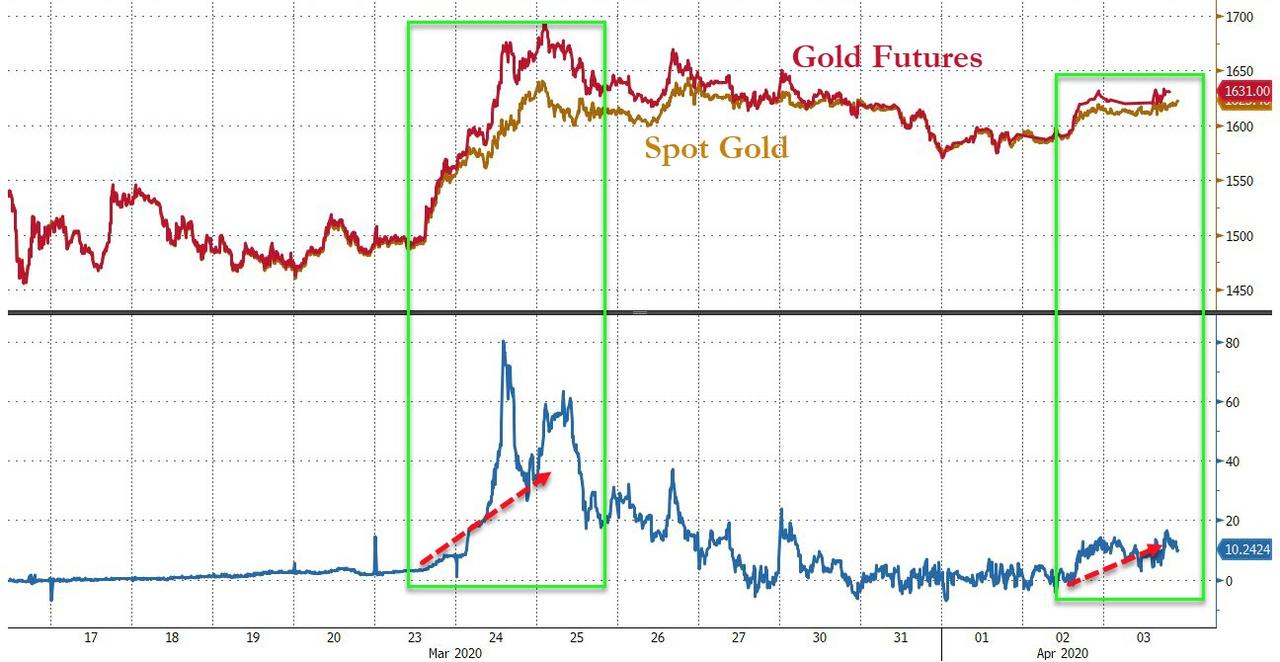

Gold Spot and Futures have started to decouple again as physical delivery fears resurface…

Source: Bloomberg

Where does gold go next?

Source: Bloomberg

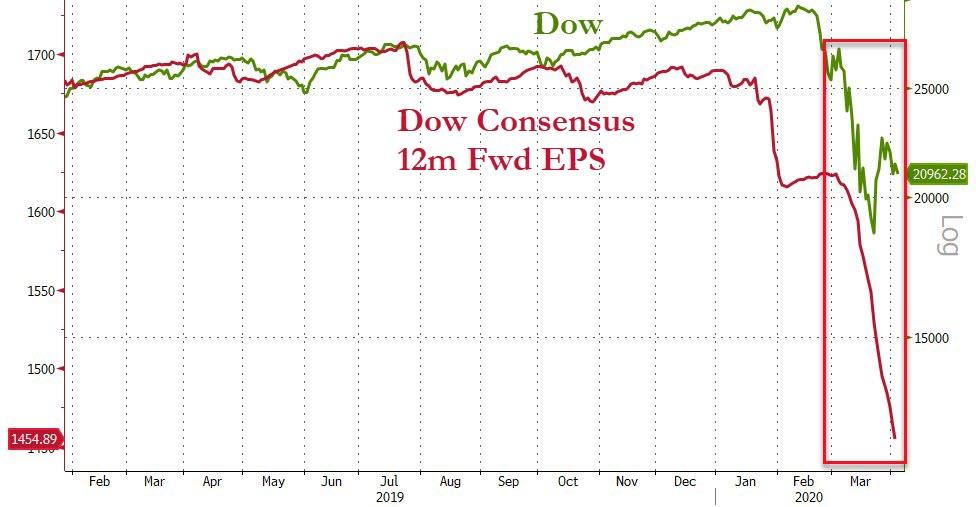

Finally, the question is – is this bounce still viable?

Source: Bloomberg

Not if fun-durr-mentals have anything to do with it…

Source: Bloomberg

Tyler Durden

Fri, 04/03/2020 – 16:00

via ZeroHedge News https://ift.tt/346Y2oa Tyler Durden