“This Is Easy…”

Tyler Durden

Fri, 05/22/2020 – 15:10

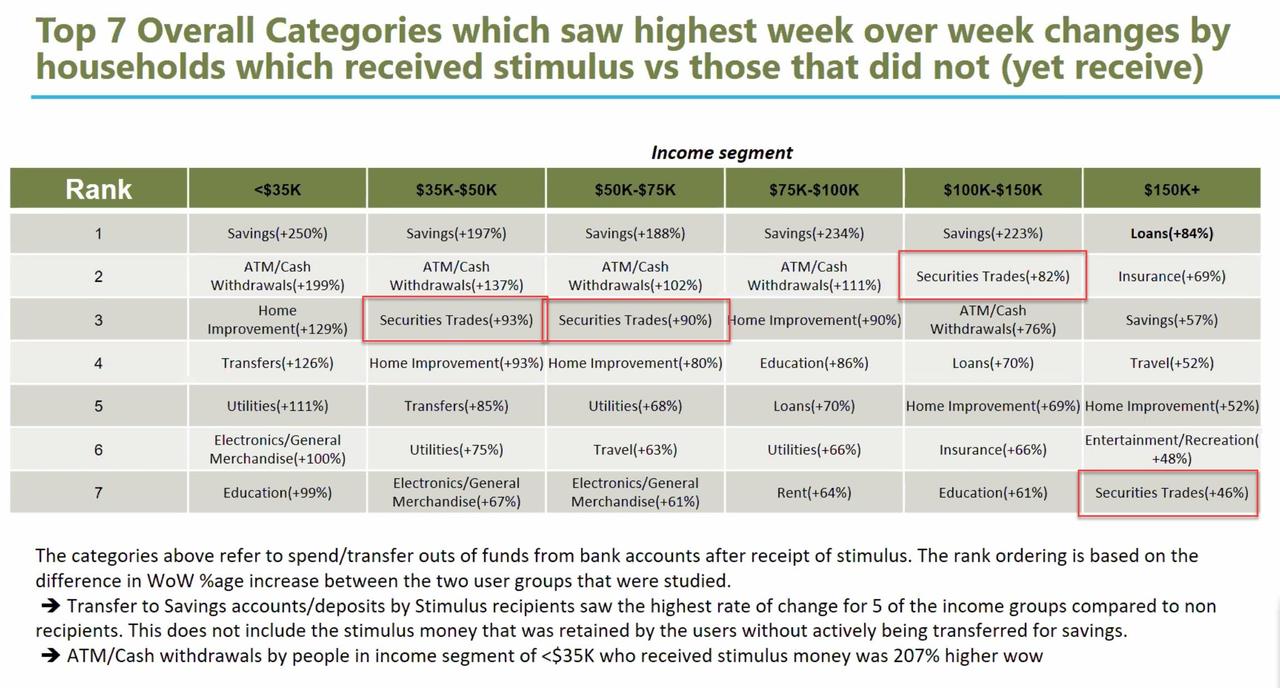

With stimulus checks flooding the stock market…

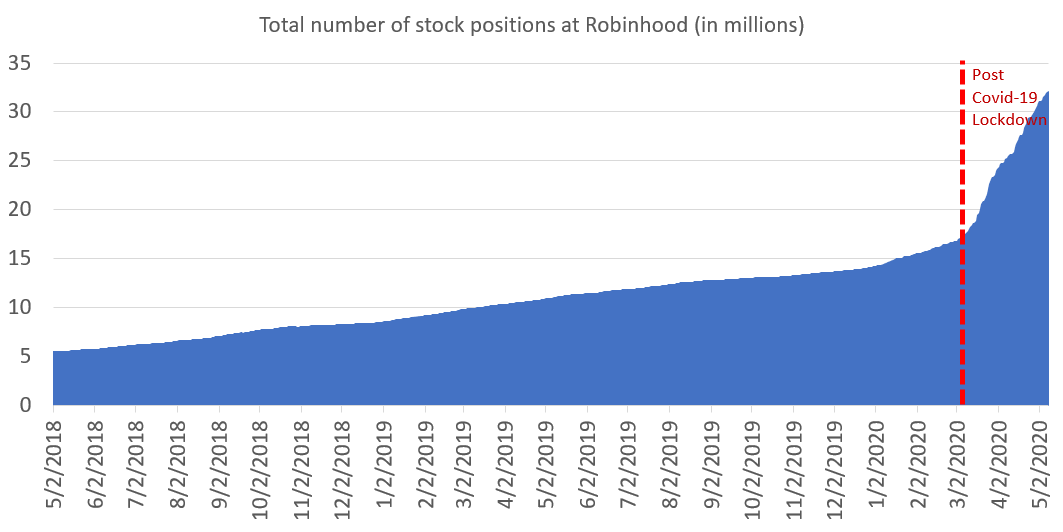

…and Millennials never seeing any momentum they didn’t want to chase (especially leveraged)…

…everyone and their pet rabbit is now a lean, mean, day-trading machine… looking for the next “get rich quick” trick or utterance from Fauci.

Well, there’s an even easier route to all-the-gold-you-can-eat, and for the special low price of absolutely-free, we will share this limited-time-only market insight.

It’s highly complex – so pay attention.

Step 1

(Optional) – Put on pants

Step 2

a) Buy European stocks (not US stocks) at the open of the US day session.

b) Sell European stocks at the close of the US day session.

c) Buy US stocks at the close of the US day session.

d) Sell US stocks at the open of the US day session.

Step 3

You’re rich…

Don’t believe it can be that easy – well, ladies and gentlemen (and non-gender-binary members of society), it really is.

European equities only catch a bid once US markets open.

