Futures Surge On Surprise Google Beat As Dismal GDP, Fed Meeting Loom

S&P index futures jumped on Wednesday, following another solid day for European and Asian stocks, wiping out yesterday’s sharp post-consumer confidence swoon, after Google reported upbeat quarterly results (despite warning of a sharp drop in March ad revenue, which however stabilized in April ), while investors braced for the worst GDP print since the financial crisis and a Fed announcement this afternoon amid what may be the busiest day of Q1 earnings season

Wall Street closed down on Tuesday, as investors shifted out of growth stocks and into more value-oriented cyclical names. However, having dropped into earnings, Alphabet jumped 8% in premarket trading, as a drop in Google ad sales steadied in April and some consumers returned to using the search engine for shopping in addition to finding coronavirus information.

Next on the agenda is the first read of US Q1 GDP: the U.S. economy likely contracted in the first quarter at its sharpest pace since the Great Recession as strict lockdown measures curbed consumer activity, ending the longest expansion in the nation’s history. The Commerce Department report, due at 8:30 a.m. EDT, will show a 4% decline in GDP, which will further reinforce analysts’ forecasts that the U.S. economy was already in a deep recession.

The GDP report lands just hours before the Fed policy decision and as America and countries around the world discuss how to restart activity, with hard-hit nations like Spain saying they need at least eight more weeks to fully lift restrictions. First-quater output in the largest economy was expected to be dismal as the effects of the pandemic started to hit home. Earnings from megacaps including General Electric Co., Mastercard Inc. and Facebook Inc. will also give investors an insight into the impact of the outbreak.

Also on deck will be a closely watched policy decision from the Federal Reserve – although with interest rates near zero, policy makers are likely to turn attention to other steps they could take to ensure a strong economic rebound once the coronavirus lock-down ends – and more corporate earnings reports from planemaker Boeing before the bell and technology heavyweight Microsoft later in the day. The Fed will issue its policy statement at the end of its two-day meeting on Wednesday at 2 p.m. EDT, where the central bank is anticipated to reiterate its promise to do whatever it takes to support the world’s largest economy. If that wasn’t enough, we then get the ECB tomorrow.

It wasn’t just the US, as markets rose around the globe: gains in energy shares, carmakers and banks helped the Stoxx Europe 600 Index edge higher, but they were countered by a drop in health-care stocks as traders backed away from the top outperforming sector since the start of the virus-inspired sell-off. The Stoxx 600 Automobiles & Parts Index rose as much as 1.9% and is among top performing subgroups on the broader gauge on Wednesday, with gains led by French carmaker Renault. Volkswagen and Daimler, which reported final 1Q results after having pre-released, also outperformed. SXAP index 1.7% as of 10:33am CET; best performers include Renault +4%, Continental AG +3%, Daimler +2.5%, Nokian Renkaat 2.4%, VW +2%. Daimler’s 1Q final results “showcased outperformance” at Mercedes-Benz Cars division as luxury model sales fell less than mass market, while liquidity was in range, according to analysts. Meanwhile, the Stoxx Europe 600 Health Care index is the worst-performing sector on Wednesday following disappointing earnings from hearing-aid maker GN Store Nord, which is also dragging down peer Demant. The sector gauge declines as much as 1.4%, but is still the only group in positive territory YTD.

“We have some very extreme readings on the blow we’ve just suffered and markets are still bouncing around trying to get a reading on where we will be in the third and fourth quarter,” Christopher Smart, chief global strategist at Barings Investment Institute, said on Bloomberg TV. “That is very hard right now without knowing where the disease will be, and how quickly people will feel comfortable going back to work, going back to stores, between now and when there might be a vaccine.”

Emerging-market stocks rallied a third day and currencies strengthened as moves toward easing restrictions to fight the coronavirus pandemic buoyed appetite for riskier assets. MSCI’s measure of developing-nation equities rose to the highest since March 12, while almost all currencies eked out gains against the dollar. Hungary’s local bonds rallied after the central bank announced details of its debt-purchasing program. Efforts to roll back lockdowns across Europe are helping alleviate concern about economic turmoil, with initial data still suggesting a sharp contraction in output. Consumer-price gauges from Brazil and Russia may be the next signposts for investors scouring the pandemic’s impact. “Markets seem to be in a more positive mode as many European countries draw up plans to gradually ease lockdown measures,” Citigroup Inc. strategists including London-based Luis Costa said in a note.

