Powell “60 Minutes” Preview: Full Recovery Could Take Until End Of 2021, Will Require A Coronavirus Vaccine

Tyler Durden

Sun, 05/17/2020 – 17:14

Less than a week after Powell tried (and apparently failed) to convince the market negative rates aren’t coming to the US (right as the BOE’s Andy Haldane admits the UK is considering joining the rest of Europe into the monetary twilight zone of NIRP), and just days after the Fed’s semiannual Financial Stability report warned that “asset prices remain vulnerable to significant price declines should the pandemic take an unexpected course” traders will again be glued to their TVs at 7pm ET on Sunday evening when chair Powell sits down on CBS’s 60 Minutes – a little under 10 years after Ben Bernanke used the same venue to laughably declare that the Fed “could raise interest rates in 15 minutes if we have to,” adding “that time is not now” or apparently not ever – and will urge Americans to be patient as a full recovery may take until the end of 2021, and would require a coronavirus vaccine for people to “be fully confident” again.

Contrary to some satirical expectations…

FED’S POWELL SAYS A FED MANDATE TO BUY INDIVIDUAL STOCKS AND ETFs COULD BE A VACCINE ALTERNATIVE- 60 MINUTES INTERVIEW

— Russian Market (@russian_market) May 17, 2020

… which were taken seriously even by top-tier professionals…

Just FYI, seems like single stocks is so far just a Fin-twit rumour.

— AndreasStenoLarsen (@AndreasSteno) May 17, 2020

… perhaps be expected in a centrally-planned world where the surreal, the absurd and financial reality are in a constant state of flux, Powell will do his best “optimistic Buffett” impression (now that Buffett is decidedly not optimistic, and is not only not ‘buying American’ but selling it, in both airlines and banks) and will say that “in the long run and even in the medium run, you wouldn’t want to bet against the American economy. The American economy will recover.”

The question is when, of course, and it is here that Powell’s message gets decided more downbeat: “Assuming there’s not a second wave of the coronavirus, I think you’ll see the economy recover steadily through the second half of the year,” the central bank chief said. Yet even if the recover does start as soon as Q2, “it may take a while. It may take a period of time. It could stretch through the end of next year [before things get back to normal]. We really don’t know.”

However, he added that “for the economy to fully recover people will have to be fully confident, and that may have to await the arrival of a vaccine.”

To be sure, Powell has achieved great success in restoring the stock market. Alas, as everyone knows by now, the market is not the economy, and more than 36 million Americans have lost their jobs since February as the economy shuttered to limit virus spread, even as the S&P500 is rapidly recovering virtually all of its losses. Meanwhile, countless companies, especially small businesses, are hurtling toward bankruptcy, while states and cities are confronting gaping budget shortfalls that could provoke a massive second wave of layoffs from the public sector.

“I would take a more optimistic cut at that, if I could,” Powell said, unable to take an optimistic cut. “And that is — this is a time of great suffering and difficulty. And it’s come on us so quickly and with such force, that you really can’t put into words the pain people are feeling and the uncertainty they’re realizing. And it’s going to take a while for us to get back.”

Powell’s cautious remarks follow his grave warning Wednesday that the economy faces lasting harm from the pandemic if the government doesn’t step up, which would require even more debt issuance by the US Treasury, and far even greater QE from Powell, something which Goldman warned could be a major problem for the Fed. The comments add support to calls for more congressional spending after the Democrat-controlled house voted through another $3 trillion in virus aid on top of a record $2.2 trillion package agreed in March (the Senate is expected to summarily vote down the latest massive stimulus).

After tonight’s interview, Powell has another virtual conference just 48 hours later, when he will be interrogated about the scale and timing of additional fiscal relief when he appears before the Senate Banking Committee on Tuesday. He’ll also be asked to tell Americans what to expect.

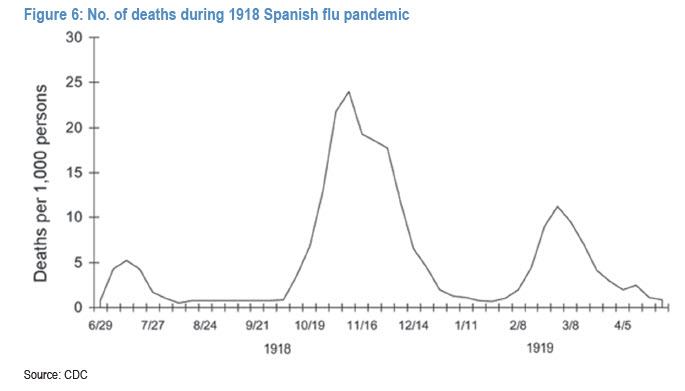

Finally, what if there is a second wave of the coronavirus, as there was during the Spanish Flu in 1917…

… and there is no recovery in late 2020 and 2021? Will Powell unleash negative rates and buy stocks to keep stocks from dropping in that case? For the answer watch tonight’s full interview as we assume CBS only leaked the boring parts.

via ZeroHedge News https://ift.tt/2zI8gAq Tyler Durden