The Fed Should Take A Deep Breath & Prepare For A Price Hiccup, “Its Credibility Is At Stake Today”

Authored by Richard Breslow via Bloomberg,

And Now We Wait For The Big Show To Begin…

I realize that Japan was off on holiday today. But when the first thing you read after sitting down is that Treasury futures traded at 20% of normal volume in Asia, it’s probably wise to take a wait-and-see approach to the day.

[ZH: of course the GILD headlines have sparked another ramp ahead of the open]

And that is how it has certainly felt. Having opinions on where things are going is essential in order to formulate a strategy. Keeping an open-mind is a pretty valuable survival trait, as well. Watching the early price action, the challenge has been deciding if this is going to be a big-picture or little-picture day. The charts have not helped. Their short-term ambiguity is startling in their starkness.

Yesterday, a big part of the story was that equities fell in large part because of a drop in the April Consumer Confidence number. We did expect it. Forecasters were not far off. But the expectations number was pleasantly good. It didn’t seem surprising, therefore, to reevaluate the number and attribute some of that, in addition to earnings of course, to why S&P 500 futures regained some of their luster this morning. That is a pretty good proxy for how a lot of people are navigating our current situation. Things stink now, but we have to believe they are indeed going to get better. The glass analogy was never more appropriate.

But there is a caveat. We need to continue to see progress. Traders will experience bouts of intermittent impatience the longer it takes for conditions to loosen up. And periodically take it out on the market. Even if the big-picture base case remains constructive. Deciding where we are on that spectrum will be the key to successfully balancing being flexible and resolute. This isn’t a time to declare you have a story and are sticking with it, unless you are also willing to go with the flow. Especially when they are big. Because the moves aren’t always something you can afford to sit through and ignore.

As we prepare for learning what the FOMC and ECB will be up to, it’s worth considering what their challenges might be as they evaluate the sometimes different demands of the economy versus the market. And it remains very much to be seen if they are able, and willing, to make a clear distinction.

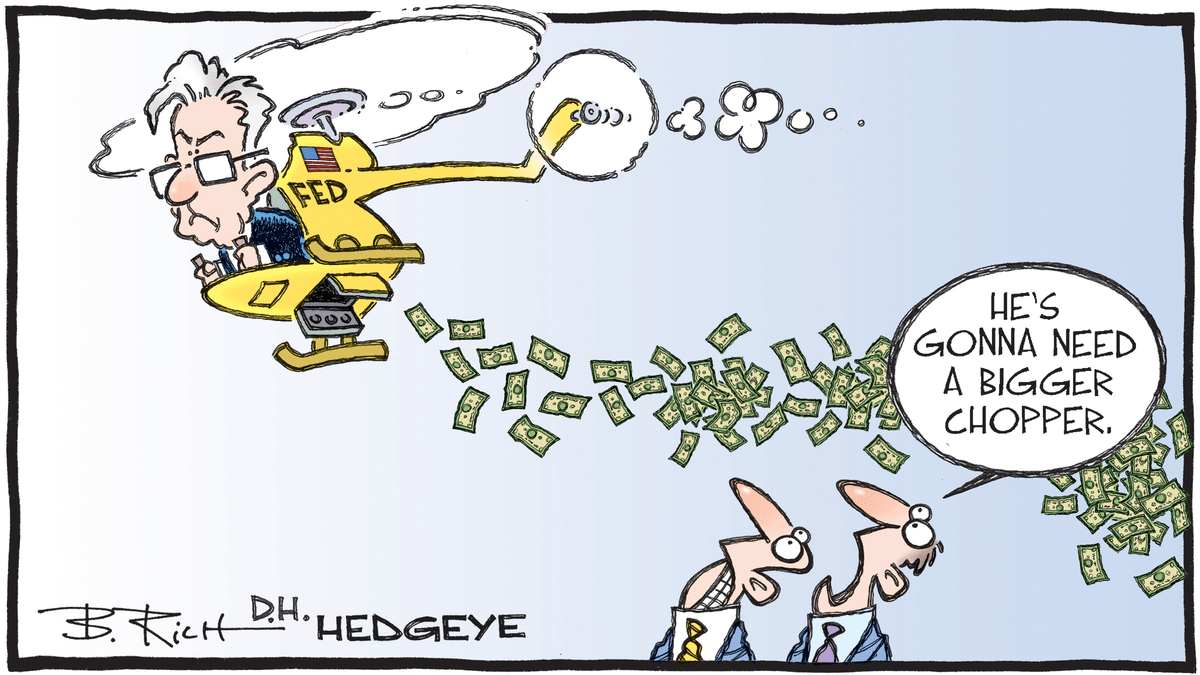

The Fed should take a deep breath, applaud recent and future fiscal policy relief efforts and be willing to live with a short-term asset price hiccup, should it happen. It will be good for their credibility. Their strength will be keeping some policy choices in their pockets. This isn’t an opportunity for hand-wringing. And their forward guidance is already pretty obvious. Chairman Jerome Powell should spend his time talking about accomplishments in keeping financial plumbing and funding functional. He can acknowledge the weak economy and still be a touch optimistic. They have already done a lot. A move to negative rates would be a very bad mistake. And crush the currency. I’m amazed that it has its advocates.

The ECB has a more immediate, and pressing, challenge. They need to compensate for the EU’s inability to adequately address burden-sharing. And a very weak and uneven economy. What they might buy now, PEPP expansion, how flexible they will make all of their rules, and changes to the Capital Key will all lead to a complicated set of decisions and a mess of a communication challenge. The mixed signals being given off by the currency suggest there is a fair degree of uncertainty about just what policy mix is coming. But be sure, they won’t be timid. Nor will the hawks be difficult. At least on the subject of ECB spending

If I had to hazard a guess, this morning’s price action will be about traders having a hard time holding onto their positions and later we could get a real sense what the next medium-term move is likely to be.

Tyler Durden

Wed, 04/29/2020 – 08:59

via ZeroHedge News https://ift.tt/3cWHLFC Tyler Durden