Job Openings Smash Expectations In Delayed JOLTS Report

There was some good and some bad news in today’s JOLTs/job openings report.

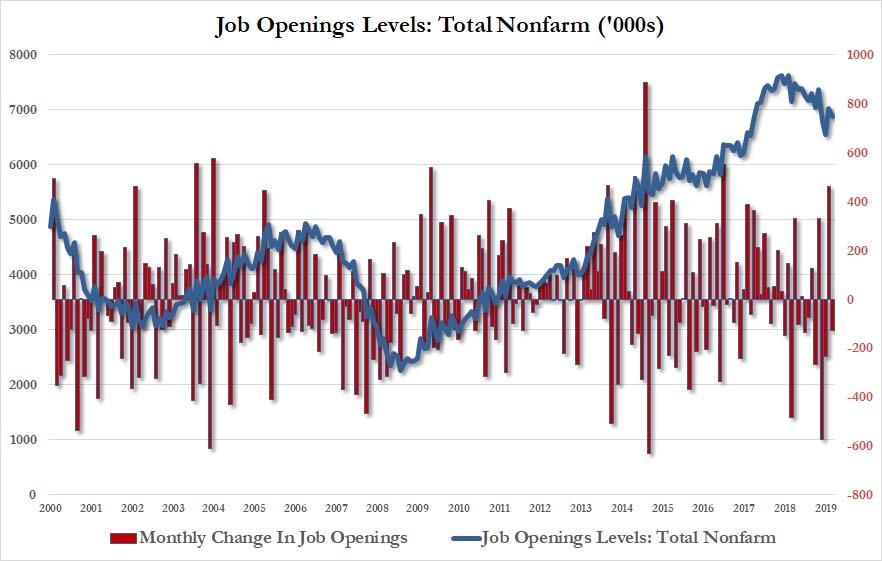

The good news was that coming in at 6.882 million, down modestly from 7.012 million in January, the number smashed consensus expectation of 6.5 million which in turn was a surprisingly low number which we attribute to the fact that most analyst forgot that i) JOLTs is delayed by an extra month and ii) there were no adverse covid impacts in February.

The bad news is that since the number is for February, it is completely meaningless, especially since we now know that according to much more recent unemployment claims, the US economy has now lost over 10 million jobs in just the past two weeks.

According to the DOL, the job openings decreased in real estate and rental and leasing (-30,000) and information (-29,000). The number of job openings was little changed in all four regions.

