Gold Knows “There Are No Temporary Measures, Just Permanent Lies”

Authored by Mike Shedlock via MishTalk,

The Fed announced today that it will buy junk bonds. This exceeds its legal authority. Supposedly, it’s temporary…

Under guise of virus support, the Fed Will Buy Junk Bonds, Lend to States to the tune of an additional $2.3 trillion in additional aid.

Dear Jerome Powell, please tell the truth. This is not virus support, it’s stock market support.

“We will continue to use these powers forcefully, pro-actively, and aggressively until we are confident that we are solidly on the road to recovery,” said powell in a speech 90 minutes after the details of the measures were announced.

The key missing word is “legally“.

Hussman Blasts the Fed

On what authority? Neither Section 13-3 nor 14 allow it, and those are the only applicable portions of the Federal Reserve Act involved. There were no provisions in CARES for this. Intentionally. This would be a real-time violation of the law.@ChrisVanHollen @federalreserve https://t.co/hf4LVDnXsV

— John P. Hussman (@hussmanjp) April 9, 2020

Part of a memo I just fired off to Congressional contacts.@FederalReserve pic.twitter.com/HxXBAk5LJn

— John P. Hussman (@hussmanjp) April 9, 2020

Pushing the Boundaries

Please consider Powell Pushed to Edge of Fed’s Boundaries in Fight for Economy

By pushing the Federal Reserve into corners of financial markets it has mostly shunned in its 106-year history, Chairman Jerome Powell is running into some thorny questions.

Like, for instance, how to maintain independence from the U.S. Treasury when the economic-support package Congress passed says they should work together? Or whether the same guidelines for companies receiving federal aid, which range from compensation limits to off-shoring restrictions, apply to the Fed if it gets more money from Treasury? And how about which companies — and perhaps eventually, municipalities and states — are invited to borrow and at what cost?

“This is going to lead to a complete re-examination of the role of central banking and the Fed’s independence,” warns Karen Shaw Petrou, a managing partner at Federal Financial Analytics, a Washington research firm. The Fed’s steps into credit allocation are tantamount to “a complete redesign of central banking on the fly.”

Pole Vaulting the Boundaries

When you take illegal actions and enter numerous uncharted territories on balance sheet expansion, junk bonds, and bond ETFs you are not “pushing” the boundaries, you are pole vaulting over them.

Temporary Measures

Powell says these are temporary facilities.

Yeah, right. Just like the Fed’s announcement that its previous balance sheet expansion was “temporary”.

The Fed had 10 years to unwind its balance sheet after the last crisis, but never did. Now we have new balance sheet records every week.

And today the Fed upped the ante by another $2.3 trillion.

There is no reason to expect it will stop there.

Gold Soars

In response to the announcement stocks and junk bonds rose.

Gold jumped as high as $1752. As of 12:50 Central it’s up $55 to $1739.

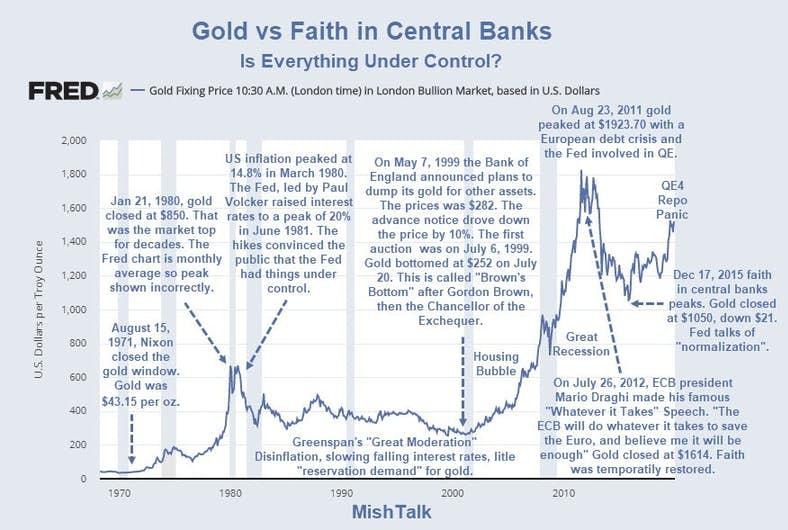

Gold vs Faith in Central Banks

Gold’s New Breakout is Very Bullish: Here’s Why

On April 6, I wrote Gold’s New Breakout is Very Bullish: Here’s Why

If you believe as I do that the price of gold is reflective of faith in central banks, there is every reason to be bullish rather than pay heed to alleged 5-year cycles.

COT action is icing on the bullish case.

Moral Fraud and Panic

In case you missed it, please note the Small Business Guarantees Are a Bucket of Moral Fraud

The Fed is in panic mode as Unemployment Claims Jump by 16.78 Million in Last 3 Weeks.

Today’s Fed actions compound the moral fraud.

Panic and fraud inevitably run on the same track.

Today’s Message from Gold

There are no temporary measures, just permanent lies.

No matter what the closing price of gold today, that’s the key message.

Tyler Durden

Thu, 04/09/2020 – 19:20

via ZeroHedge News https://ift.tt/2Rn7ZIY Tyler Durden