Futures Rebound From Tuesday’s Historic Reversal

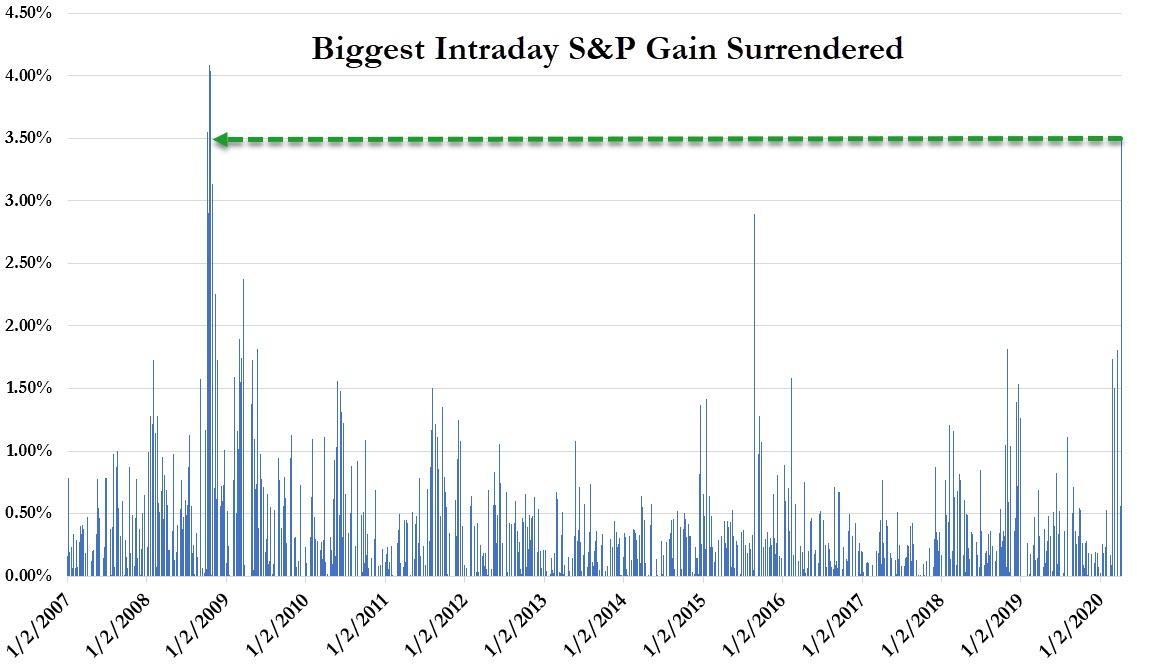

S&P futures rebounded and European stocks fell as investors were conflicted by Tuesday’s late plunge – which saw stocks close red after the biggest surrender of gains since Oct 2008…

… and the latest data surrounding the coronavirus economic, as well as the ongoing political chaos in Europe. The dollar trimmed a gain and Treasuries slipped.

The three big US index futures swung between modest losses and gains before turning higher as air carriers including Delta Air Lines rose in the premarket. Overnight, the White House was again said to be developing plans to get the U.S. economy back in action even as Wuhan reopened to the world, starting a second wave of infections.

Despite strong early gains on Tuesday after health officials said the pandemic may kill fewer Americans than recent projections, the three major indexes ended lower as oil prices tumbled. New York, the U.S. epicenter of the pandemic, was one of several states to post their highest number of daily virus-related fatalities on Tuesday, with total infections in the country approaching 400,000. Also overnight, Tesla became the latest U.S. company to furlough staff and cut salaries during a shut down of its U.S. production facilities.

In Europe, most of the 19 sector groups on the Stoxx Europe 600 Index were in the red, after euro-area finance chiefs as usual failed to agree on a $540 billion economic package to respond to the pandemic. The euro dropped as much as 0.6% to $1.0830…

… while Italian 10-year bonds took a hit with yields jumping as much as 18 basis points to 1.80% as European officials struggled to reconcile visions for how to recover from the virus as a feud emerged between Italy and the Netherlands over mutualized bond issuance. Core debt in the region gained. France’s first-quarter output shrank the most since World War II, the latest indicator of the severity of the shock to the world’s biggest trading region.