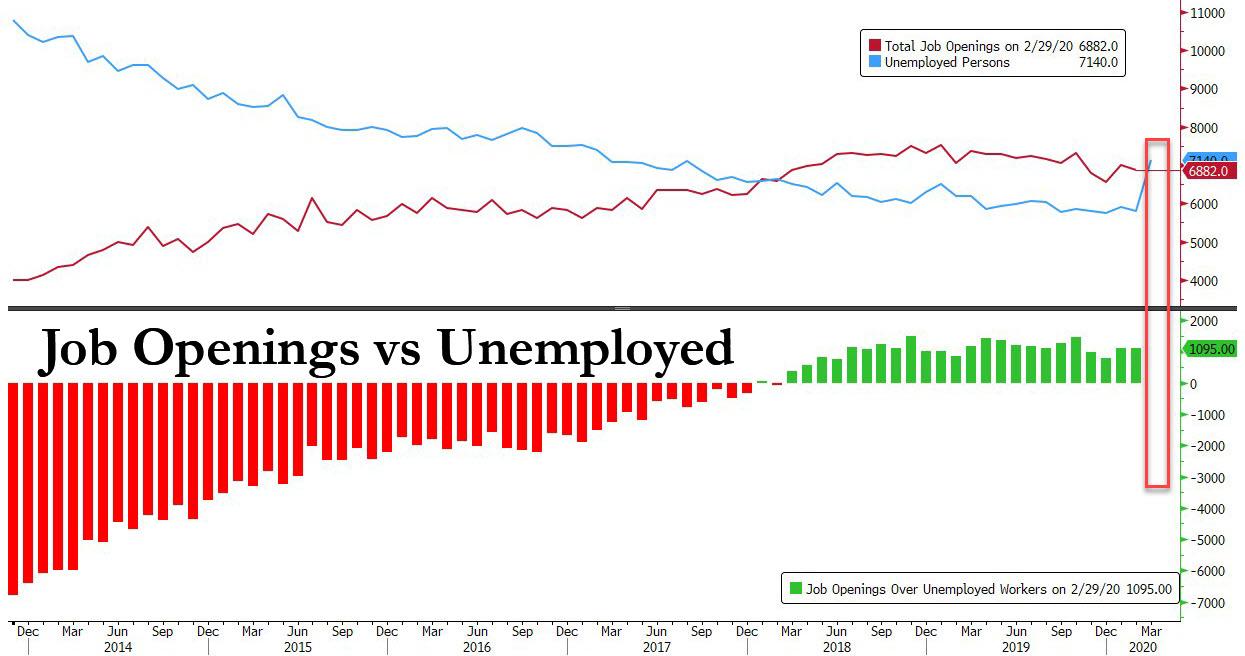

The surprisingly strong job openings number meant that for the 24th consecutive month, there were more job openings than unemployed people. That, however, is set to change next month because we already know that the number of unemployed workers soared in March so all we need is the matching data from the JOLTS report, at which point the longest stretch of more job openings than unemployed people will be over.

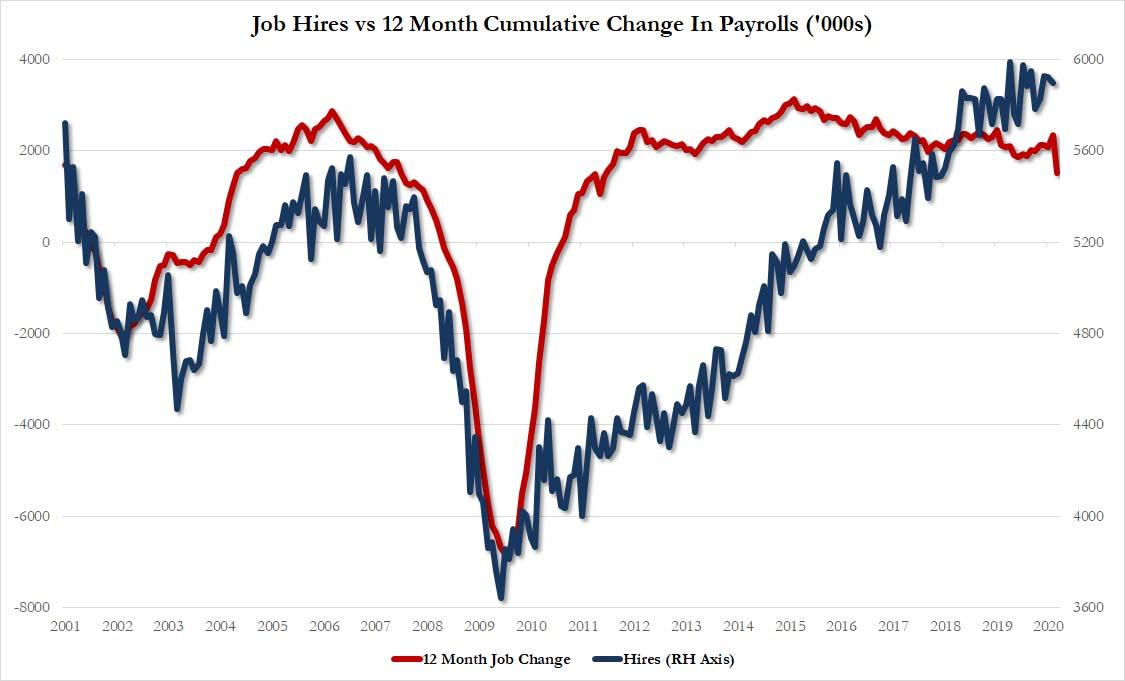

There was some more good, if meaningless news, in the number of hjires, which dipped by a modest 29K to 5.896MM, even as the matched number of 12-month rolling job change suffered a sharp drop in March. The number of hires was little changed at 5.9 million while the rate was unchanged at 3.9. percent. The hires level increased in durable goods manufacturing (+29,000). As above, expect to see hirings to slow in March and then grind to a halt in April.

In short, a good report if now totally irrelevant since the entire world changed in March, when we expect to see a collapse in the next JOLTS report which will be released one month from today.

Tyler Durden

Tue, 04/07/2020 – 10:30

via ZeroHedge News https://ift.tt/2XdsawR Tyler Durden