In rates, treasury futures traded near highs in early U.S. session with gains led by long end of the curve. Cash Treasuries, closed in Asia for a Japan holiday, began trading during London hours with a bid tone as bunds outperformed following strong demand at German 10-year auction. Treasury yields were lower by 1.5bp to 3.5bp across the curve with front end slightly lagging, flattening 2s10s by more than 1bp; 10-year yields around 0.58%, richer by 3bp vs Tuesday’s close. Bunds outperform Treasuries by less than 1bp, gilts lag by 1.5bp. Italian bonds slump after Fitch downgraded the nation’s sovereign rating to BBB- with a stable outlook, in a surprise move on Tuesday.

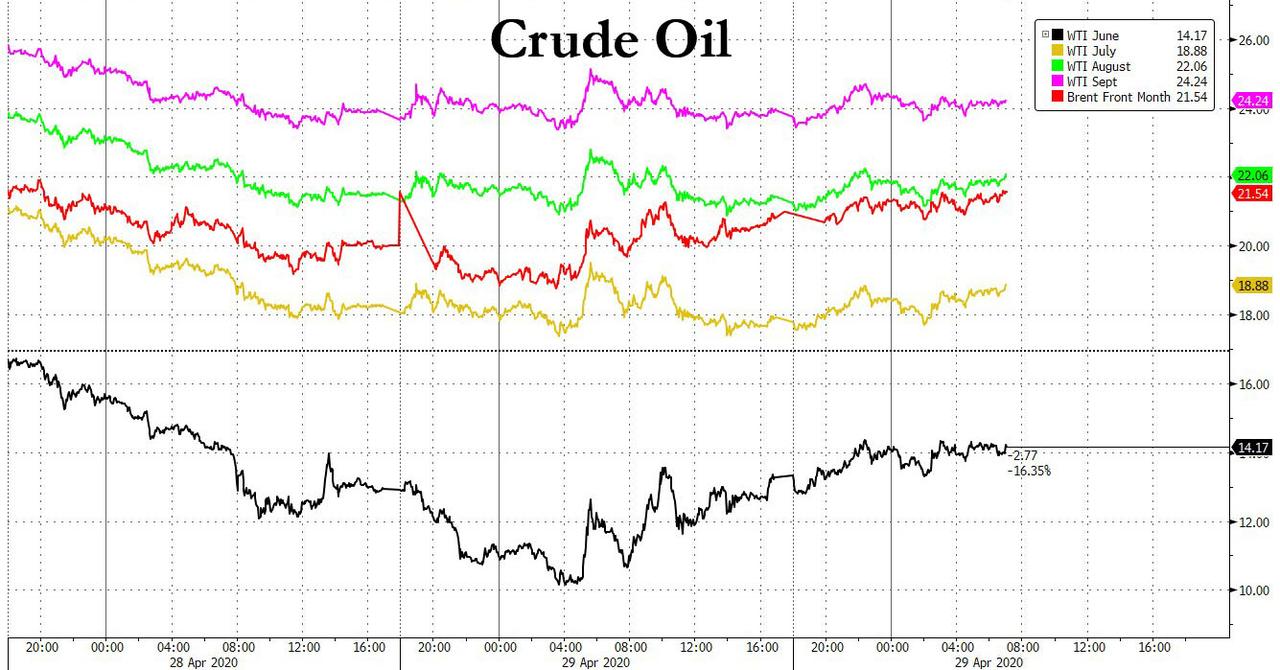

In commodities, the recent rout in oil eased, with WTI climbing 15.2% to $14.20 a barrel. Brent crude rose 4.5% to $21.38 a barrel. Gold was little changed at $1,706.62 an ounce.

In FX, the Bloomberg Dollar Spot Index weakened and the dollar fell against all Group-of-10 peers; the New Zealand and Australian dollars led gains on better-than-expected economic data. Funds covered short positions on the kiwi after the nation said March exports rose to a record, while the Aussie was bolstered by a beat in consumer prices. The euro advanced against the dollar amid supportive month-end dynamics in the cash market, and traders partially unwind shorts that are held through options structures.

