“The Cut Is Just 4.3MMbpd”- Goldman Throws Up Over OPEC+ Deal, Sees Oil Dropping Back To $20

Earlier today, when summarizing the terms of the “historic” OPEC+ cut, which was presented theatrically as a 10MMb/d 9.7MMb/d by OPEC+ and all the oil bulls (including Citi’s Ed Morse who may have been acting in his capacity as OPEC advisor instead of Citi commodity analyst, when he immediately raised his oil price target) we said “OPEC Reaches “Historic” Deal To Cut Oil Production As Mexico Wins “Mexican Standoff” With Saudis… But It’s Not Enough” because “in a world where there is now up to 36MMb/d less oil demand, the world’s oil producers have agreed to cut production by… 9.7MMb/d” and added that “the real cuts when ignoring accounting gimmicks, amount to just over 7mmb/d, still a record amount, but hardly enough to put an even modest dent in today’s massively oversupplied market.”

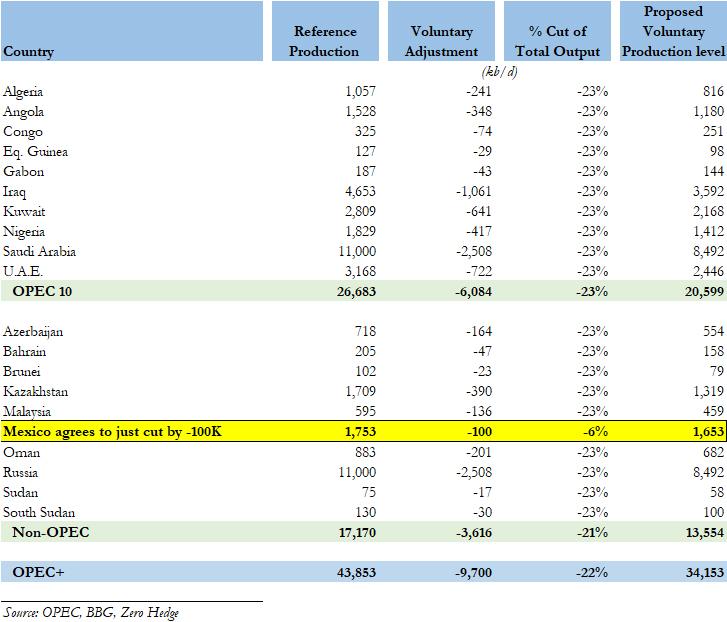

As a reminder, this is what OPEC+ agreed on, with Mexico an outlier after winning the “Mexican standoff” with Saudi Arabia which would grant the country an exemption from the deal, in cutting just 6% of production, or 100Kb/d, instead of the 23% agreed by everyone else (whether they actually do cut production by 23% is an entirely different matter, now that everyone will feel slighted by the Mexican special treatment and look to cheat by maximizing their output, especially if the price of oil does not rebound).

With that in mind, moments ago Goldman’s commodity analyst Damien Couravalin published his latest OPEC+ deal post-mortem, in which he agreed with our take (and even title) and in a report titled “A historic yet insufficient cut”, he writes that “taking into account updated core-OPEC production guidance from April, this 9.7 mb/d “headline” deal represents a 12.4 mb/d cut from claimed April OPEC+ production (given the Saudi, UAE, Kuwait ongoing surge) but an only 7.2 mb/d cut from 1Q20 average production levels.“

Precisely as we said 4 hours earlier.

Doing the math, the Goldman analyst calculates that “the OPEC+ voluntary cut would only lead to an actual 4.3 mb/d reduction in production from 1Q20 levels” adding that “based on our updated oil balances, such OPEC+ voluntary cuts would still require an additional 4.1 mb/d cut in May production at the binding storage capacity constraint” which means that “at the 35% compliance level outside of core-OPEC, the necessary production cuts need would need to be 0.5 mb/d larger.”

Then, having been skeptical about the deal all along, Couravlin adds that “today’s agreement leaves the voluntary cuts as still too little and too late to avoid breaching storage capacity, ensuring that low oil prices force all producers to contribute to the market rebalancing” which prompts the Goldman analyst to reiterate his view that “inland crude prices will decline further in coming weeks as storage capacity becomes saturated and expect further weakness in WTI timespreads and crude prices in coming weeks, as already presaged on Friday, with downside risks to our short-term $20/bbl forecast.“

Judging by the swift and violent drop in oil once the market reopened at 600pm ET, following a very brief kneejerk move higher the market agrees.

