Morgan Stanley Warns It Will Take At Least 7 Months For Markets To Normalize

As Morgan Stanley’s Christopher Metli and Amanda Levenberg write this morning, there have been signs of health returning to the market, with the S&P 500 now more than 20% off the lows again and VIX 35+ points off its highs.

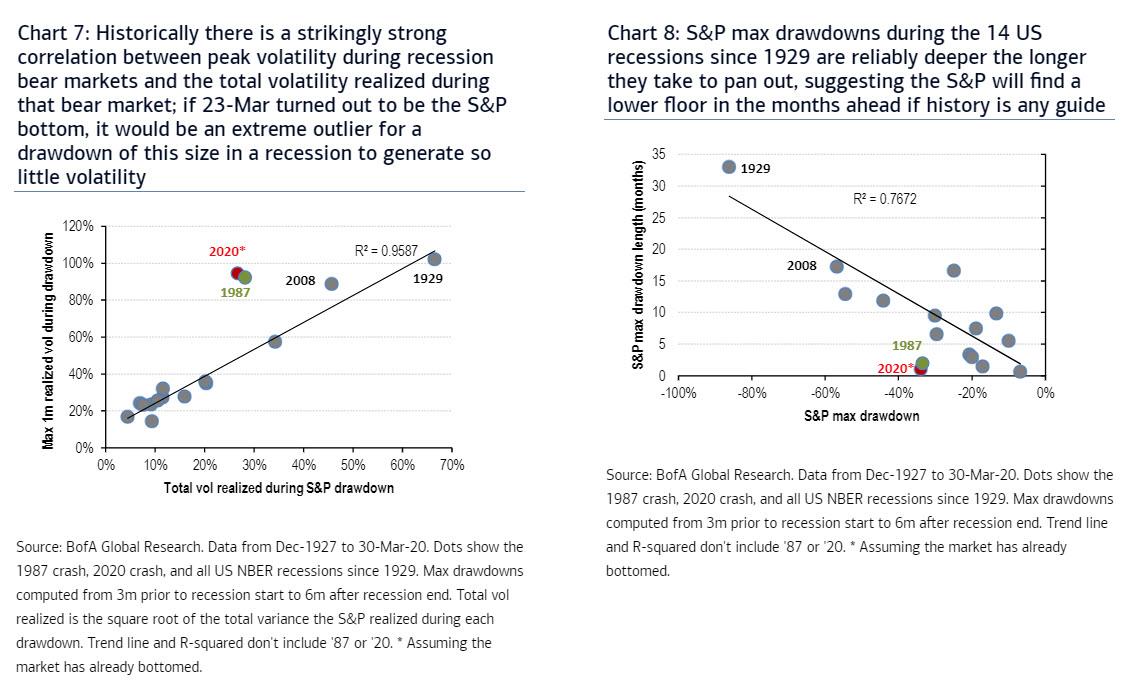

However, as we cautioned yesterday, the rally back has been sharp, and according to BofA, too sharp as “the current drawdown has so far been more similar to the 1987 crash, and it would be an extreme outlier for a drawdown of this size in a recession (particularly one as deep as it is forecasted to be) to generate so little volatility…

… unless the US can somehow avoid recession, which is now impossible, prompting BofA to conclude that “it’s likely that we haven’t seen the bottom in equities yet.”

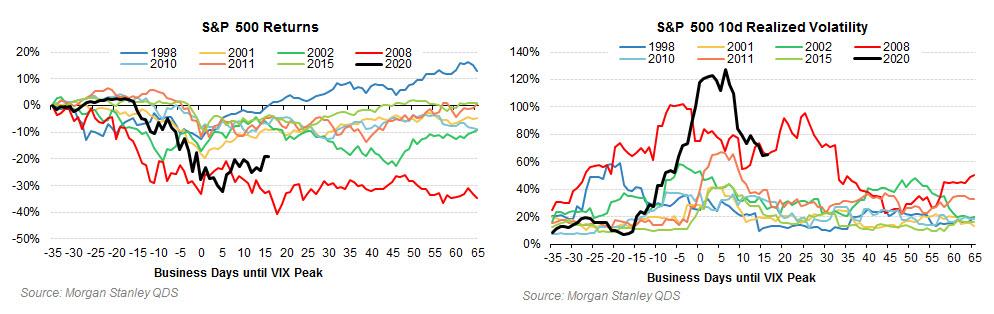

Picking up on this, MS writes that the despite the sharp rally, realized volatility has remained elevated (perhaps for the end of day rebalancing reasons we highlighted yesterday) with S&P 500 10d realized volatility still above 60% and VIX is still above 40 (an average daily move of 2.9%).