The dollar fell for a third day on improving risk sentiment as more countries laid out plans to reopen their economies. The New Zealand and Australian dollars lead gains among Group-of-10 currencies on better-than-expected data. Sales desks across Asia saw orders to sell the dollar, according to currency traders. France is planning to reopen shops on May 11, adding to more signs that Europe is easing virus-driven lock-downs. “It seems like the market is focusing on the prospect of economies re-opening and pricing in a higher probability of a V-shaped recovery in global growth,” said Thomas Nash, a strategist at HSBC Holdings Plc. “In that scenario, we think AUD, NZD, NOK and CAD would outperform in G-10, and the USD would underperform.”

Key economic data including mortgage applications, GDP, and pending home sales. Boeing, GE, Mastercard, Facebook, Microsoft, and Tesla are among companies reporting earnings

Market Snapshot

- S&P 500 futures up 0.9% to 2,891.50

- STOXX Europe 600 down 0.05% to 340.92

- German 10Y yield fell 1.7 bps to -0.486%

- Euro up 0.5% to $1.0870

- Italian 10Y yield fell 3.2 bps to 1.555%

- Spanish 10Y yield rose 0.5 bps to 0.847%

- Brent futures up 4.6% to $21.39/bbl

- Gold spot down 0.1% to $1,705.49

- U.S. Dollar Index down 0.3% to 99.57

- MXAP up 0.8% to 146.23

- MXAPJ up 1% to 471.86

- Nikkei down 0.06% to 19,771.19

- Topix up 0.1% to 1,449.15

- Hang Seng Index up 0.3% to 24,643.59

- Shanghai Composite up 0.4% to 2,822.44

- Sensex up 1.4% to 32,557.14

- Australia S&P/ASX 200 up 1.5% to 5,393.43

- Kospi up 0.7% to 1,947.56

Top Overnight News

- With interest rates near zero, Federal Reserve policy makers are likely to turn attention to other steps they could take to ensure a strong economic rebound once the coronavirus lock-down ends

- France plans to begin reopening shops in May, while Spain is preparing for a “new normal” as Europe’s hardest-hit nation eases restrictions over the next eight weeks. New cases rose for the first time in three days in Germany as the government weighs removing more curbs on public life

- The U.K. government is around three weeks from releasing the “test, track and trace” system it says is essential to easing the current coronavirus lockdown, Health Secretary Matt Hancock said, in a sign current restrictions are likely to largely continue until at least the second half of May

- The closure of businesses and loss of work across Europe has shattered confidence at companies and households, with the European Commission’s monthly sentiment index plunging by a record in April

- The majority of the world’s wealthiest investors are waiting for stocks to drop further before buying again, on concerns about the pandemic’s impact on the global economy, according to a poll by UBS Global Wealth Management

Asian equity markets were higher and US equity futures also recovered from the tech-led declines on Wall St, with the US tech giants making atonement after-hours following Alphabet earnings which missed on EPS but topped revenue forecasts. ASX 200 (+1.5%) was lifted by outperformance in energy after a rebound in oil prices and as the top-weighted financials sector also notched firm gains, while KOSPI (+0.7%) was underpinned by strong data including a surprise expansion in Industrial Production with participants also digesting earnings including Samsung Electronics which fell short of estimates for Q1 net, but operating profit printed inline and revenue beat forecasts. Hang Seng (+0.3%) and Shanghai Comp. (+0.4%) were positive amid a heavy slate of earnings including 3 of the big 4 banks which all showed an improvement from a year ago, with sentiment in Hong Kong also firmer ahead of the extended weekend. It was also reported that China’s National People’s Congress will begin from May 22nd, amid confidence the coronavirus outbreak is under control in China, where officials are anticipated to announce a new stimulus package and set this year’s growth targets. As a reminder, Japan was shut for Showa Day, while Hong Kong and South Korea will begin an extended weekend after today’s close.

