Trump Scrambles To Jawbone Oil Price Higher, Says OPEC+ Looking At Cutting 20MM Barrels, Not 10MM

Shortly after Mexico won a historic “Mexican standoff” with Saudi Arabia on Sunday afternoon, and was exempt from a historic 9.7mmb/d oil production cut by OPEC+ member states (which Mexico had held up for the previous 4 days after refusing to agree to the across the board 23% cut), we said that “OPEC Reaches “Historic” Deal To Cut Oil Production As Mexico Wins “Mexican Standoff” With Saudis… But It’s Not Enough.”

A few hours later, Goldman echoed what we said in a note titled “A historic yet insufficient cut“, writing that “taking into account updated core-OPEC production guidance from April, this 9.7 mb/d “headline” deal represents a 12.4 mb/d cut from claimed April OPEC+ production (given the Saudi, UAE, Kuwait ongoing surge) but an only 7.2 mb/d cut from 1Q20 average production levels.” Doing the math, the Goldman analyst calculated that “the OPEC+ voluntary cut would only lead to an actual 4.3 mb/d reduction in production from 1Q20 levels” adding that “based on our updated oil balances, such OPEC+ voluntary cuts would still require an additional 4.1 mb/d cut in May production at the binding storage capacity constraint” which means that “at the 35% compliance level outside of core-OPEC, the necessary production cuts need would need to be 0.5 mb/d larger.”

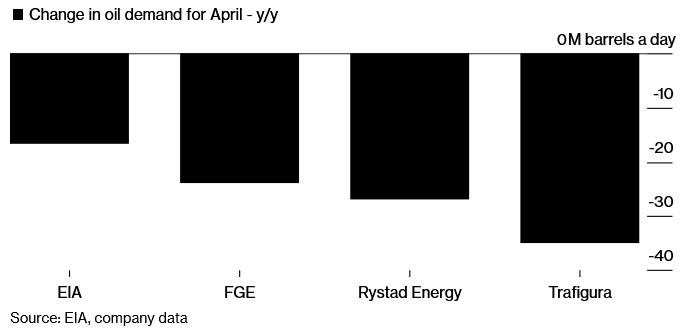

In short, and as we have been repeating all along, the 10 9.7mmb/d production cut is nowhere near enough to offset the plunge in demand which based on various estimates is anywhere between 20 and 36mmb/d.

It’s also why after knee-jerking higher, oil – which had priced in a 10mmb/d production cut as far back as the middle of last week – has been drifting lower…

… in the process infuriating the US president who had hoped the OPEC+ deal would send oil sharply higher. Alas, even algos can do math now, and everyone by now understands that a 9.7mmb/d supply cut is nowhere near enough to offset 36mmb/d in less demand.

The result: after watching Brent drift lower, Trump finally snapped this morning and in hopes of doing OPEC’s job for them, the US president tired his best to jawbone oil higher by saying that “the number that OPEC+ is looking to cut is 20 Million Barrels a day, not the 10 Million that is generally being reported.”

….disaster, the Energy Industry will be strong again, far faster than currently anticipated. Thank you to all of those who worked with me on getting this very big business back on track, in particular Russia and Saudi Arabia.

— Donald J. Trump (@realDonaldTrump) April 13, 2020

Trump has a point… the only problem is that 20 million b/d number also includes several million in US production cuts, which Trump refuses to order! In fact Trump believes that between covering Mexico’s 300kb/d shortfall (which will be met with organic production declines not an actual supply stop as of May 1), the US does not need to cut further.

So if Trump really wants to send the price of oil higher – and he does to avoid mass layoffs in the re-election critical state of Texas even if it means much higher gas prices at the pump – it is up to Trump to somehow find 2-3 or more million barrels in US production cuts. Without those, Brent will keep drifting lower because while the US president may not do supply/demand math, everyone else in the energy sector now does.

Tyler Durden

Mon, 04/13/2020 – 10:01

via ZeroHedge News https://ift.tt/2V5mSC8 Tyler Durden