Earlier in the session, Asian stocks were little changed, with energy falling and health care rising, after rising in the last session. Most markets in the region were down, with Jakarta Composite dropping 3.2% and Singapore’s Straits Times Index falling 1.3%, while Japan’s Topix Index gained 1.6%. The Topix gained 1.6%, with Kubotek and Intellex rising the most. The Shanghai Composite Index retreated 0.2%, with Ningbo Jifeng Auto Parts and Suzhou Chunqiu Electronic Technology posting the biggest slides.

As Bloomberg notes, investors remain reluctant to take big risks while forecasts are for the virus to grow rapidly in some of the biggest economies, the U.S., Japan, Germany, France and the U.K. They’re also concerned that fiscal stimulus measures will be too late or not enough to counter the effects of the pandemic as efforts to formulate a European response drag on.

“As the quarter progresses, investors start to understand that everything we’re seeing is in the form of assistance and aid to just tide the economy over,” Bob Michele, global chief investment officer at JPMorgan Asset Management, said on Bloomberg TV. “It’s not stimulus that gets the economy going at a much higher rate than where it is.”

In FX, the dollar advanced against all its G-10 peers and the euro slipped after European Union finance chiefs failed to agree measures to mitigate effects of the coronavirus. The Australian dollar slipped after S&P Global Ratings cut the country’s credit-rating outlook to negative from stable. The kiwi initially edged lower after New Zealand’s central bank said it is open to increasing the size and scope of its asset-purchase program, but since regained most losses. The pound steadied after slipping against a broadly stronger dollar; Prime Minister Boris Johnson’s deputy Dominic Raab sought to reassure Britain that the battle against coronavirus was under control even as the daily death toll rose to a record Tuesday. Norway’s krone, Sweden’s krona and the Australian dollar led G-10 declines.

In commodities, WTI crude rose after Tuesday’s sharp plunge. Investors are weighing whether the world’s biggest producers will be able to strike a deal that cuts enough output to offset an unprecedented demand loss from the coronavirus outbreak.

To the day ahead now, and data releases out today include the Bank of France’s industry sentiment indicator for March, weekly MBA mortgage applications from the US, and from Canada there’ll be February’s building permits and March’s housing starts. Later on, there’ll also be the minutes from the Federal Reserve’s emergency FOMC meeting on March 15 which will be an interesting snapshot of what went on the day the Fed cut rates 100bps to close to zero.

Market Snapshot

- S&P 500 futures up 0.7% to 2,674.5

- STOXX Europe 600 down 1.4% to 322.09

- MXAP up 0.06% to 139.57

- MXAPJ down 0.9% to 446.91

- Nikkei up 2.1% to 19,353.24

- Topix up 1.6% to 1,425.47

- Hang Seng Index down 1.2% to 23,970.37

- Shanghai Composite down 0.2% to 2,815.37

- Sensex down 1.1% to 29,750.17

- Australia S&P/ASX 200 down 0.9% to 5,206.94

- Kospi down 0.9% to 1,807.14

- German 10Y yield fell 3.6 bps to -0.345%

- Euro down 0.3% to $1.0855

- Brent Futures down 0.2% to $31.80/bbl

- Italian 10Y yield rose 12.4 bps to 1.443%

- Spanish 10Y yield fell 1.3 bps to 0.805%

- Brent Futures down 0.2% to $31.80/bbl

- Gold spot up 0.1% to $1,649.77

- U.S. Dollar Index up 0.4% to 100.25

Top Overnight News from Bloomberg

- The White House is developing plans to get the U.S. economy back in action that depend on testing far more Americans for the coronavirus than has been possible to date, according to people familiar with the matter

- A pan-European approach for Covid-19 mobile apps should be drawn up by April 15, the EU said in proposals set to be rubber-stamped as soon as Wednesday

- The French economy shrank the most since World War II in the first quarter, and the outlook for the rest of the year is souring significantly amid the confinement to limit the spread of the coronavirus, according to the Bank of France