Top Asian News

- Credit Suisse ‘Dream’ Client Becomes Nightmare in Luckin Scandal

- China Manager Who Sold Stocks Before Rout Says Worse Coming

- China Bets $600 Billion on Infrastructure to Revive Growth

- Indonesia’s Central Bank Chief Says Bond Yields Too High

Overall uninspiring trade in the equity sphere thus far (Euro Stoxx 50 Unch) as the region mimics a similar performance seen in Asia-Pac ahead of key US Q1 GDP, FOMC, and as participants digest a slew of earnings. SMI (-0.4%) sees modest underperformance on the back of large-cap stocks in the red, including Pharma-giants Roche (-1.0%) and Novartis (-0.8%) – which collectively account for just under 40% of the index, and thus pressure is also seen in the pharma sector. Other sectors are mostly mixed and do not reflect a clean risk sentiment. Energy tops the charts amid gains in the oil complex. The sector breakdown also paints the same mixed picture, with Oil & Gas at the top whilst Healthcare lags; Travel & Leisure sees itself in modest positive territory. As mentioned above, the morning saw a flurry of earnings; Airbus (+0.8%) rises despite dismal COVID-impacted numbers including a net loss of EUR 481mln, with potential upside attributed to French Finance Minister alluding to a safety net for the company if needed. Deutsche Bank (+2.2%) sees support from in-line numbers alongside FIC trading topping forecasts. Barclays (+6%) was bolstered at the open as its Corporate and Investment Bank (CIB) revenue came in at almost GBP 1bln above forecasts. Other earnings-related movers include: Volkswagen (+2.5%), Daimler (+2.2%), AstraZeneca (+0.8%), AMS (+18.8%) and Nordea Bank (+4.5%). Elsewhere, Wirecard (-4.3%) shares fell 10% at one point after activist Hohn called on the Co. to remove its CEO following the KPMG audit.

Top European News

- Gazprom’s 2019 Profit Drops on Lower Gas Prices and Exports

- Europe Tiptoes Toward New Normal as Spain Keeps Schools Shut

- StanChart Joins Bad Loan Surge With $956 Million Provision

- Finnair Loses Over a Tenth of Its Value Amid Planned Share Sale

In FX, notwithstanding the underlying or overall sell US Dollar dynamic for portfolio rebalancing that is gathering momentum via more bank models signalling the same mantra (US and Canadian indices the latest to join the chorus along with UK and Japanese trackers), the Kiwi derived independent impetus from NZ data overnight revealing record exports in March, while the Aussie has rallied in wake of firmer than expected Q1 inflation metrics. Nzd/Usd is hovering just off 0.6100+ peaks and Aud/Usd got to within a whisker of 0.6550 before waning as Aud/Nzd pivots 1.0700 ahead of the NBNZ business survey for April and the DXY holds just above 99.500 within a relatively confined 99.524-884 range in advance of preliminary Q1 US GDP and the Fed.

- EUR/CAD/JPY/CHF/GBP – All benefiting at the expense of the Greenback, but to varying degrees. The Euro remains toppy on approach towards 1.0900 amidst contrasting Eurozone economic indicators, German state CPIs inferring an upward bias to consensus for the national number and Italy suffering a ratings downgrade at the hands of Fitch having evaded the same fate from S&P. Note also, Eur/Usd has an array of decent option expiries to navigate pre-FOMC and the ECB on Thursday, with 1 bn at the 1.0800 strike, 1 bn between 1.0815-20 and 1.1 bn at 1.0865 rolling off today. Elsewhere, the Loonie continue to draw encouragement from comparative stability in crude prices and is inching closer to 1.3900, while the Yen has extended its break through 107.00 beyond 106.50 and briefly over a key 50% retracement level at 106.45, albeit in thinner volumes due to Japan’s Showa Day holiday. Meanwhile, the Franc has rebounded further from recent lows and is now eyeing 0.9700, but the Pound is lagging after failing to revisit 1.2500+ highs and maintaining its recovery vs the single currency as Eur/Gbp bounces from sub-0.8700 to circa 0.8745 and back over the 200 DMA in time for the 9 am fix and with month end RHS demand likely to persist.

- SCANDI/EM – The Swedish and Norwegian Krona have both lost a bit of traction, though remain in bullish mode despite Riksbank rhetoric reiterating that ZIRP is not the lower bound and NIER slashing its 2020 GDP estimate to -7% from -3.2% previously, while the latest Norges Bank survey portrays a bleaker picture for Q2 vs Q1 with most respondents reporting weaker activity, and for some a dramatic decline. Conversely, EM currencies are broadly bid on the back of the flagging Buck and Rub due to the aforementioned calmer waters in oil as Russia’s Energy Minister Novak confirms full compliance with the OPEC+ production pact. However, the Try is still underperforming near the 7.0000 handle that is being staunchly defended by the CBRT after a slump in Turkish economic sentiment.

