Goldman Calls The Bottom, No Longer Sees S&P Dropping To 2,000 On “Unprecedented Policy Support”

One week ago, around the time Jeffrey Gundlach said he was covering his shorts and looking for stocks to rebound, Wall Street’s formerly biggest bear, Morgan Stanley equity strategist Michael Wilson, flipped a U-turn and surprised many of his peers – especially JPMorgan which had turned uncharacteristically bearish and on March 31 was saying it’s too early to buy stocks – by becoming one of the market’s biggest bulls, saying that he is a “buyer of dips” since “2400-2600 on the S&P 500 will prove to be very good entry points for those with a time horizon of 6-12 months.” The catalyst behind his shift in sentiment? An expectation that the unprecedented stimulus will trigger sharply higher inflation and a lower dollar.

This triggered a domino effect of downstream bullish calls, with Howard Marks saying it’s time to stop playing defense, just days after saying the worst is still to come for asset prices, and this morning Goldman Sachs, which spent last weekend explaining how the coming 50% collapse in stock buybacks will wreak havoc on the S&P500 where the single biggest buyer of stocks will be MIA for the foreseeable future, and which three weeks ago said it could see the S&P dropping as low as 2,000 as it cut its EPS target by 33%…

… also threw in the towel on its cautious position and decided to follow both Morgan Stanley’s Wilson, and the momentum of the broader market, and in a note published this morning, Goldman’s David Kostin writes that the combination of unprecedented policy support and a flattening viral curve have dramatically reduced downside risk for the US economy and financial markets and lifted the S&P 500 out of bear market territory.

Specifically, “the Fed and Congress have precluded the prospect of a complete economic collapse. Reduced “left tail” risk translated into a higher P/E multiple.” This takeover of capital markets means that Goldman’s “previous near-term downside of 2000 is no longer likely” even as its “year-end S&P 500 target remains 3000 (+8%).”

To be sure there is one potential downside case: if the US experiences a second surge in infections after the economy reopens. Until then, however, the “do whatever it takes” stance of policymakers means the equity market is unlikely to make new lows, Kostin writes, while noting that “real improvement in two of the three items on our checklist suggests our previous near-term downside target of 2000 is no longer likely, and increases our confidence that the S&P 500 will reach our year-end target of 3000, which is just 8% above the current level. A return to the March 23rd low of 2237 would represent a 20% fall from today’s index level.”

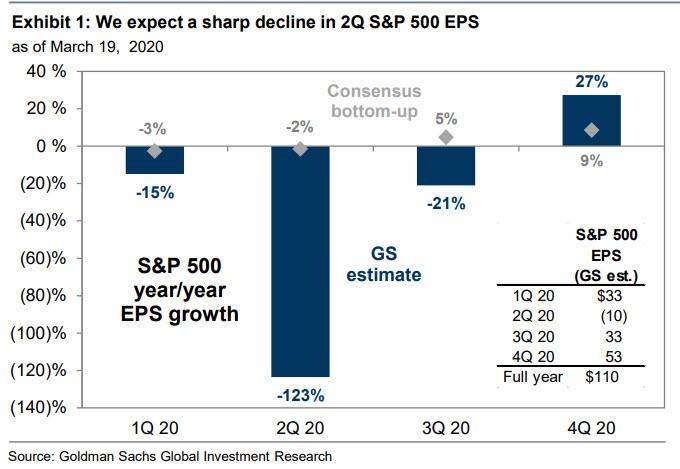

But what about the epic crash in EPS that Goldman itself was pounding the table on just weeks ago as a catalyst for the S&P dropping to 2,000? Apparently that doesn’t matter any more because – drumroll – the price makes the narrative and the price is now higher:

