Oil Deal On Verge Of Collapse As Russia Balks At Proposed US “Production Cut”

As oil traders look with dread and fear to tomorrow’s OPEC+ teleconference one day after crude oil tumbled amid speculation that the production cut standoff will not be resolved…

… there was a sliver of hope that oil prices may rebound after Reuters reported that Saudi Arabia, Russia and allied oil producers will agree to deep cuts to their crude output at talks this week but only if the United States and several others join in with curbs to help prop up prices that have been hammered by the coronavirus crisis.

However, in an attempt to have its cake and eat it too, the U.S. DOE said on Tuesday that U.S. output is already falling without government action, in line with the White House’s insistence that it would not intervene in the private markets. And as reported on Tuesday morning, super-major Exxon announced that it would slash capex by up to 30%, which would impact output by several hundred thousands barrels per day… but only in 2021 and onward. In other words, any organic decline would take place slowly, over the course of the next two years.

“With regards to media reports that OPEC+ will require the United States to make cuts in order to come to an agreement: The EIA report today demonstrates that there are already projected cuts of 2 (million bpd), without any intervention from the federal government,” the U.S. Energy Department said.

That is not enough for OPEC+ however, and certainly not Russia, which on Wednesday made clear that market-driven declines in oil production shouldn’t be considered as cuts intended to stabilize the market, Kremlin spokesman Dmitry Peskov tells reporters on conference call.

“These are completely different cuts. You are comparing the overall demand drop with cuts to stabilize global markets. It’s like comparing length and width,” Peskov says in response to a question of whether Russia would accept for the U.S. to have only a market-driven drop in output as part of a deal to stabilize oil market

“These are different concepts, they cannot be equated. Tomorrow there will be an exchange of views among specialists.”

But not American “specialists”: sources said no one from the Trump Administration was expected to attend Thursday’s call, which means the call – whose sole purpose is to get the US to join the production cuts – will be moot.

Iran’s Oil Minister Bijan Zanganeh also indicated that OPEC+ now wants the US to actively cut production when he tweeted on Tuesday that “before any meeting between OPEC and non-OPEC there needs to be an agreement on production numbers for any country that will reduce production,” adding that the United States and Canada need to play a role in determining production cuts.

While Saudi Arabia, Russia and other members of the group known as OPEC+ have expressed willingness to return to the bargaining table, they have made their response conditional upon actions by the United States and other countries that are not members of OPEC, and it now appears that the US is reluctant to shift away from a organic production cut. No agreement has yet been formalized.

OPEC+ is due to hold a video conference on Thursday at 1400 GMT, after U.S. President Donald Trump said last week that Riyadh and Moscow had agreed to cut an unprecedented 10 million to 15 million bpd, or about 10% to 15% of global supply. He has not committed to any actions by U.S. companies.

Then there is the elephant in the room, of course, that even a 10mmb/d production cut will not be nearly enough to balance an oil market where demand has plunged by more than 25mmb/d.

“The scale of this challenge is so large that OPEC+ cannot solve it,” said Jason Bordoff, director of Columbia University’s Center on Global Energy Policy and a former Obama administration official. “Only some and not all of the world’s producers have the willingness and ability to limit production.”

Finally, and at the same time as the US is being forced to join the cuts, Riyadh and Moscow are trying to overcome the rancor stemming from March’s talks, when a deal to extend production cuts fell apart. Since then, Saudi Arabia has been flooding the market with extra crude, and it has insisted it would no longer carry what it considered an unfair burden of output cuts.

***

So while any actual production cut deal appears unlikely if the US does not join in – and certainly if the US does not participate in the teleconference – here is a preview of what Wall Street expects from tomorrow’s meeting, courtesy of RanSquawk:

SCHEDULE: The delayed OPEC+ webinar on Thursday will arguably be the most important gathering of ministers to date, with countries outside OPEC+ also poised to potentially tune into the discussions, thus presenting scope for coordinated action. The meeting is due to commence at 15:00BST, with a presser to follow – all times tentative, OPEC+ pressers tend to be delayed. This will be followed by a G20 Energy Ministers’ meeting on Friday, expected to start at 13:00BST. Argentina, Brazil, Canada, Colombia, Egypt, Indonesia, Norway, the UK, the US, and Trinidad & Tobago have also been invited to partake in Thursday’s meeting, although at pixel time, not all are confirmed to attend. Sources said no one from the Trump Administration was expected to attend Thursday’s call. Saudi and Russia have called for other global producers – namely the US, Canada, and Mexico – to share the burden of cuts.

KEY PLAYERS

- OVERALL RHETORIC: Russia and Saudi have blamed each other for the collapse in oil prices. The two sides agreed to discussions following US President Trump’s recent intervention but made it clear that any cuts will have to be “fair”, and a joint global effort.

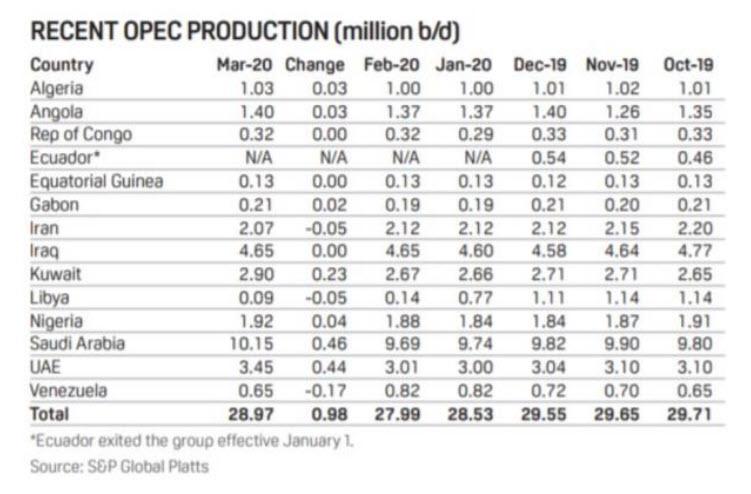

- SAUDI (12MLN BPD OUTPUT IN APRIL): The Kingdom is mulling an output cut to beneath 9mln BPD on the condition other oil members join in. A Saudi official said if there was no deal, “we will have some nice number of floating tankers going nowhere”.

