Key Events In This Extremely Chaotic, Action-Packed Week

In what is sure to be a fast-moving, chaotic week, in which attention will focus on every marginal development in the war against Coronavirus (and Chinese exports thereof), Q1 earnings will step up a notch with 88 S&P 500 companies reporting this week and Europe joining the fray with 64 companies. In terms of the highlights to look out for, proceedings kick off today with IBM. Then tomorrow we’ll hear from The Coca-Cola Company, Netflix, SAP, Philip Morris International, Lockheed Martin, Texas Instruments and BHP. On Wednesday, we’ll then get AT&T and Thermo Fisher Scientific. Thursday sees releases from Intel, Eli Lilly and Company, NextEra Energy, Union Pacific, Credit Suisse and Hyundai. And finally on Friday we’ll hear from Verizon Communications, Sanofi, T-Mobile and American Express.

Going back to the virus epidemic and ongoing responses to the current economic depression, Thursday is the key day this week with the EU leaders summit a potentially big event for the future of Europe as they discuss how close the region can get to joint issuance in the near future. As Deutsche Bank’s Jim Reid writes, “expect creative ambiguity to rule as it normally does on the continent. Nevertheless you would expect more explicit details to be outlined as to how Europe will help Italy.” Will this be enough to keep Italian spreads (and domestic politics) in check though? To add to the story, S&P are expected to finalize the review of their BBB rating on Friday. The implications of Italy is junked will be dire. Staying with European discussions, the FT broke a story yesterday saying the supervisory wing of the ECB is pushing for an EU wide bad bank. It’s not clear whether this story will have legs but it’s clearly something that the weaker members will welcome much more than the stronger ones. Whether it’s NPLs or peripheral debt, can this crisis be the catalyst for more European financial solidarity or will it be one to expose the cracks of an imperfect union.

On the issuance of joint Eurogroup debt, Italian PM Conte said in an interview to Germany’s Sueddeutsche Zeitung yesterday reiterating the need for joint debt issuance highlighting the risk of market contagion if European leaders fail to act on pressure from Italy and Spain. He also added that the ESM rescue fund, Germany’s preferred tool to address the economic impact, “has a bad reputation in Italy.” Meanwhile, Klaus Regling, the ESM’s director-general, said in a separate interview with Italy’s Corriere Della Sera that concerns that the fund’s lending will have two parts — one to specifically deal with the outbreak, the other to reduce budget deficits — was misplaced. He added, “The conditions agreed at first will change during the period of which the line of credit is available. The Eurogroup will clarify it, saying that the only requirement for obtaining the loan is the way in which they spend the money.”

Looking at Thursday, we will not only will we see the latest jobless claims but also the flash PMIs from around the world for April – the first reading covering nothing but lockdowns. If you want a potential worst case scenario Italy was the only Western country to be on full lockdown in the survey period for March and they saw their services PMI fell to an astonishingly low 17.4. In all truth though the market has rightly or wrongly moved on from how bad data could get in the near-term to absorbing up the extra liquidity and also whether economies can open progressively through May.