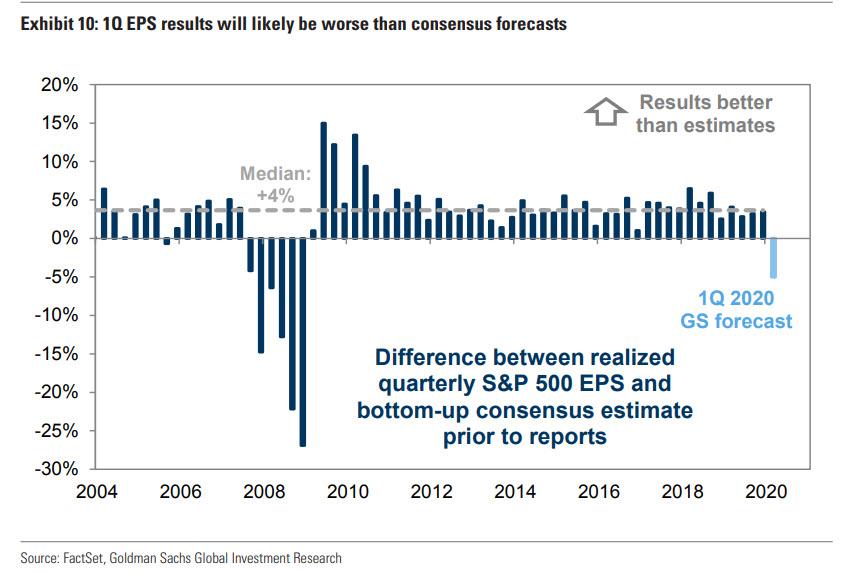

Despite the likely steady stream of weak earnings reports, 1Q earnings season will not represent a major negative catalyst for equity market performance. While earnings season always conveys backward-looking data, rarely has the information content of quarterly earnings reports been as outdated as the figures US companies will release starting this week. We expect investors will mostly “look through” reported 1Q results, which will capture only the start of shutdowns that began at the end of the quarter. In fact, many investors we have spoken with have discounted 2020 earnings altogether, and are focused instead on the outlook for 2021.

Translation: nobody cares about earnings any more, Goldman certainly doesn’t. And since nobody has any idea what 2020 will bring, everyone is suddenly convinced that things will be so much better in 2021 so… buy!

Does this also mean that Goldman no longer believes that this is just a bear market rally, as it did just two weeks ago? On this topic Kostin is far more elusive, but in general it appears that the bank changed its opinion on this matter as well.

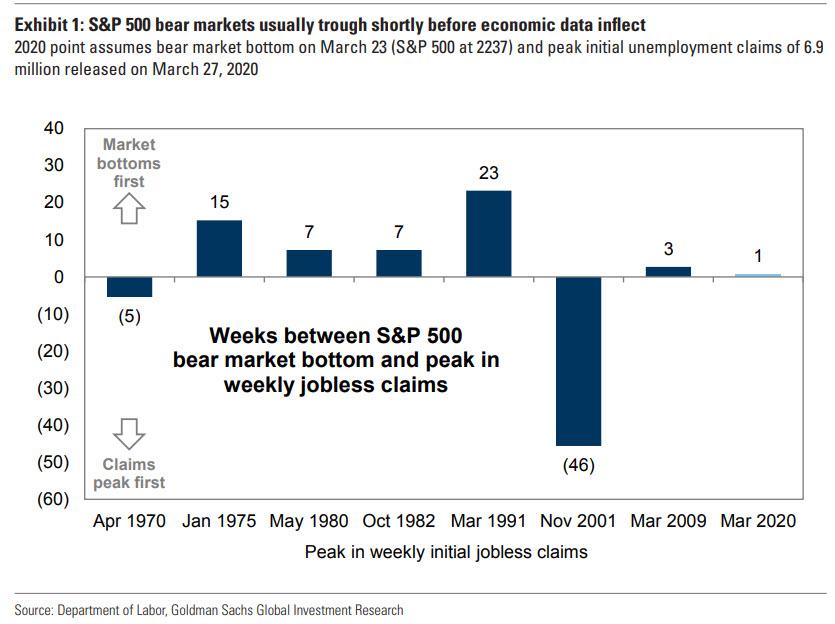

We have previously highlighted the similarity between recent market performance and the “bear market rallies” that were catalyzed by policy stimulus measures in late 2008. The multiple 10%-20% rallies eventually faded and stock prices traded lower until economic data bottomed in March 2009. In this case, however, policy measures and the trough of the economic data appear to be occurring in much closer proximity. The historical relationship between equity bear markets and second-derivative inflections in economic data support the market bottoming before economic data reach their nadir, which will likely occur this month.

In other words, “this time it’s different” only it isn’t, because in the very next paragraph Goldman admits that there is nothing about this rally that is actually different, and it is all a function of unprecedented fiscal and monetary stimulus:

The numerous and increasingly powerful policy actions have spurred equity investors to adopt a risk-on view. The series of important monetary policy measures started on Sunday, March 15th with the Fed cutting the funds rate by 50 bp to 0%-0.25%. On March 17th the Fed unveiled a Commercial Paper Funding Facility (CPFF) that back-stopped short-term borrowing by investment-grade (IG) issuers. The central bank has subsequently provided liquidity further out on the risk spectrum culminating with the April 8th announcement of a $2.3 trillion loan facility to ensure credit availability for small businesses and municipalities that also included high yield (HY) issuers. Fiscal stimulus, most recently in the form of the $2 trillion CARES Act, has also been significant, although implementation remains a work in progress.

In summary…

The combination of unprecedented policy support and a flattening viral curve have dramatically reduced downside risk for the US economy and financial markets and lifted the S&P 500 out of bear market territory. At 2790, the S&P 500 now stands 25% above its March 23rd low of 2237.

Amusingly, not even Goldman can believe the unfounded optimism it is spewing, and writes the following:

“surprisingly, the largest shock to the global economy in 90 years has left equities only 18% below the record highs of mid-February and roughly in line with the market price in June 2019, just 10 months ago.”

And yet here we are, and while this time may be different one thing that has certainly not changed is banks telling you to sell at the lows, and turning bullish after a 25% rally… just as Goldman has now done.

Tyler Durden

Mon, 04/13/2020 – 08:58

via ZeroHedge News https://ift.tt/2K3f1hT Tyler Durden