As Coronavirus Depression Continues, Americans Are Putting Their Rent On Credit Cards

Despite what the stock market would have you believe, the United States is sinking further into a depression. And the unemployed are now resorting to putting their rent on credit cards.

It’s a temporarily solution that may help tenants get through a month or two, but it’s ultimately driving an already broke consumer deeper into debt that will cripple them in the long term. About 84% of tenants in the U.S. have paid full or partial rent through April 12, the WSJ reports, a number that has risen significantly since the first week of April.

But credit cards as a form of payment are also rising by 13%, compared to the first three months of the year. The number of tenants paying with a credit card is up 30% when compared to the same period in March.

While sometimes tenants pay rent with credit cards to boost their credit score or earn rewards, this is increasingly looking like a desperation scenario, where credit cards could be the last fallback before tenants start filing for bankruptcy and wind up out on the street.

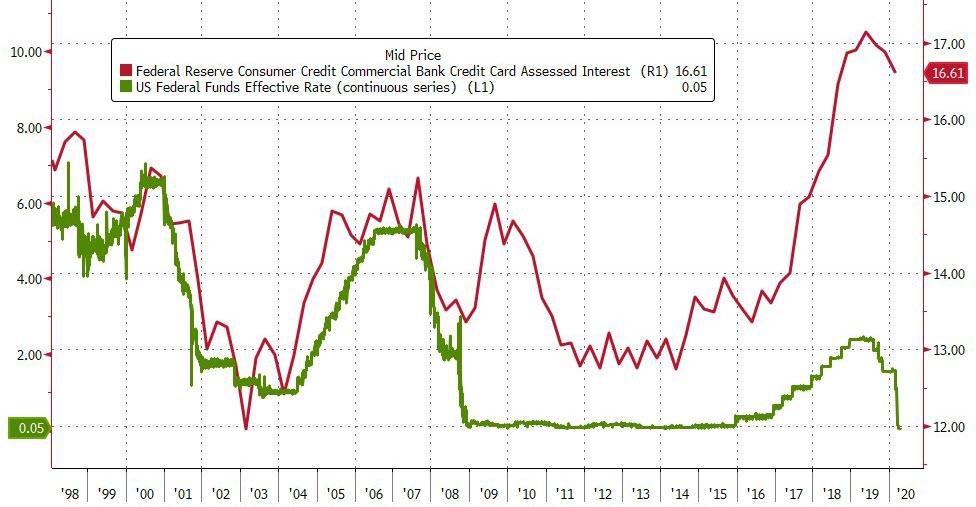

In general, electronic payments have risen since the start of the pandemic. Building owners will sometimes accept credit cards through apartment management software or third party apps. Even with interest rates near 0%, the average interest rate on a credit card is still in the double digits. It’s even higher for those taking cash advances.

While some landlords and creditors have said they would make provisions for those who have lost their jobs, the credit bureaus will be far more unforgiving. They will be offering no special treatment, according to the WSJ, because a revision to the CARE act that would have prevented them from reporting negative information due to the pandemic was left out at the last minute.

Some landlords have offered to absorb the transaction costs related to using credit cards. “Once we saw where things were going with this pandemic, a lot of our rules just kind of went out the window,” one landlord said.

But if unemployment doesn’t start to arrive by the time many of these tenants have to pay May rent, they could be faced with far more dire consequences.

Bruce McClary, spokesman for the National Foundation for Credit Counseling, said: “Your rent payment isn’t the only thing you owe, and chances are you have other financial commitments you’re having to keep on track as well.”

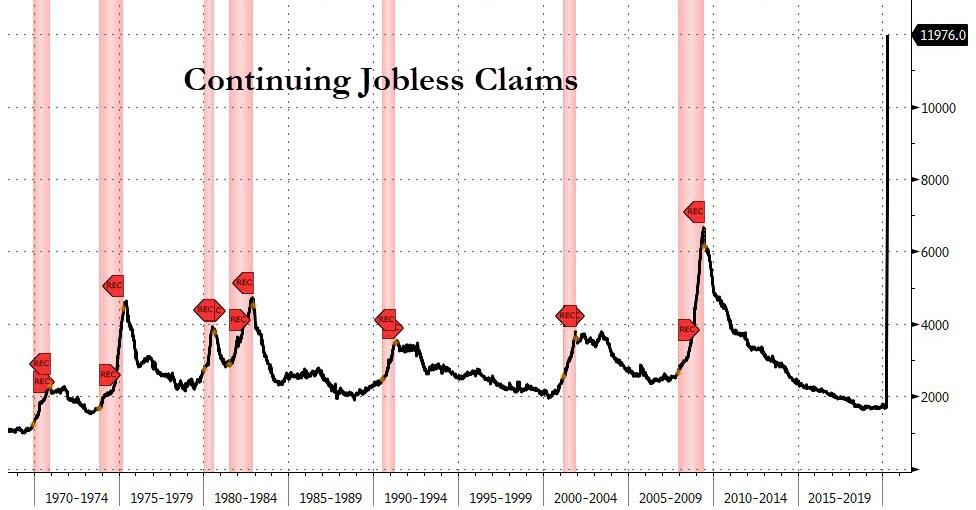

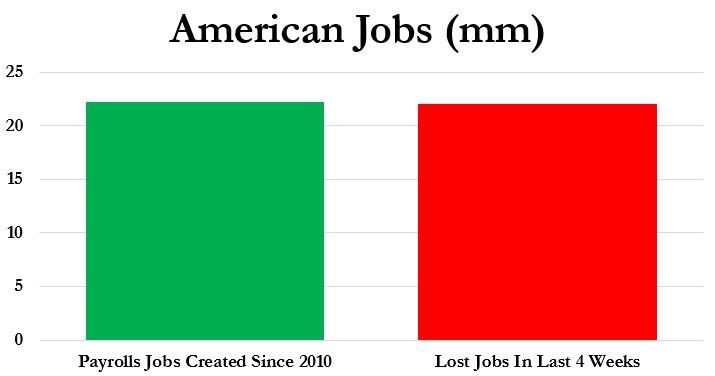

Over 22 million people have applied for unemployment over the past fourweeks.

Tyler Durden

Sun, 04/19/2020 – 21:50

via ZeroHedge News https://ift.tt/2VLX394 Tyler Durden