When Plagues Pass: Slower Growth, Social Unrest, & Labor Gets The Upper Hand

Authored by John Authers, op-ed via Bloomberg.com,

As the Black Death scythed through Europe in 1348 and 1349, workers across the continent discovered that they had power for the first time in their lives.

Textile workers in St. Omer in northern France asked for and received three successive wage rises within a year of the Great Plague’s passing. Many workers’ guilds struck for higher pay and shorter hours. When the French government tried to cap these demands in 1351, it still allowed pay rises of as much as a third more than their pre-plague level. By 1352, the English Parliament — which in 1349 had passed a law limiting pay to no more than its pre-plague level — was taking action against employers who had instead doubled or tripled workers’ pay.

These numbers come from the historian Barbara Tuchman’s, “A Distant Mirror,” a masterwork on the miseries of Europe in the 14th century. Published in 1978, when she thought it reflected the contemporary miseries of the 1970s, it has surged up the Amazon ratings as scholars from all disciplines search the history of pandemics to understand the post-coronavirus future that awaits us.

Pandemics, we discover, have shaped civilization, and there are even arguments that they have ushered in positive change. The Black Death, which came as the Catholic Church was riven by a papal schism, changed attitudes toward religion, leaving Europeans more reluctant to submit to authority. As Tuchman put it, “the Black Death may have been the unrecognized beginning of modern man” — even if the Renaissance, Reformation and Enlightenment were all centuries in the future.

One of the clearest lessons: labor gains in power at the expense of capital. This might seem too big an extrapolation from one of history’s truly extreme events. The Black Death cut Europe’s population by some 40% in less than two years. Naturally that strengthened the hand of the surviving workers. No other epidemic has had so great an impact, and neither will this one.

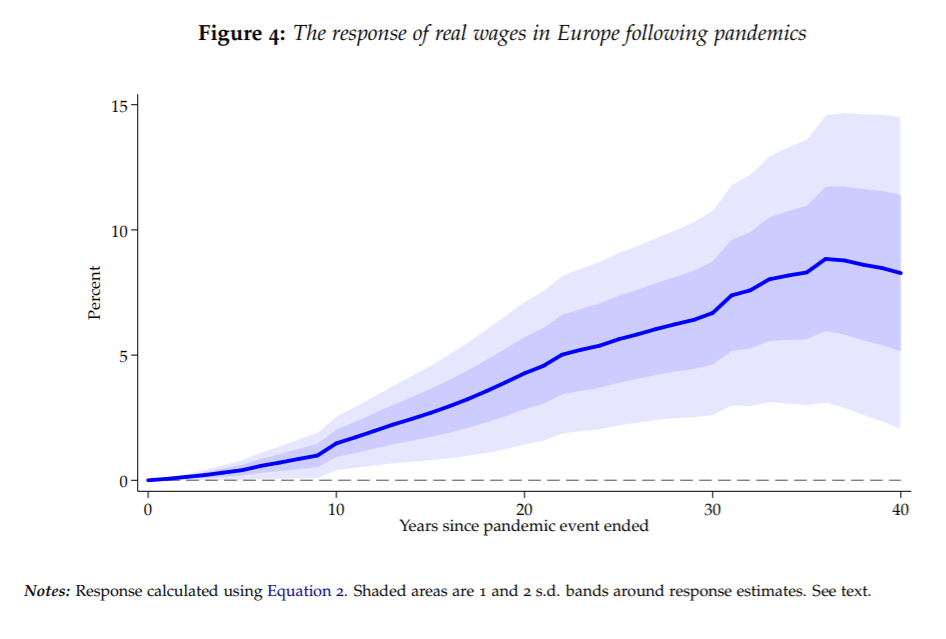

But research just published by the San Francisco Federal Reserve suggests that less damaging pandemics have similar effects. They looked at a dozen epidemics, from the Black Death through to the H1N1 flu of 2009, which claimed at least 100,000 lives. The final death toll of several of these outbreaks was much lower than the current estimates for Covid-19 — although they tended to attack the working-age population more directly. The academics also re-ran their data excluding the Black Death (by far the most lethal) and the Spanish flu of 1918 (because the Great Depression following barely a decade later might have skewed results) and found the same picture. In the decades after a pandemic, real wages in Europe (for which there is the best continuous data) invariably increase:

These figures are relative to what would have been expected absent the plagues, (and they are in real terms: after the Black Death, grain prices shot up, so higher wages initially only kept up with inflation) and show that pandemics boost labor for almost four decades. These gains are at the expense of capital; shareholders should brace for lower returns than they had been anticipating.

Any look at the headlines should confirm that we could see a replication of these patterns. Under emergency conditions, governments across Europe are subsidizing wages and paying workers not to work. Workers who are still required to work while others are social distancing, and who had previously been prepared to accept poor pay and conditions, are becoming much more assertive. Most famously, workers at Amazon, long subject to complaints about practices at its warehouses, took to the streets to protest being forced to work in close proximity to each other after colleagues had contracted Covid-19; and Amazon even responded by making 80,000 new hires.

