Bear-Market Bounce Breaks Despite “Global Money-Printing Orgy”

As stocks soared overnight and into the open this morning, pundits quickly appeared to proclaim the bear is dead and a new bull market had begun (as The Nasdaq completed a 50% retracement of the Feb-April drop)…

By the close, having tagged the 50% retracement of the plunge and dragged down by oil’s plunge, equity markets tumbled into the red…

At their best levels, Trannies and Small Caps were up over 4.5% this morning before giving it all back…

And VIX refused to play along with the excitement…

Source: Bloomberg

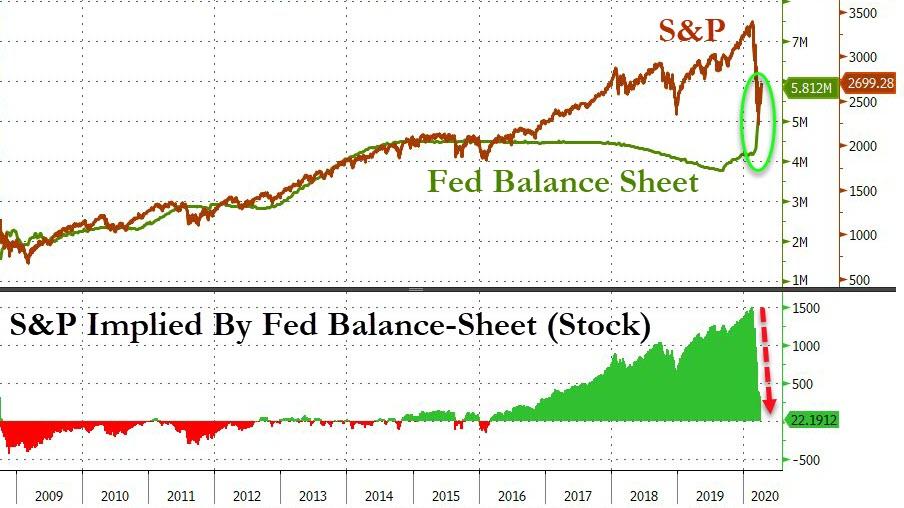

Of course, as is obvious to many, this bear market bounce is thanks to what Michael Novogratz, who formerly led hedge fund Fortress Investment Group, calls a “global money-printing orgy that’s going on…money is growing on trees right now,” adding that he is long “hard assets” like gold and bitcoin because of this as “at one point that comes home to roost.”

“Money is growing on trees right now. I learned when I was a little kid that money really doesn’t grow on trees. We have a global, money-printing orgy going on … at one point that comes home to roost,” says @novogratz on why he is buying hard assets like gold, #btc #bitcoin pic.twitter.com/TvWiQdntmt

— Squawk Box (@SquawkCNBC) April 7, 2020

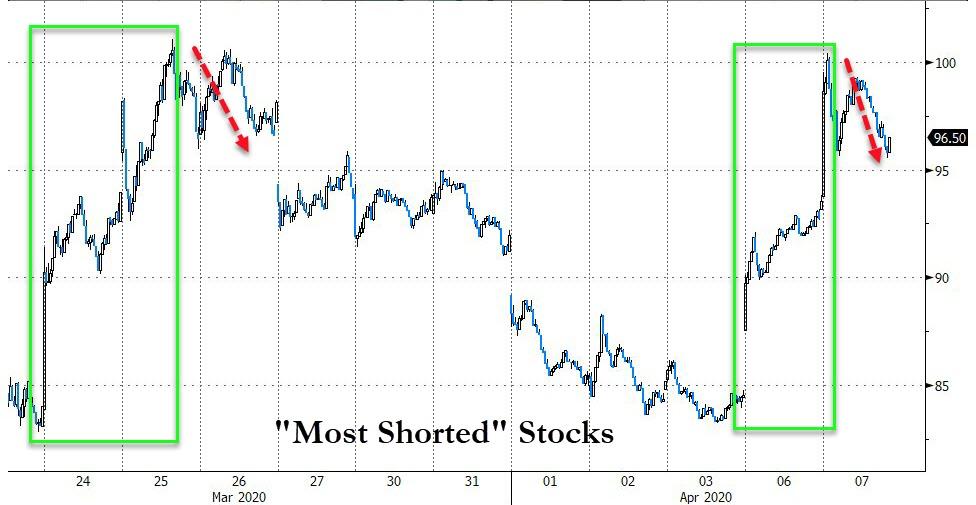

As Nomura quant Masanari Takada wrote this morning, the steep rally in global equities is nothing more than a giant “bear squeeze” rally, driven by panicked exits from shorts that investors accumulated during the downturn, something we pointed out yesterday when we showed that Monday’s action was the 2nd biggest marketwide short-squeeze in history.

