The Top 4 Themes And Trends From Q1 Earnings Conference Calls

Tyler Durden

Sun, 05/17/2020 – 22:40

Every quarter, Goldman Sachs published its so-called Beige Book (not to be confused with the Fed’s publication by that name) in which the bank gathers anecdotal evidence of fundamental and thematic trends from the earnings transcripts of companies in the S&P 500. Obviously, the latest, Q1 edition, spotlights commentary around the coronavirus outbreak. As Goldman’s David Kostin summarizes, there were four key themes to emerge across sectors:

- Business outlook (uncertainty, earnings guidance withdrawal, U- or L-shaped path more likely than a V);

- Accelerating revenue model changes (digitalization, DTC, automation initiatives);

- Corporate operations and labor force changes (WFH, cutting labor costs);

- Cash use priorities (liquidity paramount, suspending buybacks and dividends).

Some more observations on these four key themes:

Theme 1: An uncertain recovery

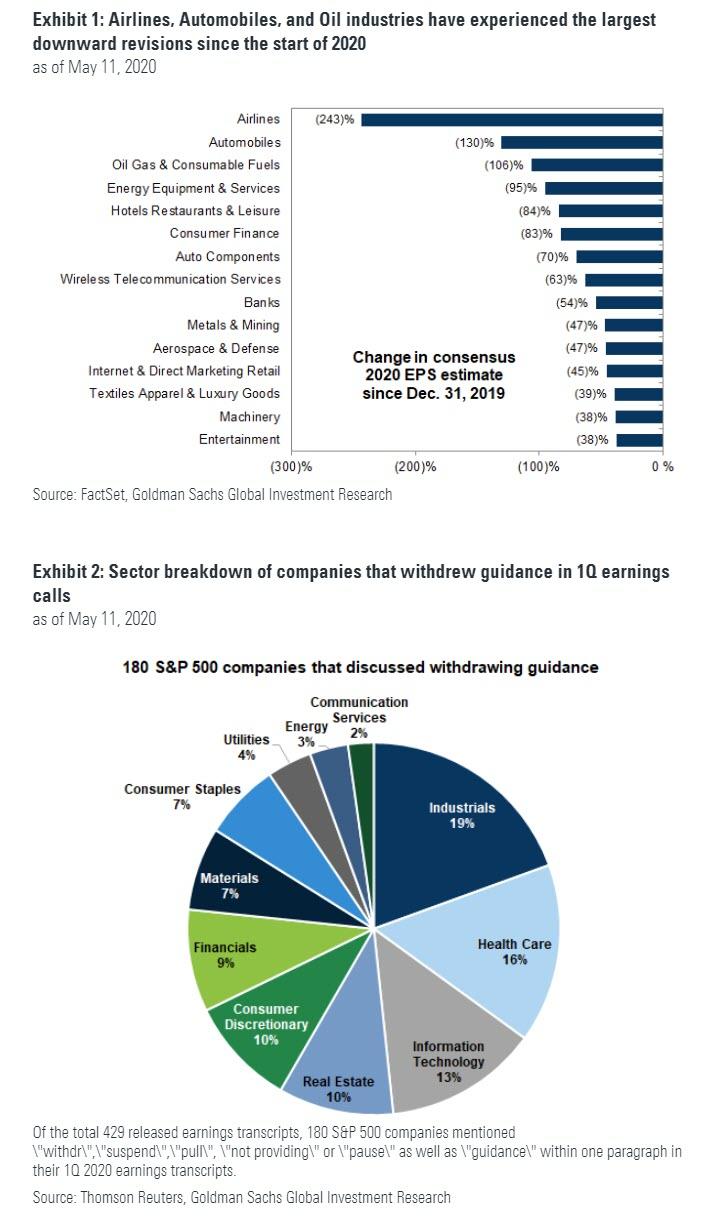

Many corporate managers highlighted extreme uncertainty around the path to recovery. Amid the ongoing stay-at-home mandates, business closures, and social distancing measures, roughly 180 companies pulled earnings guidance. The bottom-up consensus estimate of 2020 S&P 500 EPS has been revised down by 27% since the start of the year.

Overall, managements anticipated activity would trough in 2Q 2020, but firms had mixed views on how long the financial impact of the pandemic would last. Only a few companies posited a V-shaped rebound while most others expected a U- or L-shaped recovery. Unsurprisingly, companies facing greater exposure to travel and requiring face-to-face interactions expected a longer stretch of time before business activities would return to normal. In contrast, companies in market segments like construction, business supplies, and data centers expected faster normalization. Although some companies gained insight from their business recovery experience in China, others were wary to extrapolate China’s rebound to other countries due to varying national responses and governing systems.