- Germany’s economy will likely shrink this quarter at more than twice the pace recorded at the height of the financial crisis, according to the country’s leading research institutes

- The number of new coronavirus infections in Germany rose the most in three days, bringing the total to 107,663 in one of Europe’s worst-hit nations

A tentative tone was observed in Asia-Pac bourses following the lacklustre performance stateside where all major indices finished with marginal losses after the initial risk on tone eventually lost steam ahead of looming key risk events including the conclusion of the Eurogroup deliberations and tomorrow’s OPEC+ meeting. ASX 200 (-0.8%) traded choppy with the early heavy losses in Australia triggered by weakness across the top-weighted financials sector after the regulator issued guidance on banks and insurers in an effort to restrict dividends and with sentiment also dampened after S&P cut the outlook on the country’s AAA sovereign rating to negative from stable, although the index later shrugged off the losses as the sentiment improved in late trade, while the Nikkei 225 (+2.1%) was also indecisive for most the session after the cabinet approved a record JPY 108tln stimulus package and declared a month-long state of emergency as expected. Hang Seng (-1.1%) and Shanghai Comp. (-0.2%) conformed to the early cautious tone in the region amid PBoC liquidity inaction but with downside stemmed after the State Council continued to outline supportive measures and after outbound travel restrictions were lifted from Wuhan which was the former epicentre of the coronavirus outbreak. Finally, 10yr JGBs traded back above the 152.00 level but with price action rangebound amid the indecision in Japan and following a tepid Rinban announcement in which the BoJ are present in the market for a total of JPY 670bln of JGBs in 1-3yr and 5-10yr maturities with the amounts unchanged from prior operations.

Top Asian News

- Morgan Stanley Among Biggest Lenders to Embattled Luckin Founder

- Nintendo’s Animal Crossing Becomes New Hong Kong Protest Ground

- Fuchs’s BFAM Hedge Fund Suffers 16% Loss Amid March Market Rout

- Pakistan’s Fragile Health System Faces a Viral Catastrophe

The risk tone across Europe took a turn for the worse after Eurozone Finance Ministers yesterday failed to agree on the stimulus measures to deploy in light the coronavirus crisis. Italy noted that it will reject a final report sent to EU leaders unless debt mutualisation is mentioned as a tool whilst also demanding no conditional attachments to the ESM loans. Netherlands reiterated their objection Eurobonds and intimated a majority agree on this. Price action this morning saw futures sliding off following reports of the impasse in talks, and confirmation via Eurogroup President Centeno of the delay. European cash markets are subdued by circa 1.0-2.0% across the region (Euro Stoxx 50 -1.4%). Sectors are mostly in the red with underperformance seen in Energy amid yesterday’s losses in the complex, whilst Financials also bear the brunt of the Eurogroup deadlock and lower yield environment. Looking at the breakdown, Oil and Gas are the laggards whilst Travel & Leisure continue to feel some reprieve. In terms of individual movers, Tui (+3.5%) leads the early doors gains in the Stoxx 600 after the Co. confirmed the signing of EUR 1.8bln state aid bridge loan. Tesco (-5.0%) shares remain in negative territory after the Co. noted that COVID-19 is having a material impact on business and the group is incurring significant additional costs. The estimated impact is seen on retail cost lines seen between GBP 650-925mln. Commerzbank (-6.4%) remains near the bottom of the pan-European index after reports the sale of its Polish unit mBank could be delayed amid the virus crisis

Top European News

- Hedge Fund Lansdowne’s Decline Deepens After Worst-Ever Loss

- Tesco Plans $6 Billion Special Dividend as Stockpiling Eases

- Goldman’s Oppenheimer Says Recovery Will Be Strong After Big Dip

In FX, the Aussie has reversed further from Tuesday’s post-RBA peaks in wake of S&P’s ratings review that came with a sting in the tail as the agency downgraded its outlook on the sovereign’s AAA standing. Aud/Usd is back below 0.6150 vs 0.6200+ when broad risk sentiment was still buoyant and its Antipodean peer was also outpacing the Usd on the 0.6000 handle compared to just under 0.5950 currently. In terms of Kiwi specifics, RBNZ Deputy Governor underlined the severity of the COVID-19 contagion overnight by stating that QE can be expanded to include other assets like linkers given that the pool of conventional bonds that can be purchased is limited. Elsewhere, the Loonie has lost 1.4000+ status after failing to test sub-1.3950 resistance ahead of Canadian housing data and against the backdrop of idling crude prices awaiting tomorrow’s OPEC+ showdown.