Source: Bloomberg

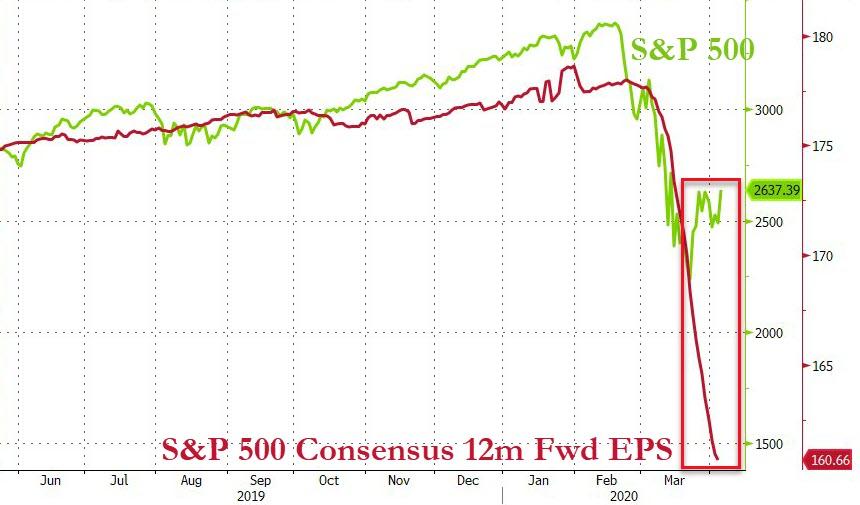

And, as Bloomberg’s Michael Regan warns, regardless of when the economy officially “reopens”, it’s almost impossible to predict when consumers will be comfortable enough to crowd into restaurants, movie theaters, cruise ships, airliners, amusement parks, hotels and shopping malls with the same gusto they did before the virus.

Forget all that for a moment. Instead, as the equity market rips higher to leave the S&P 500 down less than 20% from its last record, just ponder the potential for this: A 50% drop in buybacks and a 25% decline in dividends in 2020. (Those are Goldman’s forecasts, and due to the abundance of uncertainty, I’d view them as perhaps only slightly better than spitball estimates — but that’s about the best anyone can do at the moment. Would greater reductions be much of a surprise? We won’t even mention their estimates for a 33% decline in EPS.)

Hate to be the Eeyore on a beautiful spring day when the market is ripping higher. But just ask yourself: Is this bear market really over?

We suspect no…

Source: Bloomberg

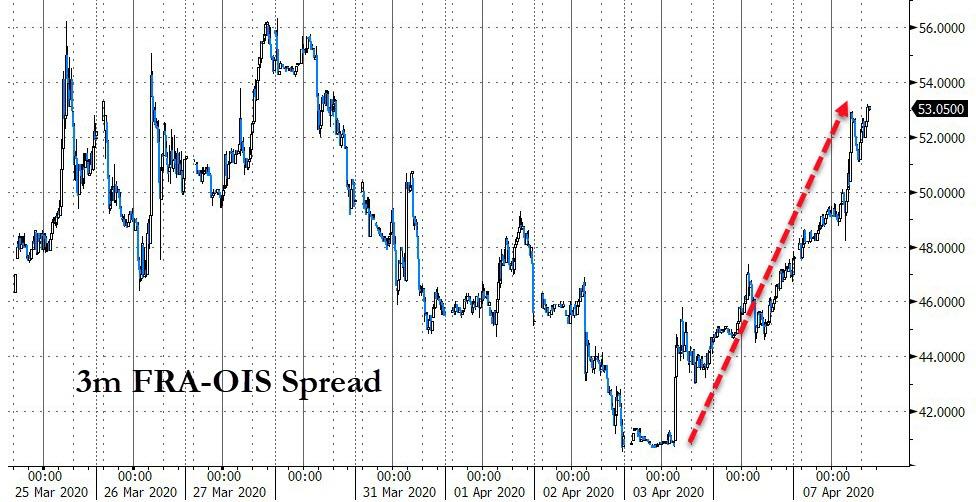

And just in case you thought everything was awesome (because stocks were soaring), there is still some serious dollar shortages/liquidity issues as FRA-OIS spread spikes today…