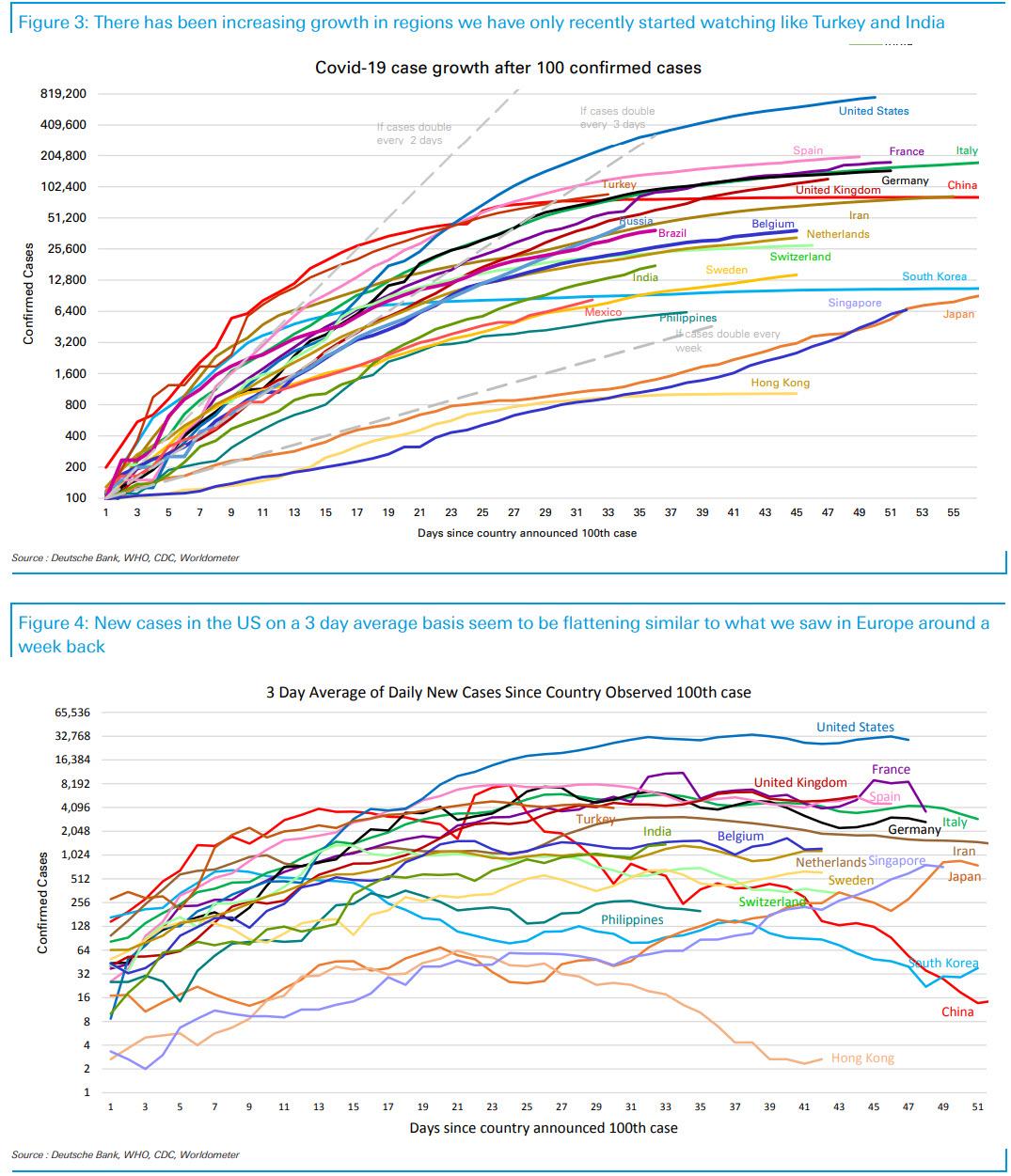

On this the latest on new cases and fatalities generally continue to show steady improvements as you’ll see in our Corona Crisis Daily. However this improvement is being used by many countries to encourage debate on what exit strategies will look like and the lifting of restrictions at potentially an earlier stage than China did. A risky balancing act.

Back to earnings, Saxo’s Peter Garnry writes that this week will be the first real litmus test on sentiment vs earnings reality and the outlooks from companies. Many interesting companies such as Netflix, Intel, Biogen, Delta Airlines, American Express and Boeing will report earnings this week. Maybe bad earnings are what finally get investors to realize that they are buying equities at very expensive levels here. No matter whether we use the dividend futures market or expected GDP growth numbers and how they have translated into EPS growth in the past we get to the same conclusion. The equity market is very expensive here and the risk-reward ratio is not attractive.

Among this week’s earnings Saxo highlights IBM (today) as the 350,000 employees company has a big footprint on corporate spending on technology infrastructure and thus is a good litmus test on corporate spending in the US. Tomorrow the big one is Netflix which is enjoying investors appetite for entertainment stocks – key here is the US segment because rising unemployment could be a risk to their subscriber base in the US unless streaming TV is now like the utility bill. Tomorrow we also get earnings from the first P&C insurer (Chubb) which will give insights into whether the sell-off among insurance stocks has been too much. Wednesday we get the first biotechnology earnings from Biogen which is a key risk to the health care sector which has been one of the best performing sectors during COVID-19. Delta Airlines also report on Wednesday which will undoubtedly be sad reading but hopefully there is some light at the end of the tunnel. Key focus for Delta Airliners is the balance sheet damage as that feeds directly into default risks etc. On Thursday we have Intel which will give the first glimpse of end-user demand in the computing industry and Credit Suisse will also report providing the first and most likely shocker to European investors. Friday we have earnings from American Express which could be very bad given the consumer credit card provisions delivered by banks last week. Boeing is also reporting on Friday and could be the positive surprise despite the negative backdrop from airliners as the company is restarting 737 Max production in May. Finally we have many Swedish earnings this week so we expect volatility in OMX this week and we believe Swedish earnings could be the first full picture disappointment for investors as Sweden’s procyclical companies must be hurting big time during these lockdowns.