- RUSSIA (11.29MLN BPD OUTPUT IN MARCH): Moscow’s participation is highly contingent on the US, and is unlikely to agree to output cuts if the US does not join the effort; separate reports said Russian producers are ready for oil curbs on the same proviso. Indeed, the CEO of The Russian Direct Investment Fund was optimistic, stating that Riyadh and Moscow are near an accord. The Kremlin has declined to signal Moscow’s position ahead of the meeting.

- US (13MLN BPD OUTPUT AT END-MARCH): The US has leaned back on calls to commit to cuts. President Trump said he did not make concessions during talks with Saudi and Russia and has not agreed to a US domestic production cuts. Further, he said US producers have already cut back as a reaction to the market. Meanwhile, US independent oil producers reportedly have told OPEC that they will voluntarily cut output, but US oil majors worry about the antitrust issues around any coordinated effort.

OTHER PRODUCERS

- BRAZIL (3.06MLN BPD OUTPUT IN FEBRUARY): State-owned Petrobras said it will curtail production by 100k BPD, according to a statement in March.

- CANADA (5.78MLN BPD OUTPUT IN FEBRUARY): Alberta’s Energy Minister stated that the country will take part in the talks and will “keep an open mind”. A senior government official downplayed any suggestions that the country will go along with further production cuts. NOTE: Alberta, like Texas in the US, has the regulatory framework to force producers to curb supply.

- NORWAY (2.07MLN BPD OUTPUT IN FEBRUARY): Norwegian Oil Ministry stated that it would consider partaking as an observer if there was broad participation but said, at the time, that there are no ongoing talks with oil companies on cuts. For reference, the country produces less than 2% of global supply.

PROPOSED CUTS

- DURATION OF CUTS: Delegates has said that current options being considered range from a 10mln BPD cut to no reduction at all, with a three-month agreement being considered, according to some reports. Some question whether a three-month deal would be sufficient to balance the market. The pact could be extended, but may face resistance from Russia and US, and could be highly contingent on market conditions at the time. Separate reports noted proposals for a year-long agreement.

- TOUTED SCENARIOS: Two scenarios will reportedly be put forward: 1) OPEC+ would no longer bound by production restrictions, which would see a continuation of the current situation. 2) OPEC alongside Russia and other producers would implement joint 10mln BPD reductions through to the end of the year. A separate report touted a joint 10mln BPD cut which would see the involvement of the US, Canada, and Brazil. The cuts will be distributed as follows: Saudi would cut a minimum of 3mln BPD from current levels, Russia 1.5mln BPD, Non-Saudi Gulf 1.5mln BPD, US, Canada, and Brazil almost 2mln BPD with Texas at least 500k BPD.

- BASELINE: It is unclear which production month will be benchmarked in any cuts. This set level could prove to be significant given Saudi’s output hike. OPEC sources said there is a rift between Moscow and Riyadh regarding which baseline to use, with latter calling for the current production environment to be used as the base line.

HOUSE CALLS

Analysts at Credit Suisse outline five potential outcomes from the meetings:

- 1) NO OPEC+ DEAL (5%): Russia and Saudi talks will break down – Brent could be pushed lower to ~USD 20/bbl

- 2) NO US DEAL (20%): If the US refuses to partake, Russia and Saudi will also ditch talks – Brent could be pushed lower to ~USD 20/bbl

- 3) A “LARGE” DEAL (20%): around 15mln BPD cut from current levels supported by OPEC+, US and other producers for at least three months with possible extension – Brent could rise to around USD 35-40/bbl.

- 4) A “SMALL” DEAL (35%): Immediate OPEC+ cuts of 12-13mln BPD; US offers mild reductions in Gulf of Mexico and Shale output and the purchase of oil for the Strategic Petroleum Reserve (SPR) – Brent could see USD 30-35/bbl.

- 5) AN “EVEN SMALLER” DEAL (20%): US relies on natural output reductions and offers to purchase around 0.8-1.0mln BPD for the SPR. Brent could meander below USD 30/bbl with scope for a rise to ~USD 35/bbl should US production markedly decline naturally.

TARIFFS:

US President Trump on the weekend said he was considering slapping tariffs on oil imports, or even take other such measures, to protect the US energy sector from falling oil prices. For reference, the US imports of petroleum were around 9.1mln BPD in 2019, of which Saudi and Russian imports were just over 500k each.

G20 ENERGY MEETING:

The fallout from the OPEC+ meeting would set the stage for the G20 webinar on Friday. Energy Intel notes members outside OPEC+ will be asked pledge additional reductions, “over and above 10mln BPD”. A Senior Russian source noted that efforts to get the US involved in cuts will be on the agenda for Friday’s call. Desks remain sceptical a deal can be reached at this meeting. G20 members such as South Korea and Japan produce little oil, whilst others such as China, India, and the UK are more reliant on imports.

Following the meeting, Saudi Aramco, UAE’s ADNOC and Kuwait’s KPC are expected to release their OSPs for May.

Tyler Durden

Wed, 04/08/2020 – 10:46

via ZeroHedge News https://ift.tt/34jVHGs Tyler Durden