Source: Bloomberg

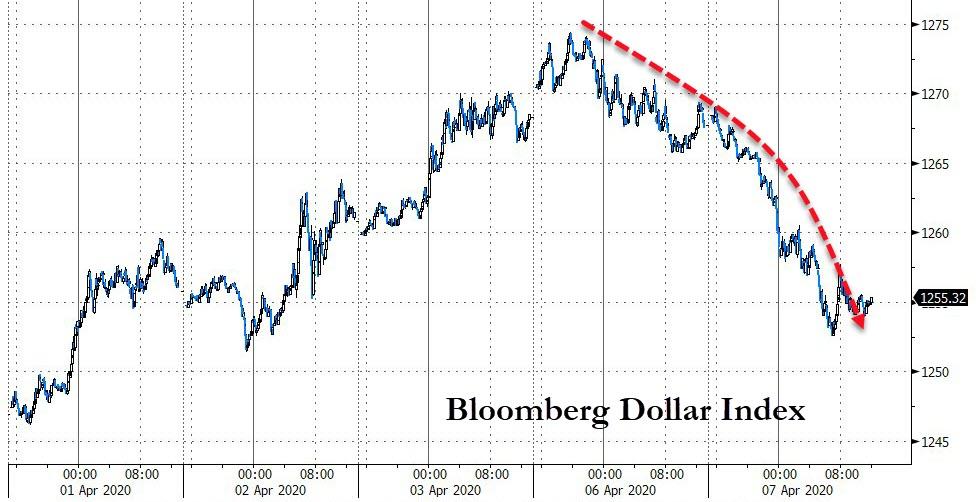

And while the squeeze hit,, the dollar was weaker for the second day in a row…

Source: Bloomberg

Oh, and in case you thought oil was supporting things as OPEC+ was about to agree to some magical thinking deal… think again – WTI was clubbed like a baby seal today after a strong open, erasing the trump spike…

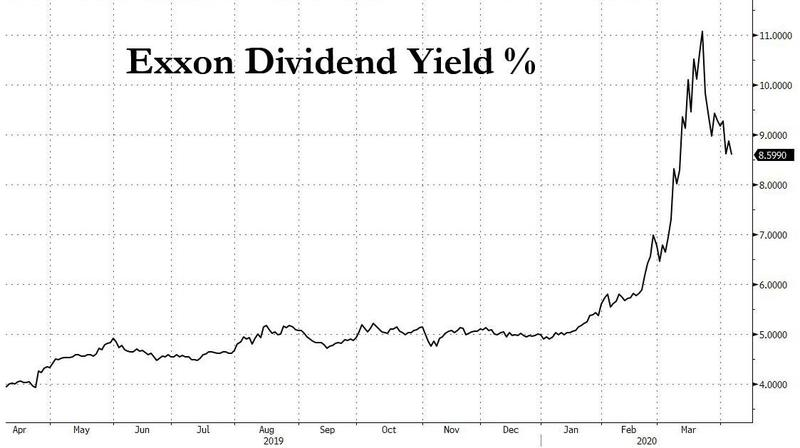

As Exxon slashed capex by 30% and projected a 25% demand drop…

Source: Bloomberg

Remember, you never “meddle with the money”…

Source: Bloomberg

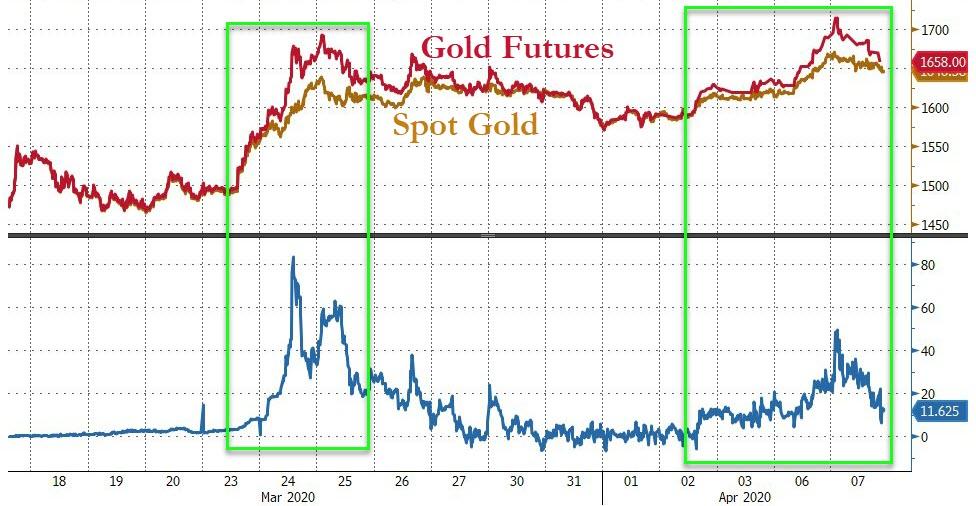

Talking of “money” – gold dipped today after spiking overnight above $1740…

And cryptos stabilized, holding on to gains…

Source: Bloomberg

Treasury yields were higher (2Y +2bps, 10Y +6bps) for the second day…

Source: Bloomberg

…but we note there was a rally this afternoon after the auction and as oil slid into settlement…

Source: Bloomberg

HY bonds were sold this afternoon as IG held up…

Source: Bloomberg

Commodities were mixed today with copper higher, PMs slightly lower and crude clubbed…

Source: Bloomberg

And finally, Gold, notably seeing decoupling again between Spot and futures markets…

Source: Bloomberg

Tyler Durden

Tue, 04/07/2020 – 16:00

via ZeroHedge News https://ift.tt/2V3LY2M Tyler Durden