Below is a day by day summary of the key events, courtesy of Deutsche Bank

Monday

- Data: Germany March PPI, Italy February current account balance, Euro Area February current account balance, Canada February wholesale trade sales, US March Chicago Fed national activity index

- Central Banks: BoE’s Haldane and Broadbent speak

- Earnings: IBM

- Other: Second UK-EU future relationship negotiating round begins

Tuesday

- Data: UK March claimant count, February employment change, unemployment rate, average weekly earnings, Japan final March machine tools orders, Germany April ZEW survey, Canada February retail sales, US March existing home sales

- Central Banks: Reserve Bank of Australia release minutes of April policy meeting, ECB’s Stournaras speaks

- Earnings: The Coca-Cola Company, Netflix, SAP, Philip Morris International, Lockheed Martin, Texas Instruments, BHP

Wednesday

- Data: UK March CPI, RPI, PPI, France April business confidence, Italy February industrial orders, industrial sales, US weekly MBA mortgage applications, February FHFA house price index, Canada March CPI, Euro Area advance April consumer confidence

- Central Banks: Central Bank of Turkey policy decision

- Earnings: AT&T, Thermo Fisher Scientific

Thursday

- Data: Preliminary manufacturing, services and composite PMIs from Australia, Japan, France, Germany, Euro Area, UK and US, South Korea preliminary Q1 GDP, Japan final February leading index, Germany May GfK consumer confidence, UK March retail sales, public sector net borrowing, UK April CBI quarterly industrial trends survey, US weekly initial jobless claims, March new home sales, April Kansas City Fed manufacturing activity index

- Earnings: Intel, Eli Lilly and Company, NextEra Energy, Union Pacific, Credit Suisse, Hyundai

- Other: EU leaders hold video conference

Friday

- Data: UK preliminary April GfK consumer confidence, Japan March nationwide CPI, February all industry activity index, Germany April Ifo business climate indicator, US preliminary March durable goods orders, nondefence capital goods orders ex air, final April University of Michigan sentiment

- Central Banks: Russian central bank policy decision

- Earnings: Verizon Communications, Sanofi, T-Mobile, American Express

Finally, here is a focus just on US events, coutesy of Goldman Sachs, which notes that the key economic data releases this week are the jobless claims report on Thursday and the durable goods report on Friday. There are no scheduled speaking engagements from Fed officials this week, reflecting the FOMC blackout period.

Monday, April 20

- There are no major economic data releases scheduled today.

Tuesday, April 21

- 10:00 AM Existing home sales, March (GS -10.0%, consensus -8.2%, last +6.5%); After surging by 6.5% in February, we estimate that existing home sales fell by 10.0% in March. Existing home sales are an input into the brokers’ commissions component of residential investment in the GDP report.

Wednesday, April 22

- 09:00 AM FHFA house price index, February (consensus +0.3%, last +0.3%)

Thursday, April 23

- 08:30 AM Initial jobless claims, week ended April 18 (GS 4,300k, consensus 4,500k, last 5,245k); Continuing jobless claims, week ended April 11 (consensus 17,271k, last 11,976k); We estimate jobless claims remain elevated at 4,300k in the week ended April 18.

- 09:45 AM Markit Flash US manufacturing PMI, April preliminary (consensus 38.0, last 48.5)

- 09:45 AM Markit Flash US services PMI, April preliminary (consensus 31.3, last 39.8)

- 10:00 AM New home sales, March (GS -15.0%, consensus -15.8%, last -4.4%); We estimate that new home sales fell by 15.0% further in March after declining by 4.4% in the previous month.

- 11:00 AM Kansas City Fed manufacturing index, April (consensus -34, last -17)

Friday, April 24

- 08:30 AM Durable goods orders, March preliminary (GS -19.0%, consensus -12.0%, last +1.2%); Durable goods orders ex-transportation, March preliminary (GS -12.0%, consensus -6.0%, last -0.6%); Core capital goods orders, March preliminary (GS -10.0%, consensus -6.2%, last -0.9%); Core capital goods shipments, March preliminary (GS -7.0%, consensus -7.0%, last -0.8%); We expect durable goods orders to fall 19% in the preliminary March report, reflecting a jump in Boeing cancellations, sharp declines in rail freight, and reduced domestic and foreign demand related to the coronavirus. We estimate a 10% drop in core capital goods orders and a 7% decline in core capital goods shipments.

- 10:00 AM University of Michigan consumer sentiment, April final (GS 67.5, consensus 68.0, last 71.0); We expect the University of Michigan consumer sentiment index to decline by 3.5pt to 67.5 in the final estimate for April, reflecting further jobless claims and declines in the GS Twitter Sentiment Index. The report’s measure of 5- to 10-year inflation expectations increased by two tenths to 2.5% in the preliminary report for April.

Source: Saxo Bank, Deutsche Bank, BofA, Goldman

Tyler Durden

Mon, 04/20/2020 – 09:32

via ZeroHedge News https://ift.tt/3cvos63 Tyler Durden