- EUR/CHF/GBP – All on a weaker footing against the US Dollar as risk appetite wanes, but with the Euro also undermined by the Eurogroup’s failure to resolve differences on a coordinated fiscal response to the coronavirus even though dire economic predictions continue to unfurl, ie French Q1 GDP -6% per the BdF and Germany contracting almost 10% in the current quarter according to leading institutes. Eur/Usd holding between 1.0902-1.0831 parameters and perhaps propped by an array of decent option expiries stretching from 1.0800 to 1.0900 – full details available via the headline feed at 7.33BST. Meanwhile, the Franc is skirting 0.9700, but retaining an underlying safe-haven premium relative to the single currency as the cross hovers around 1.0550 and Sterling is also somewhat mixed awaiting more UK nCoV updates and progress reports from hospital where PM Johnson remains in intensive care. Cable is clinging to 1.2300 and Eur/Gbp is meandering in the low 0.8800 area, well above 1.5 bn expiry interest from 0.8700 to 0.8710.

- JPY/DXY – The Yen and Buck are still jostling for position amidst fluctuating risk-on/off phases, with Usd/Jpy confined to narrow 109.00-108.50 extremes and the index not much more adventurous in advance of weekly US mortgage applications and FOMC minutes either side of 100.00, albeit with a firmer bias on balance up to 100.430 at best.

In commodities, choppy price action is seen in the energy complex in the run-up to arguably the most OPEC+ meeting to date. A delegate overnight noted that scenarios range from 10mln BPD of output curtailment to no cuts at all. The OPEC+ group’s monitoring committee is said to be preparing a draft for prospective output cuts. Several sources via Energy Intel note two scenarios will reportedly be presented: 1) The first scenario sees OPEC+ no longer being bound by production restrictions. This set-up would see a continuation of the current state of affairs – Saudi would stick to its current production quota in excess of 12mln BPD (vs. 9.7mln BPD in March) 2) In the second scenario, OPEC members alongside Russia and other producers would implement joint 10mln BPD reductions through to the end of the year, whilst TASS yesterday reported a time-frame of three months. Elsewhere, last night’s APIs proved to be another bearish release, with inventories building 11.9mln barrels vs. Exp. build of 9.3mln. Albeit, prices remained locked onto OPEC headlines. The release of the EIA STEO (ahead of next week’s OPEC and IEA Oil Market Reports) encapsulated the March impact of COVID-19, the agency cut 2020 world oil demand growth forecast by 5.6mln BPD to 5.23mln BPD and raised 2021 forecast by 4.68mln BPD to 6.41mln BPD. Nonetheless, WTI and Brent front-month futures are now mixed after sentiment was hit by news of a roadblock among EZ finance ministers on a stimulus package for the bloc. WTI outperforms its Brent counterpart with the former currently residing around USD 24.50/bbl, having had earlier topped its 21DMA (USD 24.98/bbl) to a high of USD 25.29/bbl in overnight trade. Brent meanwhile briefly dipped below USD 32.00/bbl having earlier tested resistance at USD 33/bbl (intraday high). Elsewhere, spot gold remains steady and within a relatively narrow USD 1640-57/oz intraday band. Copper prices meanwhile wiped out mild overnight gains as risk sentiment deteriorated after reports EZ finance ministers failed to reach a consensus on EU-wide stimulus to combat COVID-19. The red metal looks to retest its 21DMA to the downside at USD 2.25/lb.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 15.3%

- 9:45am: Bloomberg Consumer Comfort, prior 56.3

- 2pm: FOMC Meeting Minutes

DB’s Jim Reid concludes the overnight wrap

Things are getting to a stage at home where my wife has started to give haircuts to the children. I didn’t watch her give the 2 year old twins their sheering yesterday but in seeing the results last night at bed time my strong guess is that they moved a lot in the process. I have numerous pictures from my childhood where my brother and I have spectacular bowl cuts as home haircuts in the more austere 1970s and early 1980s were all the rage. Parents literally used to put bowls on your head and cut around it – well mine did. Nowadays my children normally get pampered in a salon with an exotic fish tank. So we’re taking them back 40 years albeit without the bowl as a template. I look forward to the photographic memories of uneven hair in 40 years’ time. Thankfully this problem has passed my hair by long ago.

