Global Economies Suffer “Largest Drop On Record”: OECD

In case anyone needed more proof that the entire world is sliding into recession, if not outright depression, on Wednesday morning the Organisation for Economic Cooperation and Development said that major economies are seeing the biggest monthly slump in activity ever amid the coronavirus crisis and no end is in sight without clarity about how long lockdowns will last.

The OECD said its leading indicators, which are designed to flag turning points in economic activity, suggested all major economies had plunged into a “sharp slowdown” with only India registering as being in a mere “slowdown”.

The indicators were flagging “the largest drop on record in most major economies”, the Paris-based OECD said in statement, adding that huge uncertainty over how long lockdowns would last severely muted their predictive value.

As a result, the OECD said the indicators “are not yet able to anticipate the end of the slowdown, especially as it is not yet clear how long, nor indeed severe, lockdown measures are likely to be”. Last month, the OECD estimated that each month major economies spend in lockdown knocked 2% off their annual growth.

Yet while the OECD has no idea what will happen, traders appears to be convinced that the worst is now behind us. As Rabobank wrote this morning, the stock market rallies of the past two days are despite the fact that neither economic nor earnings data have really begun to unveil the enormity of the economic crisis that the world has been plunging into in the past few weeks.

Even though investors have been appeased by the massive policy responses of governments and central banks around the world, this will not be cost free. The weakness at the long end of the US curve yesterday is likely related to the Treasury’s plans to resume sales of 20 year notes. The deteriorating position of public finances of governments can be expected to bring a reaction from credit rating agencies in various countries. S&P marked out Australia this morning with a reduction in its AAA credit rating outlook to negative. Unsurprisingly, the decision was based on the anticipated sharp rise in public debt and the fact that the country is facing its first recession in almost 30 years. On Tuesday, Fitch had already downgrading the credit ratings of the country’s big banks from AA+ to A- on the expected rise in bad debts as business fail. The news threw cold water on yesterday’s sharp recovery in AUD/USD.

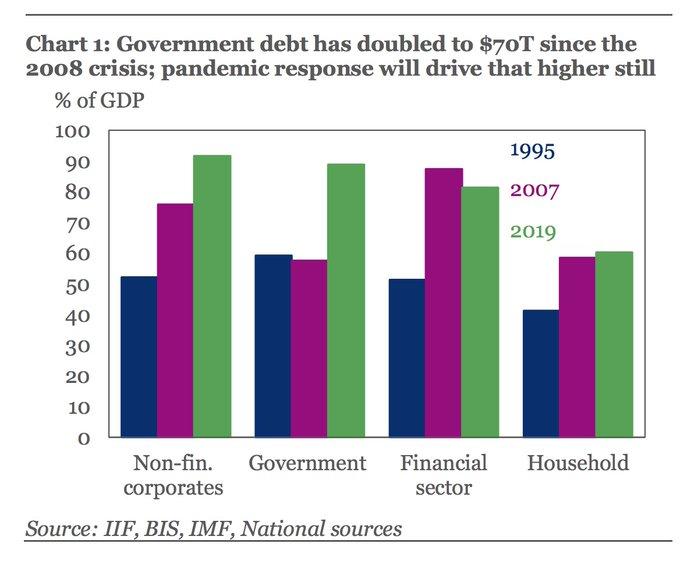

In other words, just to get back to even the world will have to incur tens of trillions in more debt which will make future growth even more scarce. Even before the global corona crisis, the IIF calculated that global debt rose by more than $10 trillion in 2019 when the global economy was humming, topping $255tn. At over 322% of GDP, global debt is now 40% or $87tn higher than at the onset of 2008 financial crisis, with the bulk of the increase in government debt (+$4.3tn) & non-financial corp sectors (+$2.8tn).

This ensuring that even the tiniest hint of inflation and jump in long rates will result in a global debt crisis, forcing even more central banks intervention, until eventually the Fed owns every risk asset to delay complete, systemic collapse.

Tyler Durden

Wed, 04/08/2020 – 09:25

via ZeroHedge News https://ift.tt/2xYP9Bf Tyler Durden