Selected examples:

- Uncertainty around financial guidance: AKAM, CMS, FB, KSU, MDLZ, MMM, PKG, UPS

- Anticipated 2Q trough: ADM, AMGN, APTV, DD, HLT, JNJ, LDOS, NEM, REGN

- U or L more common than V-shaped recovery: ABBV, ABT, ADP, CE, ECL, EMR, HBAN, IDXX, PNC, PPG, RF, WHR, WY

- Wary of extrapolating China’s recovery: APH, ETN, IEX, ZTS

- Pockets of optimism: AXP, BAC, FOXA, IQV, V

Theme 2: Accelerating digitalization, direct-to-consumer, and automation strategies

Executives highlighted digital transformation as their top priority given online engagement has skyrocketed following stay-at-home mandates and government-mandated business closures. Digitalization solutions centered around shifting consumer behaviors within the low mobility, contact-less environment. Among the broad span of businesses that accelerated digitalization: Restaurants added online order-and-pay services, retailers turned to digital marketing and e-commerce, patient care pivoted to telemedicine, work-from-home mandates boosted collaborative technologies, and banks further invested in mobile financing capabilities. Companies within consumer sectors, in particular, overwhelmingly cited spikes in online sales. Video chat apps (+1,485%), home fitness apps (+288%), grocery apps (+214%) and e-commerce apps (+116%) have all more than doubled the number of app downloads since last year .

Direct-to-consumer channels experienced a similar surge as retail customers found alternative ways to purchase goods. Executives highlighted sustained or increased direct-to-consumer sales, with many consumer-facing companies aggressively pivoting to sell directly to their end-market customers.

Managements also escalated automation strategies into their operations and supply chains. Automation technologies were cited as long-term strategies to permanently lower operating costs. Reduced headcount and social-distancing measures within facilities further increased the demand for automation to help firms sustain or increase operational efficiency.

Selected examples:

- Digitalization: ACN, AKAM, ANTM, AOS, C, CDW, CFG, CHD, CHTR, CMCSA, CMG, CVS, EL, FB, GE, GM, GOOGL, GPC, HBI, HSY, ICE, KEY, KO, LEN, MA, MGM, NKE, NOW, TSCO, UPS, WBA, WRK

- Direct-to-consumer: AFL, CHTR, CL, DRE, GRMN, LEG, MKC, STZ, WHR

- Automation: AME, OXY, SEE, SLB, TEL, XYL, YUM, ZBRA

Theme 3: A changing workforce

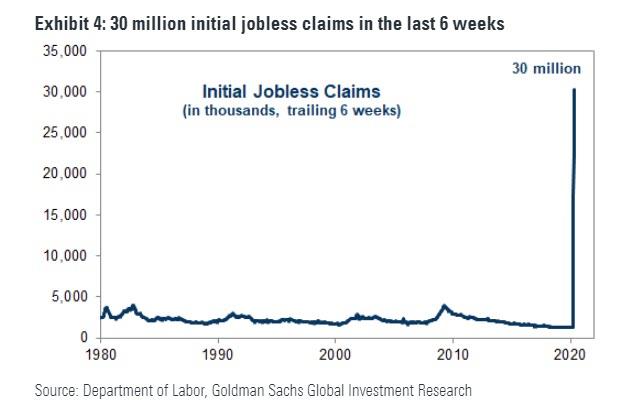

Amid the economic and health crisis, many companies reduced labor costs through layoffs, furloughs, and pay cuts. Actions on labor costs were widespread and were not confined to the industries that were most acutely impacted by government-mandated social distancing. Pay cuts were a common labor cost reduction lever, especially at the executive level. In April alone, 20.5 million jobs were lost and the US unemployment rate spiked to 14.7%. Many companies indicated actions on labor costs were intended to be temporary, suggesting that the lasting economic effects of job losses may be limited at the moment.

Companies able to transition employees to working-from-home did so, with mixed results. Some companies called out sustained or improved efficiency from their remote employees and potential opportunities for some of their employees to continue working remotely long-term, whereas other companies discussed diminished productivity and operational challenges. Firms with employees still on-site incurred additional costs associated with ensuring employee safety.

Selected examples:

- A remote workforce: AEP, APD, APTV, CDNS, COF, CTXS, GPN, HCA, LHX, NEM, OMC, SLG, SPGI, VRSK

- Cutting labor costs: BWA, CAT, CHRW, EMR, L, LH, LKQ, MGM, NWL, TDG

- COVID-19 related employee expenses: AIZ, CVS, SYF, TSN, YUM

Theme 4: New cash spending priorities

Management teams prioritized liquidity and balance sheet strength. Heightened uncertainty prompted companies to reduce capital expenditures, buybacks, and dividends. Many companies, however, committed to their dividends, emphasizing the importance of dividend payments to shareholders and their priority of maintaining their long track record of paying dividends.