Talking of haircuts, the Eurogroup meetings yesterday were trying to find ways of ensuring bondholders don’t take one in the future. However talks have continued through the night and a press conference has been scheduled for 10am CET this morning. According to Bloomberg, France and the southern bloc have been pushing for a firm commitment for a recovery fund that would be financed by jointly issued bonds however this has caused a split with the likes of Germany and the Netherlands pushing back. The plan of a recovery fund has been put forward by the French government and aims to create a temporary reserve worth 3% of EU GDP with a lifetime of as long as 10 years, and would be funded by the joint issuance of debt to mutualize the cost of the crisis. This is in addition to the three main proposals which we had highlighted yesterday that are under discussion. As well as the recovery fund, the group is also believed to be struggling on the wording related to the ESM proposal. A preliminary draft agreement distributed to ministers yesterday night didn’t include a reference to joint debt or the time frame for a recovery fund to be arranged, and was rejected by supporters of these solutions. We should know more later this morning.

In addition to the Eurogroup, the ECB unveiled a set of temporary collateral easing measures yesterday, which included accepting Greek government bonds as collateral. Looking at the other measures, there was also a temporary increase in the Eurosystem’s risk tolerance with a “general reduction of collateral valuation haircuts by a fixed factor of 20%. However, the statement did say that the measures were temporary during the coronavirus and “linked to the duration of the PEPP”, with a reassessment coming before the end of the year. However it shows that rules are rules until events overtake them.

Over in the US meanwhile, Senate Majority leader McConnell said that he was working to provide further funds for the small-business loan programs, with a vote being held tomorrow. The initial numbers released are in the $250bn range, supplementing the $350bn that the government passed in the original $2.2 trillion stimulus package. Treasury Secretary Mnuchin said he excepts the votes in the Senate and House to take place by the end of the week, having spoken with leaders in both chambers. This plan is not in conjunction with Speaker Pelosi’s for another $1trillion aid package focused on small businesses that she floated at a call with Democrats on Monday, and it remains to be seen whether the two party leaders can merge the two bills or if there will be more political gridlock on this round of stimulus.

In terms of markets, it looked set to be another positive day for risk assets across the board yesterday, with a number of equity indices technically entering bull market territory intraday, having risen by at least 20% from their closing lows less than a month ago. However after Europe closed we saw a notable retracement. The S&P fell from a near 3.5% gain to close down slightly at -0.16%, the smallest absolute move the index has seen since a similar drop on February 13th and only the 3rd day out of the last 28 trading days where we saw a smaller than 1% move in either direction for the day. Interestingly twitter suggested this was the biggest intra-day gain for the S&P 500 where the index eventually fell and closed lower since 17th October 2008. The late market fall did seem to coincide with a fall in Oil which went from positive territory to close -3.57% in the last three hours of trading as nervousness mounts about whether the imminent OPEC+ talks (meeting tomorrow) will see enough progress, although the news appears to be more positive overnight (see below). There was also an increase in US weekly inventory levels which contributed to the late fall.

Over in Europe before the falls, Germany’s Dax did cross the so called bull market definition, with its +2.79% increase yesterday putting it up +22.68% since 18th March. The STOXX 600 was up +1.88% and is now +16.79% from the lows. Credit spreads reflected the change in risk sentiment, with US HY cash spreads -38bps tighter and IG -11bps tighter. While it was similar on this side of the Atlantic, where Europe HY cash spreads were -31bps tighter and IG -8bps tighter.

