Uber Slides As Company Continues To Burn Cash, “Eats” EBITDA Drops Despite Soaring Revenue

While Lyft impressed investors with its Q1 earnings beat, which however barely accounted for a dramatic slowdown in the company’s business in the second half of March which forced the company to fire thousands and suspend guidance, moments ago Uber also reported numbers that beat deeply cut expectations across the board.

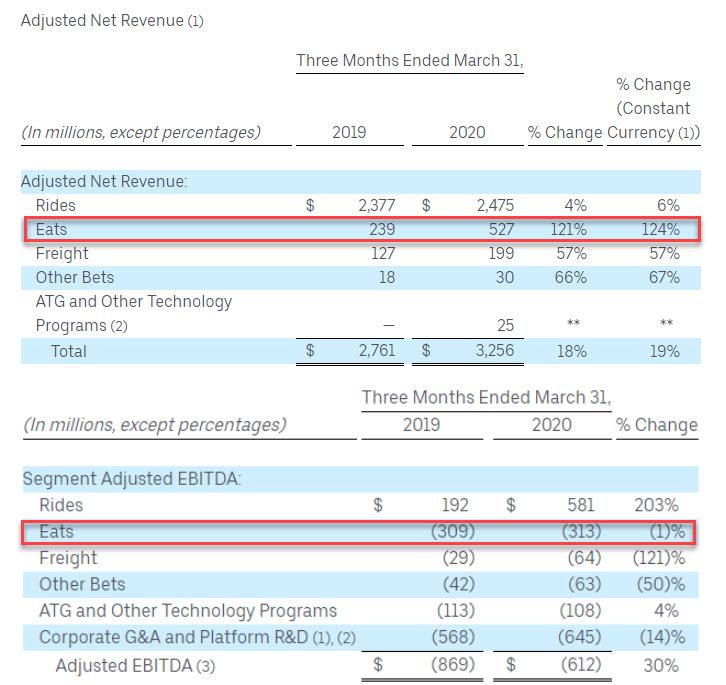

Below is a summary of the key first quarter results:

- Q1 monthly active platform consumers: 103 million, beating the exp. 102.7 million

- Q1 ridesharing bookings $10.87 billion, beating exp. $10.68 billion

- Q1 Gross Bookings $15.78 BN, +7.7% Y/Y, and beating the exp. $15.27 BN

- Q1 adjusted net revenue $3.26 BN, +18% y/y, beating the exp. $3.02 BN

- Q1 adjusted EBITDA loss $612 million, a 30% improvement Y/Y, beats the exp. loss $726.7 million

- Q1 Uber Eats bookings $4.68 billion, beating exp. $4.32 billion, BUT EBITDA from Uber Eats actually dropped from a $309MM loss to a $313MM loss.

- Q1 loss $2.94 billion, which includes a pre-tax impairment write-downs of $2.1 billion and $277 million in stock-based compensation expense, partially offset by apre-tax gain on business divestiture of Uber Eats India operations of $154 million

- Q1 loss per share $1.70

The bottom line is that no matter what the revenue does, the company just can’t lift that deeply negative EBITDA.

In other words, the just concluded quarter was solid, and if one believes CEO said Dara Khosrowshahi, the future is starting to look good as well:

“Along with the surge in food delivery, we are encouraged by the early signs we are seeing in markets that are beginning to open back up. Our global footprint and highly variable cost structure remain an important advantage, as our expectation is that the Rides recovery will vary by city and country.”

That said, Dara admitted that the “Rides business has been hit hard by the ongoing pandemic” which is why Uber took “quick action to preserve the strength of our balance sheet, focus additional resources on Uber Eats, and prepare us for any recovery scenario.”

While Uber’s core business was impacted, Uber’s food delivery business was the silver lining, growing dramatically year over year however what surprised investors is that Uber’s food delivery margins have actually gotten slightly worse at scale. Eats revenue grew by 53% year over year to $819 million in the first quarter of 2020, yet as Bloomberg points out, Eats’ adjusted EBITDA grew 1% to $313 million loss. That, a Bloomberg notes, could worry investors that it is having a hard-time outgrowing its food delivery losses.

And while the bottom line is that for all its various adjustments, the company continues to hemmorhage cash, its unrestricted cash was $9 billion, so the company can argue it has plenty of dry powder to not only weather the coronavirus storm, but to cover its ongoing cash burn.

Uber shares traded slightly up before falling by more than 2% after earnings hit, as investors grew concerned about the company’s inability to monetize the tremendous surge in Uber Eats.

Uber presentation slideshow can be found here.

Tyler Durden

Thu, 05/07/2020 – 16:33

via ZeroHedge News https://ift.tt/2WfReCx Tyler Durden