Goldman also notes that some companies were also opportunistic around M&A given the current environment, and the bank’s Strong Balance Sheet basket (GSTHSBAL) outperformed its Weak Balance Sheet basket (GSTHWBAL) by 24 pp YTD (2% vs. -22%), but trades at a forward P/E of 32x, representing a 3 standard deviation premium vs. history. As a reminder, Goldman recently forecast S&P 500 buybacks will fall by 50% and dividends by 25% in 2020.

Selected examples:

- Liquidity: AIG, BA, CDW, DVN, HSIC, MDLZ, SWK, WAB

- Cutting out of caution: CHRW, IVZ, MCO, NTRS

- Commitment to dividends: CAT, ETN, FANG, FLIR, KSU, PEG, PG, TRV, WM

- M&A opportunities: BAX, CERN, JKHY, LVS, SYK, XRX

* * *

In addition to these four key themes, Kostin also highlights 4 core trends that emerged during Q1 conference calls:

First, S&P 500 earnings are partially insulated relative to the economy given its large-cap tilt and high weight in non-cyclical industries.

Concentration within the equity market has been growing. The ongoing crisis has exacerbated the “winner-takeall” nature of the equity market, acutely affecting small companies with less operational and balance sheet flexibility than their larger peers. While S&P 500 EPS fell by 14% in 1Q, small-cap Russell 2000 EPS fell by 90%. Furthermore, the S&P 500 carries large earnings weights in non-cyclical industries, which posted positive EPS growth in 1Q and are expected to post much stronger full-year EPS growth relative to the broad index. Software & Services share of S&P 500 EPS has grown to 9%, led by MSFT. Health Care and Consumer Staples account for 16% and 7% of S&P 500 EPS, respectively.

Second, online platforms and shifting business models will partially offset the revenue declines in in-person consumption.

The consumer accounts for 70% of the US economy and has been impaired by restrictions on face-to-face transactions. Consumer Discretionary sales excluding AMZN fell by 6% in 1Q and US retail sales fell by 16% in April. However, restrictions have expedited the shift to e-commerce and other online services. For example, online retailer Wayfair (W) reported that gross revenues 2QTD have grown by 90% year/year, Target (TGT) reported 275% growth in digital sales MTD through April 23, and Chipotle (CMG) reported that, while in-store ordering plunged by 75%, delivery and order-ahead sales surged by

150% and 120%. Video chat apps (+1,255%), grocery apps (+134%) and ecommerce apps (+118%) have all more than doubled the number of downloads since last year. Several companies have also adjusted their business models. In mid-April, Best Buy (BBY) reported that it had retained 70% of sales by enhancing curbside pickup offerings despite all US stores being closed to customer traffic.

Third, increased costs associated with maintaining or resuming business activity will continue to pressure profit margins.

S&P 500 net margins fell by 107 bp in 1Q. Several brick-and-mortar companies have highlighted increased costs associated with coronavirus. Target (TGT) noted that costs were expected to be higher because of investments in pay and benefits as well as additional cleaning of stores and distribution centers. Even Amazon (AMZN), a relative revenue beneficiary, guided for $4 billion of extra costs related to COVID-19, including worker safety measures, virus testing, and higher labor costs.

Fourth, several companies noted that revenue declines stabilized in April and there were pockets of improvement in early 2Q.

Commentary on signs of stabilization was present in a variety of sectors, such as Consumer Discretionary (e.g., MAR, BKNG, YUM), Industrials (e.g., URI, WM), and Info Tech (e.g., FIS, IT, ADP). Several firms leveraged to consumer spending, such as payment processors V, MA, and GPN, even highlighted sequential improvements in April and May. On Thursday, MA noted that it believed it was starting to see the transition from the “stabilization” phase to the “normalization” phase in some markets. This pattern is consistent with data from Opportunity Insights, which tracks consumer spending, and also our own observations form last week.

Their measure of total consumer spending stabilized at -30% in the first half of April and has improved to -20% at the end of April. While this nascent improvement is encouraging, it certainly reflects the direct consumer payments under the CARES Act, which will prove temporary. However, even outside of the consumer, FB noted that after an initial steep decline in March ad revenue was roughly flat during the first three weeks of April vs. the same period a year ago.

via ZeroHedge News https://ift.tt/2yXiT2k Tyler Durden