This morning Asian markets are a bit more mixed. The Hang Seng (-0.99%) and Shanghai Comp (-0.32%) are both down while the Nikkei (+0.57%) and Kospi (+0.08%) have posted modest gains. In FX, the Australian dollar is down -0.65% after S&P cut the country’s credit-rating outlook to negative from stable while the US dollar index is up +0.31% this morning after yesterday’s -0.78% decline. Elsewhere, futures on the S&P 500 are trading flat. In commodities, WTI and Brent crude oil prices are trading up +5.25% and +2.20% respectively with President Trump saying in an interview overnight that he has spoken to Russian President Vladimir Putin and Saudi Arabia’s Crown Prince Mohammed bin Salman about low oil prices and believes that “it’s all going to work out.” Base metal prices are also trading up with iron ore up as much as +2.82%.

In other news, the SCMP has reported that the Hong Kong government is set to announce a fresh round of more than HKD 30bn ($3.87 bn) in stimulus to support businesses devastated by the coronavirus pandemic. Meanwhile, Australian parliament is also expected to pass a record AUD 130bn ($80 bn) jobs-rescue plan today.

The positive sentiment earlier in the session yesterday came as the market narrative continues to shift towards the exit strategy from the shutdowns and social distancing measures. In the US, the Director of the National Economic Council, Larry Kudlow, said that the economy could re-open in the next 4-8 weeks. Remember in our “The exit strategy” note from last week (link here) we had the US easing restrictions at May 22nd so a choice price for you rather than a four week bid-offer. Over in Italy, Bloomberg reported that certain firms could open again in mid-April, earlier than our May 7th speculation but clearly baby steps still at the moment. Nevertheless, it should be pointed out that the news wasn’t entirely one-sided, with Prime Minister Abe declaring a state of emergency in 7 prefectures including Tokyo, while Paris banned outside sports (i.e. exercise) between 10am and 7pm.

In terms of new covid-19 cases our fears that Tuesday would bring a lagged weekend reporting catch up of new cases and deaths in the UK materialised as the UK saw 786 new deaths reported yesterday, the highest of the outbreak. However as you’ll see in the Corona Crisis Daily the 3-day average of growth in UK deaths at 12.6% is still substantially below the previous 3-day growth rate of 22.4%. A similar story emerged in NY as even while new case growth fell to 5.2%, the rate of new deaths rose yesterday even though it broadly remains in a down trend. Spain and Italy showed no “Tuesday effects” with both countries seeing the lowest percentage change so far in both new cases and fatalities.

Back to markets and the risk-on meant it was another bad day for safe haven assets, with yields on 10yr Treasuries and bunds up by +4.2bps and +11.6bps respectively, the biggest daily increase for both in nearly 3 weeks. The moves in southern Europe were also sizeable, with BTPs up +12.6bps (spreads only 1.0bps wider), though Greece was the outlier as yields fell by -6.6bps given the collateral news reported above. Other safe assets also suffered, with the dollar index falling by -0.78%, snapping a run of 4 successive increases, while gold’s 4-day winning run also came to an end with a -0.80% decline.

There wasn’t much in the way of data out yesterday, though the NFIB’s small business optimism index in the US fell to 96.4 in March, down from 104.5 in February. That’s the largest decline on record, and it’s the lowest level since October 2016, before President Trump’s election. We did get data on US job openings for February, which stood at a higher than expected 6.882m (vs. 6.500m expected), though the number has been rendered a snapshot of a previous age thanks to the impact of the coronavirus. Finally from Europe, we also got February’s industrial production numbers from Germany. They showed a year-on-year decline of -1.2% (vs. -3.0% expected). Largely old news.

To the day ahead now, and data releases out today include the Bank of France’s industry sentiment indicator for March, weekly MBA mortgage applications from the US, and from Canada there’ll be February’s building permits and March’s housing starts. Later on, there’ll also be the minutes from the Federal Reserve’s emergency FOMC meeting on March 15 which will be an interesting snapshot of what went on the day the Fed cut rates 100bps to close to zero.

Tyler Durden

Wed, 04/08/2020 – 08:24

via ZeroHedge News https://ift.tt/34ltijj Tyler Durden