ECB To Discuss Accepting Junk Bonds As Collateral

Now that the Fed has opened the pandora’s box of moral hazard by purchasing select junk bonds, every other central bank would like a piece of the action. And sure enough, as Bloomberg reports, on Wednesday evening the ECB will hold a call where they may discuss whether to accept junk-rated debt as collateral from lenders.

Translation: the ECB is about to announce it will accept junk bonds as eligible collateral, and why not: the Fed is doing so, so it makes sense for everyone else to pile on.

According to Bloomberg, in a step similar to the Fed’s backstopping of fallen angel high yield paper, the ECB’s conference could be “intended to head off concerns that some sovereign and corporate bonds will soon be downgraded to non-investment grade because of the cost of fighting the coronavirus pandemic.”

Already a storm is brewing: on Friday S&P is set to review credit rating, which it currently ranks two notches above investment grade with a negative outlook. A downgrade would be a step toward potentially excluding the euro zone’s third-largest economy from the ECB’s refinancing and asset-purchase programs, precipitating a crisis.

Yields on Italian debt have risen in recent days. The premium investors demand to hold 10-year Italian debt over Germany’s soared 25 basis points on Tuesday to 263 basis points, despite the country managing a successful bond sale. In raising more than 110 billion euros ($119 billion), it reminded investors just how much it needs the cash. Barclays Plc sees outflows of as much as 200 billion euros if the nation’s rating is cut below investment grade.

As we discussed over the weekend, ratings have become a pressing concern in markets as lockdowns spark the biggest recession in decades. Moody’s Investors Service, which will review Italy in May, rates the nation at its lowest investment grade. While the ECB’s current rules mean Italy would have to be cut to junk by each of S&P, Moody’s Investors Service, Fitch Ratings and DBRS to be excluded from its operations, the prospect of downgrades is unnerving investors. A cut in the sovereign would flow through to the corporate bonds and commercial paper that the ECB also buys and takes as collateral.

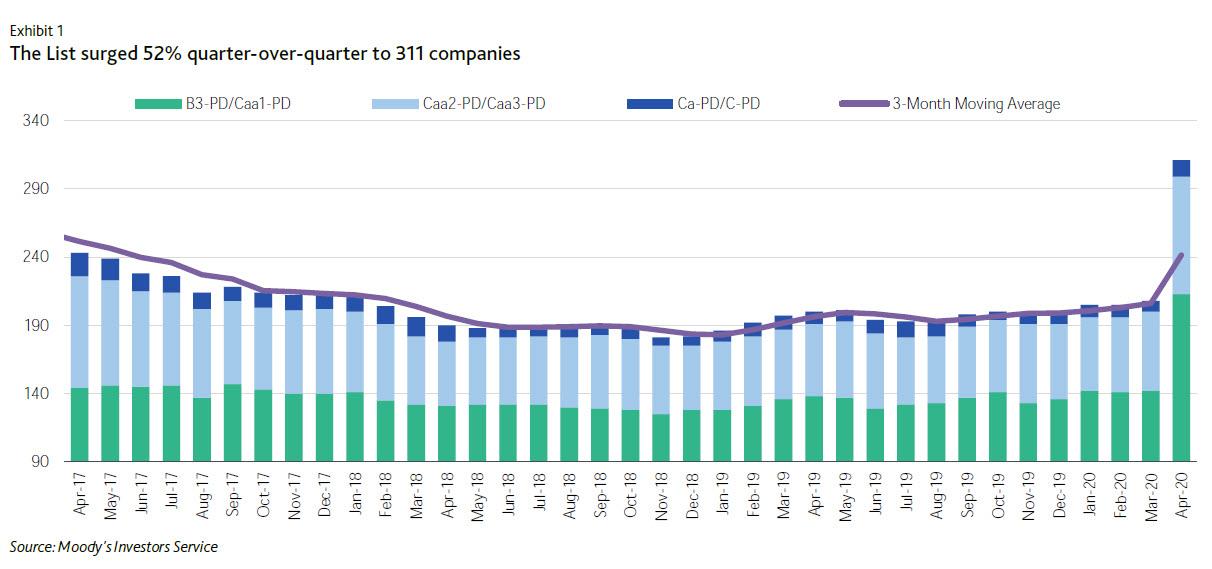

Last week, Moodys reported that its “B3 Negative and lower list” soared to its highest tally ever — 311 companies. That tops a former peak of 291 companies, reached during the credit crisis of 2009 and the commodity-related downturn in April 2016. At 20.7% of the total rated spec-grade population, the list also shot up above its long-term average of 14.8%, and closing in on its all-time high of 26.1%. This spike is the result of the confluence of a coronavirus outbreak, plunging oil prices, and mounting recessionary conditions, which created severe and extensive credit shocks across many sectors, regions and markets, the effects of which are unprecedented.

Tyler Durden

Tue, 04/21/2020 – 15:52

via ZeroHedge News https://ift.tt/3brkawh Tyler Durden