Another alarming finding from the study is that there is no great recovery to look forward to. Pandemics are not like wars. Buildings and machines are not destroyed, and so there is nothing to rebuild. Some European politicians, including Spain’s prime minister, already are calling for a “new Marshall Plan” that would be “the greatest mobilization of economic and material resources in history.” But it may be optimistic to draw a parallel to the Marshall Plan, the enormous program of investment with which the U.S. supported the reconstruction of western Europe after World War II.

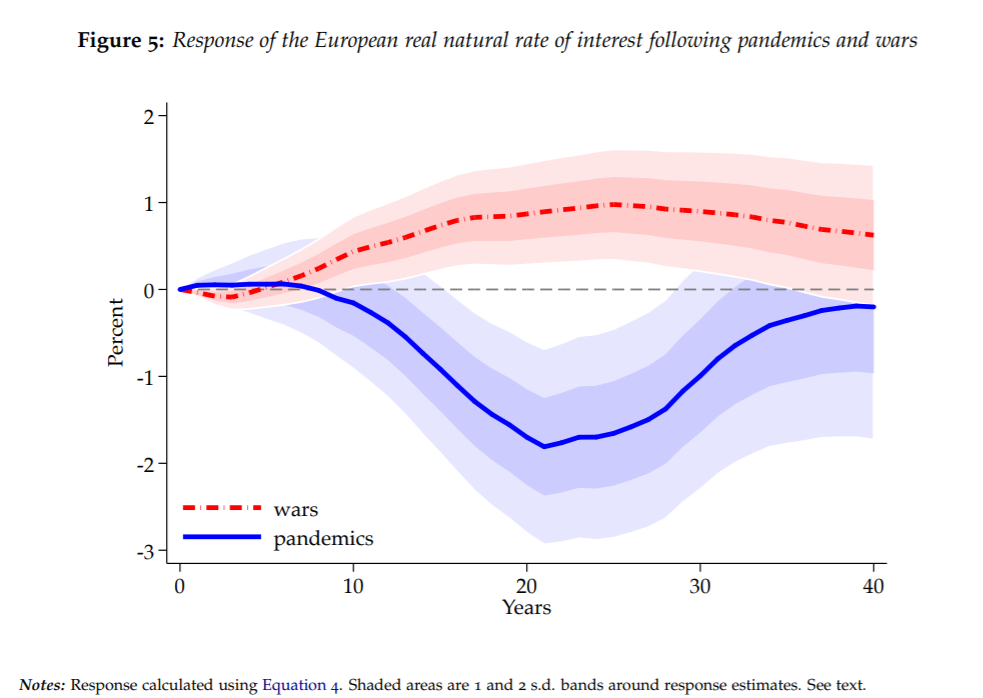

When the academics looked at real natural interest rates after pandemics and compared them with the impact of wars, they found they had exactly opposite effects. The natural rate of interest, by their definition, is “the level of real returns on safe assets which equilibrates savings supply and investment demand—while keeping prices stable—in an economy.” Greater economic activity will require higher rates, all else being equal, while weaker economic activity will bring with it lower rates. A remarkable paper published by the Bank of England earlier this year calculated real natural rates back to 1311, before the Black Death.

Their finding was clear-cut. Wars lead to higher real interest rates, which imply greater economic activity that needs to be controlled. Pandemics are followed by lower real rates, implying sluggish economic activity:

The intuition behind this is that there is no shortage of capital that needs to be replaced, as there would be after a war. Further, there is probably a tendency to save rather than invest. When the economy takes a huge hit, many feel the need to save more — and hence consume less, meaning slower economic growth.

There are also important psychological differences. After a war, traumatic though it was, the winners have the satisfaction of victory, while the losers can bring great intensity to rebuilding and salvaging national honor. The second half of the 20th century, and the economic rise of countries such as Germany, Japan and South Korea, shows the possibilities.

After a pandemic, people have literally had the fear of God put in them, and there is no great sense of victory at the end. Often survivors feel guilty. Thus consumption and investment patterns can be influenced by post-traumatic stress disorder. To quote the investment analyst Peter Atwater, of Financial Insyghts:

“We don’t recover from trauma; we adapt to it. We learn to live with its scars and to move forward amid the pain.”

Specific effects of the coronavirus also include greater demands on government, as this generational crisis has shown at least one case where clear direction from the top can be very helpful. Figures on the political right are already alarmed that the coronavirus era will lead to a “collectivist temptation” and a rise in the appeal of left-wing and socialist political movements.

More alarming is the potential for disorder and unrest. A common thread of pandemics has been an attempt to blame outsiders and foreigners. Massacres of Jews during the Black Death forced them to resettle in eastern Europe. Loss of faith in the church’s authority was disorienting, as were workers’ attempts to assert their rights. The two centuries after the Plague saw Europe riven by a succession of unnecessary wars. Revolts by peasants and artisans were common and always ended in brutal suppression.

Like its predecessors, this panic has probably tipped the balance in favor of labor and against capital. It will intensify distrust in governments while also intensifying the desire for governments to take a more active role in society and in markets. We will be lucky if those conflicts are resolved peacefully.

Tyler Durden

Thu, 04/09/2020 – 06:30

via ZeroHedge News https://ift.tt/2XmQagQ Tyler Durden