His full note is below:

A historic yet insufficient cut

OPEC+ members have agreed to cut production by a record large 9.7 mb/d from May 1. The agreement came after settling over a smaller contribution from Mexico of only 0.1 mb/d instead of the 0.4 mb/d initially planned. Taking into account updated core-OPEC production guidance from April, this 9.7 mb/d “headline” deal represents a 12.4 mb/d cut from claimed April OPEC+ production (given the Saudi, UAE, Kuwait ongoing surge) but an only 7.2 mb/d cut from 1Q20 average production levels.

G20 ministers appear to have also committed to output reductions, with headlines today of potentially 3.7 mb/d output cuts by the US, Brazil and Canada or even 5 mb/d mentioned on Friday. These are very unlikely to be voluntary cuts but instead set to occur over time and due to market forces (ie. low prices) given the significant geological and regulatory hurdles in reducing production (well illustrated by Mexico’s refusal to cut by a reported 0.4 mb/d following its 50% increase in upstream capex since 2018), with the Iranian minister adding that they could take a year. We therefore do not count these as voluntary cuts in our oil balance.

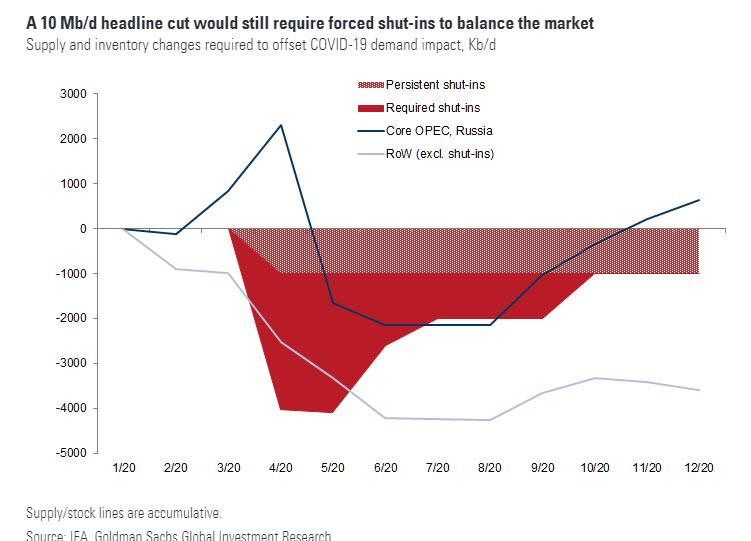

Optimistically, assuming full compliance from core-OPEC and 50% compliance by all other participants already in May (vs. 35% achieved in Jan/Feb-19 despite the new cut being 8x larger), the OPEC+ voluntary cut would only lead to an actual 4.3 mb/d reduction in production from 1Q20 levels. Based on our updated oil balances, such OPEC+ voluntary cuts would still require an additional 4.1 mb/d cut in May production at the binding storage capacity constraint. At the 35% compliance level outside of core-OPEC, the necessary production cuts need would need to be 0.5 mb/d larger.

Given the difficulty for most producers outside of core-OPEC to implement large cuts, today’s agreement leaves the voluntary cuts as still too little and too late to avoid breaching storage capacity, ensuring that low oil prices force all producers to contribute to the market rebalancing. Ultimately, this simply reflects that no voluntary cuts could be large enough to offset the 19 mb/d average April-May demand loss due to the coronavirus. We therefore reiterate our view that inland crude prices will decline further in coming weeks as storage capacity becomes saturated and expect further weakness in WTI timespreads and crude prices in coming weeks, as already presaged on Friday, with downside risks to our short-term $20/bbl forecast.

The reduction in seaborne exports from OPEC+ producers will however likely lead Brent prices to outperform as the cut in seaborne exports (especially from the record April Saudi/UAE export program) will ease the pull on the global VLCC fleet, freeing vessels to be used for floating storage and capping freight rates. We therefore expect Brent prices to outperform WTI prices in coming weeks. The announcement of today’s cuts may also provide some support to long-dated prices as the expected price support later this year creates a disincentive for producers to add new hedges and instead likely incentivize them to monetize existing ones (a buying flow of forwards)

Finally, Reuters reported that the IEA is set to announce this week oil purchases into SPR that would contribute towards effective oil output cuts. For example, a 2.5 mb/d SPR purchase announcement would help square the “20 mb/d cut” stated in the OPEC+ draft statement (pegging OPEC+ at 12.5 mb/d cut and G20 at 5 mb/d). Importantly, we do not view such SPR purchases as changing our supply-demand balance since we estimate that combined commercial and government storage capacity would be reached by late April, with 4 mb/d of production shut-ins required even before the OPEC+ deal starts. Such a high SPR purchase pace would further likely be logistically difficult as strategic reserves are designed for fast drawdowns not fills, and typically operate at high utilization levels with low spare capacity.

For once, Goldman was right:

Tyler Durden

Sun, 04/12/2020 – 18:46

via ZeroHedge News https://ift.tt/2RzgD7h Tyler Durden