Questions Swirl As To Why Small-Business Emergency Lending Drops

It’s becoming increasingly clear that a quick economic recovery is not in the cards this year. That’s a very big problem for struggling small businesses, who need emergency loans from the coronavirus relief program to stay afloat.

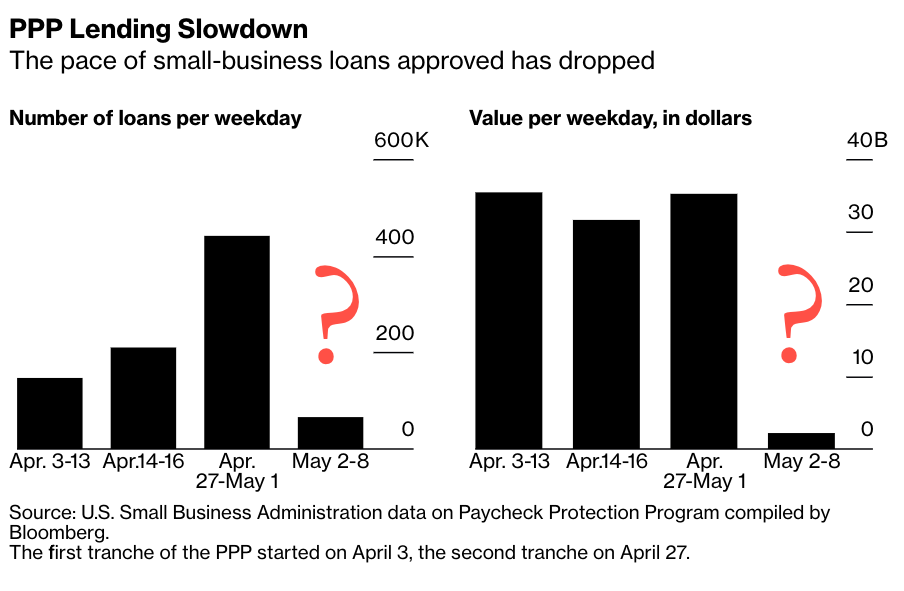

As Bloomberg reports, the pace of processing loans from the Paycheck Protection Program (PPP) has “slowed abruptly,” suggesting the second round of relief could soon be exhausted.

The first round of PPP was quickly depleted in April in under two weeks. The total size of the program was about $349 billion, which fed $30 billion in emergency loans to companies affected by virus-related shutdowns each day for the duration of the 13 days of operation. The program was relaunched on April 27, with about $320 billion for companies, exhausting about 55% of the funds in the first five days. The daily pace of loan processing has dramatically slowed from $35 billion to $11 billion to now a daily pace of about $2.3 billion.

Many questions remain as to why the rapid decline in loan processing has been seen:

“The slowdown has raised a fresh question: Why? Groups representing small businesses and lenders pointed to several possible factors, including the processing of a backlog of applications from the first round; the removal of duplicates from borrowers who applied at more than one bank; and the wariness of some firms applying after the Trump administration warned that companies that take loans and don’t need them could face criminal prosecution,” Bloomberg

Here’s a visual take on the plunge in PPP loan processing from May 2-8:

Marco Rubio, chairman of the Senate Committee on Small Business and Entrepreneurship and one of the creators of the loan program, said the decline in loan processing could be a combination of things, including the lack of how the funds can be spent and public backlash from the first program of how larger companies were receiving the funds rather than mom and pop shops.

Demand for #PPPloans has slowed down for two reasons:

1. Lack of clear guidance yet on exemptions from requirement that 75% be used for payroll in 8 weeks;

2. Scrutiny over what businesses received loans turned into hysteria & is scaring many from applying https://t.co/sZZTgQUx6s— Marco Rubio (@marcorubio) May 8, 2020

Rubio touched on the importance of the PPP program:

Last month unemployment hit 14.7 & 20 millions jobs were wiped out

This is terrible & unsustainable

But without #PPP an additional 25 to 30 million jobs could have been lost

If 20 million lost jobs is unfathomable just imagine what 45 million lost jobs would be

— Marco Rubio (@marcorubio) May 8, 2020

As of Friday evening, he noted that round 2 of PPP “as made 2,545,571 #ppploans for $187.1 billion of the $310 billion available. The average loan amount continues to drop. Now down to $73,512.”

As of 5pm tonight round two of #PPP has made 2,545,571 #ppploans for $187.1 billion of the $310 billion available.

The average loan amount continues to drop. Now down to $73,512

— Marco Rubio (@marcorubio) May 9, 2020

Another reason behind the slowdown could be due to the US Treasury and Small Business Administration (SBA) missed a deadline to provide guidance on how to determine what part of the emergency loan is forgivable.

SBA spokesperson, said, “the main reason is that the agency has processed batches of applications submitted by banks when the program restarted — batches initially of at least 15,000, then reduced to 5,000 — and is now handling them individually on a rolling basis.”

While it remains open to discussion of why PPP loan processing has dramatically slowed, one particular thing that cannot be debated is that if loans are not directed to small businesses in a timely fashion — there is a risk that many will not survive in an economy that remains depressed.

Tyler Durden

Sat, 05/09/2020 – 16:55

via ZeroHedge News https://ift.tt/35JIyaF Tyler Durden