The chart below splits the performance of Euro STOXX 50

futures into the performance generated during European-only trading hours (from 8am to 2:30pm), US trading

hours (to 9pm) and overnight. The 22% rebound in the region’s shares has come from U.S. trading hours, or overnight trading.

The best period for European equities has been when US markets have been open,

and cumulatively during those hours European equities are actually up since early February.

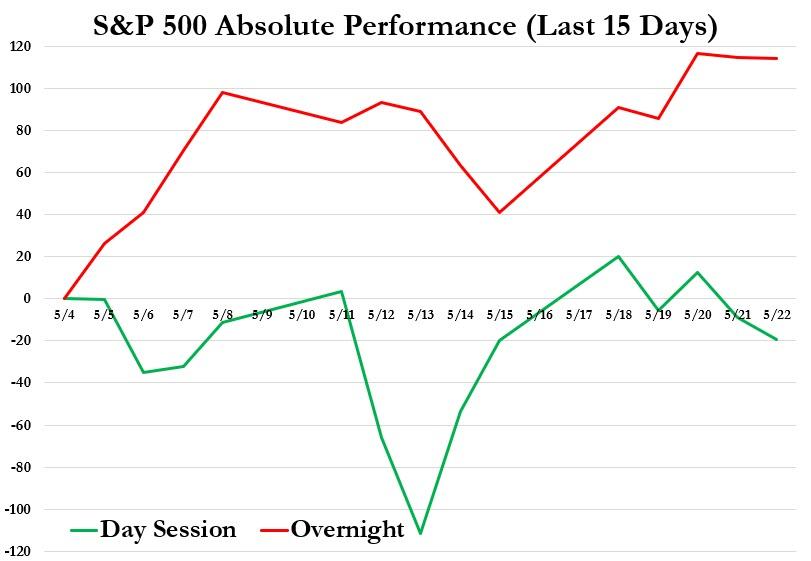

And US equities only go up after the cash markets close…

The last 15 trading days have seen the S&P 500 gain 114 points between the US close and the US open the next day and lose an aggregate 19 points from the US open to the US close.

In the words of one newly-minted thousand-aire day-trading ‘history of art’ student, “this is easy!”

Indeed it is mate, indeed it is… just don’t tell anyone or you’ll ruin it.

(just in case readers were unaware, despite the ‘facts’ about market performance this post is largely one of mockery and snark and not trading advice).

via ZeroHedge News https://ift.tt/2ATzLre Tyler Durden