Economic Virus Shock Crushes America’s Working Poor, Fed Finds

Tyler Durden

Fri, 05/15/2020 – 22:30

The Federal Reserve on Thursday published a new survey of how virus-related lockdowns disproportionately affected Americans, suggesting the working-poor has been crushed under the weight of high unemployment and economic distress.

The new survey, titled “Report on the Economic Well-Being of U.S. Households in 2019, Featuring Supplemental Data from April 2020,” provides further clarity into the upcoming social-economic challenges of widening wealth inequality as a result of the economic devastation triggered by lockdowns.

It said 40% of respondents earning less than $40,000 per year reported a job loss in March. The Fed’s report concentrated on the economic conditions of households at the end of 2019, which was then supplemented with employment data from the start of March through early April, capturing the first several weeks of unprecedented job loss.

“Thirty-nine percent of people working in February with a household income below $40,000 reported a job loss in March. Another 6 percent of all adults had their hours reduced or took unpaid leave. Taken together, 19 percent of all adults reported either losing a job or experiencing a reduction in work hours in March,” the report said.

Fed Chairman Jerome Powell outlined in a webcast to Congress this week that severe economic impacts related to virus shutdowns were mostly seen for lower-income Americans:

“The numbers show clearly that it’s more recent hires and lower-paid people who are bearing the brunt of this, although people are suffering all across the income spectrum,” Powell said.

Powell urged Congress to do more to prevent long-lasting economic damage from the virus.

The Fed’s survey doesn’t capture the millions more that were laid off since early April. At the moment, current figures show 36 million Americans have applied for unemployment benefits since early March. The unemployment rate jumped to 15% this week, the highest since the Great Depression.

Most of the job loss has been concreted in the leisure and hospitality industry, which is an industry where many low-income folks have been working over the prior expansion. Many of these folks are stuck in a renting society, gig-economy, insurmountable debts, and limited savings, some, as we’ve noted, are now financially doomed. They will be pushed onto the government welfare system, with an increasing possibility that universal basic income will become a more permanent program.

The collapse in employment has substantially affected the financial well-being of families; many of these households may never recover. We recently noted, “42% of the layoffs seen over the last several months would result in permanent job loss.” Talk about a shell shocker for when all these folks try to find a job when states reopen. The worst part is that an economic recovery could take 2-4 years, with unemployment staying at elevated levels as the country must restructure the economy. This virus-induced downturn is already fundamentally altering the lives of tens of millions of folks, who even before the virus, were not prepared for financial Armageddon.

Back to the Fed survey, of the respondents that lost their jobs or had hours reduced, 70% reported an income decline, impacting their ability to service debt.

About 64% of those with a job loss or decline in weekly hours worked were able to pay bills in full, compared with 85% of those who continued to work.

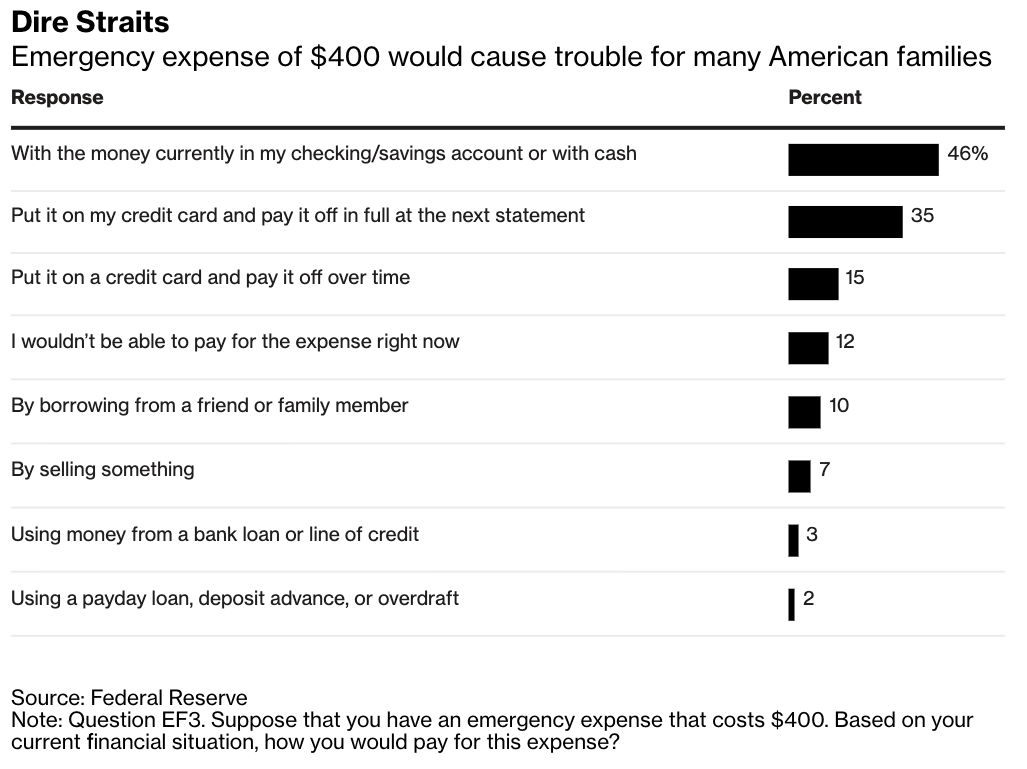

At least half of the respondents said they would have trouble covering a $400 expense.

The survey offers a unique perspective into the economic devastation that has already crushed the lower tier of society and the challenges that could develop as wealth inequality is pushed to extremes.

via ZeroHedge News https://ift.tt/3bDoYOD Tyler Durden