In commodities, WTI and Brent futures continue their rebound from yesterday’s volatile session, with some desks citing short covering as a potential catalyst. Underlying fundamentals remain unchanged, although firms have been cutting exposure to the front-month contracts amid fears of similar price action in the run-up to the WTI May contract expiry. Yesterday’s API printed another substantial 10mln barrels build in US inventories, but below market expectations. Cushing also showed a lower build than the prior which could provide short-term relief regarding the pace of dwindling storage at the WTI delivery hub. The weekly DoEs will be eyed for confirmation of this. In terms of OPEC, Russian Energy Minister Novak reaffirmed Moscow’s commitment to the output pact but noted that Russian energy firms will be cutting output by around 19% from February levels. Assuming the 11.29mln BPD February output reported by IFAX – this would take production to just over 9mln BPD vs. the 8.5mln BPD output cap agreed with Saudi. Although, Novak added that smaller oil firms will also cut output, which may take production to the threshold. WTI (June) meanders around USD 14/bbl having printed a base at USD 12.67 and a high of USD 14.50/bbl, whilst Brent (July) also trades on a firmer footing, albeit to a much lesser extent, and resides around the middle of its current USD 22.73-23.77/bbl range. Elsewhere, spot gold trades flat within a tight band just north of USD 1700/oz and remains relatively uneventful ahead of US GDP and the FOMC monetary policy decision. Copper meanwhile benefits from the weaker Buck and reclaimed USD 2.35/lb to the upside. Zinc prices continued advancing in overnight trade amid supply woes induced by COVID-19 alongside improving Chinese demand.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -0.3%

- 8:30am: GDP Annualized QoQ, est. -4.0%, prior 2.1%

- 8:30am: Core PCE QoQ, est. 1.7%, prior 1.3%

- 10am: Pending Home Sales MoM, est. -13.6%, prior 2.4%

- 10am: Pending Home Sales NSA YoY, est. -7.55%, prior 11.5%

- 2pm: FOMC Rate Decision

DB’s Jim Reid concludes the overnight wrap

Strangely, we had our second leak of the lockdown yesterday and this time inside the house (thankfully small). As such we had to call a plumber out. After only operating within the family bubble for six weeks it felt really strange to have someone else a few meters from me in the kitchen as I was preparing lunch. It was quite unnerving. I’ve lost 46 years of social skills in six weeks.

Staying with all things virus related, in today’s CCD we look at some interesting stats from yesterday’s weekly U.K. ONS report on fatalities relating to covid-19 and other causes. This weekly report is being used mainly to show how ‘excess’ deaths are higher than the official reported covid numbers meaning the fatality tally could be revised up. However I think the real interest comes from the demographic breakdown. For example in England and Wales ‘only’ nine people have died of covid-19 under the age of 19 to April 17 (23.7% of the population are in this bucket) out of 19,903 covid deaths. 33 people have died who were in their twenties (13.3% of the population). At the other end of the scale 3,319 over 90 year olds have died of the virus so far (0.89% of the population are over 90). 55% of all registered covid-19 deaths (10,566) have been those aged over 80 years old. This group make up 4.9% of the population. This virus is a horrible age discriminator and probably even more so than most of us think as the media is understandably focusing on some of the tragic deaths from relatively young people. See the graphs in the CCD today for more.

Sticking with the UK, Health Secretary Matt Hancock has said that the government is about three weeks from releasing the tool it says is essential to easing the current coronavirus lockdown. This likely indicates that the current lockdown restrictions are likely to largely continue until at least the second half of May. The government has said it sees a “test, track and trace” system as the way to ensure that Covid-19 infections don’t take off again as the lockdown is eased. That requires the recruitment of 18,000 “contact tracers” to identify people who might have been exposed to the virus, as well as the release of a mobile phone app that will do part of that job automatically.

Attention will turn to the Federal Reserve today, who will be announcing their latest monetary policy decision. In terms of what to expect, our US economists’ view (link here) is that this meeting will primarily provide a status update on the Fed’s actions so far, as well as the FOMC’s evolving views on the economic outlook. On forward guidance, they similarly think there’ll be little change with the FOMC continuing their commitment to keep the federal funds rate where it is “until it is confident that the economy has weathered recent events” and begun to recover. And though it’s a close call, they don’t think there’ll be an IOER hike either, as the FOMC won’t want to unintentionally send a hawkish signal about monetary policy, even if this is a technical adjustment.

