Tailing, Mediocre 10Y Auction Prices At Lowest Yield On Record

One day after the Treasury sold a tailing, mediocre 3Y auction, which priced just shy of the lowest yield on record, moments ago the Treasury sold $25BN in a 10Y reopening (Cusip Z94) which was first sold in February, and which this time yielded a new all time low of 0.782% down from 0.849% last month, and tailing the When Issued 0.775% by 0.7bps.

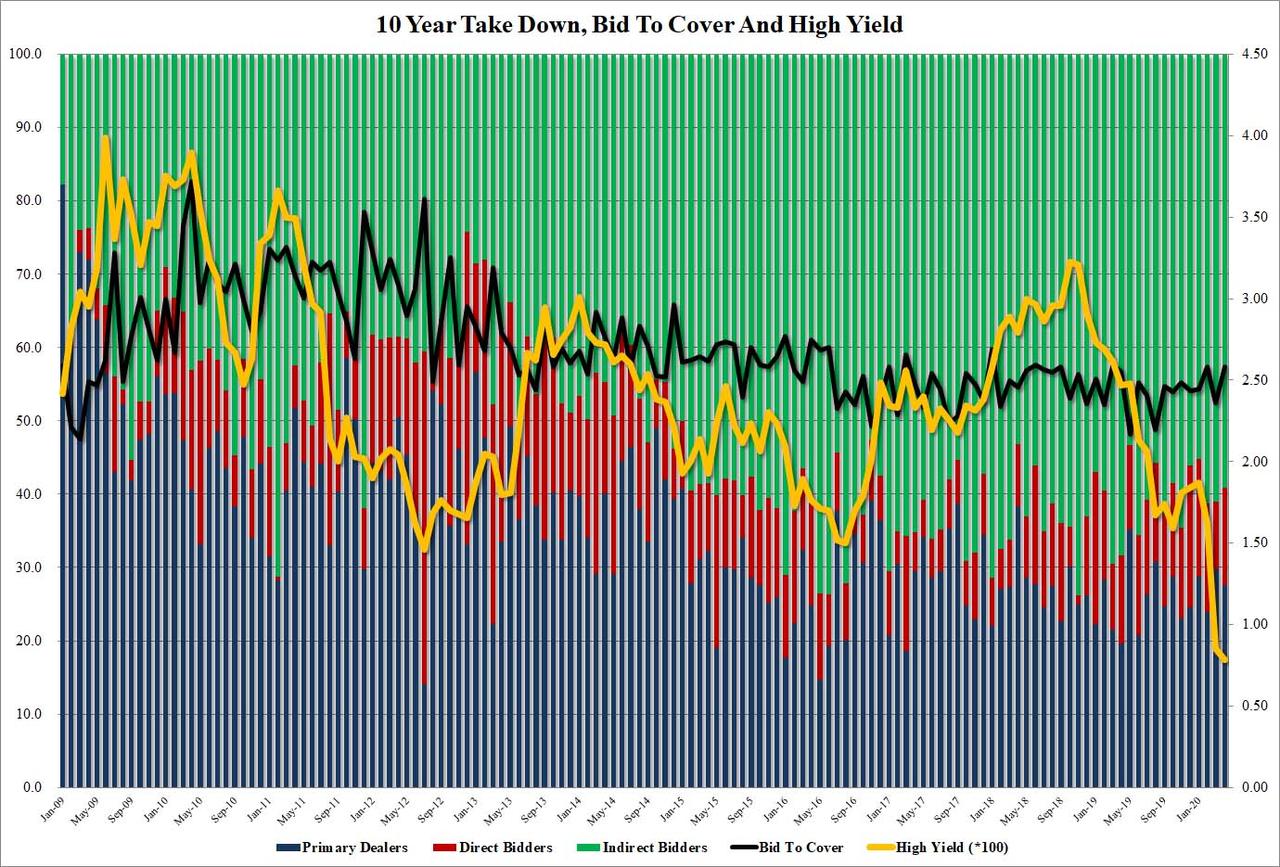

The Bid to Cover rebounded from last month’s 2.36, rising to 2.58, which was above the 6 month average of 2.46.

The internals were average if a tad weaker, with Indirects taking down 59.2%, down from 61.0% last month, although the hit rate was just below the 59.5% recent average. And with Directs taking down 13.2%, up from 9.2% last month, Dealers were left with 27.6%, an amount which they will quickly flip to the Fed which has been on full tilt in recent weeks as it monetizes the entire US deficit for 2020 and onward as part of its balance sheet doubling.

Overall a mediocre auction, which perhaps is a bit surprising considering the Fed is still buying some $55BN in coupon securities every day.

In response to the tailing auction, 10Y yields briefly rose to 0.78%, session highs, and some 10bps from overnight lows, although they have since faded some of the move higher.

Tyler Durden

Tue, 04/07/2020 – 13:14

via ZeroHedge News https://ift.tt/2Rn4RNo Tyler Durden