Silver Joins Gold At The Party

Tyler Durden

Tue, 05/19/2020 – 15:35

Silver has finally joined gold at the party.

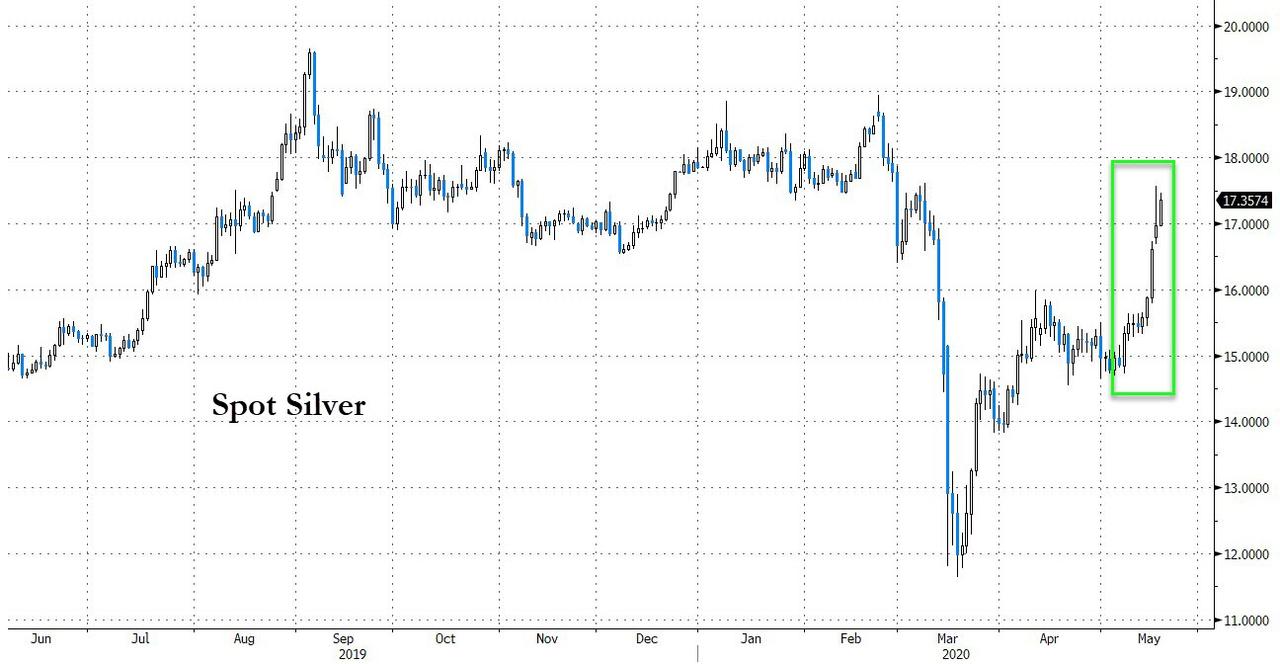

In the last week, the price of the white metal has moved up from $15.51 to $17.35. (as I type this on Tuesday morning May 19) That’s an 11.9% increase.

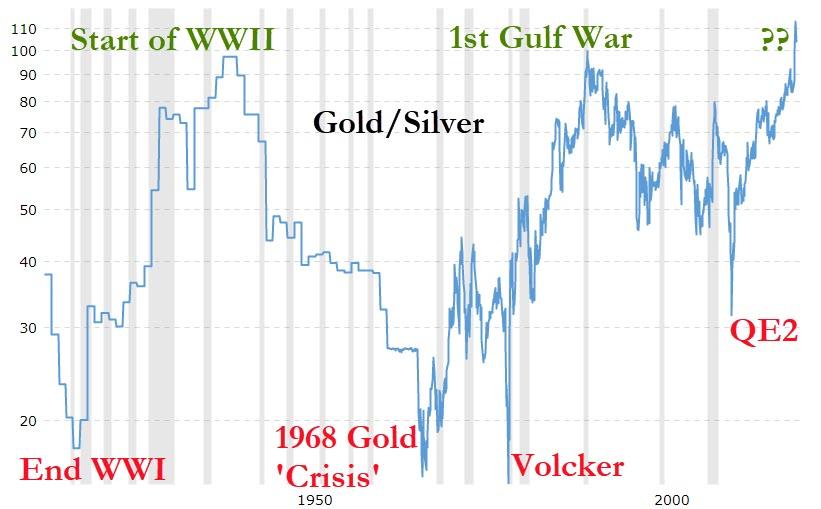

With the jump in the price of silver, the silver-gold ratio has dropped from over 115-to-1 earlier this month to 101-to-1 today.

In early May, we reported that silver hasn’t been this undervalued when priced in gold in over 5,000 years of human history.

Although the silver-gold ratio has fallen, the white metal remains historically inexpensive compared to gold. We still effectively have silver on sale.

At its peak in March, the silver-gold ratio hit an all-time high of over 125-to-1.

Analysts have been expecting silver to break out. A recent article in the Financial Times declared, “Investors make big bets on silver closing giant gap with gold.” The report points out that since silver hit an 11-year low back in March, holdings of silver-backed ETFs have surged, hitting a record high of 675 million ounces.

Silver took a similar track during the 2008 financial crisis. The price of the white metal dropped precipitously along with gold in the early days of the crisis. But once Federal Reserve quantitative easing kicked in, silver rallied along with gold and hit near-record highs. In fact, silver outperformed gold between early 2009 and 2011, rallying a staggering 440%.

Mirroring ’08, silver and gold both dropped as the coronavirus lockdowns took hold in March. Gold has since rallied, but silver was a little slower to join the party. It appears the white metal might be about to make a fashionably late appearance. As one analyst told the FT, “Gold’s safe-haven status is coming to the fore. Normally you’d expect silver to come along for the ride.”

In fact, typically silver has outperformed gold during a gold bull market. Peter Schiff talked about this earlier in the year, saying “If we’re going to go to a new high in gold, if gold is going to take out $1,900, which I believe it is, silver should outperform.”

There is every reason to believe gold’s rally will continue. The Federal Reserve continues to print trillions of dollars out of thin air and inject it into the economy. The Federal Reserve’s balance sheet swelled by another $212.8 billion to $6.934 trillion last week, as the money supply surged another $198.6 billion. To put that into perspective, when the Fed did QE3 during the great recession, it was expanding the balance sheet by $80 billion a month. The central bank just did over $212 billion in one week.

The supply-demand dynamics also look good for silver. Investment demand was already surging before coronavirus. Global silver investment jumped 12% to 186.1 million ounces last year. This represented the largest annual growth since 2015. Meanwhile, silver mine output has steadily dropped over the last several years. Global mine production fell for the fourth consecutive year by 1.3% to 836.5 Moz in 2019. Primary silver production declined by 3.8%.

Silver is historically more volatile than gold because about half of its demand comes from the industrial sector. Slowing economic growth typically puts a squeeze on industrial demand. But at its core, silver is a monetary metal and it tends to track with gold over time. And as already pointed out, it has historically outperformed gold in a gold bull market.

The silver-gold ratio tells us the white metal is still significantly undervalued. History tells us silver will eventually close the gap with gold. That means either gold will drop or silver will rise. Given the economic dynamics and the current extraordinary monetary policy, a continued gold bull run seems more likely and silver will probably come along for the ride.

via ZeroHedge News https://ift.tt/3bSsy7K Tyler Durden