Though this would represent a pause, it does follow measures in recent weeks that have been unprecedented in their scope, including rates back at the zero lower bound, and a number of credit and liquidity facilities to support markets. Indeed, the extent of such measures is one of the main reasons why we think defaults are going to be well below what would have happened in a free market, with the Fed’s measures once again enabling negative/low-profit companies to stay alive for much longer than they’d have done in previous eras. See more in the default study.

Staying with the US for now, another highlight today will come from the first look at Q1’s GDP reading, where our economists are expecting a -2.3% annualised qoq contraction. With the Euro Area’s Q1 GDP reading also coming tomorrow, this will start to give us some clues as to the extent to which the initial lockdown measures affected output. Though a -2.3% print would make it the worst quarterly performance since Q1 2009, we’re unlikely to see the full extent of the deterioration until Q2, since the lockdown measures didn’t really come into place until the second half of March.

With all that to come, global equities had a varied performance yesterday as yet more countries announced moves to ease their lockdown measures, something investors will be hoping offers some at least short-term respite to their economies. The most notable announcement yesterday came from France, where the Prime Minister said that the country was planning to reopen shops from 11 May, while schools would also be able to reopen from then, albeit with strict rules. That said, large public events of more than 5,000 people wouldn’t be allowed until at least September, so events such as major sports fixtures will remain cancelled. Elsewhere Spanish Prime Minister Sanchez proposed a plan to reopen in four phases, with each lasting approximately two weeks. The proposal did not set specific dates for when bars and restaurants would reopen or sporting and other large-scale events can resume. The reopening began this past Sunday, with young children being allowed out with parents for exercise, while this upcoming Saturday adults will be allowed to do the same. The Prime Minister also said that the less affected regions of the country may be reopened faster.

In terms of the moves, the S&P 500 surged at the open to an intraday high of +1.48%, which actually put it more than 30% above the closing low for the index back on 23rd March. However it gave up its gains in the first couple of hours, before ending the session lower at -0.52%. The reversion seems mostly to have been driven by a rotation out of large-cap Tech names like Facebook and Amazon ahead of earnings announcements in favour of more ‘value’ oriented stocks.

Overnight, markets in Asia have advanced with the Hang Seng (+0.26%), Shanghai Comp (+0.46%), Kopsi (+0.75%) and ASX (+1.12%) all up as we go to print. Markets in Japan are closed for a holiday. In FX, the US dollar index is down -0.14% this morning after yesterday’s -0.18% decline. Elsewhere, futures on the S&P 500 are up +1.02% and those on the NASDAQ are up +1.29% following Alphabet’s revenue beat (more below). WTI oil prices are trading up +14.67% this morning to $14.13.

In other overnight news, Xinhua reported that China’s National People’s Congress will start its annual session on May 22. The government usually uses the meeting to announce its annual growth target, defense spending projections and other key policy decisions. Meanwhile, Kyodo reported that Tokyo Governor Koike has asked the government to extend the state of emergency beyond May 6 as the coronavirus situation remains severe in the nation’s capital. The report further said that Governor of Japan’s other prefectures are also of the same view and added that the governors are also seeing the possibility of changing the law so that businesses can be fined if they stay open despite being asked to shut.

After the close, we heard from Alphabet, which was up +7.40% post-market, after closing down -3.41%. The company traded higher after hours on news that the company beat on revenues, with sales up 14% from a year ago. The company does not normally offer forecasts, but CFO Ruth Porat said that ad sales could see headwinds next quarter after there was a significant slowdown in ad-revenue for March. Ford was down -4.83% in after-market trading after the company announcing a forecasted operating loss of $5 billion for the company’s second quarter. This was over $2billion more than analysts’ estimates. The company is expecting a significant volume decline in every region, especially its only consistently profitable one – North America. Starbucks fell by -0.88% after-market, with the company announcing that nearly all Chinese locations were now open, but that same store sales were down 15-25% this fiscal year in the country. Globally, same-store sales have fallen 10% for the quarter, though the company is expecting the following quarter to have the brunt of the shutdown impact. In Asia, Samsung also reported its March quarter earnings overnight highlighting that net income declined by 4% to KRW 4.9tn while also issuing a warning that earnings may decline in current quarter after the coronavirus outbreak hurt demand for its smartphones and gadgets, trimming income gained from surging server-chip orders. The stock is trading down -0.20% this morning.