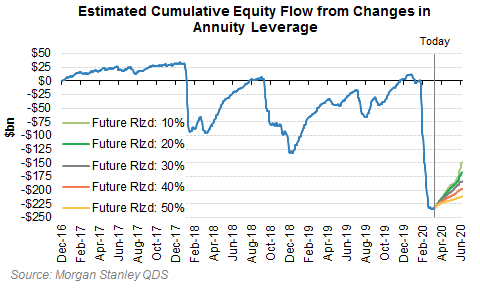

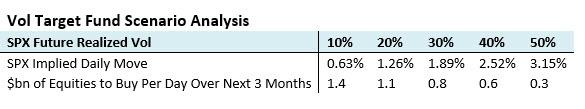

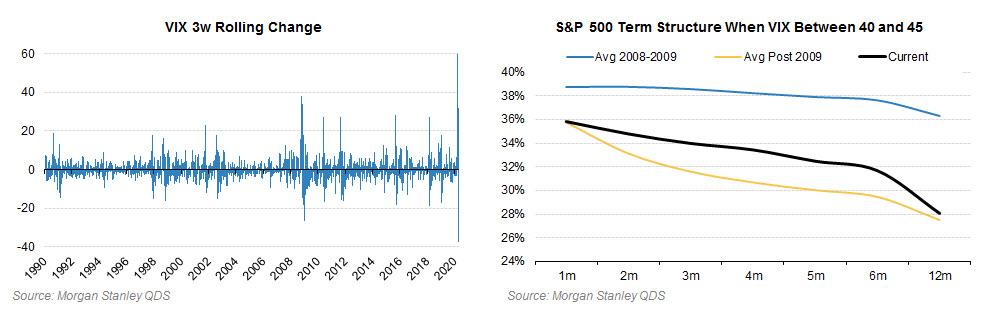

This means that while the market recovery and vol compression are impressive, they are not enough to force material buying from systematic strategies (Vol Target Funds and Trend Following CTAs). To generate meaningful demand from Trend Followers, Morgan Stanley calculates that the S&P 500 would have to rally closer to 2900 (50d moving average, and many strategies wouldn’t even buy until prices are higher) and Vol Target Funds would only buy once falls down to 20 to 30% – and stays there. But volatility generally falls much more slowly than it rises, and history suggests that it could take several months for volatility to reset to ‘normal’ (sub-20) levels. After previous peaks in volatility, it took an average of 6 to 7 months for VIX to fall back down below 20.

Some more observations from MS:

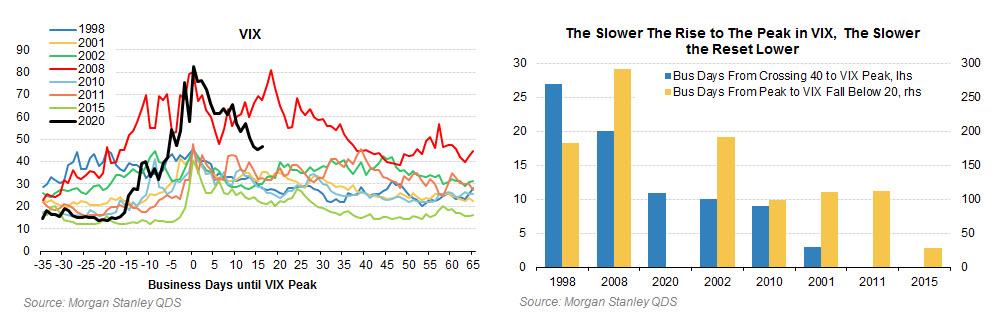

VIX hit its closing peak just over 3 weeks ago on March 16th at 82.69 (intraday peak of 85.47 on March 18th) and has fallen to a 40 handle since then – its sharpest 3w decline ever which followed its fastest rise ever (first chart below). Many investors are comparing spot and vol dynamics over the past month to what happened during the Financial Crisis. While the level of expected volatility for the next several months (as priced by SPX options) is somewhere between the 2009 recovery and recoveries from after the GFC, the market is priced for a faster recovery than seen in 2008 (the shape of the curve is more in line with vol pricing after post-GFC selloffs). This pricing likely reflects the now large and well-known Fed put, which also existed during 2008 but was much more slowly to be deployed. Compared to prior days when VIX was at a similar level to where it is now, S&P 500 implied volatility across the term structure is more in line with post-2009 levels and well below 2008-2009 levels.

Echoing BofA, MS cautions, that despite VIX falling sharply and the S&P 500 term structure pricing in a quicker reversion in volatility than it did in 2008, there’s reason to believe that it may be a while before we see VIX back to ‘normal’ levels (sub-20).

After previous peaks in VIX, it took an average of 7 months for VIX to fall back below 20. There were naturally a wide range of outcomes though – 2015 was the quickest reversion back (at 29 business days) while 2008 was the longest (it took over a year). Also, the longer it took VIX to reach its peak after crossing 40, the longer it generally took for VIX to reset back below 20. If the VIX peak for this cycle does end up being on March 16th (11 days after initially crossing above 40), this relationship would imply that VIX should stay above 20 for about 6 to 7 months from now. To play for a floored fall in VIX over the next few months, the desk likes buying the Aug VIX 1×2 18 / 23 put spread for ~80 cents (ref: 32.05, pricing indicative).

During large shocks the market bottom often occurs after the peak in volatility, while the peak in vol and market bottom have occurred simultaneously in smaller selloffs (i.e. 1998).

So what does that mean for the market? In the near-term, Morgan Stanley’s quants are “balancing a concern of further market downside from retail/passive selling against unprecedented stimulus which could continue to accelerate the recovery. History suggests that regardless of the path of the underlying market, it could be several months before VIX fully normalizes.“

Tyler Durden

Wed, 04/08/2020 – 11:57

via ZeroHedge News https://ift.tt/34ma2SQ Tyler Durden