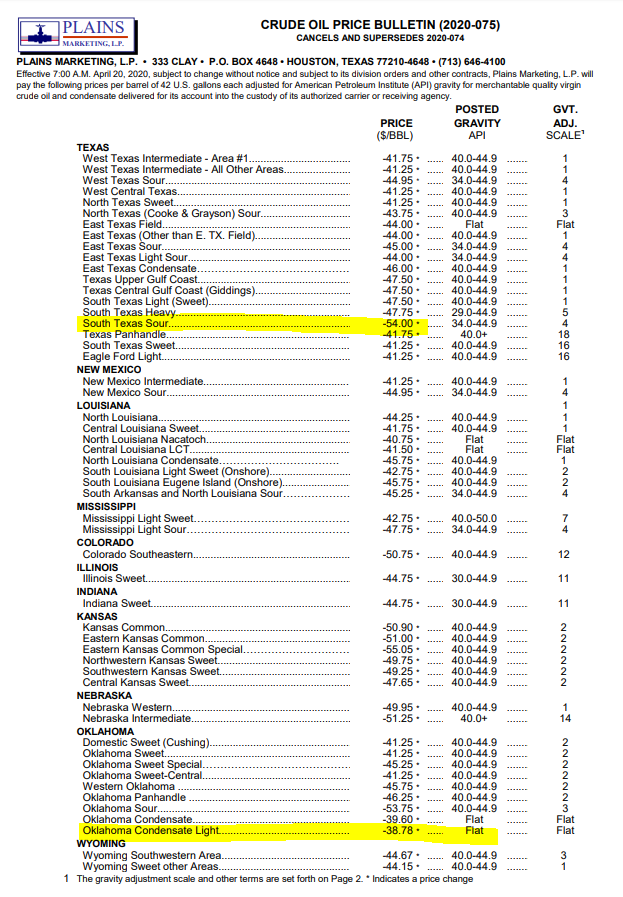

Oil Producers Will Pay You $54/Barrel To Take South Texas Sour Off Their Hands

All day long we have been told, “ignore the price collapse in the May WTI futures contract,” look over here instead at how well stocks have rebounded…

Excuses vary from “it’s purely technical” to “a fund or twelve probably blew up, it’s not fundamental” to “ahh, it’s just the roll” but as it becomes clearer and clearer that the world is coming to terms with what Goldman called “The Largest Economic Shock Of Our Lifetimes“, and the record surge in excess oil output amounting to a mindblowing 20 million barrels daily or roughly 20% of global demand.

Besides that simple supply/demand imbalance, we explained here in great detail exactly what drove today’s move:

…all the storage in Cushing is booked, and there is no price they can pay to store it, or they are totally inexperienced in this game and are caught holding a contract they did not understand the full physical aspect of as the time clock expires.

Or, put another way, today’s negative prices are the reflection of dire market conditions for producers, and as the following price sheet from Plains Marketing LP notes, producers are paying up massively for you to take crude off their hands…

As Elisabeth Murphy, an analyst at consultant ESAI Energy previously noted, “these are landlocked crude with just no buyers. In areas where storage is filling up quickly, prices could go negative. Shut-ins are likely to happen by then.”

And it’s not about to get better anytime soon as oil demand has been so battered by global government lockdowns to stop the spread of the coronavirus (that are being reinstated amid secondary waves of infection or delayed for fear of such) that any conceivable oil production cut is a drop in the ocean.

Yes, the crude futures curve offers hope but that contango is supported by the ETF as much as anything else and given spot deliverable prices above, rolling down that curve of pain, just as May contract longs did today, to converge with spot will come very soon for June… and as Kyle Bass explained this afternoon, there is little expectation that the Saudis and Russians will take their foot off the throat of US shale anytime soon…

Tyler Durden

Mon, 04/20/2020 – 18:35

via ZeroHedge News https://ift.tt/2RVBHVE Tyler Durden