Earnings earlier in the day continued to highlight the virus’s effects on corporates. ABB rose over +5.36% post better than expected profits , while also offering guidance showing a gain in Q2 even as they expect revenues to decease. UBS rose +5.52% on news that its loan loss provisions were more manageable than analysts thought. Caterpillar’s profit per share in Q1 fell by 39% compared with the previous year to $1.98, with the stock finishing fairly flat at +0.12%. The company has not yet provided an outlook for 2020, continuing to cite uncertainties. UPS (-6.06%) withdrew its 2020 revenue and diluted EPS growth guidance and their adjusted net income of $1bn in Q1 was down from $1.204bn a year earlier. We’ll have another raft of major releases today, including Microsoft, Facebook and Boeing.

Back to equities and Europe managed to maintain most of its gains though as US markets slid late in the European session. The STOXX 600 was up by +1.68% to almost close above its 50-day moving average for the first time since February, a milestone that the S&P 500 crossed last Friday.

Sovereign debt rallied on both sides of the Atlantic yesterday, with 10yr Treasury yields down -4.8bps to 0.613%. In Europe, sovereign bond spreads also continued to narrow, with the Italian spread over 10yr bund yields falling for a 5th successive session (-1.6bps), while the spreads on Spanish (-3.1bps), Portuguese (-3.7bps) and Greek (-3.7bps) debt also came down. Though it was widely anticipated, Italy had their credit rating cut to BBB- by Fitch with a stable outlook after the US close last night. This follows S&P and Moody’s decision not to cut last week. So news-flow will have to get incrementally worse from this point for Italy to be downgraded to junk. This is quite possible over time but it will won’t be in the near-term.

Meanwhile, oil had a volatile session, with WTI fluctuating between gains and losses before closing another -3.44% lower at $12.34/barrel. This was on the back of news that USO, the largest WTI crude ETF, rolled completely out of the June contracts earlier than anticipated. However, as our colleague Michael Hsueh noted, a lot of commodity index funds have long had more ‘intelligent’ roll strategies, which wouldn’t have been invested in front month futures. Regardless, given that inventory increases are still running at extreme rates we may still be seeing such violent moves in WTI futures without the fund rolls. The EIA inventory report later today will be very important, as is the global floating storage data. The last week of floating storage data ending 24 Apr shows the biggest 2-week build on record (since data starts in 2010), well exceeding anything in 2015-16. Outside of WTI, Brent crude ended the session almost unchanged however, at +2.35%. The effect of declining crude prices was also seen on Saudi Arabia’s central bank’s net foreign assets as they dropped by c. SAR -100bn (-$27bn) in March, the fastest pace since at least 2000, to $464bn, the lowest since 2011. Last week, Saudi Finance Minister Mohammed Al-Jadaan said the Kingdom would only draw down reserves by up to SAR 120bn over the whole year. So interesting that c. SAR 100bn was drawn in March itself.

Economic data yesterday continued to deteriorate, with the Conference Board’s consumer confidence index from the US falling to 86.9 (vs. 87.0 expected) in April, down from the 118.8 reading in March. That makes it the lowest reading for the index since June 2014. The present situation saw an even larger decline to 76.4 from 166.7 in March, though the expectations reading actually increased slightly to 93.8. Elsewhere, the Richmond Fed’s manufacturing index for April fell to a record low of -53, and in France the INSEE’s consumer confidence indicator fell to a stronger-than-expected 95 in April (vs. 80 expected).

To the day ahead now, and the main highlight will be the aforementioned Federal Reserve decision and Chair Powell’s subsequent press conference. Before then, data releases out include the advance reading of Q1 GDP in the US, along with Q1’s personal consumption and core PCE readings. The US will also see weekly MBA mortgage applications released and March pending home sales. Over in Europe, there’ll be the preliminary reading of Germany’s CPI for April, as well as the Euro Area’s M3 money supply and consumer confidence reading. Finally, earnings releases out later include Microsoft, Facebook, Mastercard, Boeing, General Electric and Tesla.

Tyler Durden

Wed, 04/29/2020 – 07:43

via ZeroHedge News https://ift.tt/2W8EoV9 Tyler Durden